For any modern insurance company, customer satisfaction is the ultimate goal. It can be achieved only by obtaining a 360-degree view of the clientele, which means carefully storing, organizing, and tracking information about them. Insurance contact management software, as an industry-specific variety of a customer relationship management (CRM) system, is a second-to-none tool for handling customer data efficiently and always having them at your fingertips.

Benefits of custom contact management system

Bespoke contact management software for insurance agents serves as a digital data bank that they can draw upon to retrieve all necessary information about clients. When created by competent professionals, it becomes a valuable asset for the organization since it:

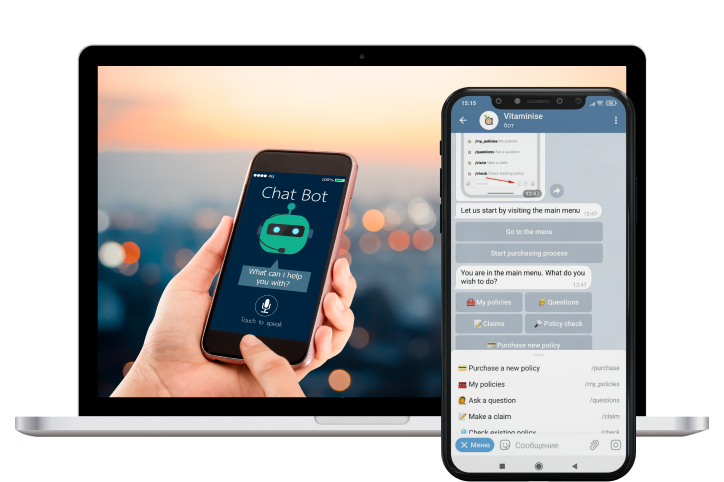

Helps optimize pipeline activities for automation

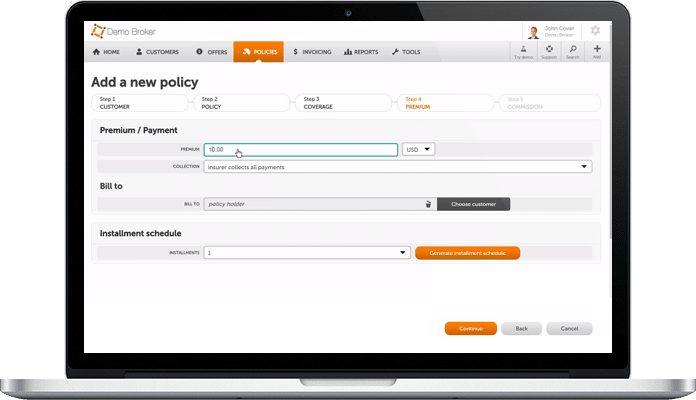

A number of insurance workflows (lead, policy, and claim management, customer onboarding and support, underwriting, and more) can be streamlined and automated thanks to a tailor-made insurance contact management system.

Improves data management

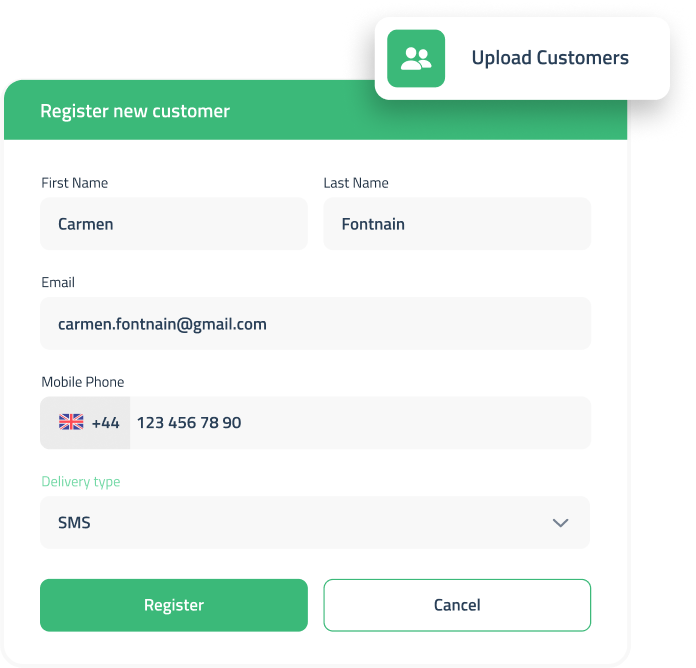

Name, policy number, address, and other contact information are stored in one easily accessible place that serves as a single source of truth for the insurance organization’s personnel.

Enhances productivity and efficiency

As manual labor related to data processing is minimized, insurers perform routine operations much quicker and have more time to spend on other assignments.

