Solutions we develop

DICEUS serves to complete your qualified lending performance with advanced digital solutions. Based on your specific needs, we may implement a range of tools and pieces of software, including the following.

Banking loan software

Streamline loan origination, management, and processing with custom-tailored banking loan software. Get the unique software powers driven by innovation to offer efficient lending services, automate workflows, and enhance customer experiences.

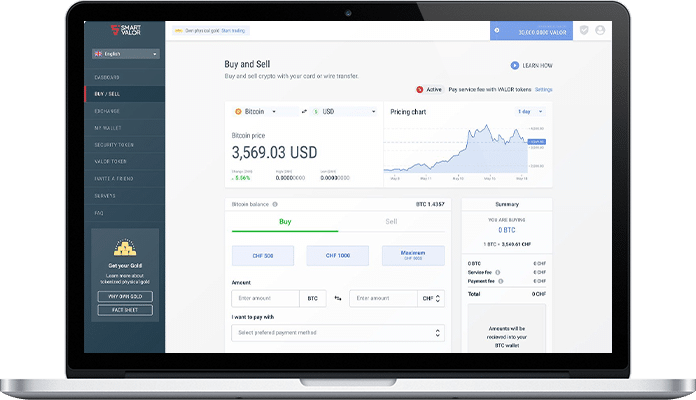

Fintech applications

Explore cutting-edge fintech applications designed to transform the financial landscape. We create advanced lending software solutions for digital banking, lending, payment processing, and investment platforms for a seamless and up-to-date financial experience.

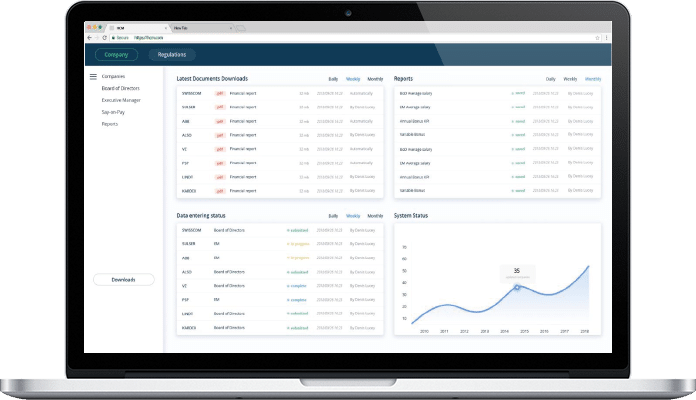

Loan modules in core banking

Elevate your core banking capabilities with the specialized loan modules created for your essential needs. These modules integrate with your core banking system easily and fast, enabling efficient loan origination, servicing, and portfolio management.

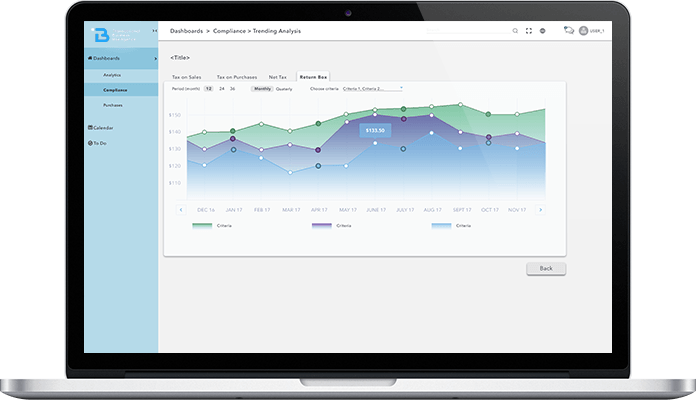

Loan decisioning software

Make data-driven lending decisions with authentic loan decisioning lending software. Leverage advanced analytics and AI to assess creditworthiness, automate underwriting, and optimize loan approval processes.

