What we offer

Distributed Ledger

Digital Ledger Technology is an alternative to depositing and storing various assets (money, personal data, intellectual property) in banks, medical institutions, or social media. The DLT technology is designed to securely store data and send it straight to the intended recipient bypassing intermediaries and avoiding cheating. DLT-based solutions allow for tracking assets ownership using the principle of decentralization. We use DLT to create private systems with a limited number of participants and public ledgers, as well.

Decentralized applications

Decentralized applications, often referred to as smart contracts, allow for sending money in a decentralized way removing middlemen. These apps are used to exchange property, money, shares in hassle-free way. Smart Contracts are written as code, they include particular conditions, and are publicly available on the ledger. Our blockchain fintech development company delivers decentralized applications concerning your contract conditions and other requirements.

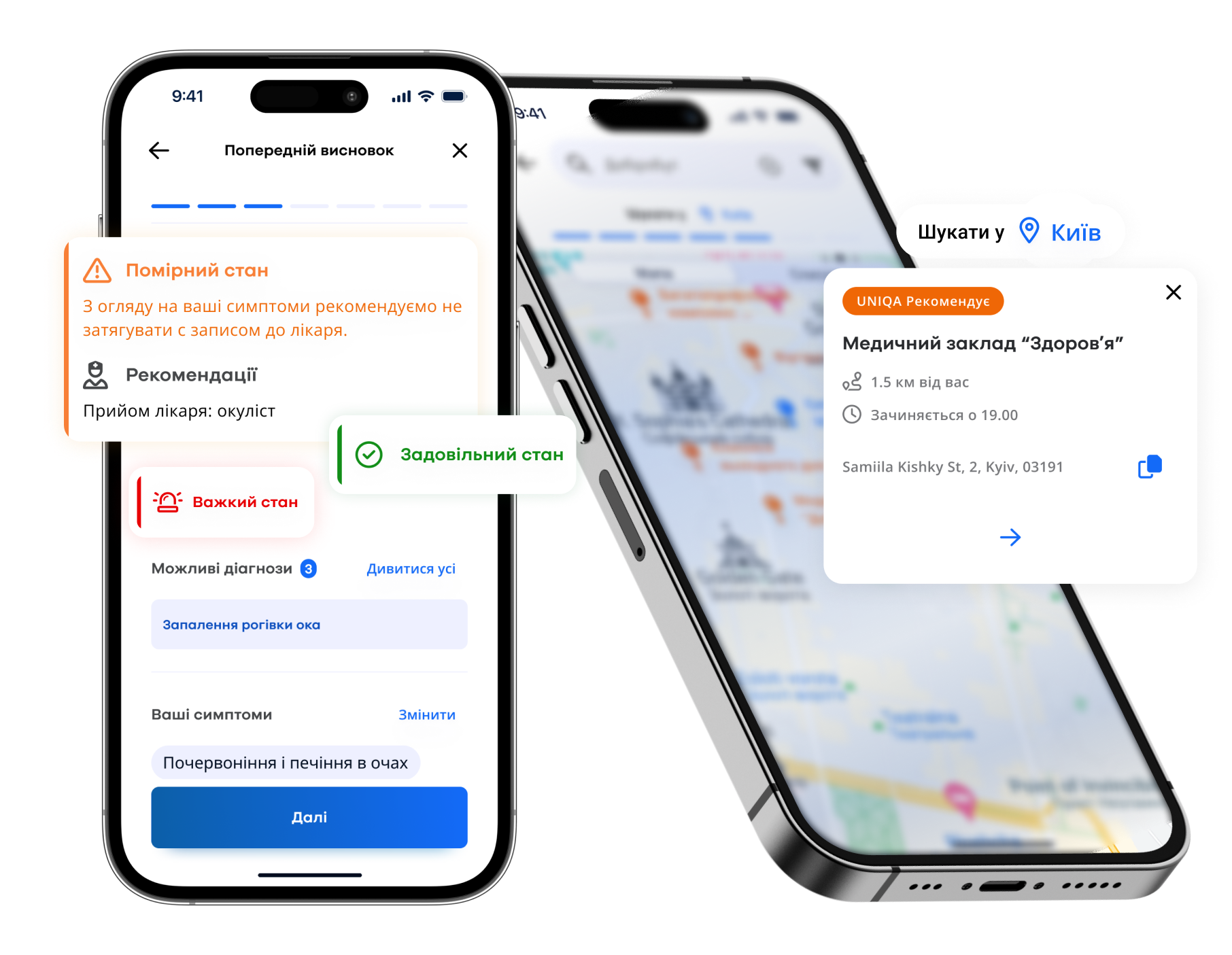

Blockchain for lending

The implementation of blockchain technology for loans can help solve such pressing issues, as a missing view on the credit score, manual data aggregation, frequent cyber-attacks, and many more. Blockchain provides a wide range of benefits like speed, flexibility, security, and transparency. What is more important — users are put in center and given a full control over their sensitive data. We build, test, and implement blockchain for financial services in general, and for loans particularly.

Blockchain for transfers

Money transfers, both domestic and international, are much faster and cheaper with blockchain. It takes a couple of minutes to settle a payment using blockchain. There are no or small fees unlike in traditional banking. We offer our professional consulting on how to better implement a blockchain application in banking and financial organizations.

Get a free consultation on your project!

Benefits of blockchain solutions for banking

Our blockchain fintech app development process

Get a free consultation on your project!

What impacts your project duration

The duration of a Blockchain project is affected by many factors. The most important are mentioned below.

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

- Type and complexity of a blockchain solution

What affects your project costs

To estimate the cost of a blockchain project, we consider a lot of things.

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

What we need from your side

Our clients entrust their projects to us as they are sure that we will deliver them on time, scope, and budget. Usually, we need some information from your side. Your goals and vision are very crucial for the appropriate planning. Based on your requirements, we create software specification document. Thus, we appreciate it if you provide us as much data as possible.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, software architecture and mockups

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

How is blockchain used in banking?

Blockchain in banking can be used for faster and cheaper money transfers, payments, and smart contracts. Traditional banks adopting blockchain can benefit from getting innovative technology on board and attracting more customers with unique services and products.

What is blockchain in banking sector?

Blockchain in baking sector is an innovative experience banks can present to their customers. Unlike traditional banking solutions, blockchain is cheaper, faster, and securer. We help banks and financial institutions implement blockchain in their operations and service offerings.

Why is blockchain important for banks?

Blockchain is a new technology that can help any bank achieve a competitive edge. Blockchain allows banks to keep transfers transparently, reduce fraud and money laundering activities, improve know your customer (KYC) processes, and attract more customers.