What we offer

You can get various core banking services: design, development, deployment, optimization, upgrade, and support of any core banking tool or functional module. Often, we work with legacy platforms that banks want to update or change. These outdated systems lead to exorbitant IT spending related to manual, inefficient processing, poor time to market, lack of personalization and integrations.

Modern digital tools can solve these challenges. Get your old app replaced with a universal solution for automated processing, efficient data storing, analysis, high-level customer support, and omnichannel delivery. As well, new core banking and financial services provide 360-degree client views, regulatory compliance, and reliable IT security measures.

Oracle FLEXCUBE

10% of all banked people in the world have FLEXCUBE-powered accounts. This software is modular and interoperable. It focuses on truly digital core banking experience that evolves depending on the local financial requirements. The system has various core banking services, including machine learning, open-source development, APIs, multiple environments and ecosystems.

- Number of business clients: 600

- Number of accounts: 380 million

- Number of offices: 79

- Date founded: 1997

Temenos T24

Being one of the most experienced teams, Temenos provides core banking and financial services to many major banks. It helps microfinance, community, private, corporate, and retail institutions with a digital core, front-office, and management solutions. Temenos also empowers Islamic banking thanks to the modules and rules tailored to this financial landscape.

- Number of business clients: 3,000

- Number of accounts: 500 million

- Number of offices: 68

- Date founded: 1993

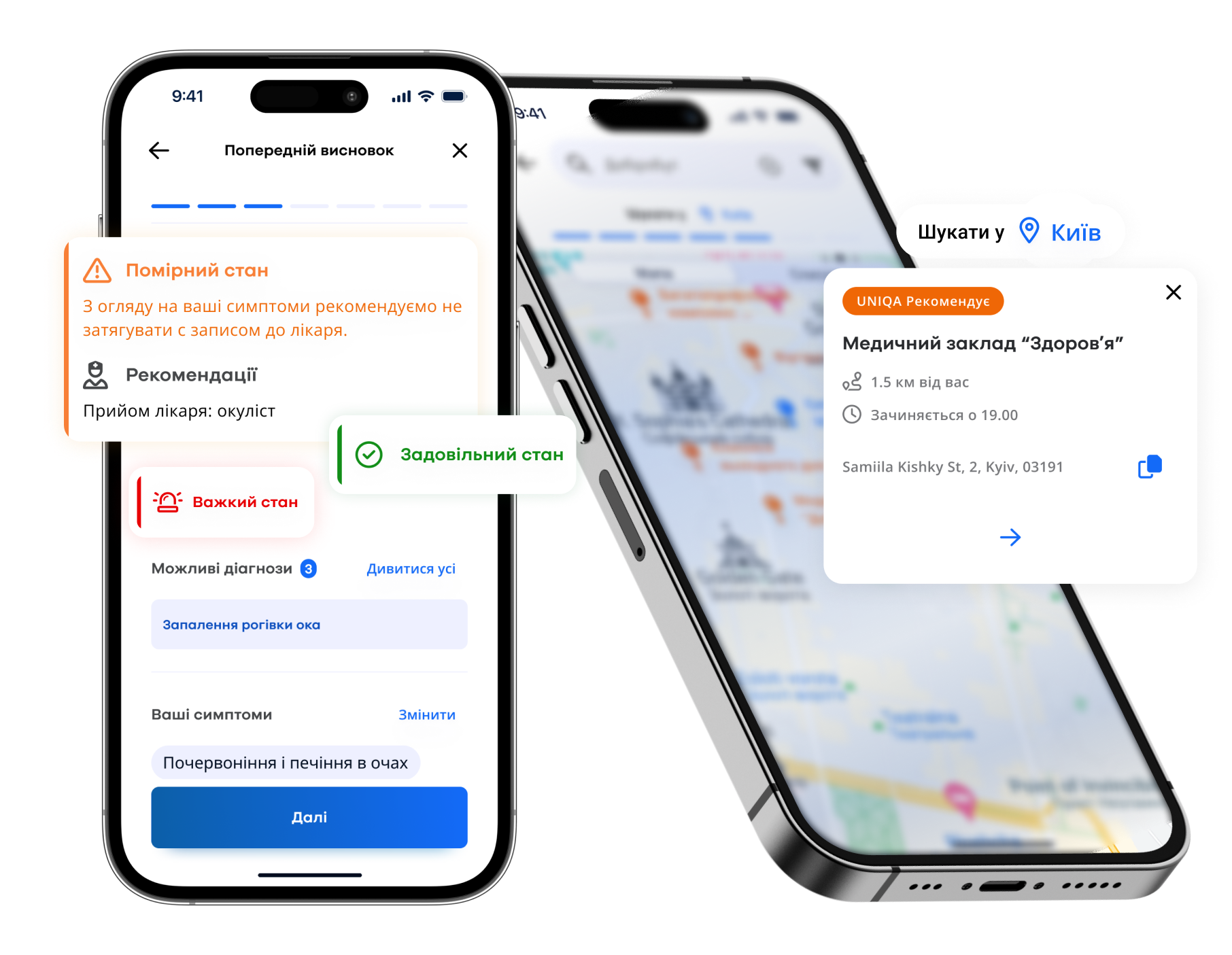

Mobile banking app development is crucial for financial institutions. As customers become more dynamic, they prefer to access core services through apps. Even websites are becoming less demanded because people focus on the smooth native experience. When your clients can check balances, send money, pay bills, or find ATMs in a few clicks, they appreciate your effort. Hence, the mobile banking software is one of the best investments you can make right now.

Core banking services

- 24×7 functionality for branches

- Application decommissioning

- Application and EOD issue analysis

- Changes and updates to existing apps

- Consulting and audit

- Data migration

- Database migration and optimization

- Database-related services

- EOD analysis and reporting

- Execution of Host EOD/EODM

- Issue resolution

- Monitoring of EOD

- Network monitoring

- Participation in new products

- Platform and system upgrade

- Preparation of test environments

- Support for your team

- Testing and validation

- Troubleshooting

- Verifications

Get a free consultation on your project!

Benefits of core banking transformation

Don’t miss your chance to gain a competitive edge by upgrading or transforming your core banking system. Main differentiators that you can get from a new or upgraded core banking software include the benefits below.

Our core banking solutions and approaches

Depending on the needs of your business, we can use one of three implementation approaches: Big Bang, Progressive, or Greenfield. The starting phases are often similar. It’s possible to develop a custom tool, upgrade your existing legacy platform, change one module or the entire system. But the general flow remains unchanged for all core banking solutions: pre-project assessment, discovery, engineering, quality assurance, deployment, operation and support.

