What we offer

Our online banking system development services are diverse, so we have five offerings for our customers. You can choose any service from this list or contact us and describe your needs if nothing looks suitable here. We specialize in custom online banking software development and integration, so we will carefully analyze your goals and propose a relevant approach.

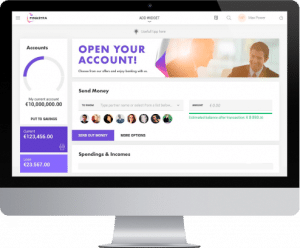

Online banking offers a lot of capabilities for users to feel comfortable with banking services. Clients can view their transactions, pay bills online, transfer money between accounts, track their budget and spending without contacting a bank advisor. Online banking has become one of the must-have things a modern bank should provide to their customers to remain competitive.

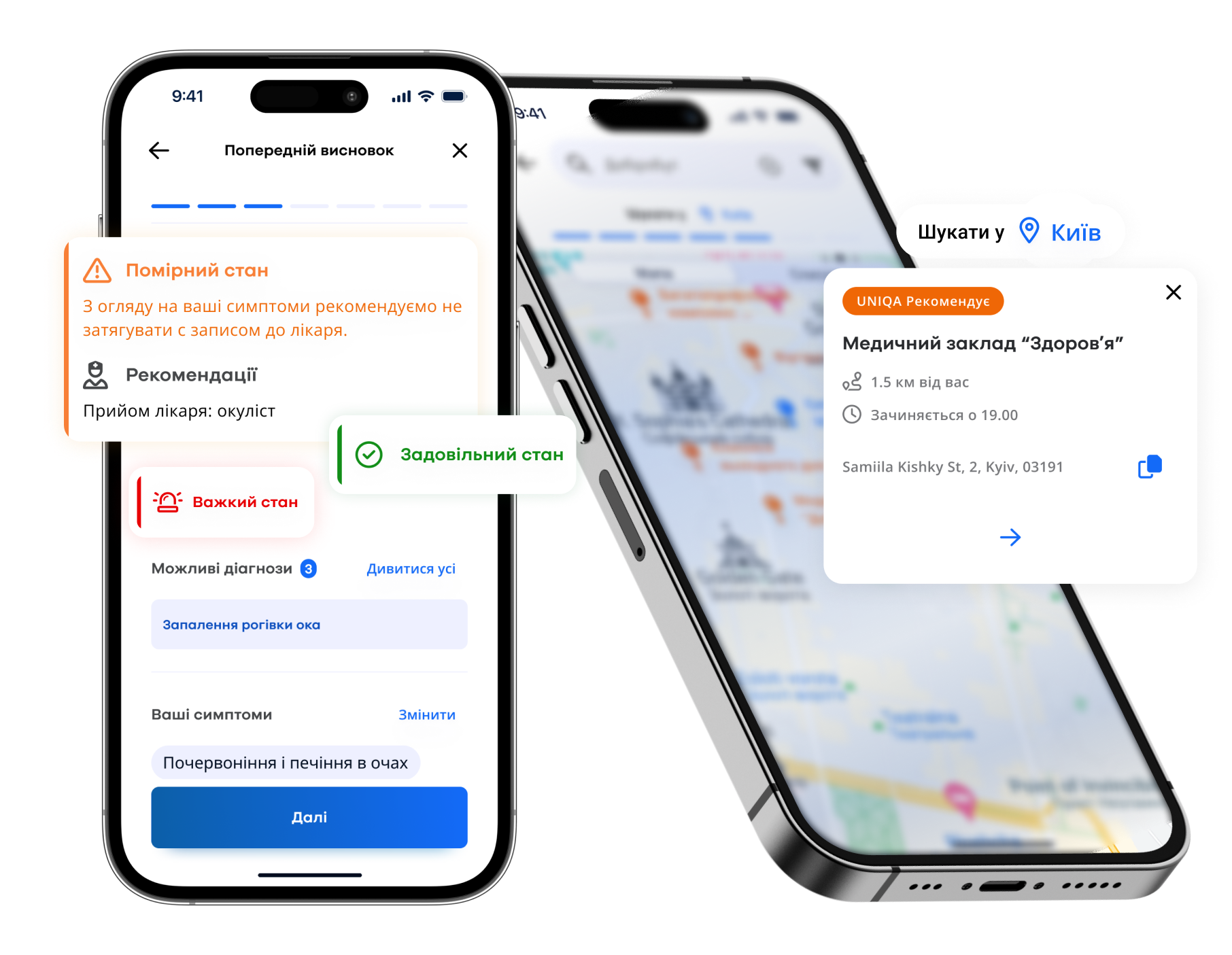

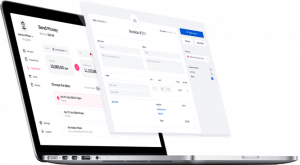

Responsive user interface

Is the design of your platform more attractive than the competitors’ solutions? People tend to choose good-looking sites. UI design services help you to get or improve the look of your software.

