What we offer

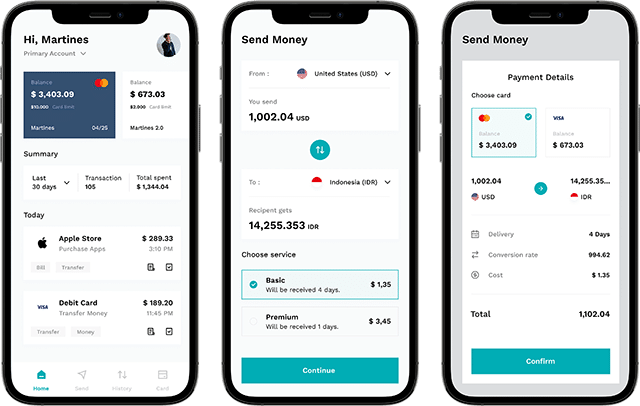

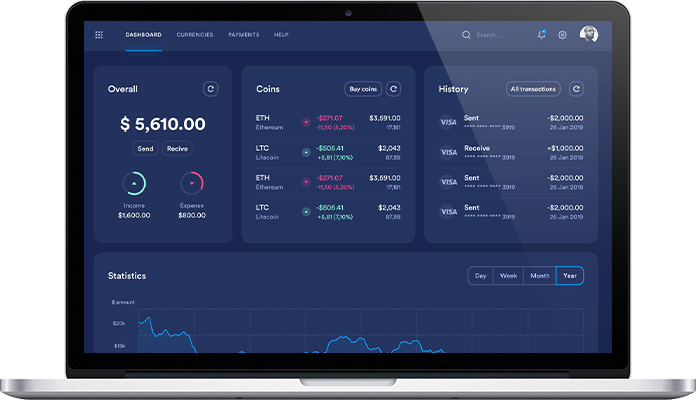

Money transfer functionalities

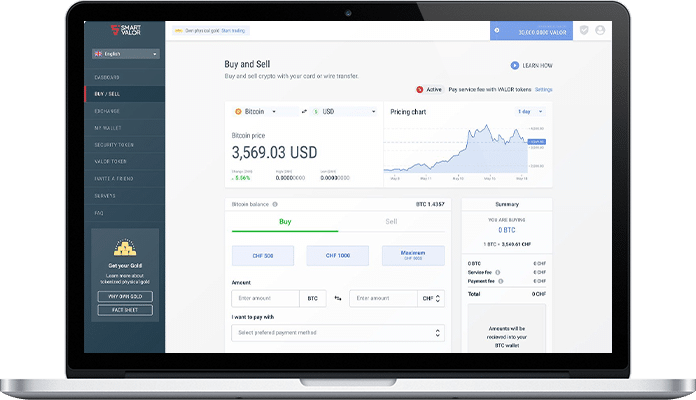

High transaction speed is not the only thing that allows money transfer apps to contribute to your financial freedom. In contrast to banks, the significantly lower transaction fees make money transfer apps much more affordable for users. Access to international payments is another advantage of the financial services provided by money transfer apps to those people who are deprived of conventional banking systems. Besides, money transfer app development offers many other helpful things such as payments stats, e-wallet features, 24/7 support, notifications, currency exchange, and even earning opportunities.

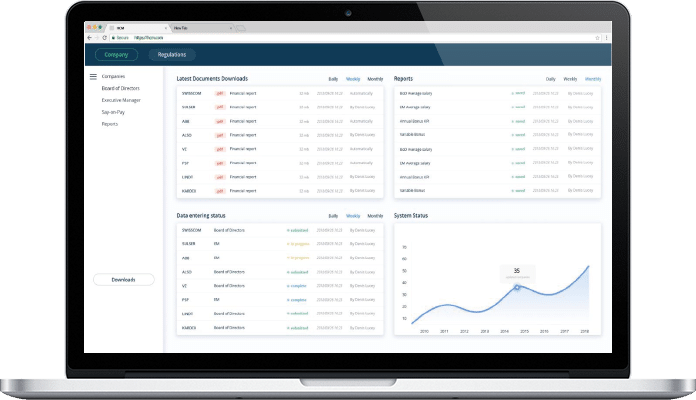

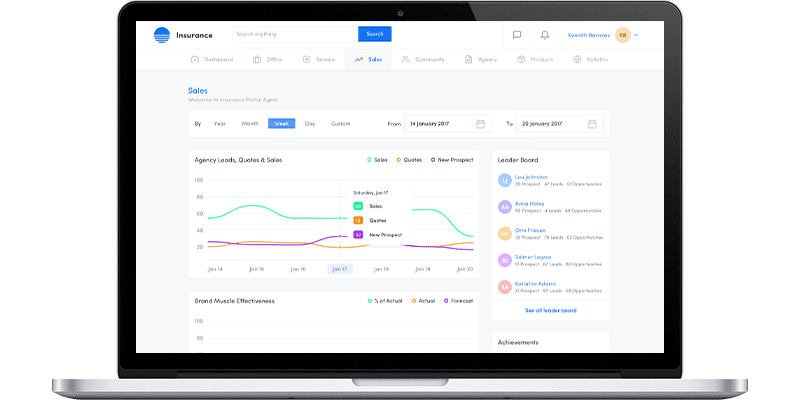

CRM and user management

A fully-functional money transfer application is something more than just an e-wallet. Quite a wide CRM functionality should be available to allow managing various sorts of customer relations. Otherwise, customer loyalty can suffer due to seemingly non-essential issues that may arise between your app and its users. Since DICEUS has a long hands-on experience in developing CRM systems, your money transfer application will be abundantly saturated with CRM features. Money is always a sensitive subject, whichever audience uses your app. Even the tiniest aspect of user management cannot be left to chance.

