How to create custom CRM for insurance agents

Management of large client bases with restricted technologies like Google spreadsheets requires extra time, effort, and expenses. As an insurance services provider, you can eliminate existing flaws and gain more profit by deploying a tailored Customer Relationship Management (CRM) system. This system will serve as a centralized platform to manage your connections with customers, leads, and prospects. The technology helps consolidate client data, policy information, communication history, and marketing initiatives to effectively manage leads, handle policies and claims, and automate conversations for higher customer engagement and loyalty.

Bespoke CRM solutions drive customer satisfaction, sales productivity, and business growth, optimizing customer engagement and retention, providing up/cross-selling possibilities, and facilitating long-term client relationships.

According to Salesforce, companies using custom solutions can boost sales by up to 29% and improve sales forecasting accuracy by up to 32%, whereas sales productivity can increase by 39%.

Let’s explore how a custom CRM can help insurance agents handle their jobs.

DICEUS offers end-to-end custom development services for the insurance industry: Learn more

Benefits of a custom CRM for insurance agents

Insurance firms benefit from adopting digitization and innovative technologies. Here are the most vivid advantages of implementing a custom CRM system.

Improved customer experience through personalized communication and tailored insurance products

A recent survey revealed that around 72% of companies believe using a custom CRM gives agents access to more accurate and comprehensive customer data. Businesses may use insurtech solutions to acquire and evaluate data on client interactions across all digital channels to better understand customer habits, preferences, and pain points.

Insurers also use CRM data to enhance customer interaction. With CRM for health insurance agents, for instance, carriers can discover what communication channel customers love most, which is performing best for claims processing, and which is the most convenient for scheduling an appointment with the doctor or getting telehealth services. Understanding this data, insurers can optimize channels for more personalized conversations, improving customer experiences with upgraded or new features.

Improved sales, lead/account management, and automation of administrative tasks

Agencies can improve productivity via an insurance CRM’s advanced marketing automation features, such as automated email campaigns and newsletters. Besides, custom CRM for insurance helps agents automate routine tasks, such as appointment scheduling, following up, and status tracking, which frees up time to focus on more complex tasks. Businesses that use a CRM for insurance agents can strengthen marketing and sales initiatives, boost customer retention, and, ultimately, expand.

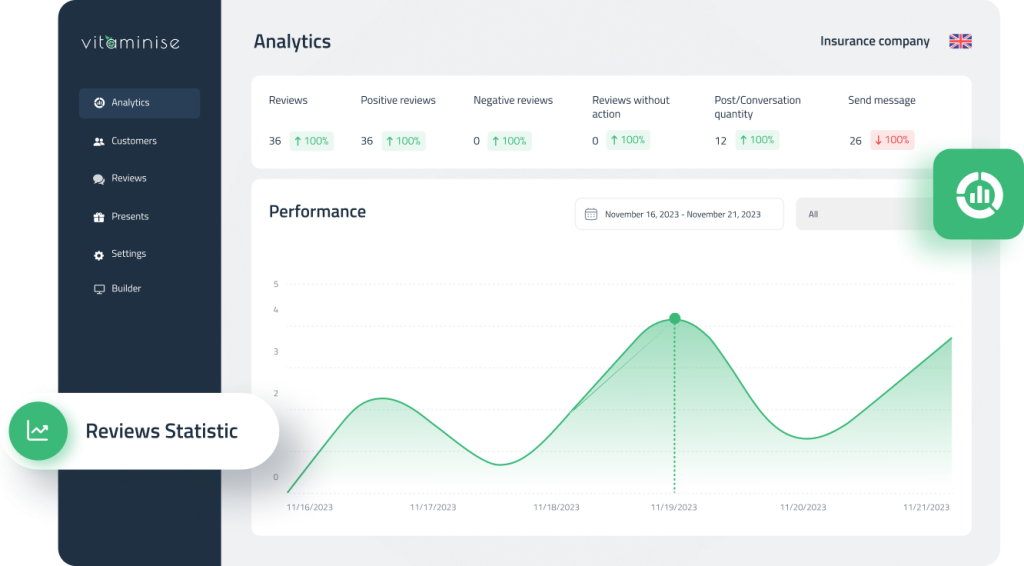

Improved data analytics and reporting

A tailored CRM for the insurance industry provides detailed reports on customer behavior like previous purchases, converted/unconverted quotes, submitted claims, etc., which helps agents understand how to interact with customers efficiently.

