Mobile banking app development: Benefits, features, and steps to develop

Long gone and forgotten are the times when hearing the word “bank,” most of us imagined an impressive-looking building with numerous counters and long lines of customers waiting to be served. Modern people are more likely to get hold of their smartphone to open a bank account, apply for a loan, or pay for the product they acquired. Brick-and-mortar financial institutions are increasingly ousted by neobanks and other fintech organizations, forcing traditional banks to embrace digital transformation. They try to harness the power of internet banking and meet their clientele halfway by providing them with a high-end mobile banking experience. What makes mobile banking services all the rage nowadays and how to build a mobile banking app?

The popularity of mobile banking: Discovering the reasons

Contemporary civilization is essentially a mobile-powered one. We rely on our gadgets to work, study, shop, and have fun, rarely letting them out of our hands 24/7 (minus short sleeping time). Given the dominating presence of smartphones in different aspects of human life, it is natural that online banking services are among the most widespread use cases of our gizmos.

Why do people enjoy using mobile banking?

- It gives them a sense of control. No matter where you are, you can check your transaction history or current balance in a split second. And not only that. Many mobile banking apps enable users to manage their finances, keep track of expenditures, and even pinpoint the categories of products and services on which they spend most of their money.

- It saves their time. No more going to a bank’s branch, standing in queues, filling out forms, and wasting your precious time on other routine financial operations. In a matter of minutes, you can obtain any banking service you need. Just a couple of taps on your phone screen, and you can turn to other errands that await your attention.

- It gives them a sense of security. Carrying around a large sum of fiat money you want to deposit or receive as a loan is never a good idea, even in a decent neighborhood. With mobile banking, you can stay in your safe lodgings out of harm’s way and manage cash flows by pressing buttons.

- It lets them pay bills on time. The nightmare of being cut off from the electricity supply or internet connection just because you forgot to pay the respective bill is over. The banking app will send you a notification that the payment is due or – even better – charge the necessary sum off your account automatically and make the mobile payment on a certain date.

- It enables them to save money. The strong competition symptomatic of the current mobile banking market stimulates financial institutions to provide their clients with the best-in-class user experience by offering attractive deals, higher interest rates, and special discounts on their services that will let them save a pretty penny.

- It enhances their financial awareness. Today, financial operations aren’t delegated to egg-headed professionals only. When banking services are brought within your close reach, you are encouraged to try to make head or tail of them yourself. No wonder 25% of American high-school students chose to take a course in personal finance in 2022, which is 9% more than four years ago. Definitely, the spread of mobile banking has something to do with such a spike.

A spike can also be observed in the number of online banking services consumers. In 2020, 1.9 billion people used them regularly, but by the end of this year, this figure will double and reach 3.6 billion – and that’s 45% of the world’s population! And the younger the person is, the more likely they are to harness mobile banking. For Boomers and Gen X, the employment of banking applications is a prevailing practice (70% and 87%, respectively), whereas for millennials (98%) and Gen Z (99%), it is a must. Evidently, both consumers and banks find numerous perks in leveraging mobile banking.

Need custom banking software? Check what we offer.

Zooming in on mobile banking benefits

As a company with extensive experience in banking mobile app development, DICEUS knows that banking apps usher in multiple boons for their users and owners.

What do customers like about using banking apps?

- Round-the-clock access. People can open a new account, check their balance, view recent transactions, transfer funds, and more, 24/7. They don’t need to wait for business hours to obtain any financial service at their convenience.

- Convenience. With a mobile app installed on your phone, you carry the bank with you. You can pay for products or transfer funds even in the most remote location.

- Instant transactions. You don’t have to visit a physical bank and fill out multiple forms to apply for a loan or write a check. All operations are hassle-free and prompt.

- Affordability. With no upkeep costs for bank branches, the absence of paper routine, and the minimization of manual labor, mobile banks can provide their services at a competitive price.

- Notifications set up. The app informs users about important events and dates to avoid missed payments or credit renewals.

- Spending tracker. These specialized apps allow users to monitor their expenses and stick to the budget, thus preventing earn-outs.

- Cashback opportunities. Thanks to this rewards program (which is no longer limited to credit cards but also extends to some debit cards), customers can return a share of the money they spend shopping.

