What we offer

Claims management

A critical process in the insurance industry, claims management, needs meticulous attention. It is relevant for all insurance sectors including life insurance, health insurance, property and casualty, etc. We offer tailored solutions that provide advanced options for handling requests. The modules specially developed for processing claims are intended to automate an entire claims life cycle. According to your business demands and organizational workflows, different functionalities can be added.

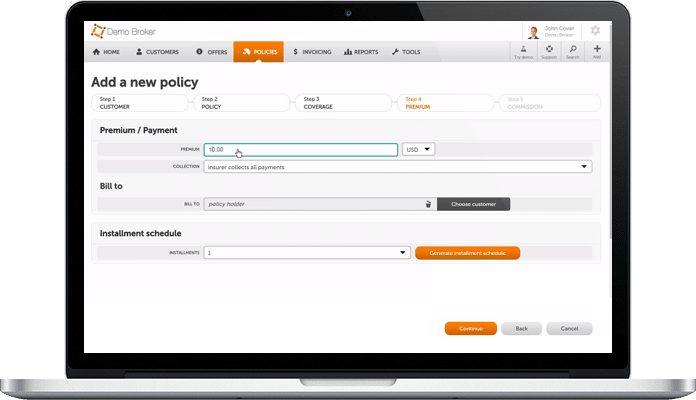

Policy management

Insurance policy administration is a comprehensive process that includes resource management, data sharing, licensing, quoting, proposals generation, renewal, cancellation, reinsurance, and other tasks. Each of these workflows consists of many routine tasks. We develop excellent insurance policy management software that offers the basic features, such as quoting, policy issuance, renewals, and claims management, as well as bespoke modules to comply with your specific demands. As a result, you will expedite your workflows, and enhance insurance customer experience management.

Risk management

Every business is faced with risks. To prevent or mitigate the ones for your organization, you need the ability to identify, assess, and prioritize the risks your business encounters. In this regard, risk management software can help you more efficiently than any human. Our AI-based software enables business owners to manage various risks and assess them individually. We offer custom insurtech solutions that can be integrated with other management systems for higher efficiency.

Customer 360

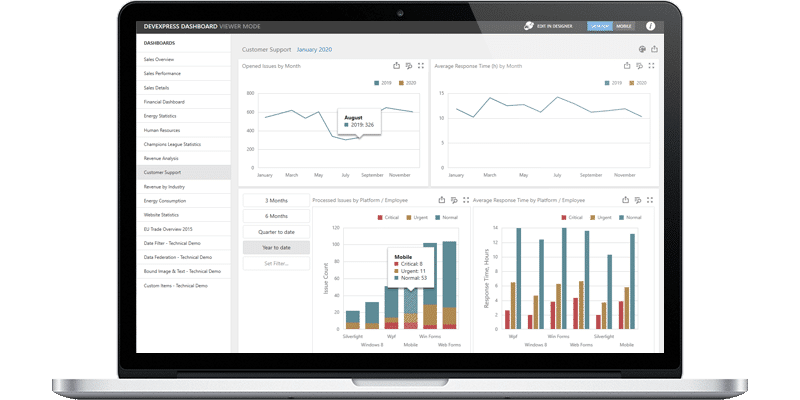

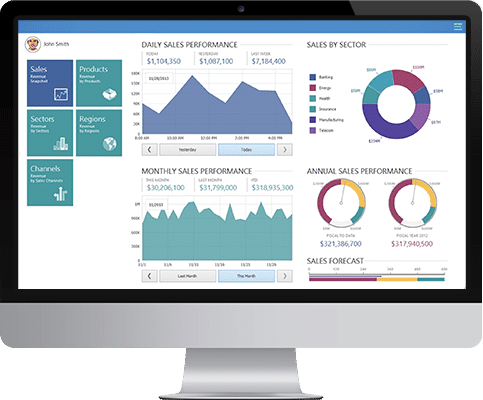

Do you want to expand your client base and retain the existing customers? Then, implement a client-oriented approach and deliver superior customer experience in insurance. Leverage customer profile software that can provide a 360-degree view of the user. Staying at the forefront of modern technology, we offer Customer 360, a sophisticated integrated software solution that provides meaningful real-time data and relevant analysis with practical potential. It allows you to conveniently collect all the required information and obtain valuable insights.

