Flexible insurance: Powerful software solutions

The market for insurance broker services is expanding. The major dynamic for the changes is a new way of making decisions and purchases by millennial buyers. Old mechanisms are still working, but they tend to become hard to implement and scale. Millennials will change this niche as they spend more time online and seem to perform more activities within a short period of time.

We know two types of insurance brokers these days: commercial and retail. Commercial brokers offer complex policies with high values for enterprises in aviation, oil, gas, or other industries. Commercial property is secured in this case. Retail insurance brokers offer personal policies that comprise health, home, vehicle, and others. Personal health and property are insured in this case.

An insurance broker is an intermediary between the insurance company and the client. This should be a company with a license. Each country has its own legislation norms that regulate the work of brokers. A broker helps clients save time and effort by offering several of the most interesting options to choose from local or worldwide insurance service providers.

Read a related article:

Get medical insurance verification software in 4 simple steps

Why you need an insurance broker for your business

Various comparison websites are good if you run a small business and you have less than 10 people on the team, and you want to buy an insurance policy for each of them. You will need some days to look for the available variants and make a deal. If you have a bigger company or you are responsible for the insurance issue in a big corporation, you will need a broker.

Purchasing a policy directly from the insurance companies is not the easiest or the cheapest way. Here are five reasons why you should have a broker.

Markets access. A bigger part of insurance companies don’t offer direct sales of their products to businesses. This gives insurance companies direct access to the markets and no need to spend money on advertising and marketing campaigns. This leads to lower premiums and a low cost of the broker commission.

Low premiums. A broker will organize a negotiation with an insurer to get the best offer and good value for money. There’s good trust between a broker and an insurance company, so there’s always a good agreement as a result of negotiation.

Products. There are a lot of complex things about insurance policies, like documents and claims, that are filled with complicated terms and legal concerns. It may be hard for you or your employees to understand what is covered or not with the policy. A broker can help with choosing the product for each employee and make sure that this will be mentioned in the policy.

Claims. Brokers provide support for every person in your team who will have a claim. In real life, we have a situation when insurance companies don’t accept about 50% of claims, and brokers come to the rescue in such cases.

Part of your team. Having a broker gives you a wide choice of products that are available in the market. You will have cost-efficient solutions, advice on legal concerns, and other aspects related to insurance issues.

See why you should care about millennials when developing the software

Insurance brokers – workflow and software solutions

What we have today is a group of people that process tons of information every day. New policies, claims, and negotiations – ERP systems come to help the team cope with all the tasks. However, the current software is not enough to deal with huge blocks of data as it requires a lot of human work.

As a rule, brokerage firms recruit a staff of highly qualified employees who understand all the intricacies of the insurance market, so the client can rely on their expertise. Brokers also protect the interests of their clients in the case of an insured claim and in conflict situations. There’s always a high demand in training the staff to keep the level of services high.

How do insurance brokers work without software automation solutions?

What does a typical workflow of an insurance broker look like if there are no automated solutions? Let’s imagine a situation where we have a big company with over 1,000 employees that requires an insurance policy. The overall number of people who work in this company doesn’t change significantly, but we have about 50 people who are fired and hired every six months. Some people change their position.

A company has one or several people who are in charge of dealing with the insurance broker. An insurance broker should have a team of people who will process all the information about the company employees, all the changes that every team member faces, and claims that come in an insurance case.

An insurance broker may have hundreds of people busy with paperwork as there are always new people that come to the company, new claims because of insurance cases, new hires, and other situations when there’s a need to update the insurance policy. Each case requires time and effort. Each member of the team will be required to pay a salary and all the taxes.

There are three major things that require much human work and time:

- Processing new policies

- Updating current policies

- Processing claims

- Regulating conflicts

Each team player will have a different amount of experience and knowledge, but here are the average figures for their salary (here, we mean staff that deals with policies):

- Ireland: €26,961

- USA: $60,432

- South Africa: R228,537

- India: Rs 550,000

Let’s take a close look at the cost of hiring a team of employees that will work with a company with 150 people:

- Training to get started with the work – 1 month – $4,000

- Paying taxes – about 20% of the monthly income – $800

- Monthly salary for hard work of two people – $4,000 and more

Let’s take a look at the cost of hiring a team of employees that will work with a company with 1,500 people:

- Training to get started with the work – 1 month – $40,000

- Paying taxes – about 20% of the monthly income – $8000

- Monthly salary for hard work of two people – $40,000 and more

A big team will make you pay big sums of money in the form of salaries. You will also need to provide your staff with the opportunity to get sick leave, some days off, and regular vacations.

