Health insurance mobile app development: Key features and benefits

Like any other modern industry, healthcare was steadily transforming its traditional practices by embracing high-tech advancements when the global pandemic hit. In the post-COVID next normal, this slow but sure changeover received a powerful boost, which revolutionized all adjacent fields, including medical records, remote billing, drug discovery, telehealth, hospital management, and the like.

The health insurance industry, as a closely related realm, is moving in the wake of this across-the-board digital transformation drive, finding ever-new ways to satisfy customers’/patients’ growing needs and streamline the business pipelines for insurance organizations. A mobile insurance app is one of the most effective instruments a health insurance company can leverage to keep abreast of the technical progress and stay on the same digital page with their clientele.

Need a fast solution to implement a health insurance mobile app? Check our Vitaminise Mobile App for insurance.

Why a health insurance app reigns supreme: A customer’s take

In the mobile-driven world of the 21st century, we tend to rely on our gizmos for a whole range of tasks — from working and learning to shopping and having fun. Obtaining health insurance services is no exception. What reasons stimulate people to use a health insurance application?

- Convenience and accessibility. Mhealth insurance apps place all essential information within easy reach of people 24/7. Customers can access their insurance and medical records anytime, assess their health condition, check their coverage, browse available insurance plans, etc., whenever and wherever they please.

- Paperwork reduction. The insurance sector is notorious for the amount of red tape it deals with. A mobile app, as a pivotal element of a comprehensive health insurance platform, can spare users from printing out a lot of forms to fill out by hand. Instead, all necessary documents are handled in the electronic format.

- Timesaving. No more standing in long queues and wandering from one office to another to get a policy or receive a reimbursement. All shop-floor procedures take minimal time and can be performed in a couple of taps on the phone screen.

- Real-time updates. Every change that occurs in claim status or policy conditions is immediately conveyed to the customer, who can thus make prompt and informed decisions regarding their healthcare and insurance options.

- Single data storage venue. A health insurance mobile app serves as a gateway to any data storage facility with which it is integrated. In this way, people can consult their EHR, EMR, or third-party data depots via secure APIs, which rule out their personal and financial data leakage.

- Streamlined navigation. Choosing the best doctors, finding the necessary services, and opting for the most suitable insurance plan are always major headaches for customers. People can drastically simplify and facilitate these tasks with this kind of health insurance software.

- An efficient communication channel. Thanks to apps, all domain stakeholders stay in touch, exchange messages and relevant information, obtain consultations and advice, clarify issues, and solve problems, which accelerates health insurance workflow immensely.

Evidently, consumers gain a lot by using such digital products. Moreover, health insurance application development is extremely advantageous to insurers as well.

You might be interested in reading our article “A compelling guide for telemedicine app development”

Health insurance app benefits: Insurers’ take

As a vetted health insurance app development company with multiple successful projects of this kind on our track record, DICEUS envisages the following perks that sector institutions obtain when they create a health insurance app.

- Simplifying the selection of an insurance plan. Picking an insurance plan that suits them to a tee is often a real challenge for people. An app is a good crutch in this respect since it essentially streamlines the search for the appropriate insurance plan based on the customer’s requirements and health condition.

- Facilitating claim processing. This routine is the core of providing insurance services. Thanks to the app that gives access to all necessary data, insurers can keep the procedure running smoothly and avoid claim rejection due to incorrect data or invalid diagnosis codes.

- Minimizing paperwork. A large amount of documents is a problem not only for customers but for insurance agents as well. Going digital and mobile sends the extensive use of physical forms into oblivion and paves the way for switching to a paper-free and branchless paradigm.

- Reducing errors. Since the repetitive and mechanical tasks are delegated to AI-powered apps, the risk of human errors is diminished radically.

- Providing continuous transparent communication and support. Apps enable doctors, insurers, and policyholders to maintain constant contact with each other and address issues lightning-fast. Besides, integrated chatbots create a round-the-clock, on-demand support line to answer customers’ inquiries.

- Increasing productivity. A high degree of automation ushered in via health insurance app development allows personnel to accelerate most insurance workflows (such as claim handling, policy renewals, report generation, and more), thus enhancing their productivity immensely.

- Maximizing ROI. With many assignments performed by machines, the need for personnel is lessened, allowing insurance organizations to save a pretty penny on administrative costs and operational expenditures. As a result, their revenue grows exponentially.

