What we offer

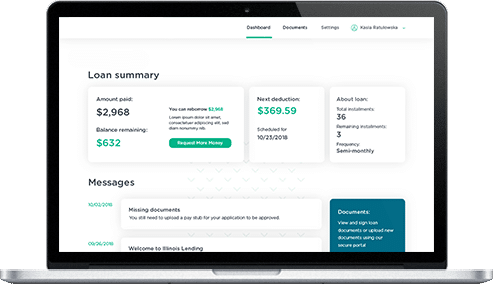

Banking loan software solutions

Today, retail and SMBs banks and corporate business banks are in need of efficient software solutions to offer their customers the best experience in every banking service and product. Loan management is currently facing challenges like the lack of proper fraud monitoring, long loan decision processing cycle, gaps in customer support, legacy interfaces, and many more. Our custom development services for banks include business analysis, UI/UX, design and development, legacy system modernization, integration, testing. And we will be happy to help you overcome your challenges.

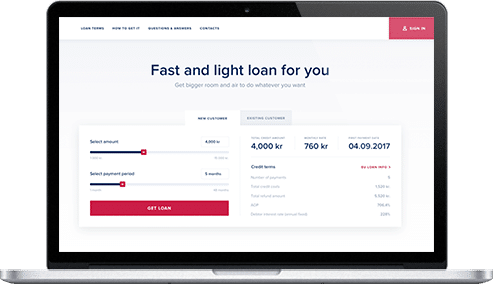

Fintech money lending software

We actively partner with fintech companies to build new-generation applications and software solutions for the banking and financial sectors. Fintech is changing the global financial landscape by giving the world new fast and super-intelligent solutions for payments, lending, money transfers, and many more. We have expertise in artificial intelligence, robotic process automation, blockchain, machine learning, IoT, and many more. Each of these technologies can be used to build new-level lending management software offering fast loan lifecycles, secure data processing, regulatory compliance, and high operational efficiency.

Loan module in core banking

We have experience modernizing, integrating, and customizing digital lending platforms for core banking systems like Oracle FLEXCUBE. Driven by new regulations, policies, and standards, banks have to regularly audit loan origination, lending management, decision engines, debt collection systems, and other functional modules. Being an official Oracle partner and having expertise in other core banking systems, we provide professional core banking and lending software development services for all types of banks globally.

