What we offer

When it comes to AI for FinTech, many clients don’t fully realize how powerful this technology can be. Let’s dive a bit deeper and look at how AI can empower your business. The following offerings are well-tested and time-proven, our clients already selected them and got their benefits.

First and foremost, what’s artificial intelligence in banking? AI includes systems that mimic human behavior and are capable of self-learning and correcting actions by analyzing information. In the banking industry, AI optimizes internal and external operations, strengthens workflows.

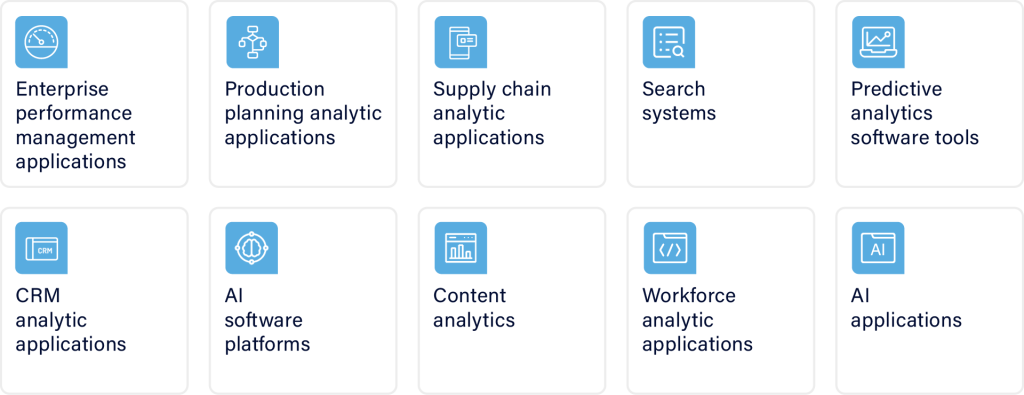

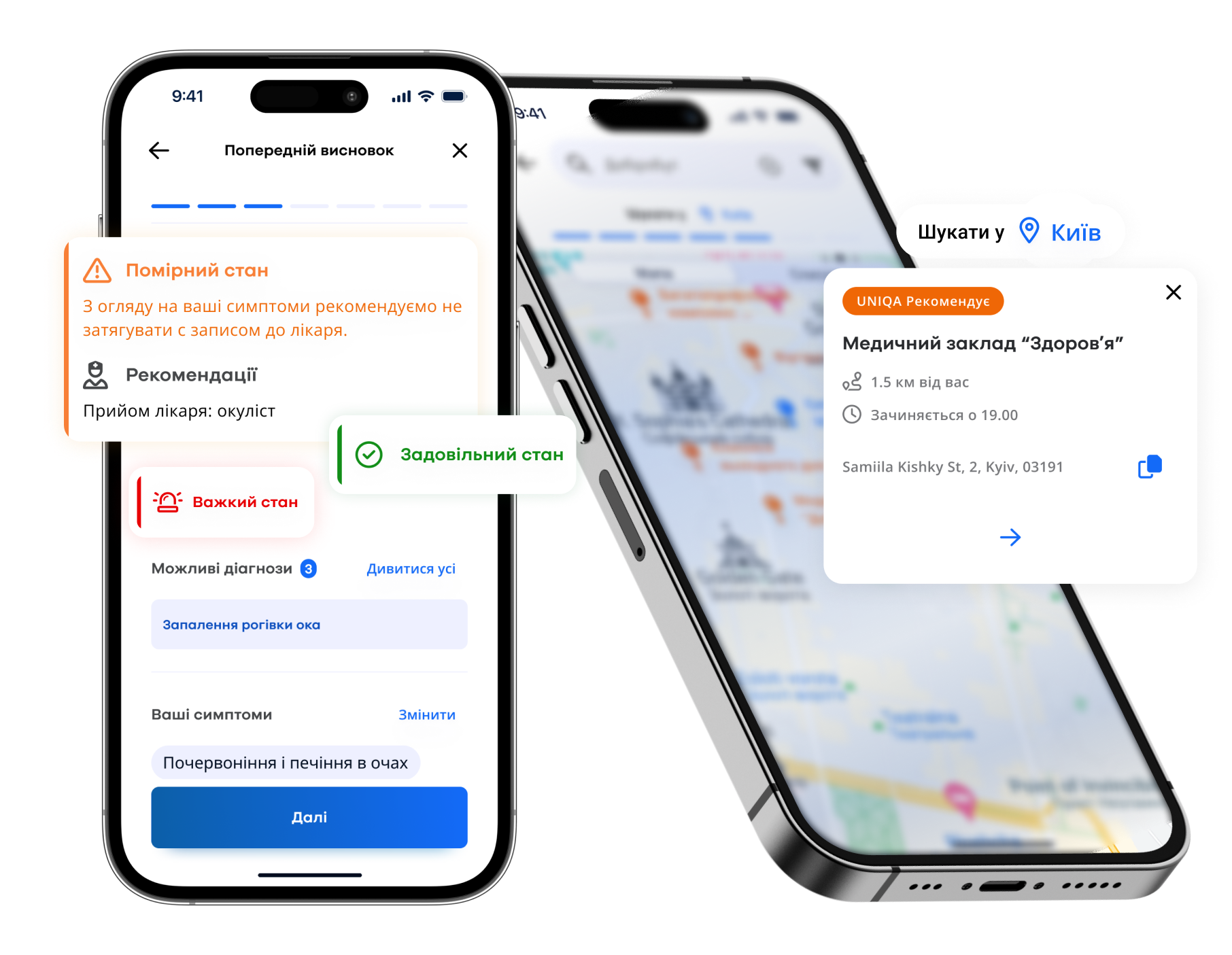

We offer a few core services of AI for FinTech, including the development of enterprise performance management, production planning analytics, workforce analytics, CRM analytics, supply chain analytics, advanced predictive analytics tools, and AI software platforms. AI for banking is among the hottest trends right now. Modern digital financial teams utilize AI-based tools to provide better services, attract more clients, and increase revenue. They help optimize data aggregation and usage, mitigate regulatory and market risks, improve customer experience, and combat many banking problems, including fraud.