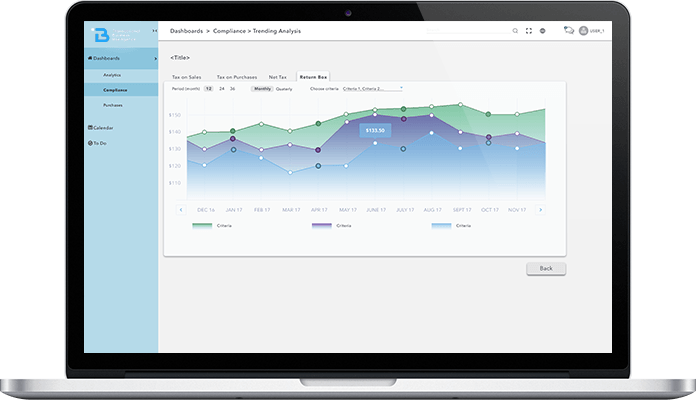

Reporting and accounting

Any successful business is hardly possible without comprehensive reports coming to business owners in due time. Fortunately, no extra staff is needed to generate professional business reports nowadays. Reporting is getting smarter with corresponding software solutions such as money transfer apps we develop. The same goes for accounting as well: create bills and invoices right in your app. Keep all your financial activities under the radar with the reporting and accounting features that we can develop according to your requirements.

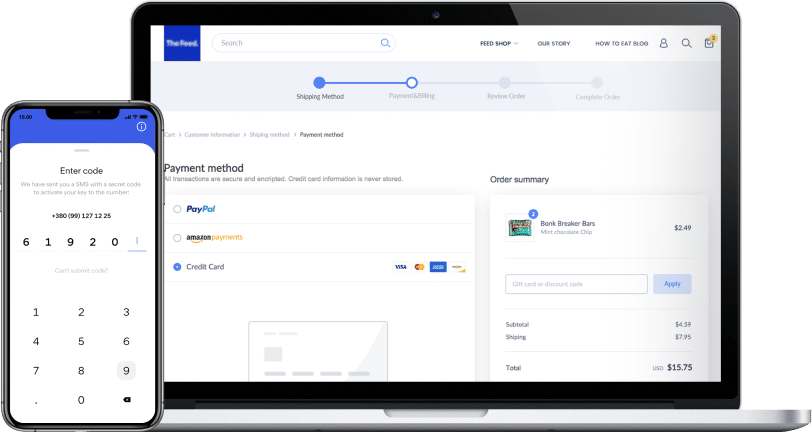

Security and compliance

Money loves peace, as wise financiers are used to saying. With our money transfer app, your funds will be securely protected with the most advanced digital technologies of encryption. We use only those protocols of compliance that are accepted and recognized by the world banking system as global standards. Besides, we are very close to the distributed ledger technologies widely used both in the crypto space and legacy banking networks. Money becomes data in this digital age, and we know how to keep your private data bullet-proof secure.

Get a free consultation on your project!

Benefits of custom money transfer system development

Our money transfer system development process

Get a free consultation on your project!

What impacts your project duration

To provide our customers with quite precise calculations of working hours necessary to develop a custom money transfer system we need the following factors to be taken into consideration:

- Project requirements

- Expected time-to-market

- Team composition

- Chosen platforms and technology stack

- Integration needs

What affects your project costs

Every custom software system is unique. That’s why the cost of each solution is to be calculated individually. The following factors have a significant impact on the price:

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

To accelerate and simplify the calculation of both the scope and cost of the future money transfer software, we ask our customers to deliver the following info, if available:

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, software architecture and mockups

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

What are the key challenges related to money transfers today?

There are three areas where money transfer systems should demonstrate advanced functionality. The first one is security related to the private data of users and info about each transaction. Cryptographic encryption technologies effectively mitigate the challenge. The second aspect relates to compliance with regulations. The requirements of a local fiscal system along with the international AML rules should be covered with corresponding features of a money transfer app. The third critical moment belongs to the transaction fees: P2P payment protocols should correspond to the latest standards of global banking networks.

Do you provide consulting on money transfer system implementation?

We are always happy to deliver valuable insights on money transfer software to our customers. Our expertise allows making tough issues simpler to understand: we can explain how to implement a money transfer system into the existing IT infrastructure of our customers. Besides, we can recommend what features should be available in a certain custom-made money transfer app. We prefer an individual approach to each customer that allows adopting digital P2P payments in a smooth cost-effective manner.

What are the basic functionalities of a money transfer system?

Almost instant peer-to-peer payments conducted in a couple of clicks allow contemporary money transfer apps to outperform conventional banking transactions in both speed and cost. Users need no specific financial data of their counterparties to send/receive money through a money transfer app: either a telephone number or a credit card number is usually enough to make a transaction. The e-wallet functions of money transfer systems are supplemented by financial reports, accounting features, notifications, currency exchange, and even earning/saving opportunities.