Today’s global insurance and insurtech market is a fierce arena filled with both supply and demand. Standing out among the crowd of competitive market players calls for faster, more convenient, and all-around better services. To achieve that level, you need next-gen digital solutions, namely, a custom insurance underwriting software system. At DICEUS, we know how to build the one that will fit to your vision and needs.

Benefits of custom insurance underwriting software

Top 4 values of custom insurance underwriting software

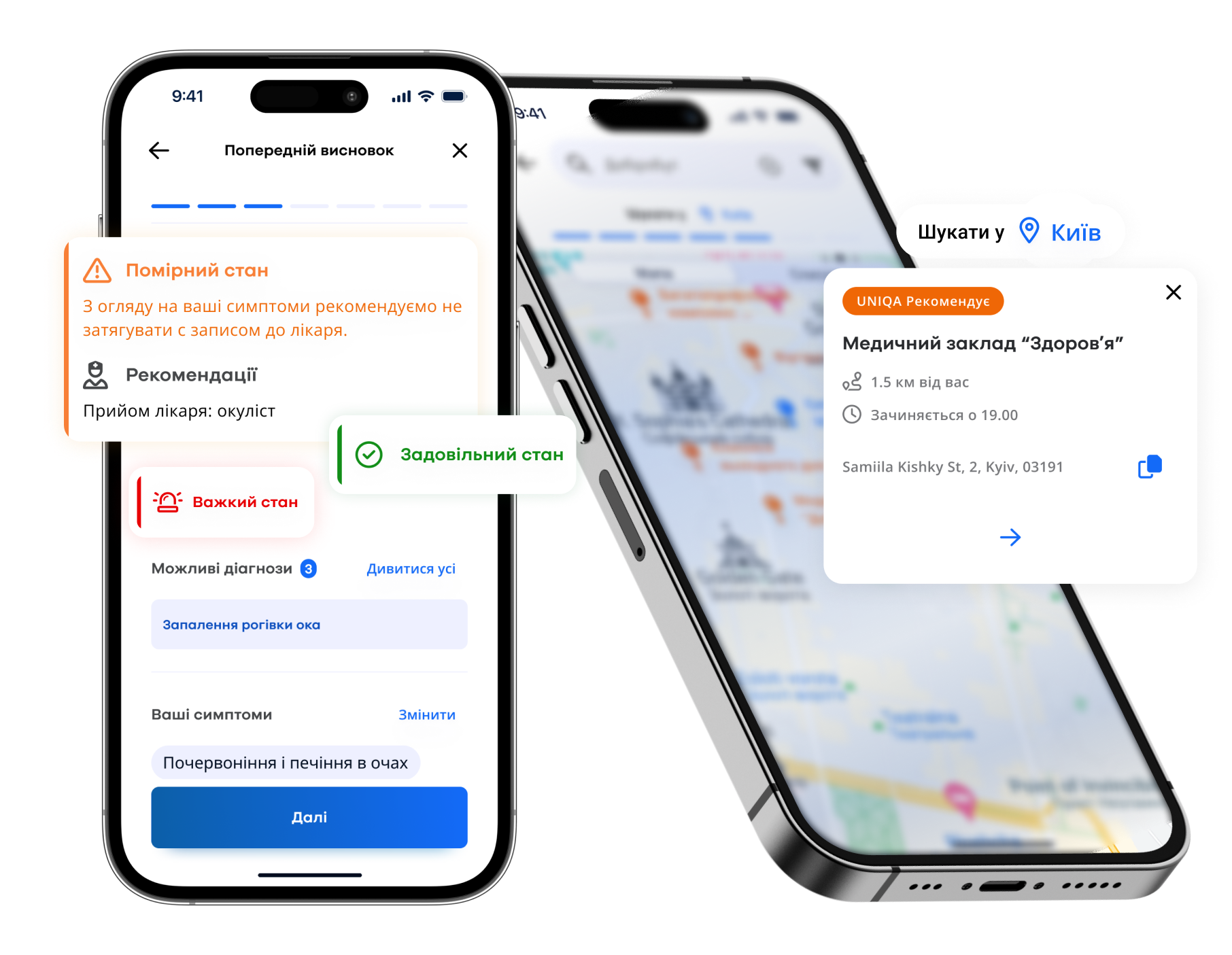

- New data sources incorporation. Real-time data about customers and additional data inputs through public data portals and AI-powered technologies like telematics.

- Easy ways for customers to apply. The possibility of automated auto-filling of customer data from open data sources makes the application process effortless.

- Accurate risk management. Insights generated by advanced analytics can simplify the risk management process and make it more accurate.

- Consistent decision-making. Accurate risk management and simplified application processes facilitate more efficient decision-making.

Need tailor-made underwriting software?