Friendly user experience

Is it simple for users to access the required features? Interfaces and structures should be simple and friendly. UX design option ensures that your individual and business clients will interact with the system smoothly.

Anti-fraud patterns

Are you sure that you can protect yourself from various fraudulent actions? With new rules through online banking system development, you get reliable protection from fraudulent operations, as well as monitoring and reporting tools.

System architecture

Can you add or change any online banking function in 2 days? Improved architecture boosts flexibility. After tuning, your bank analysts will be able to add or change processes in your Internet banking software in a few days.

Business processes

Does your online banking software development deliver all modern functions? Could your clients fill a loan application or send money in a few clicks? The exact list of the functionalities may change, but we handle various tasks.

Banks use various online banking development services nowadays to meet the rising level of competition. Many smaller FinTech teams, from Revolut to Robinhood, offer highly convenient online services. Thus, underbanked customers switch from outdated and clumsy traditional offerings to smooth and powerful innovations. Don’t you think that it’s a perfect moment for e-banking software development?

Online banking features

- Customer registration

- Customer Identification

- Bank account application

- Deposit application

- Bank card application

- Card activation, blocking, and replacement

- Loan application

- Loan repayment

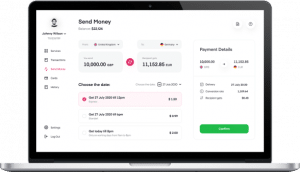

- Payment scheduling

- Deposit withdrawal

- Cash withdrawal

- Money transfers

- Payment of utility bills

- Service payments

- Tax and budget payments

- Salary projects

- Mobile phone recharge

- Foreign currency exchange

- Document scanning

- Payment templates

- Limit management

- Personal finance tracking

- ATM and branch locations

- Communication with the bank’s representatives

- Access for employees and accountants

Get a free consultation on your project!

Benefits of internet banking development

While many online banking solutions are typical for financial institutions, only a tiny fraction delivers business benefits. To get them, you should care about the proper development of electronic banking. Don’t hesitate to choose the vendor carefully, so you can get the most tailored and effective software thanks to custom Internet banking development.

Great web banking systems for individuals and SMEs deliver several benefits. You can get them. Just contact us and get your first free consultation.

Our online banking development process

Two critical areas related to online banking systems divide by customers. Often, banks work with both individual and business clients, and these two groups require different approaches. That’s why we deliver two types of services.

In both cases, you get your online banking system designed, developed, and updated according to your unique needs. We guarantee that our solutions include all the key functionalities and have an attractive and user-friendly design. Moreover, after deployment, you can add or change features or other modules quickly to introduce new services, adjust existing ones, or comply with regulations. Needless to say that all projects are completed on time, on budget, and on spec.

Actual service delivery processes are standard-based and stable. Traditionally, we start with the business analysis phase to gather your requirements and understand business needs. Further, we design architecture and UI/UX, develop the online banking system itself or upgrade existing modules, test everything, deploy, and support online banking solutions. The flow can be changed upon request, for example, we can speed up everything if you want to launch software faster.

What impacts your project duration

The average time for an online banking software project is from 6 to 9 months. The schedule depends heavily on your requirements. The more features you want to implement, the longer the project will be. That’s why we provide business analysis to understand how quickly the project can be completed. Below are the things affecting the project duration.

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

What affects your project costs

Exact expenses on online banking projects differ a lot. We can estimate the cost of your project after gathering initial requirements and analyzing the scope. Precise costs also depend on a number of factors, including:

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

- Integrations with other systems, as well as API availability

What we need from your side

From the client’s side, we need access to the core banking system with related APIs. We ask you to assist by providing your in-house IT team consisting of subject experts and a person responsible for handling project-specific activities at your side. This way, we can effectively collaborate and implement planned changes and software solutions.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, a test strategy or test cases

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

What do you mean by the term online banking?

It’s a strategy that includes processes and systems focused on banking services provided via the Internet. In other words, online banking software development delivers apps and modules that allow customers to access your bank online. People don’t have to visit branches or call your operators. Instead, they open the website and do what they want.

Why is online banking important nowadays?

In the era of online solutions that are presented everywhere, the finance sector can’t stand aside. The development of electronic banking systems is a new norm. They save the time of users, help access banking services much faster. This improves customer experience, boosts your retention and acquisition rates, stimulates revenue.

Why choose us for online banking development?

In DICEUS, we gathered professionals with dozens of years of banking experience. With us, you can get online banking software development from scratch, with all the required features. Moreover, you can control your project seamlessly thanks to the Customer Portal. As a result, the whole cooperation becomes simple, quick, and cost-efficient for both parties.