Get a free consultation on your project!

Benefits of our custom development services for insurance

Our insurance software development process

Get a free consultation on your project!

What impacts your project duration

The insurance software development process can take from a few days to a few years. Several major aspects will determine your project duration.

- Project requirements

- Time-to-market

- Team composition

- Chosen technology stack

- Integration needs

What affects your project costs

Our experts make the cost estimation process transparent for our customers. The calculation for your specific project will depend on several vital factors.

- Scope of work and project’s complexity

- The number of upgrades and customizations

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

Detailed information from the customer’s side facilitates a conducive working environment and leads to a valuable outcome. Basically, we request the following.

- Project goals and vision

- Project requirements

- All relevant documentation, such as software architecture and mockups

- Your availability schedule for meetings and discussions

- Estimated deadlines

Our tech stack

Testimonials

Explore our case studies

Frequently asked questions

What are the main customer challenges in insurance?

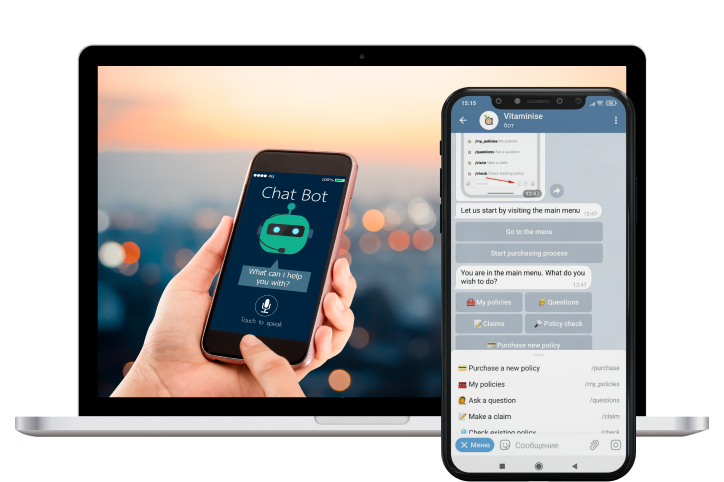

Among the key challenges our customers face in insurtech are the following: implementing an omnichannel sales process, which means today’s market demonstrates convincing tendencies towards digitalization, which dictates the need for high-quality mobile apps and websites; developing digital channels that enable clients to manage their policies, thus, the respective applications and websites can boost customer experience in insurance; embracing IoT — the Internet of Things is making the insurance industry smarter, as it improves personalization and business decisions.

What are the most demanded features an insurance app should have?

According to our experience, the features that are mostly praised by customers are as follows: continual access to helpful resources that allows policyholders to view their insurance information anytime; integrated bill payment and ability to set reminders, which help customers make payments timely and conveniently; electronic ID storage – for instant access to insurance accounts; timely policy update – to avoid confusing paperwork; opportunity to create a claim report and filing capabilities.

What are the most promising insurtech trends to consider today?

Firstly, insurtech is gaining traction. The importance of digitalization makes the players in the insurance industry realize the need to renew the existing business models and increase investment in the sector. Secondly, historical patterns no longer help to predict the future. This forecasting approach might have worked yesterday, but today insurers must utilize IoT, Artificial Intelligence, and telematics to collect, analyze, and interpret data. Insurance is an attractive addition as opposed to necessity. Thirdly, the need for insurance has always been dictated either by law or by commonsense. However, it becomes more appealing when embedded in an existing transaction, such as buying or renting something.