There are a lot of drawbacks when we talk about manual processing of the information that comes to us in the form of requests for a new policy or anything else:

- You need to check new policies to make sure they meet the requirements and interests of the clients

- If there are requests to update a policy or add some more points, you will do it manually

- There’s a need to process each claim manually as well

- You need to have good customer support for cases of trouble or conflicts

This creates a huge load on the staff and requires each company owner to hire more people to handle all the requests and claims.

How do insurance brokers work with software automation solutions?

What is the automation of the insurance processes? Here we mean that a part of the work that was performed manually will be done by the software. How can you benefit from using the software?

- You will reduce the costs that you pay for human work

- You will significantly reduce the time required for processing one request

Let’s take a close look at the cost of hiring a team of employees that will work with a company with 150 people if you have automation for the bigger part of operations:

- Training – 1 month – $2,000

- Paying taxes – about 20% of the monthly income – $400

- Monthly salary for hard work of two people – $2,000 and more

- Custom automation solution – $10,000 and more

Let’s take a look at the cost of hiring a team of employees that will work with a company with 1,500 people:

- Training – 1 month – $6,000

- Paying taxes – about 20% of the monthly income – $1,200

- Monthly salary for hard work of two people – $6,000 and more

- Custom automation solution – $30,000 and more

In the latter case, you will spend about $60,000 on salaries and the software solution for automating the operations, while you will spend over $400,000 on human work. Of course, you will spend some money on training the staff to get used to new ways of dealing with the clients, but you will get a great benefit in the long run.

Learn more about how to develop insurance policy management software.

Automation helps with recording sold policies

You will have the possibility to store an unlimited amount of information regarding each sold policy. You will have a standard set of filled-in fields such as name, period, cost, fees, etc. And you will be able to add more fields to provide a wider choice of services on demand. You can also attach external files to the personal profile.

Automation helps you with payments

You can offer to pay by different means. It can be a payment in installments. You may have direct payment from the company to the insurance company, where a broker gets the commission fee only. It will be much easier to calculate the commission fee as well. No more boring and dull calculations; all the data is in one place.

You will also set reminders for payments that will let you get the money on time. The analytics system allows you to track the expiration dates of policies and the date of the next payment. You will not need people to enter new data into the system — it will be done automatically.

Relationships with insurance companies will improve as well

On the basis of the data on insurance operations, the system allows the automatic generation of reports for insurance companies. Automation is also provided for tracking mutual agreements between a broker and an insurance company.

You will get all the reports with accurate data that will let you analyze the costs, predict revenue and look for ways to optimize the workflow efficiency.

Enhance risk performance with our insurance risk management software development services.

What is flexible insurance, and why is it gaining popularity?

Flexible insurance comprises benefit programs for the company employees that let them choose different benefits like cash, health and life insurance, retirement programs, vacations, and child care. As an employee, you will have a specific sum of money defined by your employer. You can choose a number of benefits within this sum or contribute more for some additional coverage.

Here are the key benefits of flexible insurance:

- Precise analysis of what kind of products people require at different stages of their life or depending on their position in the company – a benefit for insurance companies.

- Brokers have automated solutions that will offer their clients a wide choice of benefits and get more profit from selling a bigger number of products.

Flexible insurance: E-commerce and wizard solutions

Developing complex software solutions for insurance brokers requires a thorough analysis of their work, a discussion of business goals, and what kind of problems the software should solve. We have built a few insurance products, and we have used different ways to solve one and the same task – deliver an automated solution for insurance brokers.

We can offer you to take a glance at what it may look like in real life but with an imaginary company.

Let’s take the imaginary company that we have talked about above. We have about 1,000 workers, and we need to offer an insurance policy for each of them. Flex means flexible, where a person can choose a set of services that they need.

We offer two variants of custom automated solutions: e-commerce and wizard. Each solution has its pros and cons. Let’s take a close look at each of them.

E-commerce. A person who wants to get a new insurance policy goes to a website and registers there. There will be a shopping cart where a user will drag all the policy features they want to have. There will be a total sum and an option to pay in installments. This web platform will have a user-friendly interface to make the choice easy and fast.