- Customizing services. When equipped with analytics tools, health insurance apps can collect customer information that will be further used to administer targeted marketing campaigns, offer personalized services, boost cross-selling and upselling opportunities, etc., thus focusing on the unique needs of individual clients.

- Enhancing customer engagement. A user-friendly and seamlessly functioning insurance app that helps people receive a wide roster of top-notch niche services is a second-to-none tool for generating high customer satisfaction, fostering brand loyalty, nurturing leads, and broadening the client base.

In view of these numerous assets, it is no wonder that health insurance apps are gathering an ever-increasing momentum in the global insurance market, which exceeded the astounding $2 trillion in 2021 and is expected to reach the breathtaking $3.62 trillion within four years, manifesting a solid growth of 9.5%. If your insurance organization wants to carve a share of this huge revenue pie, today is the best time to build a health insurance mobile app. The first step to take on this journey is to come to grips with the capabilities your custom product will include.

Zooming in on health insurance app features

DICEUS has specialized in iOS and Android insurance app development for over 13 years, so we know what functionalities a first-rate solution should include.

To begin with, let’s enumerate its must-have features.

User profile management

This is the departure point of any app. Here, users sign in and manage their personal information, such as name, age, electronic and physical address, phone number, insurance ID card, and various medical data (height, weight, etc.).

Multi-factor authentication

People must feel sure their personal and financial data will not be compromised. Moreover, all healthcare organizations must comply with the HIPAA regulations that demand it. Since cybercriminals never get tired of devising new ways to burglarize sensitive information, simple passwords don’t safeguard against penetration attempts. A reliable authorization system should be enforced with AI-powered biometric authentication (face and/or touch ID) and a one-time code system.

Policy information and management

Customers must be able to access their policy details (coverage, premiums, deductibles, copayments, effective dates). Moreover, they should have an opportunity not only to review such records but also to purchase, amend, renew, or cancel their current policy, compare several insurance plans, and switch to another contract type (or even change the provider).