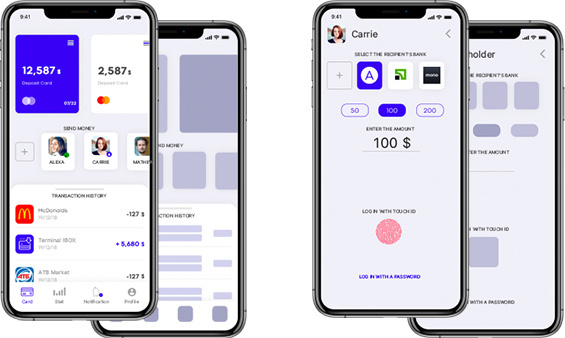

- User-friendly app design. When developing a mobile banking application, its creators aim to streamline the user journey to the maximum and enable people to smoothly perform all operations for which they employ the app.

- Solid security. Multifactor authentication and other best practices of access control safeguard the integrity of customers’ personal data, as well as the safety of financial operations, and rule out compromising the clients’ bank accounts.

You might be interested in our latest article:

List of the top banking software to use in 2024

What do financial organizations gain via mobile banking application development?

- OPEX reduction. By moving their operations online, banks can cut down on personnel and working space-related expenses. They don’t need to launch new branches, expand their international network, and hire new staff to manage all storefronts, which allows them to allocate their finances for other purposes and increase ROI.

- Pricing policy optimization. With expenditures kept to a minimum, banks can offer their customers first-rate services that won’t cost them an arm and a leg.

- Greater competitive edge. A smaller price tag, combined with the top quality of their online banking services, enables fintech-driven companies to outstrip their rivals in the niche and expand their client base.

- Elevated company brand. Today, banking app development is not a whim but a basic necessity for banks that want to stay abreast of technical progress. Without a robust app, financial institutions can’t hope to maintain the brand name of a modern and digitally aware organization.

- Faster service. Time-squeezed people of the 21st century crave speed in all their activities. A banking app is a second-to-none tool for accelerating the banking pipeline routine and swiftly satisfying customer needs in the field.

- Unlimited client reach. The ubiquity of mobile phones enables banks to attract and engage ever-new customers, with distance and borders between countries no longer an obstacle.

- Another marketing channel. Mobile application development for banking equals acquiring an additional marketing vehicle. The AI-fueled capabilities of such apps can help banks collect essential information about clientele to promote their services and keep users up-to-date with changes in policies and approaches.

- Personalized banking experiences. The information banking apps gather and accumulate can be leveraged for personalization initiatives. With dossiers on customer behavior at their fingertips, bank marketing specialists can segment their user audience, devise targeted campaigns, create special offers, and adjust pricing policies to satisfy the needs of individual clients.

- Improved customer loyalty. All the previously mentioned perks translate into this one. People who use their smartphones to obtain the service they need immediately and at an affordable price are sure to stay with the bank. Moreover, they will recommend it to their family, friends, and colleagues.

As you see, launching an app is a win-win solution for banks and their clients alike. Modern financial institutions realize this perfectly, which explains why banking apps are among the top banking software nowadays. However, to make it click, you should know how to build a banking app. And the first thing to do in this endeavor is to identify the features such an app will contain.

A comprehensive list of mobile banking app features

As experts in banking software development with in-depth competence in how to create a bank app, we recommend dividing the functionality roster of your future app into obligatory and optional parts.

What are the core features of a banking app?

- Authentication and authorization. In any finance-related industry, security is the foremost consideration. The same is true of banking solutions, which should be super safe to prevent data leakage and money burglary. With cybercrime and digital fraud rampant, simple passwords aren’t the best authentication technique anymore. To make users feel at ease, you can use AI and equip your app with biometric authentication like face ID or Touch ID sign-in. This is a measure not only to please your customers but also to comply with industry-specific regulations.

- User profile. Clients store information about their debit/credit card to access all the app’s functionalities and operations with their account.

- Transaction management. Users can view their balance, monitor transaction history, and more. This information must be synchronized across all customer devices and updated in real-time.

- Payments. This is one of the vital banking app features enabling users to pay for their everyday expenses, transfer money, reimburse loans or mortgages, and conduct all financial operations via available payment systems (for instance, Stripe or PayPal).

- Bank accounts and card management. Here, clients can open or close an account, order a physical card from a bank, block their cards in case of loss, attach new cards to the account current, set limits to it, change the PIN code, and so on.

- Deposit check. This functionality spares the client a visit to the bank. Instead of going there in person, they can just take a photo of both sides of the check, endorse it, and upload it with the app’s help.