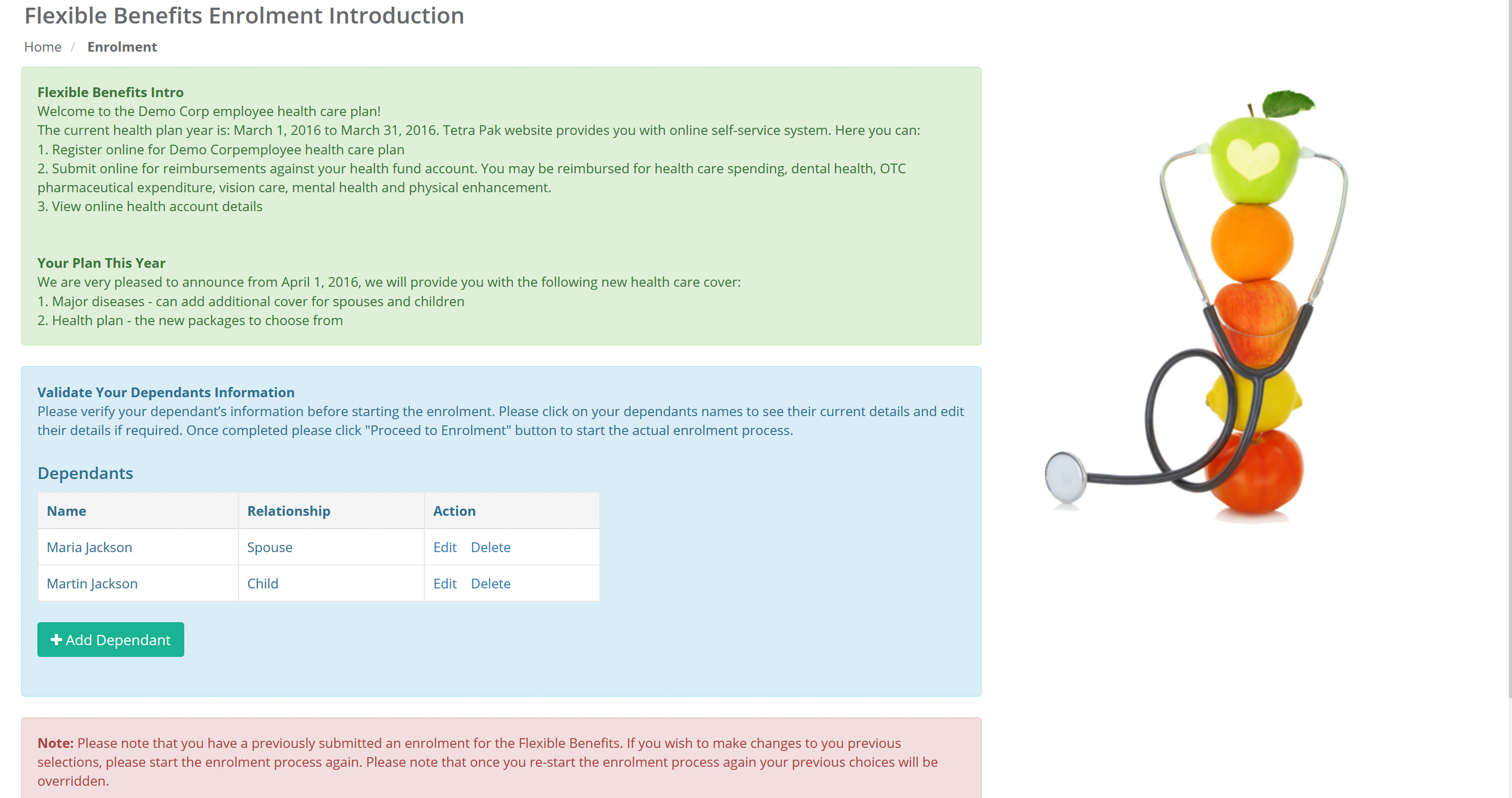

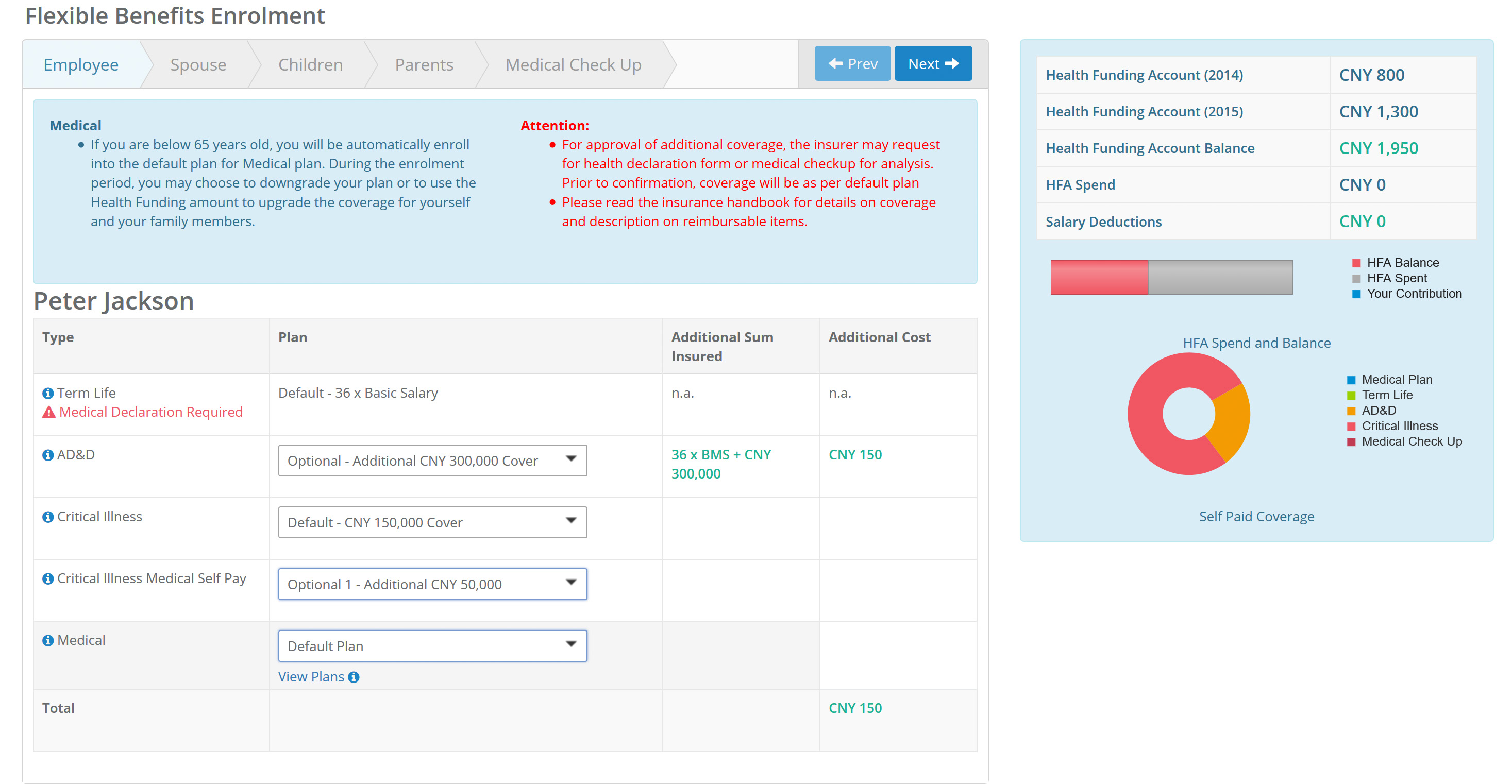

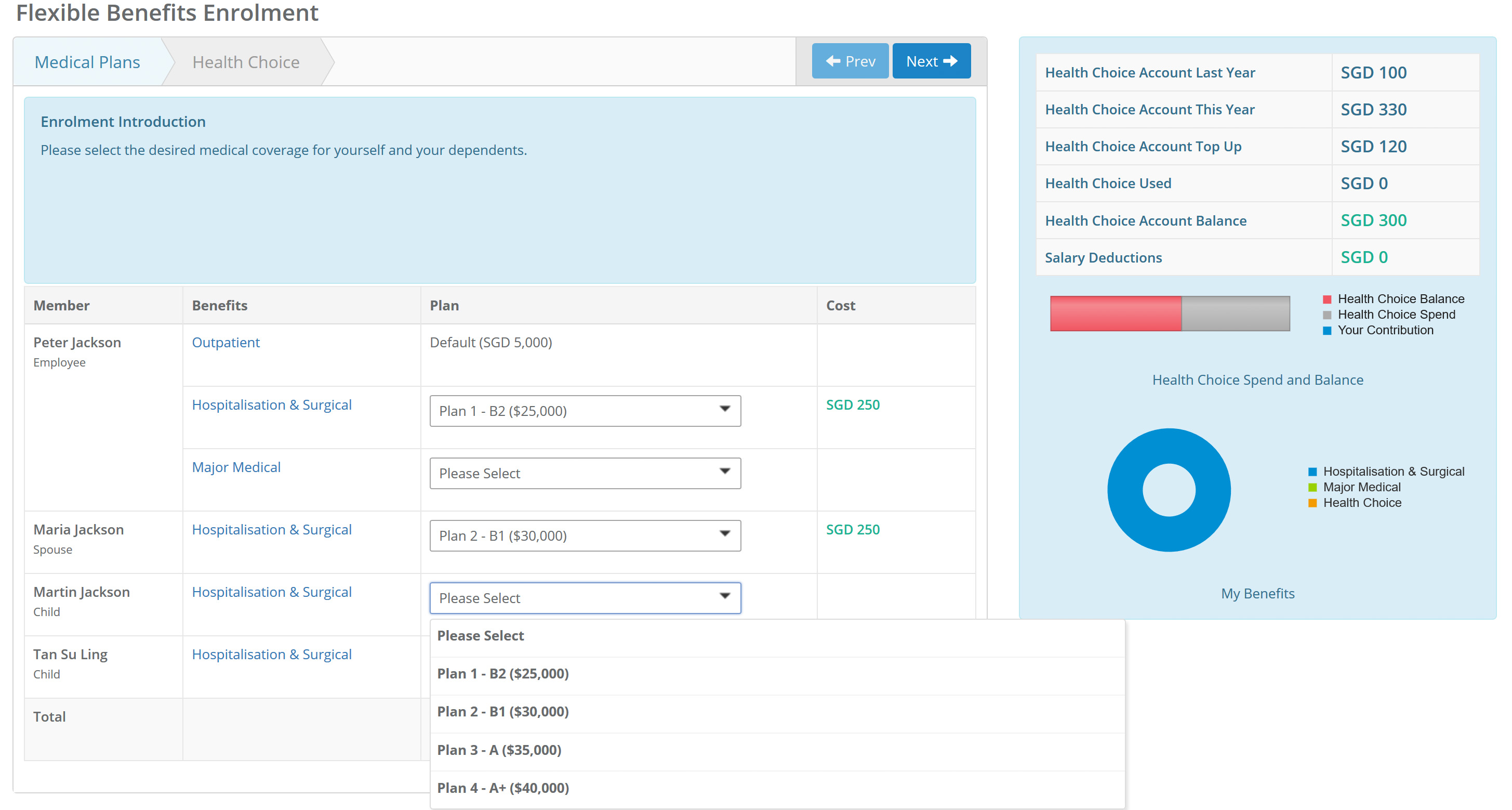

Wizard. This is a step-by-step solution where a user will be guided from start to finish in one single try. A user will start a web app and follow the guidelines of the wizard. There will be a need to enter some data or tick some points to pick up the required features of an insurance policy. It will also have a user-friendly interface for easy and fast work.

These solutions aim to make the processes go faster and offer customized variants of policies for each user. How do brokers benefit from using such solutions? As a broker, you will reduce the costs and time that you spend on processing all the requests. Insurance companies will get a chance to get analytical data about the expenses in real-time, and they will have a chance to sell more services at once.

Willis Tower Watson is the company that started using a new solution for automating operations. There was a need to scale the business and make this process efficient. There’s a need to work with a bigger number of clients and fully meet their requirements and needs. There’s also a need to spend as little time as possible on repeated or administrative tasks.

A good way out is to automate routine processes and delegate them to the automated software system. We have developed a powerful solution for insurance brokers that offers their customers a flexible choice of benefits and other additional services. It’s powerful and reliable software.

Want to enhance claim handling?

Check out our insurance claims management software development services.