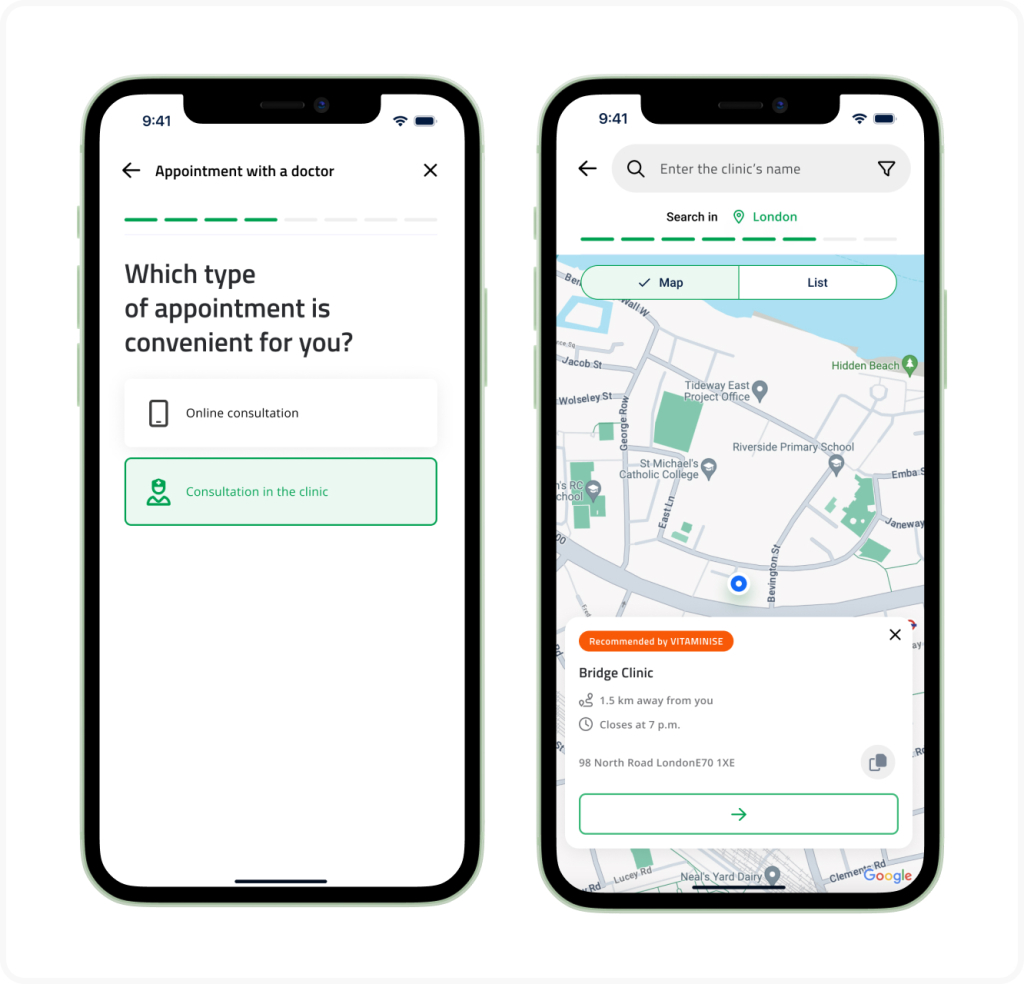

Choice of healthcare providers

App users can discover the network of medical specialists, pharmacists, hospitals, drug stores, and other healthcare facilities with which the app-owning insurance company has established a partnership.

Claims management

This is the staple of any insurance app that allows customers to file, track, and manage claims. To do that, they should be able to upload supporting documents and get regular updates on the change of their claim status.

Document storage

Your app must become a one-stop shop for storing all insurance-related documents, such as medical reports, prescriptions, accident protocols, etc.

In-app payments

An integrated payment gateway must be secure and convenient, offering people a variety of options to pay for their premiums. The best-in-class insurance apps also provide configurable commission and incentive calculation as well as enable monthly automation of premium payments to make sure customers never miss them and lose coverage as a result.

Push notifications

These serve as an effective means of reminding people about important moves to be made (renewal dates, due payments, etc.), changes in policy conditions, claim processing status updates, or issuing warnings in the form of critical healthcare alerts.

Communication channel

Effective communication is crucial for establishing your company’s brand credibility and the reliability of its products. To provide it, your app should offer users a variety of options (video calls, voice calls, chat) through which they can contact insurers and clinicians and obtain the necessary advice and assistance.

Media sharing

This feature allows clients to share documents, medical reports, X-rays, etc., with doctors who will review them and give their judgment as to the validity of the claim.

These bread-and-butter capabilities are the core features of any health insurance app. However, you can add some advanced functionalities to make your product stand out among competitors and elevate the customer experience.