Financial reports generated by custom CRMs provide performance insights and identify improvement areas. By tracking sales trends and other key metrics, insurance companies can make strategic decisions about allocating resources, improving marketing efforts, and growing their business over time.

Improved security and compliance

Insurance agents deal with a hefty amount of personal data daily, making it crucial to have a system that can store and protect it. Insurance CRM should have robust data security mechanisms such as data encryption, a two-step verification procedure, and other user controls. Encryption is one of the key security features guarding sensitive information such as personal details, financial info, and medical records from unauthorized access. A CRM for health insurance agents must also comply with GDPR and HIPAA.

Check out the insurance contact management development services we provide.

Key functionalities of insurance CRM systems

The development of CRM for insurance agents requires a thorough discovery phase, including UX/CX research, architecture design, recommended tech stack, team composition, and project roadmap.

A huge part of this phase is the selection of essential features that a completed CRM would offer. The must-haves include the following.

- Account management

- Lead/prospect management

- Policy management

- Claim management

- Document management

- Marketing automation

How to build custom CRM for insurance agents

Building a custom CRM for insurance agents requires careful design and execution to meet the needs of an insurance firm and its customers. A hyper-personalized approach offers the greatest efficiency and straightforward integration in the insurance business.

Here are seven critical stages we follow for effective implementation.

Step 1: Define goals

We start by determining the insurance CRM requirements and objectives, considering important elements such as customer management, policy tracking, claims processing, communication tools, etc. Understanding the workflows and procedures within insurance operations helps us efficiently design the CRM for health insurance agents.

Step 2: Tech stack

A tech stack for an insurance CRM platform typically comprises databases, programming languages, frameworks, and any additional tools. Popular options for databases include MySQL and PostgreSQL, while programming languages like Python or Java are commonly used for insurance CRM development.

Frameworks like Django or Spring can also be leveraged. As the insurance sector is continually evolving, the CRM for the insurance industry must be able to adapt to changing business requirements. That’s why we focus on scalable technology frameworks that efficiently handle data and user expansion.

Step 3: UI/UX

When building an insurance CRM software interface, we aim to provide a straightforward and accessible environment. Customization helps give end-users tailored digital environments that are easy to navigate. We consider the following factors during this stage of the development process:

- Optimized layout. Organizing menus and elements logically allows users to locate functions and information with ease.

- Usage of UX/UI principles. Creating a distinct visual structure via a smart blend of color, contrast, and font to grab users’ attention.

- Sustained consistency. Maintaining coherence in design components, vocabulary, and interactions increases user trust, minimizes intellectual burden, and enables smooth navigation.

- Dynamic and adaptable UI/UX. The interface should be scalable to fit various screen sizes and gadgets. It should also be accessible to users with diverse needs, considering aspects such as text legibility, color contrast, keyboard navigation, and screen reader compatibility.

Step 4: Development

After the UI design has been crafted, we create the core functionalities of the CRM software for insurance agents. This entails customizing crucial functions and integrating ready-made modules for policy administration, lead generation, and handling communications.

Combining automated sales, lead administration, and client support aspects is critical for offering the smoothest insurance CRM experience. Insurance-specific pipeline oversight and sales process automation may be used to deliver successful renewals and track insurance sales.

Step 5: Security

After creating the fundamental functions of the CRM for insurance agents, we add comprehensive security measures to protect sensitive data.

We maintain the dependability of these features by updating our security measures regularly and conducting extensive testing, therefore improving the system’s integrity and trustworthiness. This technique allows us to fully adhere to industry regulations while maintaining a safe space for life insurance information, sales team data, and other private information.

Step 6: Testing

Once the development phase is complete, it undergoes a comprehensive testing and quality assurance process. This step is essential for recognizing and fixing any flaws, discrepancies, or performance concerns that might emerge.

We review numerous cases, procedures, and interfaces in everyday situations to guarantee that the system works as planned. This may include evaluating the software’s capacity to handle complicated data, support stress workflows, and link with other systems.

Our team assesses user adoption to improve user experience and system efficiency further. This is where we work closely with industry specialists to ensure the system’s accessibility, efficiency, and reliability in realistic scenarios.