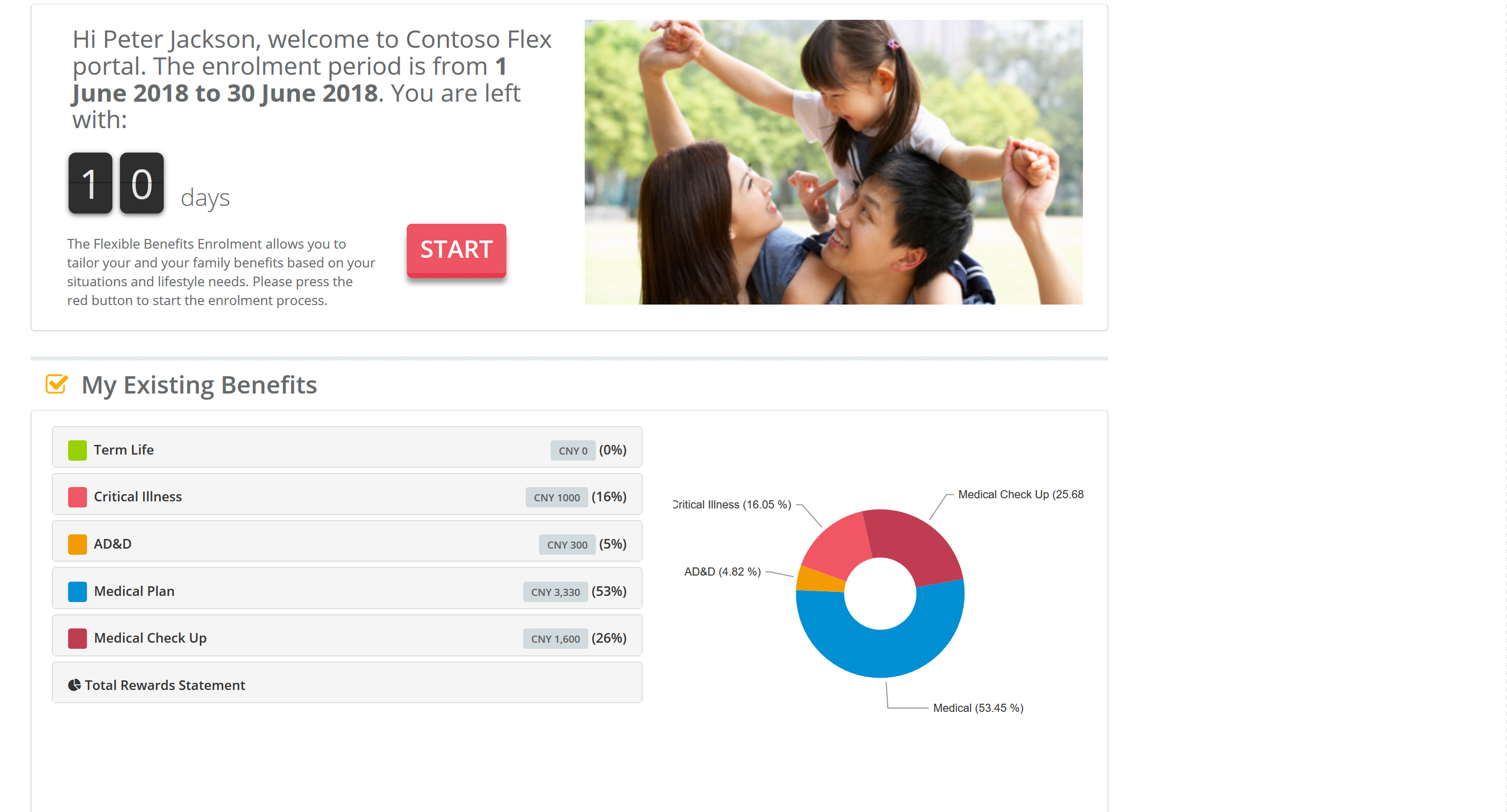

Each user has a personal page. After an employee enters a personal page, a limited time period for choosing a list of benefits comes out. It’s good as it gives time for considering various types of benefits, and their cost and making a final decision. It’s easy to access information about available benefits with a unique login and password.

Users have a wide choice of benefits. There’s a good opportunity to personalize a list of benefits, add family members as dependants, and choose a list of products for them. Each user is guided through every step of registration and benefits choice, so entering data will not take much time.

An employee has a wide choice of plans to choose from. There’s a balance of costs to see what plans do not require additional contributions. If there are dependants, an additional contribution may be needed. Everything depends on the employer’s policy and offers. In case users don’t make a choice, a default program will be chosen for them automatically.

History records. Details of all claims are recorded, as well as sums that were spent by the insurance company. It’s easy to track records for a few years in a row.