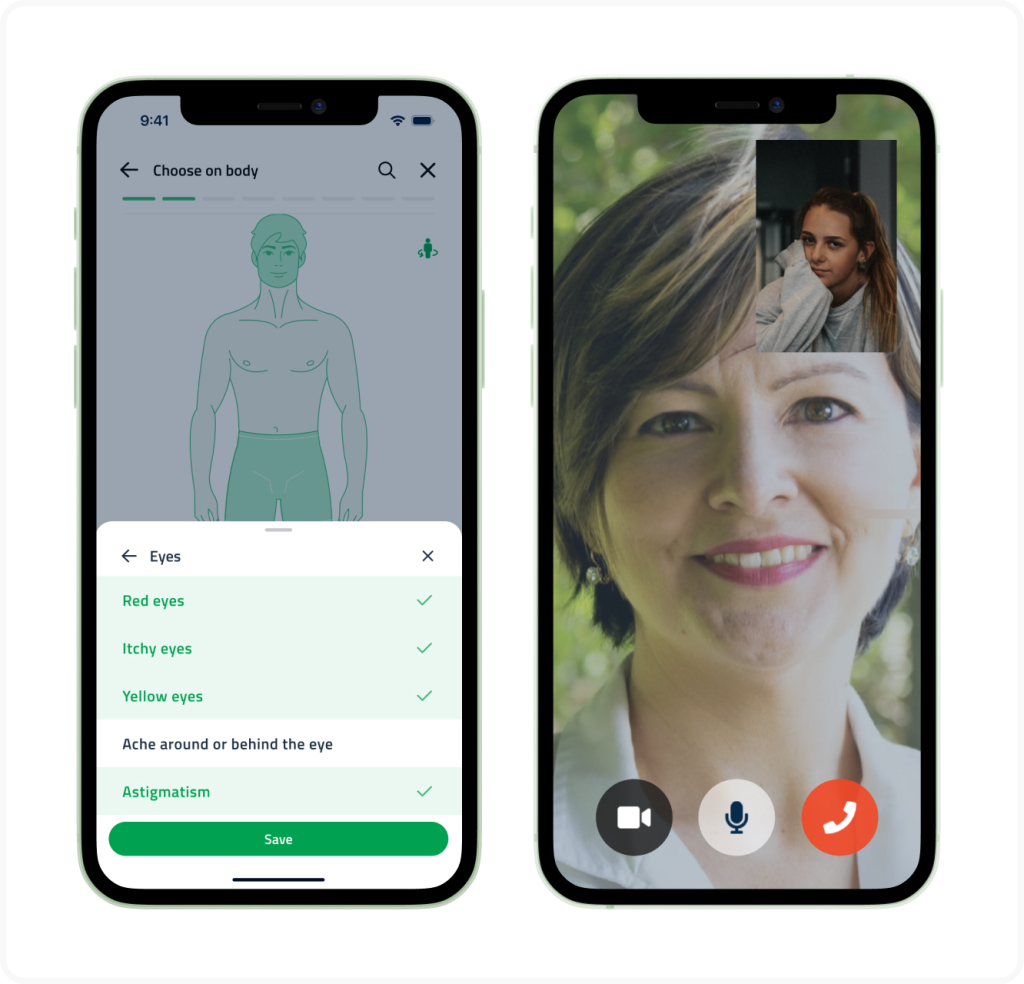

Self-service symptom checker

As our experience in healthcare mobile app development tells us, this is one of the top sought-after features of contemporary high-tech products in the industry. Typically, it is an AI- and NLP-fueled chatbot that accepts the patient’s input complaints and symptom descriptions, formulates a possible diagnosis, and recommends the specialist to schedule an appointment with.

Telehealth

Here, policyholders get an opportunity to communicate with doctors online via video call. They receive a consultation, learn their treatment plan, get a prescription, or are referred to other specialists for additional examination and tests.

Chatbots and virtual assistants

This use case of artificial intelligence and machine learning can help organizations handle insurance pipeline-related queries and provide their clients with personalized assistance during human-like communication.

Voice recognition

Insurance organizations can leverage such a capability for two purposes. First, it will help them obtain and register all information necessary for claim processing during live conversations with policyholders (incident description, date, policy number, etc.). Second, the voice recognition feature is highly instrumental in real-time fraud detection, allowing insurers to compare the caller’s voice with the voiceprints of known fraudsters and immediately detect and prevent further scamming attempts.

Image recognition

When equipped with this technology, insurance apps are empowered to help perform property or vehicle damage assessment, verify documents for fraud detection and prevention, identify facts and events that can affect a customer’s risk profile during underwriting, and more.

Video recognition

Any video evidence is the province of this capability. Its use cases range from verifying a person’s identity as a fraud prevention measure to monitoring driving behavior and analyzing video proofs in claim assessment.

These nice-to-have features are the most popular ones during healthcare app development. Plus, there are some minor capabilities that augment user experience, such as self-service appointment scheduling, medicine order and delivery, search for the nearest hospitals, physicians, access to self-care and wellness library, etc.

Knowing the functionality list for your future health insurance app is a necessary preliminary phase to embark on an app development endeavor.

How to create a health insurance app: A step-by-step guide

Our extensive experience and in-depth competence in insurance software development have allowed us to map out an effective strategy for building apps of this kind.

Step 1. Research and planning

The major question we must answer here is why we are building this app. The answer can be found by fulfilling two basic objectives for this stage: gathering information and outlining requirements. Our specialists meet the customer’s representatives and learn all necessary details both about the company (its size, the range of services it provides, business goals, target audience, and the like) and the product they would like to have.

Step 2. Studying the niche

To create a first-class health insurance app, you must understand what you are up against. We dig deep into the domain, examine the current market state, pinpoint dominant trends in it, analyze competitor products, and expose their pros and cons.