The discovery phase includes the following: inventory of current implementation, high-level and low-level architecture documentation, service line analysis, SLA/OLA and metrics agreements, system configuration monitoring, metrics. When it comes to implementation, there are three classic approaches to core banking replacement, development, or upgrade.

What impacts your project duration

The average project time depends on the size (number of accounts in your bank) and scope (number and complexity of modules or interfaces required). For new implementations, this timeline varies from 6 months to 3 years. Migration and upgrade projects also depend on the number of accounts, products such as loans or deposits, as well as infrastructure readiness. Depending on the chosen approach, these projects also can take from 6 to 36 months.

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

What affects your project costs

The total cost usually depends on the costs of software and services. The first aspect varies from vendor to vendor. For instance, Oracle, Finastra, and Temenos have different software fees. The availability of vendor support matters a lot, too. Services depend on size, scope, and schedule. The most essential factors include the complexity of integrations, localization requirements, local central bank requirements, migration strategy, the readiness of third-party services, EOD/EOM procedures, IT support, and change requests.

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

Usually, banks have strong IT services. They understand what’s needed for an automated banking system implementation, migration, or upgrade. Business users also know project acceptance criteria based on the scope and other parameters. To provide the most tailored services, we will need some info from your side: available business and tech documents, access to Jira/Confluence, description of current models, SLAs and OLAs, examples of issues and audit logs, target goals.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, a test strategy or test cases

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

What is a core banking system?

Any CBS is a general ledger that handles main operations. These processes include account management, payment processing, deposits, withdrawals, compliance, and so on. Core banking solutions integrate with other modules. They also act as core databases from which information flows to other parts of the bank.

What is the best core banking system?

The best core banking solutions depend on your unique needs. Do you need a sophisticated automated banking system? Want to optimize data processing? Focus on extra security? To choose the best solution, you can cooperate with a core banking developer, agree on the requirements, and get recommendations such as customized FLEXCUBE or tweaked Finastra.

What are the advantages of core banking?

Critical advantages of core banking services and tools center around efficiency and automation. Such software minimizes human error, cuts operational expenses, improves decision making, and helps to combat fraud. Any core banking developer can tell you that these solutions are must-have for any financial institution.