Boosts customer experience

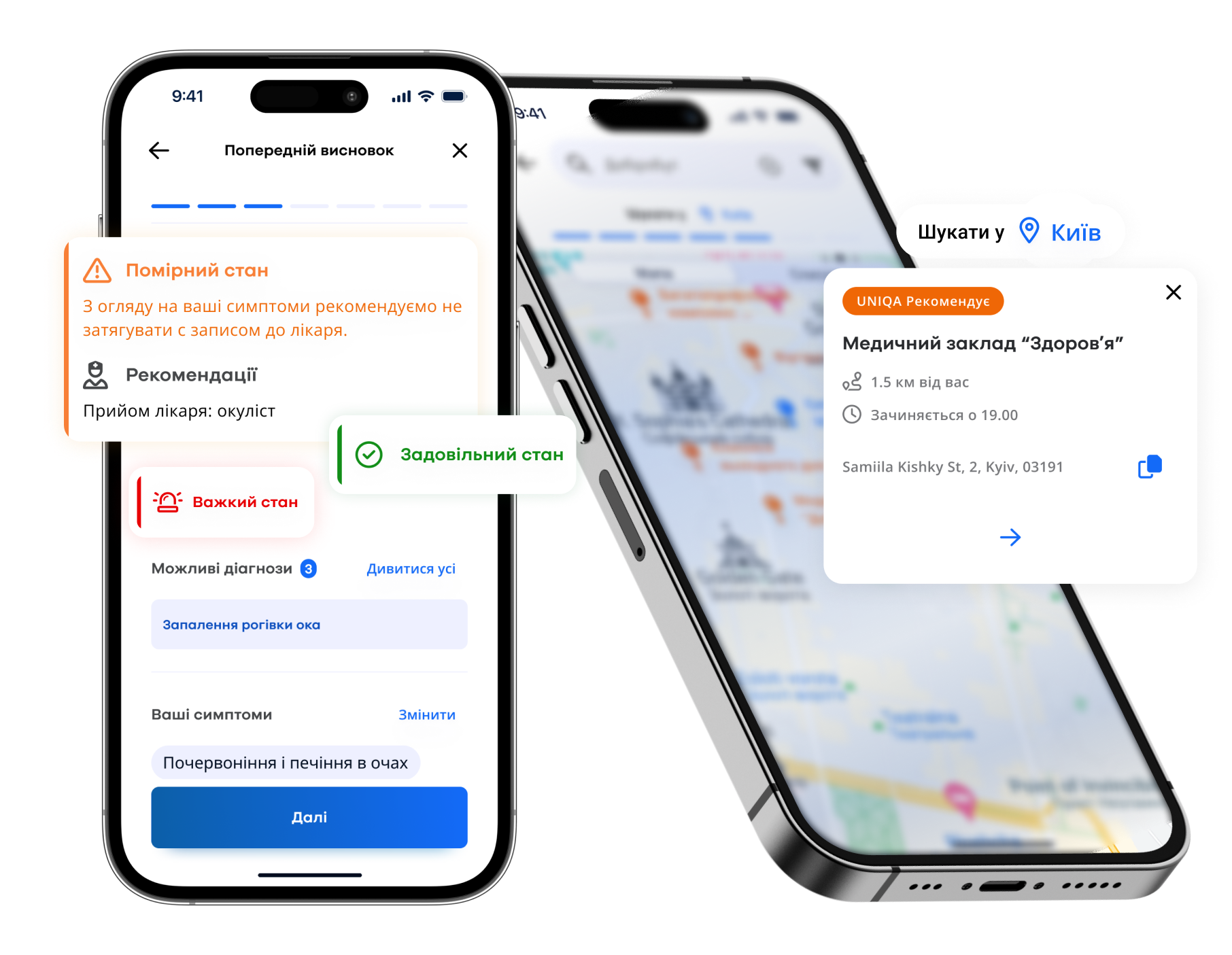

When augmented with specialized tools, insurance agent contact management software gives broad opportunities for the in-depth analysis of clients’ behavior, preferences, interests, and pain points. Being aware of such insights, insurance agents can customize their service range, offers, and campaigns to target individual customers with their unique needs.

Let’s discuss your requirements!

Basic features of custom insurance contact management software

The list of features for a bespoke contact management solution is determined following unique project requirements. However, there are core functionalities that any product of this kind should contain.

- Lead management. It aims to capture and nurture leads to convert them into customers via reaching out to interested prospects and managing contacts with them.

- Account management. It is the system’s backbone, allowing insurance staff to collect customer-related data, segment people into groups, and monitor clients’ activities.

- Sales and marketing automation. This capability enables users to create and administer targeted campaigns, special promotions, and other marketing initiatives.

- Sales analytics and reporting. The feature is leveraged to look deep into the sales indices, detect trends, identify cross-selling and upselling opportunities, and create reports that will serve as actionable insights for the marketing department of an insurance organization.

- Consumer analytics. The module serves as a tool for scrutinizing customer data and actions to understand their motives and shape the engagement and selling strategy for certain groups of people and each person in particular.

- Document management. Thanks to this feature, insurance agents have round-the-clock access to any client-related document (policy, claim, EHR data, etc.), which streamlines and facilitates shop floor routine.

Our achievements

Our insurance contact management software development services

The IT services DICEUS provides cover all needs of insurance agencies regarding high-tech products they leverage in their pipeline operations.

Explore our solutions for insurance

Why choose DICEUS as your custom insurance contact management software development partner?

- 20 projects in the industry delivered for the major-league actors in the niche (UNIQA, BenefitNet, Willis, and BriteCore)

- A rich technology range consisting of standard programming languages, frameworks, and tools coupled with disruptive know-how (AI, ML, blockchain, IoT, etc.)

- Competent and certified IT personnel possessing a versatile array of hard and soft skills

- An established SDLC that has proved its efficiency and allows our team to deliver high-quality products

About DICEUS

Our partners

Our SDLC

Discovery phase

Architecture and design

Development

Testing and QA

Deployment

Maintenance

Client reviews

Our case studies

FAQ

What is insurance contact management software?

It is a solution that contains the entire gamut of information about an insurance company’s clients (name, physical and electronic address, phone number, policy number, etc.). Being analogous to Customer Relationship Management (CRM) systems employed in other industries, insurance contact management software performs essentially the same functions since it serves as a source of personal and contact data for insurance agents to refer to.

Who uses insurance contact management software?

The major users of the insurance contact management system are rank-and-file brokers and their managers. However, this software can be a good crutch for sales departments, marketing teams, customer service staff, and other client-facing employees.

What are the benefits of custom insurance contact management software?

A robust contact management solution can help insurance companies automate the lion’s share of their workflows, step up efficiency and productivity, improve data management, streamline sales processes, boost communication with the clientele, augment the level of analytics, identify cross-selling and upselling opportunities, and more.