- Push notifications. The app is never active on the user’s phone all the time. Yet even when it isn’t, its owner should be informed or reminded about important and urgent events, updates, or actions they must not miss. Notifications are also a perfect means of asking for authorization for a scheduled transaction or performing similar tasks.

- Geolocation. You should integrate geolocation APIs to let the user know where the nearest terminals, bank branches, or ATMs are located and guide them there.

- Near-field communication and quick reply. A QR code scanner and NFC capability are indispensable nowadays to let consumers learn about goods at brick-and-mortar outlets, discover the schedule of public transport, read the menu at a restaurant, and leverage contactless payment opportunities.

- Digital wallet. Being integrated with NFC solutions, this feature creates a virtual venue for storing all the data about the user’s credit card and the bank that issued it to replace the card’s plastic version in performing banking operations.

- Customer support. Banks should ensure their clients are never left without assistance when they have problems obtaining services or questions about acting in a certain situation. The customer support button is called to connect them to the personnel and help people out of trouble.

Nice-to-have features of banking apps

These are must-have features of a garden-variety banking app. But you would like to know how to make a banking app that stands out among its counterparts, right? Then, here is the list of nice-to-have features to include in a top-notch banking app.

- Personalization. People like to customize the software they use to suit their personal preferences and tastes. You can cater to this desire by allowing them to select a theme, upload an avatar, and perform other settings that can drastically augment their customer experience.

- Cost optimization tool. This functionality is honed to help people handle their budget wisely and save money. Its expense tracking and analytical capability can pinpoint top spending areas by displaying them in the form of a graph or a pie chart and suggesting measures to reduce expenditures across them.

- Bill splitting. It enables users to automatically determine their individual shares in a summary bill they have to foot in restaurants and other establishments that they visit in a company.

- Cashback. This feature can be integrated with the consent of partner organizations (grocery stores, supermarkets, restaurants, travel agencies, etc.) to let customers return a certain percentage of the sum they spend on products and services at such places. Moreover, you can let clients choose categories that are liable for cashback.

- Recurring payments. Some people make regular payments. It is a good idea to let app users automate them, set their duration and frequency, or schedule a reminder to make them.

- Cardless ATM access. This functionality brings the demise of physical bank cards a step closer. The app will allow users to verify their identity by answering a call or replying to a text message, and withdrawing funds from an ATM without a credit card in their pocket.

- Voice control. It is not only an additional convenience but also a step to augment your product’s inclusivity. It allows users with eyesight or hand dexterity disabilities to enjoy access to your banking app and make voice payments.

- Chatbot. According to estimates, this AI-powered technology can tackle 80% of customer support tasks by answering typical questions in real-time. When upgraded, chatbots can turn into voice assistants to help users process more complex queries, schedule appointments, and more.

- Access to other bank products or third-party services. A banking app is not only about making online payments. It can become a gateway to obtaining other services from the bank (like taking a loan, for instance) or from a third-party agency (purchasing tickets, booking a table at a restaurant, renting a car, and more).

- Integration with wearables. By synchronizing a banking app with wearable devices such as smartwatches or fitness trackers, people can use them much like their smartphones (check banking information, receive notifications, make NFC payments, and more).

- Custom alerts. These come as an addition to conventional push notifications and can be configured to be triggered by different criteria (like reaching daily/monthly expense threshold). A variety of such signals are fraud alerts that warn users of any suspicious activities related to their bank account.

- Investment opportunities. Typically, people interested in serious stock and bond investments prefer to have a dedicated app for this purpose. However, equipping your banking app with basic buy-and-sell options will enlarge its functionality and attract users who dabble in-stock operations.

- Customer engagement features. The banking industry isn’t different from other business domains in its marketing and customer engagement schemes. To attract and retain clients, extend special offers, coupons, discounts, rewards, gamification, or other elements of loyalty programs to them.

- Crypto wallet. Despite their checkered reputation, cryptocurrencies are gaining traction nowadays. A forward-looking bank can communicate with modern consumers and partner with companies that offer Bitcoin, Ethereum, or other major coins.

The power and efficiency of any banking app feature can be increased manifold by boosting it with cutting-edge technologies. For instance, AI can be used to develop chatbots and voice assistants to make them more advanced and personalized. ML and big data are instrumental in the analytics tools for data analysis, obtaining insights regarding customer behavior, client segmentation, and risks. Cloud computing paves the way for the unlimited scalability of the app, enhancement of its integration potential, and improvement of its security. The latter aspect can also be reinforced by harnessing blockchain technology.