Tell us about your key requirements, and our experts will consult you on the best solution.

Basic features of tailor-made insurance underwriting software

Automated data gathering and processing

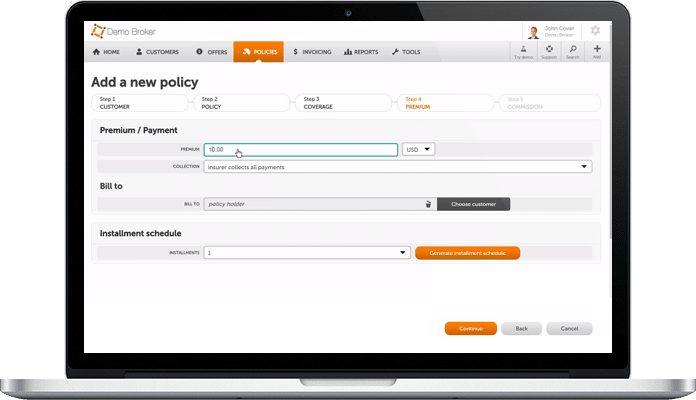

Automated insurance underwriting software streamlines data gathering and processing by getting rid of the necessity for manual data entry. Thorough automation cuts down the risk of manual input errors while boosting data accuracy.

Customization for different business lines

Tailor-made insurance underwriting software lets you organize and optimize underwriting processes based on various insurance types or business lines. Whether dealing with life insurance, P&C, or any other niche, the software adapts to the specific requirements of each sector.

Integration with external data portals

Smooth incorporation with additional data sources gives underwriters an all-around view of risk factors. Insurers get to make in-depth, researched decisions and expand their underwriting capabilities with the help of diverse data pools.

AI-powered risk assessment

Integration of artificial intelligence empowers underwriters with advanced risk assessment tools. ML-powered algorithms can predict tendencies and user behavior patterns based on historical data analysis, granting a well-rounded outlook of potential risks.

Get professional IT consulting on bespoke underwriting solutions

Book a callWant to discuss your project?

Contact usAbout DICEUS

Custom insurance underwriting software development process

DICEUS follows a well-adjusted SDLC to guarantee the successful implementation of custom underwriting software for insurance:

Aspects to consider when building a bespoke insurance solution

Our technology stack

Our achievements

Client reviews

Our case studies

FAQ

What is bespoke insurance underwriting software?

Custom-designed insurance underwriting software is a system, platform, or any set of tools aimed at automating and facilitating the underwriting tasks of carriers. Going for insurance underwriting software development, you get a solution tailored to specific requirements.

How does custom insurance underwriting software work?

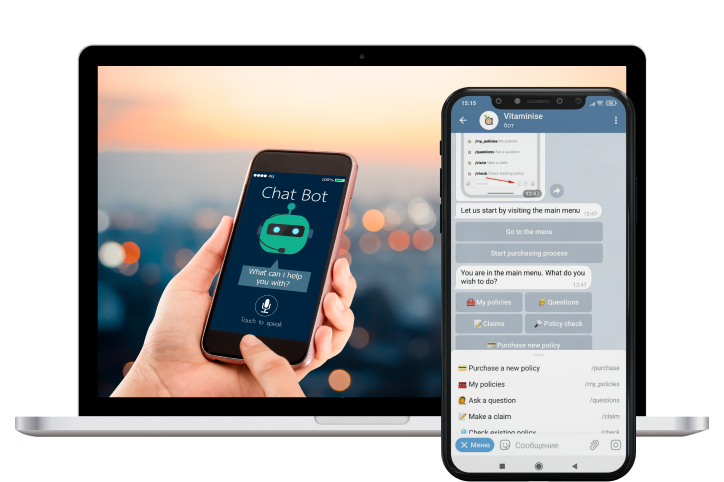

The software automates data gathering, processing, and risk assessment, utilizing advanced technologies such as artificial intelligence to improve efficiency and data consistency. It creates a streamlined workflow for insurers, minimizing manual interventions.

What are the advantages of using custom underwriting software?

The advantages encompass efficient decision-making, improved risk assessment, accurate data analysis, and streamlined automated processes. Ultimately, the software enhances overall operational efficiency and the quality of underwriting decisions.

How to choose the best custom insurance underwriting software development company?

Selecting the right tech partner is crucial. When weighing your options, consider factors such as experience, expertise, client testimonials, and the ability to deliver tailor-made solutions. Look for a one-stop insurance underwriting software development company with narrowed-down specialization for the best results.

Why is custom software essential for insurers?

Custom software is essential for insurers seeking to stay competitive in a fierce market. It enhances operational efficiency, mitigates risks, and ensures accurate decision-making. By optimizing workflows and using advanced technologies, insurers can adapt and persevere in the field.