Step 3. Taking thought for security

Both the healthcare industry and the insurance field are highly regulated spheres where client data safety is a primary concern. We practice a security-first approach to creating healthcare insurance solutions by ensuring they comply with core data security standards (HIPAA, GDPR, CCPA, and the like).

Step 4. Picking a tech stack

The choice of tools, programming languages, and frameworks to be employed in app creation is largely conditioned by the operating system your product will run on. If it is iOS, we use XCode, iOS SDK, and Swift, whereas for Android, we leverage Android Studio, Android SDK, and Java or Kotlin. As an option, you may decide on cross-platform app development.

Step 5. Building a prototype

This is the first practical stage of app development. Here, our experts create a clickable prototype that implements basic user stories and reflects the product’s structure, logic, and design. Then, this model is submitted for trial usage by testing audiences.

Step 6. UX/UI design

The prototype design improved with the amendments that were introduced after reviewing trial feedback is taken as the basis for designing the experience of the fully-fledged app. Our designers craft app and user flows, create customer journey maps, and take care of the color scheme, elements layout, buttons, and other UI components.

Step 7. Coding

Now, developers start bringing the project to life. This stage consists of three aspects. During front-end development, they craft the UI and build web-based admin panels for smartphone solutions. Back-end development focuses on the app’s behind-the-scenes functions. Mobile development deals with the client-side interface and the integration of server-side endpoints.

Step 8. Testing and launch

After the previous stage is completed, the app is submitted for various kinds of checks, such as usability, accessibility, compatibility, performance, penetration, stress, load, functional, and other test types. Once they are through and all revealed bugs are fixed, the product is deployed and goes live.

Step 9. Support and maintenance

We at DICEUS never call it a day after the project is over. Our post-release maintenance services aim to ensure the app functions as expected and handle issues if they appear. Besides, we support offering advice and answering questions about the operation of the app and its separate elements.

Given the multitude of aspects to pay attention to, such a serious undertaking as creating a health insurance app can be entrusted only to seasoned professionals in the IT realm who have broad knowledge of both healthcare and insurance industries. The qualified and certified DICEUS team ticks all these boxes. They will deliver a first-rate health insurance app within time and budget. Contact us for a robust product that will impress you with smooth performance and elegant design.

Summing it up

The insurance industry is experiencing sweeping changes related to embracing digitalization in providing various niche services (health insurance included). Far-sighted insurance companies launch health insurance mobile apps that help them streamline and facilitate the insurance pipeline and radically improve the customer experience of their clientele.

To maximize the value of a health insurance app, you should select the appropriate features, follow a well-planned SDLC, and hire a competent IT vendor to implement the project at a top-notch professional and quality level.

FAQ

Why are health insurance apps important?

Modern people rely on their gadgets for work, studying, shopping, entertainment, and other spheres of life. Health insurance apps enlarge this roster and enable customers to use smartphones to receive health insurance services whenever and wherever they are in a hassle-free and convenient way, which saves customers much time and effort. Besides, this software drastically streamlines and facilitates insurance organizations’ shop floor operations.

What features are commonly included in health insurance apps?

The must-have feature roster typically includes such capabilities as user profile management, multi-factor authentication, claims and policy management, document storage, in-app payments, push notifications, media sharing, and communication channels. On the customer’s request, some extra capabilities can be added (self-service symptom checker, telehealth, chatbot/virtual assistant, voice, image, and video recognition, etc.).

How do health insurance apps improve user engagement?

People leverage health insurance apps as convenient instruments for obtaining a wide range of services in this domain. If such apps function seamlessly and satisfy their needs, they enhance customer satisfaction, create brand loyalty, allow for the personalization of services, and broaden clientele, encouraging users to engage with the product more and recommend it to their family and friends.

Are health insurance apps customizable based on insurers’ requirements?

There is a bread-and-butter list of functionalities a garden-variety health insurance app contains. Following a certain insurance company’s specifics, requirements, and business goals, this basic roster can be modified and expanded to include unique features it would like to see in its product.

Can health insurance apps provide real-time assistance to users?

Real-time assistance can be provided in three ways. First, a person can use a self-service symptom checker to receive a preliminary diagnosis live and schedule a meeting with a doctor. Second, policyholders can contact doctors via the telehealth capability and get a consultation concerning medical issues. Third, they can address an AI-powered chatbot or virtual assistant that will answer their queries related to insurance routine.