What we offer

Banks use Robotic Process Automation (RPA) and end-to-end process automation to reduce manual processing, expand operations, and process a large volume of transactions, KYC, and onboarding requests. Using RPA expertise, you can significantly improve customer experience, increase compliance, enhance productivity. The goal of any RPA-based project is to free up resources for high-level jobs in banking, and, as a result, increase revenue.

We help banks explore the potential for digital transformation and intelligent automation with robotics process automation software. Your financial institution will be able to stay strong in the face of ever-changing challenges. Our RPA development services include RPA program planning, software systems audit, RPA integration, cloud migration, software robot development.

We execute automation projects related to core banking business functions like operations, customer experience, and AML, risk, compliance. These solutions can ensure business continuity in planned and unplanned occurrences such as a pandemic, improve employee engagement, and reduce attrition.

Process automation for GRC (governance, risk management, compliance)

RPA is a compliance enabler for banks. It can help banks and financial organizations reinvent their compliance and risk management processes. In the GRC area, RPA can provide the following benefits for banks:

- Automate internal and external reporting like liquidity coverage reports or delinquency reports

- Reach operational flexibility when needed to ramp up or down according to the changing regulations

- Align with your audit, risk, and compliance program

- Free up specialists to focus on high value-generating activities

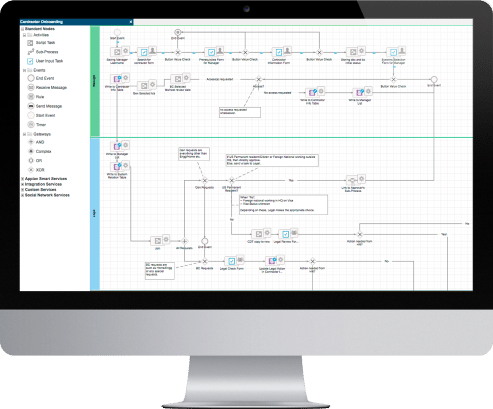

RPA for customer onboarding (KYC) and offboarding

RPA can help banks overcome their critical challenges by reducing redundant and manual labor and automating such processes as customer onboarding and offboarding:

- Automate documents aggregation

- Integrating CRM with core banking and other systems

- Improving interaction with customers through the channels they prefer

- Automating the KYC process

- Improving the average time to complete registration by reducing the number of manual inputs

- Improving the customer acquisition rate

RPA for customer experience

RPA software solutions can automate low-value and repetitive jobs involving bank advisors and agents in interaction with customers. The technology brings the following capabilities:

- Improve the productivity of agents

- Reduce customer query processing and quoting time

- Free up time for value-added activities

RPA for customer support

RPA for customer service centers automates a wide range of routine tasks performed by the bank reps and brings the following benefits:

- Faster information gathering from multiple sources

- Automation of the account verification process

- Tracking the current status

- Improved logging into numerous systems and copy-pasting between the screens

- No human error

RPA for AML and Fraud

RPA solutions, in conjunction with cognitive capabilities, can help banks regulate anti-money-laundering and fraud detection concerns. Below are the most frequent use cases within RPA implementation into the AML processes:

- Customer due diligence/Customer Fraud Management: client setup, onboarding, information validation

- Client screening: consolidation of customer information from multiple sources, client risk management

- Transaction monitoring: identification of repeated alerts, status changes check, data collection process management, analytics

- Offboarding investigation: client account status check before account closure, monitoring, and prevention of transactions of specific customers

RPA for operations

Processing large volumes of customer data and requests is effort and time-consuming. RPA-based solutions can address the challenges and increase operational efficiency significantly and decrease operational and labor costs by automating lots of manual jobs and repetitive tasks performed by customer representatives:

- Order status checking

- Cases opening

- Records updating

- Real-time communication with customers

RPA for digital transformation

RPA technology is a driving force for digital transformation for both banking business, retail, and corporate lines. Among the most meaningful benefits, RPA solutions can bring the following:

- Compared with traditional solutions for Digital Transformation (DX), quick implementation period, from days to weeks instead of months

- Rapid problem-solving capabilities with no significant impact on business continuity

- Cost reduction and automation of manual activities to free up resources for high-level jobs and high-touch interaction with customers

- Maximized efficiency of operations

- Elimination of human errors

RPA for employee and talent development

Make your HR onboarding programs a real success with an RPA technology to increase employee satisfaction, productivity, and loyalty. RPA is an excellent tool for automating recruiting, onboarding, and training processes that brings a bunch of the following benefits:

- Sourcing resources and processes standardization and automation

- Quick and accurate candidates screening process

- Offer letters composed by bots

- New profiles creation by bots

- Joining formalities tracking

- Transparent candidate verification process

- RPA-powered assistance in training and personal development programs

Application integration

RPA has all the functionalities needed to integrate all the applications to centralize and optimize all knowledge and data. RPA eliminates the manual jobs required to take the data from one application and put it into another.

Cloud adoption

Many legacy apps can be accessed only through graphical user interfaces (GUI) that can be a challenge for banks today. RPA is an enabler for cloud adoption as it can offer a coherent mechanism for integration and data migration from these outdated systems to new cloud-based solutions.

RPA for Intelligent Data Processing (IDP) including OCR (Optical Character Recognition)

RPA technology can become a major game player in data capturing for AI-based intelligent data processing (IDP), which, in turn, leverages optical character recognition (OCR) to automate the document integration processes. The implementation of IDP can significantly reduce labor costs and improve the processing of unstructured data.

