Why custom-built P&C insurance software matters for the sector

In the highly ambitious insurance market, custom software is vital to the successful digitization of P&C insurers seeking to gain or maintain leadership in the niche. With the property and casualty insurance software built specifically for you, you gain flexibility and control, enabling automation and integration across your enterprise. The investment in custom solutions yields returns through operational efficiency, customer loyalty, and accelerated growth.

Values that P&C insurance software brings

Our insurtech solutions enable your company to strengthen functionality, boost processes, and speed up operations for tangible business gains.

Get a free consultation on your project!

Core features of bespoke property and casualty insurance software

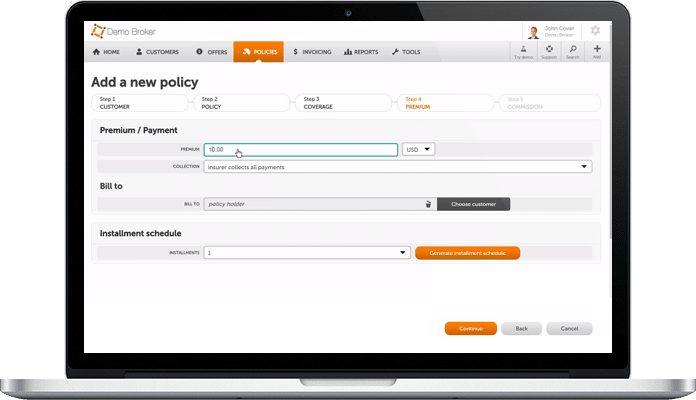

Streamlined quoting process

Automated quote generation with built-in pricing algorithms and underwriting rules enables brokers and underwriters to quickly provide clients with multiple quote options based on their unique risk profiles and coverage needs.

Robust underwriting

Your bespoke P&C insurance software solution allows you to define risk attributes, weigh their importance, and use rules to identify risk profiles and scores quickly. After issuing a policy, it continues monitoring changes to help an underwriter decide on any adjustments in the coverage or pricing before renewal.

Structured contacts management

A centralized database stores contacts for all your applicants and policyholders and groups multiple contacts at an organization under one account record. This allows a quick lookup of contact information for follow-up, service, or sales. It also provides tailoring services, products, and messaging.

Well-run document management

With documents instantly available with a single click, customer service reps can rapidly respond to inquiries, underwriters have the complete picture to assess risks appropriately, and claims adjusters have the documentation to settle claims quickly and accurately.

Optimized policy lifecycle management

Custom P&C insurance software development offers solutions that automate as much of the policy life cycle as possible. They seamlessly match your company’s products, rules, and workflows and enable you to customize policy terms, coverage, limits, exclusions, and pricing.

Timesaving claims management functionalities

A custom-made solution enables P&C insurers to reduce claims lifecycles, decrease loss adjustment expenses, investigate claims thoroughly and efficiently, and promptly proceed with payments (or denials).

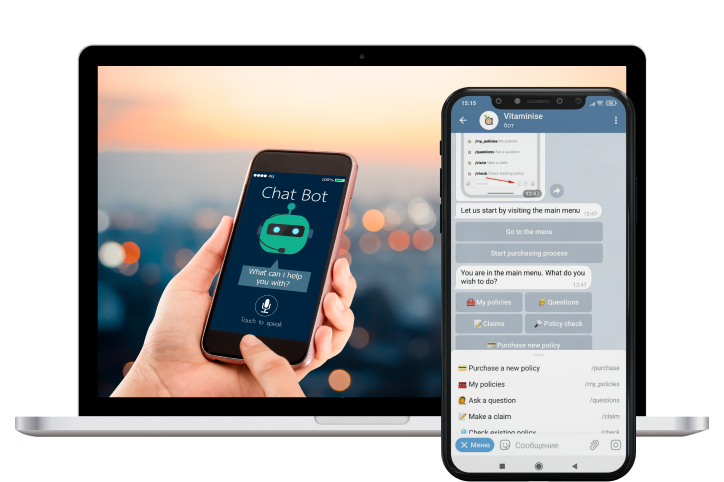

Self-service portal for customers

A self-service portal boosts convenience for your customers, increasing their retention rates. It allows your policyholders to manage their policies using a specialized timetable without calling or visiting an agent for every interaction.

