Use cases of data warehousing in the financial industry

Banks and other financial organizations manage a great amount of data in daily operations, which takes a lot of time and money. This is why building a financial data warehouse has become a reasonable solution to the problem. Firstly, it gives a clear understanding of an organization’s financial health, enabling reasonable business decisions about where to allocate resources. Secondly, data warehousing helps businesses track accurate financial indicators across numerous sources. Finally, the technology guarantees compliance with regulatory standards.

A finance data warehouse is a centralized repository for storing data captured from disparate sources (finance, accounting, operations, and sales) and providing a consolidated view of information for decision-making.

The cases below demonstrate how you can use data warehouses for banks and other financial organizations.

Get a free consultation on banking DWH from our expert

Benefits of BDW

The historical evolution of data warehousing has resulted in challenges such as inefficient dataset utilization and inconsistent information. This decentralized approach also leads to a complex data governance process, making it difficult to ensure data accuracy and compliance. Furthermore, data silos, integration complexities, and the need for real-time data analysis pose additional challenges to the effective management of data in the finance industry.

The benefits of a data warehouse for banking operations can help overcome the challenges mentioned above.

Efficient use of datasets

Many financial institutions use traditional and alternative data to make effective business decisions. The data warehouses can combine different types of information into a single dataset to create a complete picture of an investment opportunity, for example.

Streamlined reporting

Financial data warehouse solutions allow financial organizations to keep corporate information properly structured. They convert information into a convenient format for creating reports and conducting analyses.

Consistent and accurate data

The data warehouse eliminates human effort and error in finding, integrating, and managing large data sets, which enhances overall accuracy. Automated data helps companies handle large amounts of sensitive information, save time, and increase their productivity.

Improved analytics

The finance data warehouse may boost the financial data quality by quickly collecting and analyzing accurate information from many sources. The higher your data quality, the better your decision-making processes can be.

Flexibility

Data warehousing for finance industry ensures flexibility in terms of data management and analysis. Firstly, a DWH can integrate data from various sources, which helps organizations eliminate data silos. Secondly, with the constant growth of data, a financial data warehouse architecture allows for horizontal or vertical scale-up to store the required information without sacrificing performance. Thirdly, data management features, such as data cleansing, validation, and enrichment, ensure data consistency and quality. Ultimately, data warehousing in financial services offers robust security and data governance capabilities to protect sensitive information and ensure compliance with regulations.

About DICEUS

Our finance data warehouse development services

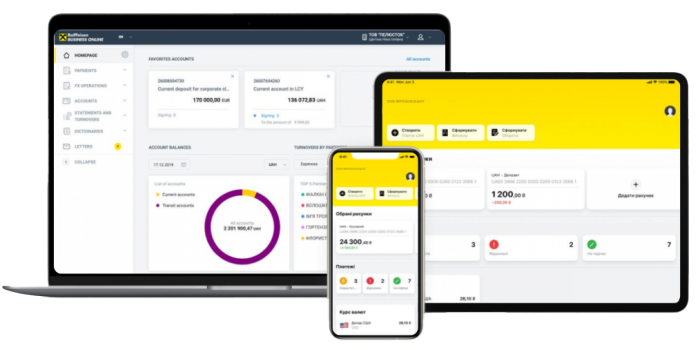

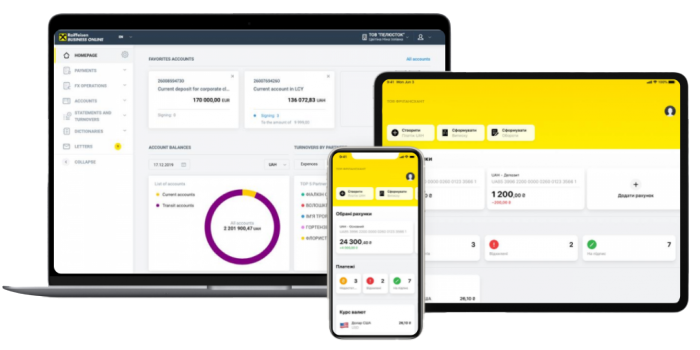

DICEUS specializes in creating and maintaining analytical DWH for banks. We provide advisory, enrichment, and integration services based on our expertise in two distinctive approaches.

Our first offering involves developing a data warehouse in financial services based on industrial banking data models from renowned brands like IBM, SAS Institute, and Oracle.

Our second offer focuses on transforming existing data models within banks, tailoring them to meet specific requirements. With a wealth of experience, we ensure the customization of industrial models, providing banks with comprehensive solutions that include glossaries, conceptual models, logical models, and frequently used data marts.

Other services

Can’t find the service you need?

Explore all servicesWant to discuss your project?

Schedule a callHow to get started

The use of DWH in banking has become an absolute necessity. The team of DICEUS simplifies the process by facilitating seamless extraction and loading from various data sources to your data warehouse. Utilizing a variety of connectors and rapid data replication, you can efficiently transfer substantial datasets for tasks like migrations and advanced analytics. Feel free to embrace the advantages of data warehousing for banks and other financial institutions with us. If you have settled on implementing a banking data model, here are the steps to take for a successful project:

Our tech stack

Our case studies

FAQ

What is banking data warehousing?

A data warehousing system for financial services is a centralized repository of integrated financial data from different sources that is used to make more informed decisions.

What are the key components of BDW?

A traditional DWH for banks has four main components: a central database, ETL tools, metadata, and access tools. All of them are engineered for speed so that you can get quick results and make a quick analysis.

What does data warehousing allow organizations to achieve?

Enterprise data warehouse for financial services accumulates large amounts of data from numerous sources for further analysis. Its analytical capabilities help organizations receive practical business insights to optimize decision-making, streamline operations, and enhance general performance.

What challenges are commonly faced in financial data warehouses?

A banking data warehouse model can face challenges related to data integration, as financial institutions deal with diverse data sources that need to be unified for comprehensive analysis. Maintaining data accuracy is another challenge, especially when dealing with large volumes of real-time and historical financial data.

What is a financial data warehouse model?

A financial DWH model is a structured framework for organizing and keeping financial data within a data warehouse. It includes data sources, data integration, data structure, granularity, security and access control, metadata management, scalability and performance. A well-developed model ensures a solid foundation for analysis and reporting.