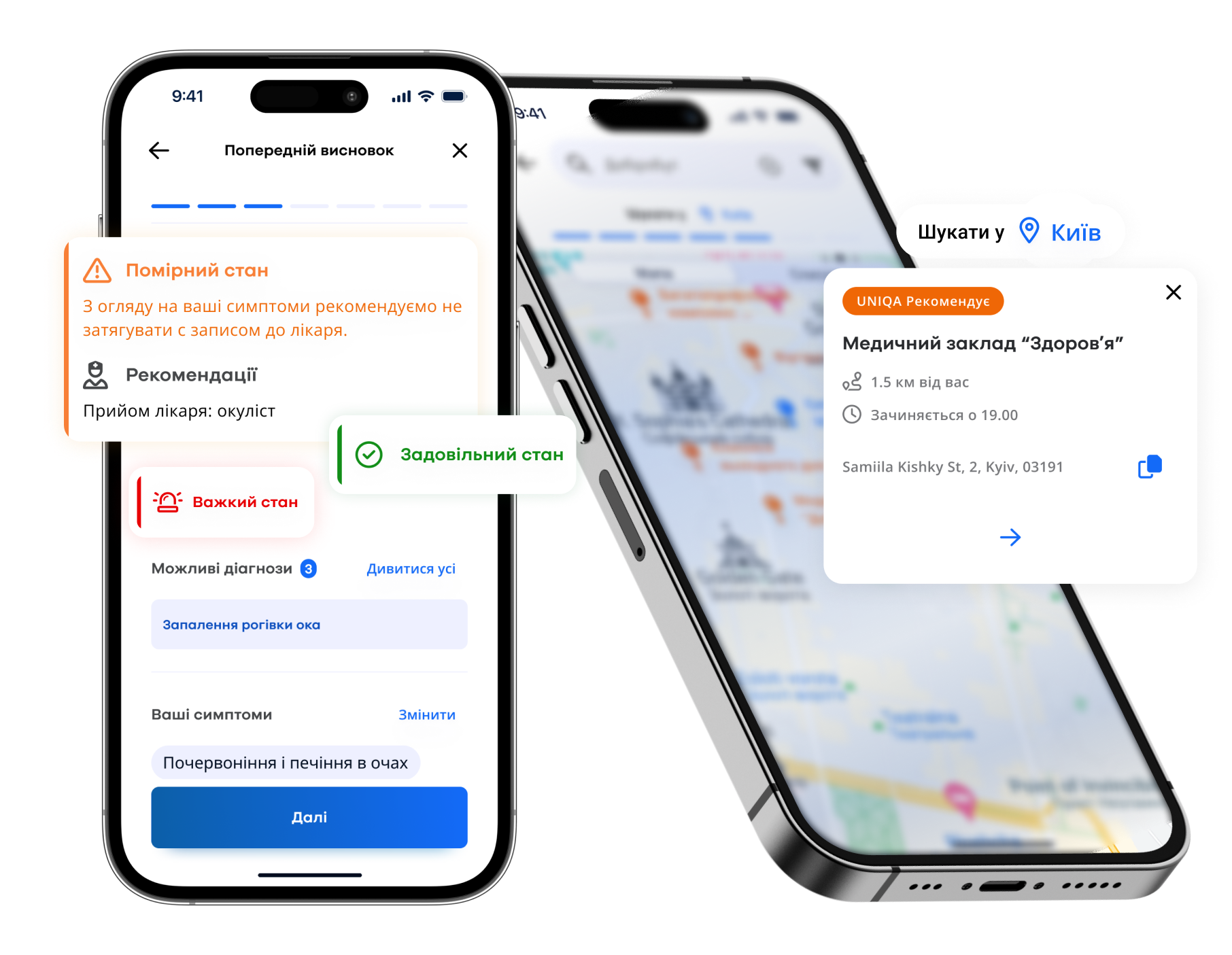

Loan decisioning software

Considering borrowers’ needs in faster loan approval decisions, lenders start harnessing new technologies like artificial intelligence and robotic process automation to build intelligent and automated lending software for banks, financial companies, mortgage firms, and credit unions. New solutions should ensure better risk management, improved customer relationships management, and higher return rates. Our lending software development company offers end-to-end custom development and expertise to meet your lending software project needs in the shortest time possible.

Get a free consultation on your project!

Benefits of custom money lending software

Our custom money lending software development process

Get a free consultation on your project!

What impacts your project duration

The duration of lending software development depends mainly on the number of functionalities you would like to realize. Here is a list of other factors affecting the project time.

- Project requirements

- Expected time-to-market

- Team composition

- Chosen platforms and technology stack

- Integration needs

What affects your project costs

The price of lending software development is affected by the following things.

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

Banking and financial projects especially require involvement from the client-side. Usually, we need at least several hours per week from you during the requirements gathering sessions and formalizing the specification. Here is the list of basic things we need from you.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, software architecture and mockups

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

What is a loan management system?

A loan management system is an automated software solution providing back-office and front-office support for banks and financial institutions in managing and servicing credits. Today, these systems are evolving in cloud-hosted and AI-based powerful machines that can significantly improve customer experience and improve banks’ performance.

How do I set up a loan management system?

The answer depends on what type of user you are, a bank, a small credit union, or an individual borrower. For all targeted users, loan management looks differently. It can be a huge module as a part of your core banking or a simple mobile app for a retail customer. We will provide you with professional consulting on setting up lending software if you are a bank or a financial institution.

What are the four types of loans?

First off, you should differentiate between personal and corporate loans. The former can be of four types: unsecured personal loans, secured personal loans, fixed-rate loans, variable-rate loans. Corporate loan types are bridging facilities, overdrafts, term loans, swingline facilities, and other. Depending on the type of loans your business provides, we can offer you the best custom-designed software solution.