Advanced analytics

Our AI-powered solutions and services are provided to equip your company with predictive analytics tools complemented with machine learning. For instance, you can use to build a smart customer relationships system (CRM) powered with forecasting capabilities to identify market demands with the help of historical data. Our AI team will help you define how AI can be helpful in your bank.

AI cloud services

AI and ML-powered software work best when combined with the cloud. Harnessing the force of the cloud, you can extend your artificial intelligence efforts and develop banking products and services faster and more effectively. Our AI team of analysts and developers will build the right strategy for adopting and implementing AI together with the cloud for your banking organization.

Image recognition

Image recognition and optical character recognition (OCR) solutions can help your bank to get and analyze digital visual materials faster. AI-based technologies provide the most effective image recognition tools to convert visual data into symbols. Computer vision software can significantly simplify bank staff work and ensure that data analysis results will be more reliable.

Natural language processing (NLP)

We offer natural language processing solutions like chat bots for banks to help you increase customer satisfaction and loyalty by providing modern customer support. Our AI team has experience building custom-tailored chat bot applications for banks and financial organizations. We conduct in-depth target audience analysis to identify your most common communicational patterns and contexts.

Get a free consultation on your project!

Benefits of our AI banking solutions

Artificial intelligence in financial services has nearly unlimited potential. From computer vision to automatic customer support, these features are really powerful. You can explore the most valuable benefits available thanks to our banking AI solutions. Don’t forget that we’re focusing on your success, so you can provide any custom requirements to get the best software.

In general, the use of corporate AI technologies can significantly increase labor productivity and improve the customer experience. We help you correctly design banking AI solutions, select existing cloud services, or develop your own custom models, implement them, and launch solutions.

Our banking AI development process

AI in banking sector requires a thorough analysis, design, and development approach. That’s why we leverage our standard-driven SDLC for different services, including digital assistance for employees, development of natural language processing tools or other systems. The whole process consists of several major phases.

What impacts your project duration

For each project, the exact schedule will be different. Overall, the duration depends on the next core factors:

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

- Availability and quality of data for analysis

What affects your project costs

With the costs, the situation is highly similar to the duration. It’s impossible to predict exact spending before checking the project requirements. Core factors that affect costs are as follows:

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

- Quantity and quality of initial data

What we need from your side

To ensure the best results of our AI solutions for banking, we encourage clients to cooperate with developers. To test our services and solutions, we need sufficient data quantity and quality provided from your side.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, a test strategy or test cases

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

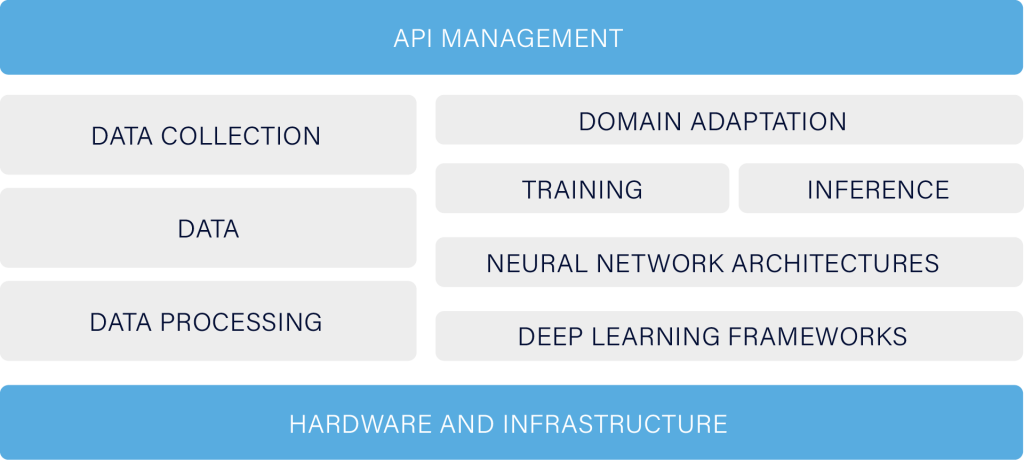

Our tech stack

Explore our case studies

Frequently asked questions

What is artificial intelligence in banking so important?

AI in financial services is a set of practices and digital solutions that facilitate operations. In other words, it’s a way in which a bank can implement AI techniques to optimize financial processes. For instance, AI can automate customer support or enhance data processing.

How do banks win with AI and automated machine learning?

Smart solutions and automation are among the hot trends nowadays. AI solutions for banking cut time and money expenses significantly, increase employee productivity, and improve customer service quality. It’s possible thanks to advanced digital operations.

Why choose us as an AI development company for banking?

We have rich experience in working with banks and providing innovative services. Our case studies include projects for American, European, and Middle East businesses, implementation of automation technologies, and advanced custom solutions.