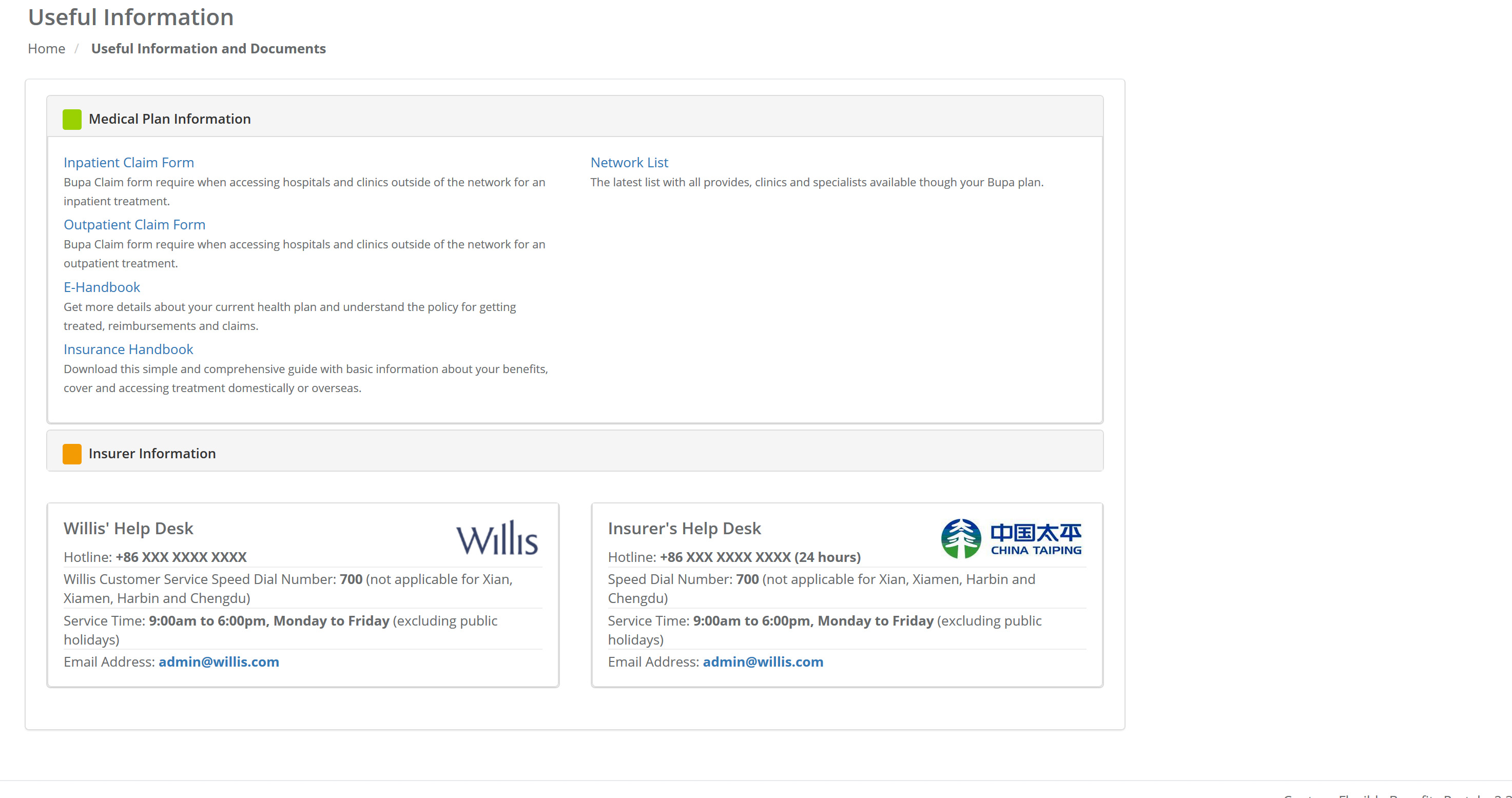

A user guide section. There’s always a Useful Information section where employees can find out questions for most of the questions about insurance policies, enrolments for upgrades, contributions, and much more.

Want to learn more about insurance software development? Read our article about the life insurance software product development process

BenefitFlex is a cloud-based application offering an easy enrolment wizard:

- You can choose a list of benefits

- You can upgrade a list of packages

- You can downgrade a list of packages

- You can pick up benefits for one employee or a whole department

All the information about the benefits and policy is available at any time of day or night, and this is handy in case of emergency or other cases.

Why is BenefitFlex a good choice? This is just a successful case of a flexible insurance solution that is available to any insurance broker. It leads to reducing time and cost loss for brokers and provides much greater employee satisfaction.