Step 7: Deployment

To efficiently integrate with existing systems, it is vital to deploy the insurance CRM for life insurance agents in its working environment the right way. We provide extensive training and assistance for insurance professionals to guarantee a seamless transition to the new system.

Periodic upkeep and update plans are required to handle evolving business demands, regulatory regulations, and technology improvements in the insurance sector. Failure to do so can lead to suboptimal performance, data insecurity, and system inefficiency. That’s why ongoing maintenance helps to obtain optimal performance, data security, and reliability.

Need to build a bespoke system? We offer custom CRM development services.

Conclusion

Custom CRM integrates features crucial for insurance professionals, such as client management, policy tracking, claims processing, and commission management, streamlining their daily tasks and enhancing efficiency. The system can also incorporate advanced analytics tools to analyze customer data, identify trends, and optimize sales strategies. By customizing the CRM to the intricacies of the insurance industry, agents can effectively manage their client base, track policies throughout their lifecycle, and ultimately improve customer satisfaction and retention while maximizing their business potential.

Here at DICEUS, we provide top-grade IT solutions and services, specializing in custom CRM development.

FAQ

What are the key benefits of building a custom CRM for insurance agents?

Insurance CRM can automate repetitive tasks, freeing up employees to concentrate on generating leads and driving sales. By taking care of administrative tasks, the software helps acquire new customers more efficiently, ultimately resulting in increased sales and revenue for the business.

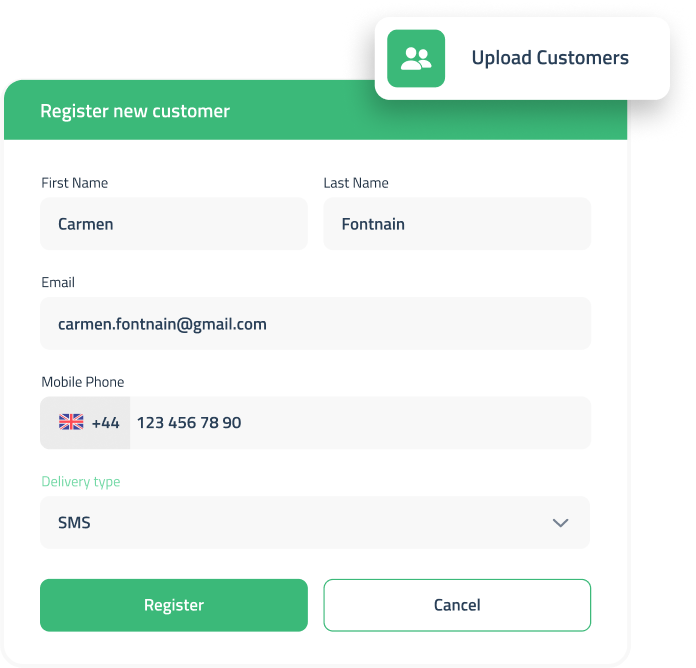

How does a custom CRM enhance client management for insurance agents?

With a high-quality CRM, agencies get a tool to keep detailed client profiles, storing contact details, messaging history, and policy info. This data helps agents provide personalized and timely communication, such as sending policy renewal reminders or updates on new products or services. A CRM for insurance agents also empowers specialists to track and manage client interactions across multiple channels, such as email, phone, or social media.

How can a custom CRM improve efficiency in lead tracking for insurance agents?

CRM software allows one to meticulously track, handle, and develop relationships with potential clients. CRM solutions empower agents to customize their follow-ups by organizing lead data and communication history to proactively transform leads into customers. With the right CRM software, insurance agents can confidently strengthen sales conversions, raise profits, and reach business objectives.

What security measures should be implemented when building a custom CRM for insurance agents?

The consolidation of information on a single platform is unquestionably the most important benefit of a CRM system. With the immense amount of sensitive information that insurance agents deal with daily, having customized CRM software with solid data security standards is critical. CRM software’s sophisticated features, such as data encryption, two-step authentication, and other user restrictions, provide the most robust security against illicit entry or tampering.

How can a custom CRM integrate with existing systems used by insurance agents?

Efficient customer data management and streamlined workflows are critical for insurance agents to maintain a competitive edge in today’s market. Connecting a CRM with other third-party software is a perfect way to centralize things. However, such integration requires careful consideration of the technology stack used.