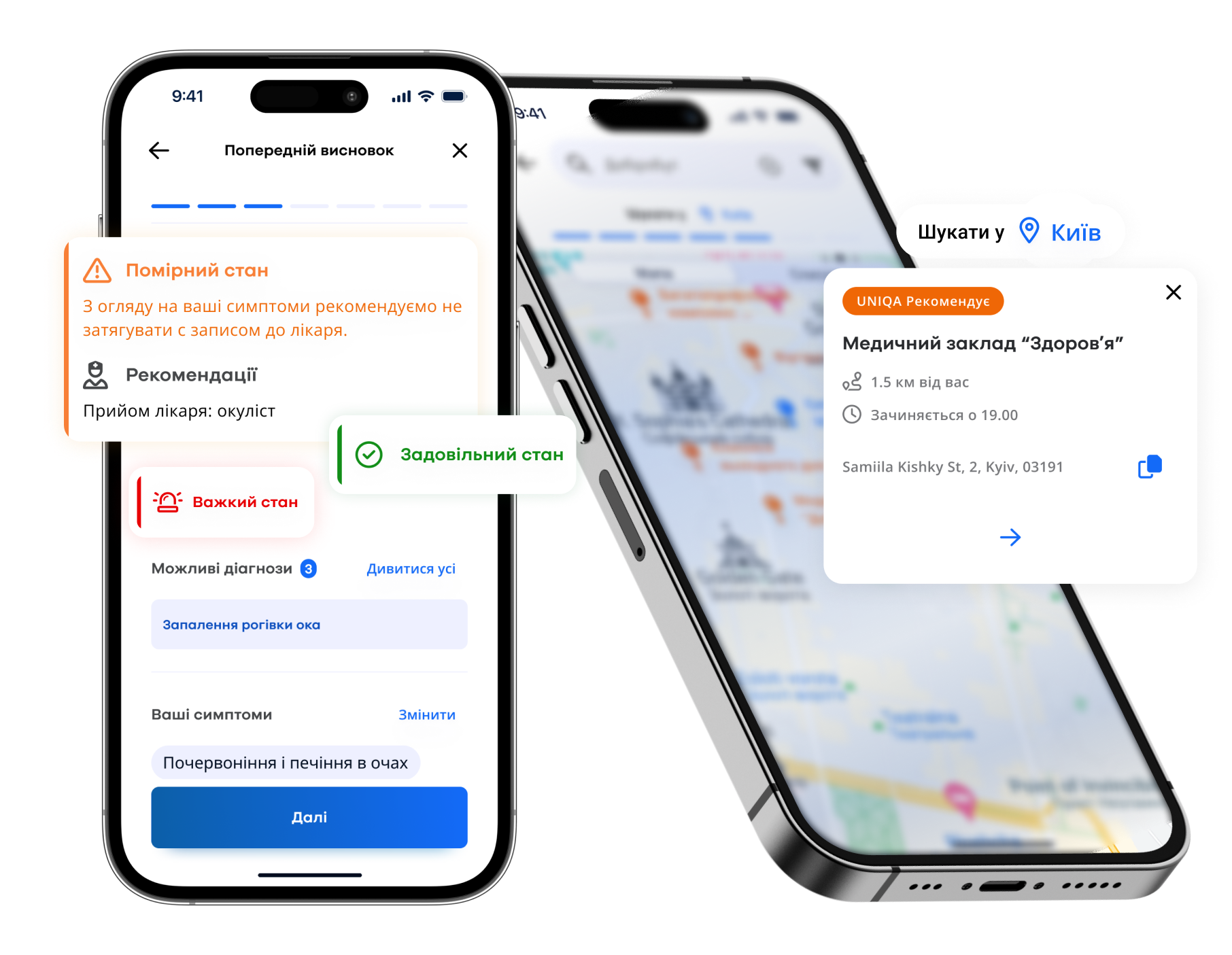

Mobile access for on-the-go users

Utilizing tailored P&C insurance software development, you can enable your clients to control their operations through staffless tools on your mobile platform. You let them report claims, download forms and policy documents, pay bills, etc, on the move.

Extensive reporting and analytics

Comprehensive reporting allows insurers to gain visibility into loss rates, claims frequency, premium growth, and other indicators. Predictive analytics can help you anticipate risks, make informed underwriting decisions, optimize ratings, make claims handling painless, and more.

Effective CRM

The system stores each customer’s contact details, communication histories, policy details, and notes. Through targeted emails, scheduling follow-up calls, and reminders, it lets your service reps build stronger connections.

Our services

Want to discuss your project?

About DICEUS

Why choose DICEUS?

DICEUS has been helping P&C insurance companies thrive in today’s fierce global market with:

- Omnichannel strategies for peerless involvement across all your customer touchpoints, whether online, mobile, or in-person

- Experience delivering over 20 projects across the global insurance sector

- Proven expertise and skills to tackle your biggest challenges

- The breadth of technology capabilities and technology-agnostic philosophy

- Emphasis on crafting robust customer-centric solutions

Our partners

How to get rolling with custom software development?

Our tech stack

Client reviews

Our case studies

FAQ

What is P&C insurance software development?

Property and casualty insurance software development refers to designing and creating software solutions for P&C insurance companies. P&C insurers provide coverage for individuals and businesses to protect them from losses from accidents, natural disasters, and more.

How does P&C insurance software development work?

Using an iterative approach, your P&C insurance software development company builds customized solutions to modernize insurance processes, cut expenses, and boost policyholder experience for insurance providers.

Can your systems integrate with external applications from other providers?

Our P&C insurance software solutions are designed to fit in perfectly with existing third-party apps your company currently uses.

What are the benefits of using property and casualty insurance software development services?

This software automates manual tasks, significantly lowering operating costs, speeds up all insurance operations, offers advanced business intelligence tools, scales with your business as it grows, and helps ensure compliance with industry regulations and reporting standards.

What are common mistakes to avoid in P&C insurance software development?

Unclear requirements, lack of research, poor project management, and choosing the wrong technology are all the most typical mistakes that fundamentally affect the success of bespoke software.