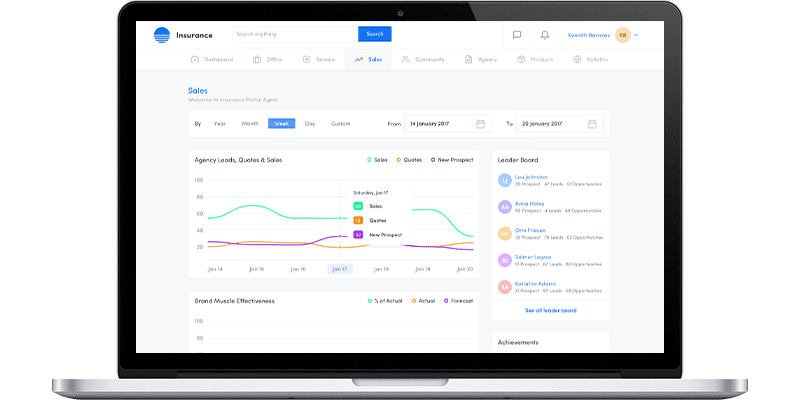

Risk management modules

Mitigate lending risks effectively using our risk management modules. We build comprehensive solutions from scratch, granting real-time risk assessment, monitoring, and reporting to ensure the health of your loan portfolio.

Chatbot development

Maximize the efficiency of customer support and engagement, automating it all with a dedicated chatbot. We create AI-powered chatbots to assist borrowers throughout their loan journey, from inquiries and applications to payments and account management.

Talk to our fintech expert

Services we provide

DICEUS is your one-stop lending app software development company for the full-on creation, integration, and adaptation of digital lending solutions. To guarantee efficient product delivery, we handle a comprehensive set of services.

Need professional IT assistance with your projects?

Explore all servicesWant to discuss your project?

Contact usWhy choose DICEUS as your software development vendor

Proven expertise

You get to benefit from our extensive experience in finance lending software development, reinforced through successful projects delivered across all relevant industries. We give you the expertise to ensure your project’s handling by truly capable hands that build high-quality solutions only.

Dedicated team

Work with a seasoned and skilled team of developers, designers, and project managers committed to your project’s success. Our professionals prioritize close collaboration to get to the bottom of your ideas, explore your vision, and create something that really hits the spot for you.

Customized solutions

Receive tailor-made loan software for lenders designed to tackle individual business needs and objectives. We take a personalized approach to development, making sure the final product aligns perfectly with your goals.

Agile approach

Embrace an agile development methodology that ensures flexibility, transparency, and frequent project updates. Agile processes enable us to keep in line with shifting requirements and deliver incremental value throughout the project.

Quality Assurance

We help achieve top-notch quality through rigorous testing and Quality Assurance processes that polish out bug-free and reliable software. We assure practical quality at every stage to develop solutions that perform seamlessly.

Timely delivery

You can always count on us to complete your project on time, adhering to strict deadlines and milestones. We fully realize the need for guaranteed timely delivery in achieving competitive business objectives.

Cost-effective

Optimize your budget with cost-effective solutions that give you an outstanding return on investment and prove their end value. We offer competitive pricing without sacrificing a single bit of quality.

Client-centric

Experience outstanding customer service and communication throughout the project, with your satisfaction as our top priority. We try to stay as transparent as possible in communication to achieve well-adjusted, consistent results.

Lending software development process

Get a free consultation on your project!

Our approach to development

Turning to DICEUS, commercial lending software vendors of all scopes gain a sharp competitive edge and advanced digital capacities to drive a market-defining lending business. We believe we stand out thanks to the following company-wide priorities as well.

Our tech stack

Explore our case studies

Frequently asked questions

What are lending software development services?

Lending software development services encompass the creation of custom software solutions tailored to the needs of financial institutions, banks, credit unions, and lending organizations. These services may include the design, development, and implementation of software that streamlines lending processes, automates tasks, enhances risk management, and improves customer experiences.

Why should I consider lending software development services?

Considering lending software development services is essential for up-to-date lending services providers seeking to stay competitive in today’s dynamic market. These services offer the opportunity to leverage cutting-edge technology to optimize loan origination, underwriting, portfolio management, and customer engagement. With custom lending software, you can enhance operational efficiency, reduce risks, and provide borrowers with a seamless and convenient experience, ultimately driving growth and profitability.

What types of lending software can be developed?

A wide range of lending software solutions can be developed to address various aspects of the lending process. These include Loan Origination Systems (LOS), Loan Management Software, Peer-to-Peer (P2P) Lending Platforms, Mortgage Management Systems, Credit Scoring and Underwriting Solutions, Risk Assessment Tools, and Customer Relationship Management (CRM) software tailored specifically for lending institutions. The choice of software depends on the particular needs and goals of the financial organization.