RPA programs planning

When planning for an RPA, start with brainstorming sessions — we build a foundation for your bank to implement an RPA. The planning includes in-depth business analysis, a technology landscape analysis, and risks, integration impact, and opportunities. You get all the requirements and implementation plans as particular deliverables of this service.

Technical debt audit

A lot of RPA projects fail because of unsustainable IT infrastructures and wrong strategies. We conduct an audit of system environments to uncover early all the legacy issues that require reworking, changes, and updates. Besides, we offer PoCs and MVPs to validate your RPA programs.

RPA / API integration

Within a broader RPA framework, we offer API integration for specific banks’ functions and complex processes automation. Our RPA development services also include API design and architecture, maintenance, consulting, RPA integration with other applications like chatbots and technologies like artificial intelligence (AI), machine learning (ML), natural language processing (NLP), optical character recognition (OCR), etc.

Low-code automation

Our RPA teams have expertise in handling projects that require low-code automation. The Low-code approach is efficient, cost-effective, flexible. It allows us to develop and customize an RPA solution quickly and smoothly.

Banking operations

RPA allows automating and improving core banking activities by minimizing the number of manual processing activities, structuring, and aggregating all the data. This technology can also enhance your decision-making processes by implementing advanced decision engines.

Card management

RPA is used for both credit and debit card management to improve and simplify such activities as a replacement or upgrade, for instance. Besides, technology is actively used to detect fraud.

Loan management

RPA solutions help increase the bandwidth of loan applications by automating this process and decreasing application processing and approval time.

Customer relationships management

Using RPA to reduce time-consuming tasks and free up advisors for high-level, and more meaningful jobs, improve customer experience and satisfaction.

Onboarding

Decrease the time needed to open an account by automating Know Your Customer (KYC) and Anti-Money Laundering (AML) checking.

Mortgage management

Improve customer satisfaction with mortgage management procedures by reducing time for calculations from hours to minutes.

Monitoring and reporting

Create reports quickly by aggregating data from various systems. RPA ensures the highest level of efficiency, along with data accuracy and consistency.

Anti-money laundering

Automate reviews of high-risk accounts and transaction screening to enhance your AML compliance and the quality of investigations.

Fraud investigations

Enhance fraud investigations by automating the data aggregation from multiple sources, data entry, reviewing, and analysis.

| Attended RPA | Unattended RPA | |

|---|---|---|

| Bots involving humans into task handling | Bots working on their own | |

| What | Front-office tasks | Back-office tasks |

| How | Human triggers a bot and interacts with it | A bot works independently |

| When | Whenever human needs | Work according to a preset schedule or if required by logic |

| Where | Workstations, servers, cloud | Workstations, servers, cloud |

| Why | Increase productivity Reduce average call handle time Improve customer experience Increase compliance | Increase productivity Reduce operating costs Eliminate errors Free humans from repetitive tasks Increase compliance |

Get a free consultation on your project!

Benefits from RPA software development

RPA software development can help banks to respond to fast-changing customer demands and compliance regulations quickly. Besides, they are under pressure as a result of new market entrants like fintech. The RPA value — bots working day and night to handle piles of digital work without hiring extra staff. The major challenges banks face today are as follows:

Our RPA development process

Our clients can choose amongst three models of engagement for RPA development services: Time and Material, Fixed Price, Dedicated Team.

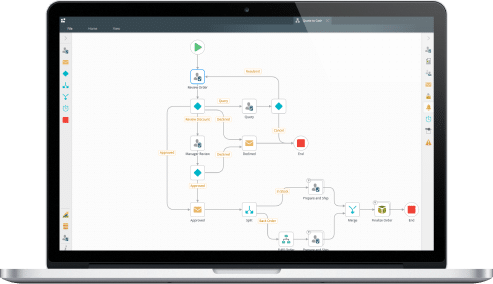

Our software development life cycle is Agile, which means iterative development and on-time delivery. The SDLC phases are as follows:

What impacts your project duration

While all RPA projects are different and take different time, we always provide estimations based on the critical path analysis (CPA) combined with the work breakdown structure (WBS). However, below are the factors affecting the time:

- Project requirements

- Expected deadlines

- Team composition

- Chosen RPA technology and platforms

- The nature of the business function you need an RPA for

What affects your project costs

We estimate costs at the beginning of each project and approve payments and schedule with you. Be aware that any change requests affect the project cost and duration, as well. The total cost of your project will depend on the following factors:

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

- The cost of the RPA technology license

What we need from your side

Robotic process automation is an extensive process that requires consistent strategy, large inputs, and governance. Thus, you should have an RPA group of C-level stakeholders for this process with a shared vision of their digital transformation roadmap.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, a test strategy or test cases

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

How to start with Robotic Process Automation services?

We can start the project once we have high-level requirements for your RPA project. These can be gathered during a certain number of sessions. You should also provide all available documentation and assign a responsible person or an RPA committee to collaborate with us.

How much does it cost to acquire RPA services?

Above you can find the information concerning the factors affecting RPA project costs. Once we define the project scope and the desired RPA technology to implement, we can make accurate estimation for you.

Will RPA services assist me in training employees?

RPA technology is one of the best ways to automate training and onboarding processes in your organization. It reduces costs for these activities by providing lots of self-service and AI-powered tools for your employees.