Why do BI solutions matter?

For many traditional banks, the development of business intelligence system is not among the top priorities on their to-do list. As a result, they lag behind their more far-sighted rivals, which invest heavily in business intelligence for banks, suffer from inadequate manageability, and face greater risks of doing business. In the branchless paradigm introduced by modern neo-banks, business intelligence development emerges as a vital necessity because a robust BI solution for banks can become a game-changer in the following workflow aspects.

Need to implement effective analytics?

Our BI experts will help you develop the most effective analytics for banking

Benefits of BI solutions

When leveraged wisely, business intelligence for banking can usher in the following boons.

What we offer

BI and banking software development are two expertise domains in which we excel. Throughout 13 years of our presence in the banking and fintech niches, we have accumulated vast theoretical knowledge and numerous hands-on skills in business intelligence development for banks and other financial organizations. We can provide our clients with modern and mature BI development and support services, which include, in addition to traditional data marts and reports, the following analysis tools and frameworks:

- Dynamic multifactor risk management model

- Formation of the target function of banking activity management

- Estimating the worst net cash outflow of non-maturity deposits based on quantile regression

- Stochastic discrete dynamic model of the bank’s liquidity

- Assessment of banking system liquidity using the payment matrices

- Anti-recessional bank management. The modeling of the borrowing money amount for supporting its liquidity

- Risk-adjusted pricing of bank’s assets based on cash flow matching matrix

- Usage of Moody’s KMV Model to estimate a credit limit for a firm

- NII/NIM/NBI calculation

- Loan and deposit production analysis

- Multidimensional approach to measuring bank branch efficiency

- GINI index, coefficient

About DICEUS

Our partners

Our services

Can’t find the service you are looking for?

Write more about your project, and we’ll offer the solution

Explore all servicesWant to discuss your project with IT professionals?

We offer free 1-hour consultations for banks

Contact usHow to get started

While looking for business intelligence for financial services, it is often hard to make a good choice among the ocean of offers available in the contemporary IT outsourcing market. What should you do to enlist a qualified vendor capable of providing top-notch BI solution development for banks?

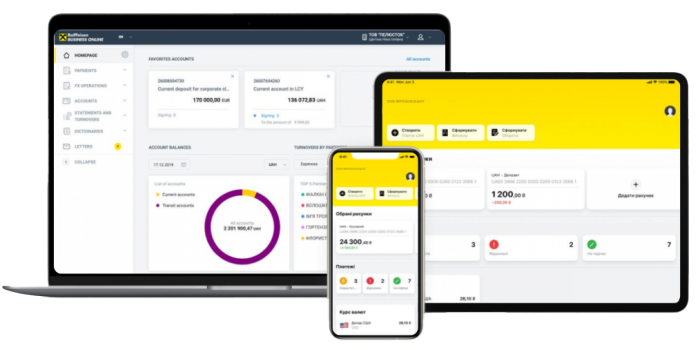

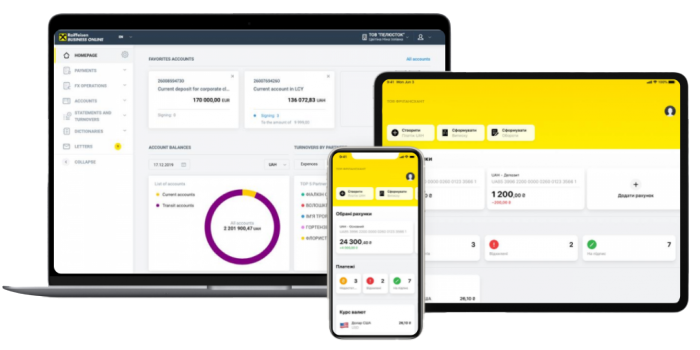

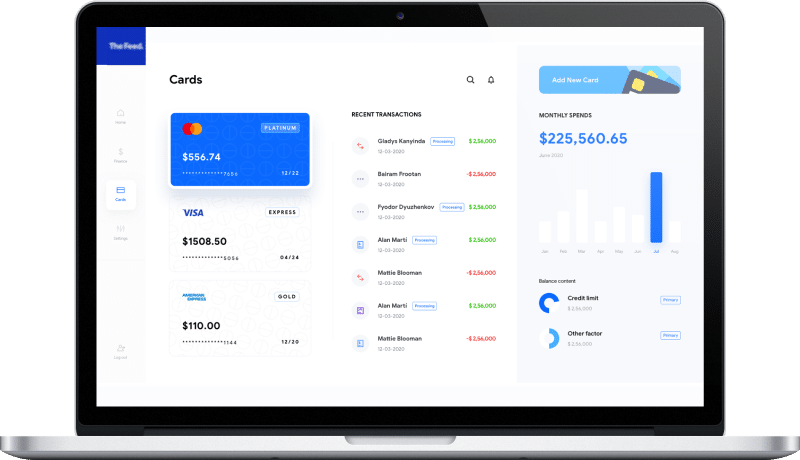

Our case studies

FAQ

What role does BI play in banking?

Workmanlike data processing is the cornerstone of success in the information-driven finance realm of the early third millennium. By harnessing a BI solution, banks will step up their analysis and planning capabilities, boost reporting routine, improve risk and revenue management, enhance personnel performance, and streamline customer data handling.

What BI tools are commonly used in the banking sector?

Among the popular tools business intelligence banks employ are Tableau and QlikView. The sophistication of natural language processing techniques will pave the way for the intense application of ThoughtSpot and similar tools. However, the unquestionable leader among business intelligence solutions in the niche is Power BI for finance data processing.

How does Power BI work in the banking sector?

Since this product by Microsoft contains a collection of apps, connectors, and other software pieces that collect and process information from multiple sources, the role of Power BI in banking can hardly be overestimated. By implementing a Power BI banking project, a financial institution will obtain not only a data analytics tool for its IT ecosystem but also a superb visualization data mechanism that will help banks monitor performance in real time and generate customized reports via an easy-to-operate dashboard.

How does BI contribute to cost reduction and operational efficiency in banks?

Leveraging BI tools, banks will have a clear view of spending with an opportunity to identify areas where expenditures are excessive or non-essential. Also, risk management BI solutions are instrumental in minimizing money losses caused by fraud or compliance breaches. As for operational efficiency, BI mechanisms excel at tracking employees’ KPIs and resource distribution, which enables banks to increase pipeline productivity and optimize resource utilization.