Banking and financial software development expertise

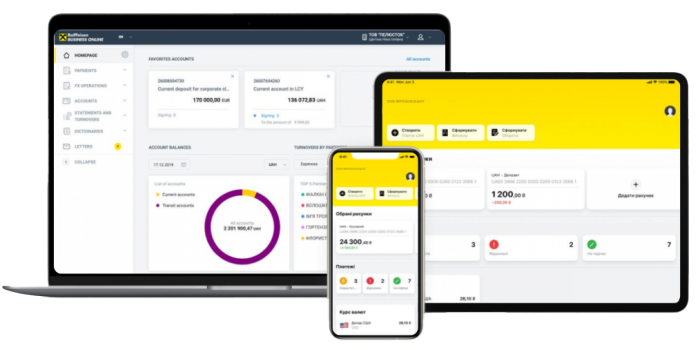

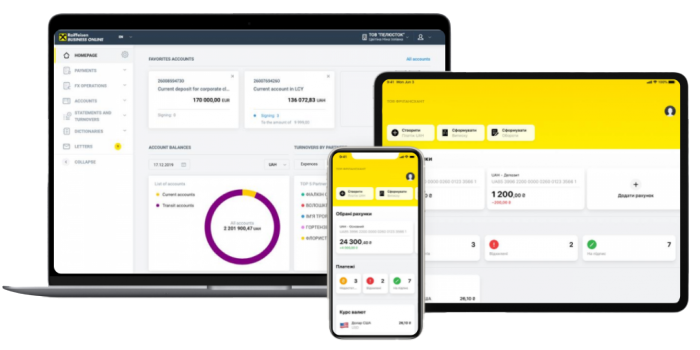

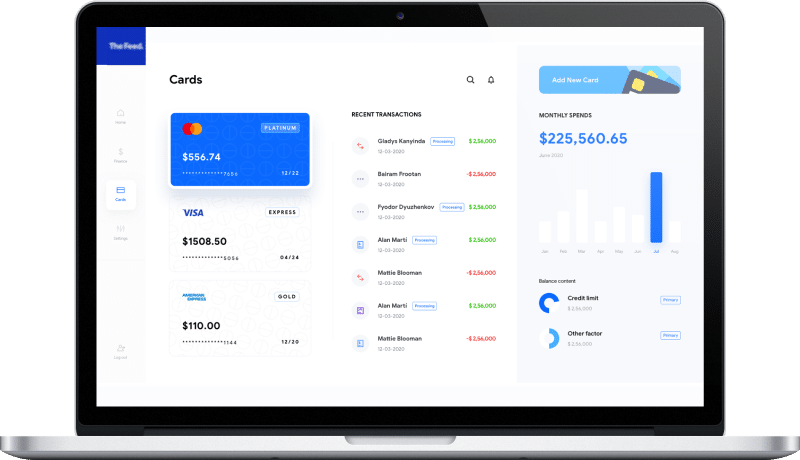

Fintech apps

Enrich your financial services with a modern and secure fintech app powered by the latest technologies. We build mobile banking app, payment applications, finance management apps, blockchain-fueled software with an in-depth understanding of your business.

Learn morePayments

Use professional fintech development services to develop a custom payment gateway or a peer-to-peer solution for payments. We offer both custom development and configuration of ready-made gateways to meet your needs and business goals.

Learn moreLending

We offer end-to-end custom development, modernization, and integration of loan management software solutions for financial organizations and banks. All solutions are produced to help our clients gain efficiency in their operations and reduce costs.

Learn moreMoney transfers

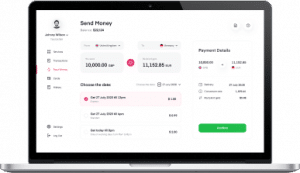

Implement cloud-based software for money transfers that will give you a 360-degree view on customers, real-time and historical data monitoring, user-friendly dashboards, and a lot of opportunities to grow. We handle both custom development and ready-made customization projects.

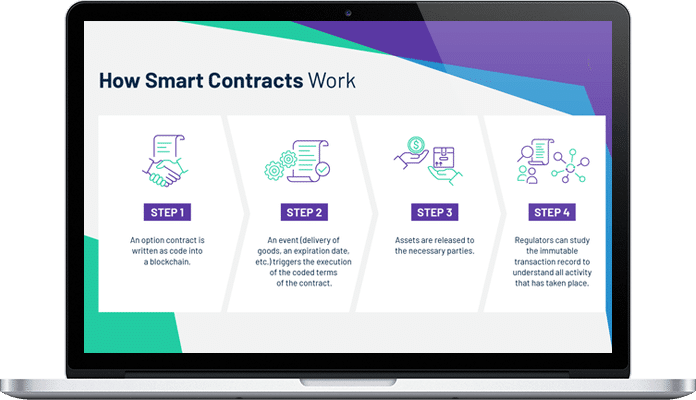

Learn moreBlockchain

Our fintech software development company can help your financial organization build and offer to your clients advanced blockchain-based solutions for cost-effective payments and transfers, secure authorization, and better cybersecurity.

Learn moreRegulatory compliance

We help financial organizations better deal with compliance regulations with the help of technology. In case you have any pressing issues with compliance, our experts will identify the right technology solutions for you based on in-depth business analysis.

Learn moreWe help a large number of our customers better understand what challenges they can overcome by adopting fintech. The fintech ecosystem is growing rapidly and unites thousands of solutions for payments and transfers, lending and financing, insurance, financial management, markets and exchanges. Our team has strong experience providing fintech software development services by implementing both ready-made solutions and custom apps. We not only deliver innovative software products, but also ensure professional tech advisory and support to manage changes to architecture that arise after implementation.

Get a free consultation on your project!

Key advantages to choose DICEUS for fintech software development services

Our fintech development process

We have a well-defined development process for every type of software product. Each project starts with the initial phase, and goes on with requirements gathering and business analysis. Next, come design and development stages, testing, and deployment. On the closure phase, we hand over all the project documentation and source code to the client and offer further technical support and maintenance.

Get a free consultation on your project!

Explore our case studies

Frequently asked questions

What is fintech software and why it is important?

Fintech software is the software built with the involvement of innovative technologies like artificial intelligence, machine learning, robotic process automation, blockchain, and a combination of some of these. Fintech is opening new opportunities to banks and financial organizations to increase customer satisfaction, improve efficiency, and reduce operational costs.

What services are provided by a fintech development company?

Fintech software development company provides custom development, implementation, testing, integration and other services related to fintech adoption and handling after-implementation effects. These companies act as technology partners to banks, insurance companies, fintech startups, and regtech businesses.

How much time will it take you to develop my fintech software?

The duration of fintech project varies and usually depends on lots of factors. Mainly, these factors include the project scope and complexity, chosen technology and platforms, time-to-market urgency. We offer flexible conditions and on-time software delivery without compromising quality — tell us about your requirements to get the time estimation.