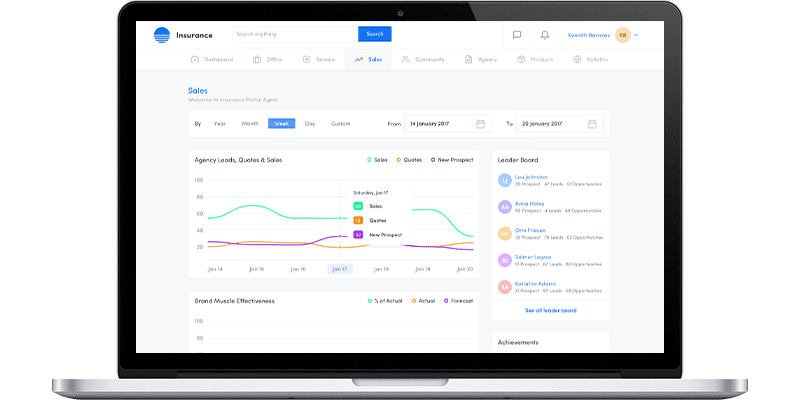

Tailor-made insurance agency management software allows agencies to operate efficiently, promote and sell coverages, create reports, and more. As a rule, such systems provide CRM, sales and marketing functionalities that can work as stand-alone modules or in confluence with each other for the best performance.

DICEUS develops custom agency management systems for insurance, considering the unique needs of a particular organization. It means you get a tailor-made and highly personalized IT product with a set of features according to organizational scale, needs, and demands stipulated by the current insurtech realm.

Our services

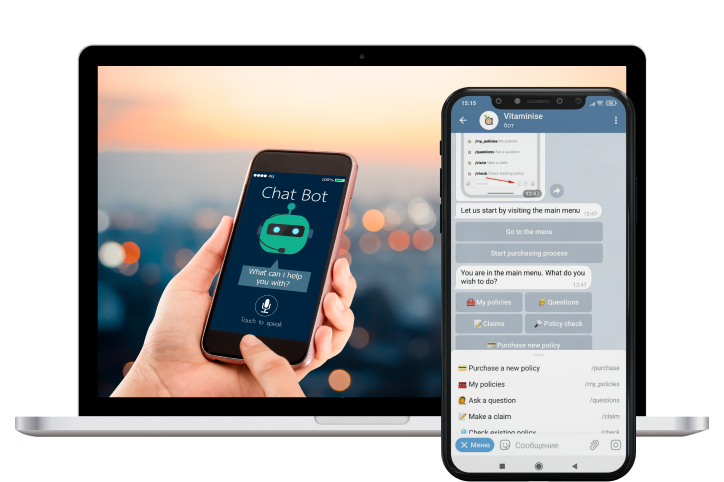

DICEUS is a custom insurance agency management software company that offers exclusive bespoke solutions empowering agency staff to work from anywhere. You can get fully customized features like quoting, account management, claim submission, marketing and remarketing — all enriched with 24/7 support and convenient payment platforms.

Want to discuss your project?

Benefits of our insurance agency software development services

About DICEUS

Our partners

Our insurance agency software development process

Our SDLC

Discovery phase

Architecture and design

Development

Testing and QA

Deployment

Maintenance

What impacts your project duration

The insurance agency management software development is a comprehensive job that can take from several days to several years, depending on the project’s complexity. The overall time frame depends on the following major factors.

- Project requirements

- Time-to-market

- Team composition

- Chosen technology stack

- Integration needs

What affects your project costs

Our experts make the cost estimation process transparent for our customers. The calculation for your specific project will depend on several vital factors.

- Scope of work and project’s complexity

- The number of upgrades and customizations

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

To make our cooperation fruitful, we usually ask our clients to provide certain information. Here are the main things that can facilitate a valuable outcome.

- Project goals and vision

- Project requirements

- All relevant documentation, such as software architecture and mockups

- Your availability schedule for meetings and discussions

- Estimated deadlines

Our tech stack

Testimonials

Explore our case studies

FAQ

What is custom insurance agency software?

Agencies require specific software that can handle various jobs. Off-the-shelf solutions do not always satisfy the agency’s needs. That’s why, often, businesses consider tailor-made IT products. DICEIS delivers feasible solutions for communication with clients, processing of claims, automation of numerous routine tasks, and minimizing paperwork. If your agency needs a system with a unique set of functionalities, we are here to help you.

How to choose the right software for an insurance agency?

The main trick here is to employ the right vendor. Developers of insurance agency software should possess a good understanding of various business lines and workflows inherent in the insurance sector. Here at DICEUS, we have already completed more than twenty projects for agencies and learned how they work, what tools they need, and how to improve processes. Our knowledge and skills in a great variety of programming languages and frameworks allow us to professionally come up with the most complicated projects.

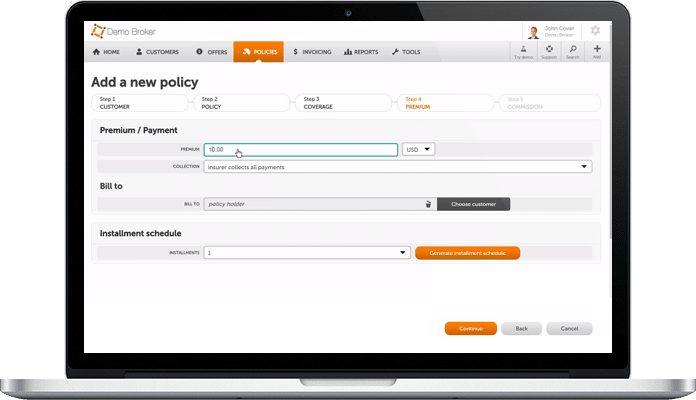

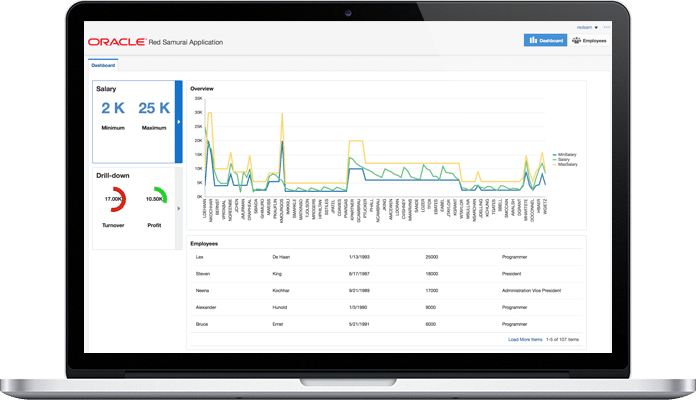

What features should an insurance agency software have?

In a nutshell, these systems should securely keep data related to the brand and its clients, track key processes, analyze information, create reports, ensure proper control, automate tasks, and support integration with other solutions. Specifically, we would highlight the following capabilities that are most helpful to customers: continual access to customer information; integrated bill payment and reminders setting; electronic ID storage – for instant access to insurance accounts; convenient policy update – to avoid excessive paperwork; and the opportunity to create claim reports.