When you understand the features, it is time to tackle the development process with a hammer and tongs.

How to build a mobile banking app: A roadmap to follow

We at DICEUS have specialized in iOS and Android banking app development for 13+ years and have devised a 9-step strategy for creating such products.

Step 1. Discovery and research

At the discovery phase, we lay the foundation for the future product. Our experts thoroughly study the niche, examine market conditions, check out similar solutions, and identify their merits and demerits. Then, they create a user persona profile with its demographic parameters, income level, cultural peculiarities, expectations, and user habits. To get a complete picture of the project, they also interview the customer’s representatives and learn everything they can about its specifics, nearest and strategic goals, and product requirements.

Step 2. Taking care of security

Rock-solid security is vital for banking software. That is why our experts pay primary attention to data privacy, secure passwords and authentication procedures, auto-logout, and secure certificates and card info. Besides, they see to it that the app-to-be complies with major data security regulations (such as PCI DSS, CCPA, GDPR, PSD2, and others).

Step 3. Building a clickable prototype

Having product specifications received during the discovery phase, developers create a prototype that represents the app’s logic, structure, and design in the most general way, considering the core user stories and job stories. It is not yet a fully functional or stable product, but its limited operability allows the development team to submit it to the testing audience for judgment.

Step 4. UX/UI Design

Feedback on the prototype and user interviews provide sufficient information for designers to start their work. They create customer journey maps, draft user and app flows, and deal with the visual side of the solution (layout, color scheme, buttons, etc.). Unlike other app types where exquisite design is welcome, customers expect a simple, intuitive, and no-frills user interface here. Finance is a serious business, after all.

Step 5. Selecting a tech stack

Depending on business goals and operating systems, the team opts for a suitable collection of tools, programming languages, and frameworks. The major technologies they need for iOS apps are Swift, XCode, and iOS SDK, and for Android apps, Java/Kotlin, Android Studio, and Android SDK.

Step 6. Developing the app

It is the longest stage of app creation when developers put their noses to the grindstone and code away. After reaching each milestone and completing certain functionalities, they are tested repeatedly to ensure the product operates according to expectations.

Step 7. Integrating third parties

Developers build APIs to allow the app to interact with other products within and outside the bank’s digital ecosystem.

Step 8. Testing and deployment

The finished product undergoes a comprehensive QA procedure when our specialists conduct performance, usability, compatibility, functional, accessibility, load, stress, penetration, and other kinds of tests. As soon as the app’s condition is satisfactory in all its aspects, it goes live.

Step 9. Post-launch maintenance and support

As a reliable IT vendor, DICEUS doesn’t call it a day after the app goes live. We stay with our customers as long as it takes to ensure the software functions properly and has no bugs. We are always ready to help in case issues arise or app owners have questions regarding its work. If required, we introduce improvements to the original design or upgrade the app on demand.

As you see, creating a first-class banking app requires in-depth knowledge of the industry, high-profile IT expertise, and multiple skills. DICEUS ticks all these boxes. Our professionals are competent in building a premium-quality banking app with the required functionalities and seamless performance. Contact us to give your bank’s digital system a powerful boost.

Drawing a bottom line

With the popularity of mobile banking, launching a mobile app has become a vital necessity for financial organizations. Such products are time- and effort-saving instruments available 24/7 that can significantly streamline and facilitate providing and using banking services.

Equip such apps with an adequate set of features to maximize their value for consumers and financial organizations. The latter include both obligatory (authentication, user profile, transaction management, payments, push notifications, QR and NFC, digital wallet, customer support, etc.) and optional (cashback, cost optimization, cardless ATM access, voice control, integration with wearables, and more) features.

The creation of a high-end banking app is possible by hiring a qualified IT vendor who will follow a well-thought-out app development strategy.

FAQ

What are the key steps of building a mobile banking app?

You should start with market research to discover the lay of the land. Then, deal with the security issues, build a clickable prototype, create the app’s UX/UI design, choose the tech stack, and develop the product. Next, provide the necessary third-party integrations. Finally, test the product, deploy it, and enjoy its work. Post-launch support and maintenance are nice bonuses from a solid IT vendor.

How important is user experience (UX) design in a mobile banking app?

A mobile banking app’s user-friendly and straightforward UX design is mission-critical for high customer satisfaction, strong brand loyalty, and considerable retention rates. If such a product meets their functional needs and provides a satisfactory user experience, clients are likely to engage with the app and recommend it to their immediate social environment.

Is it necessary to comply with industry regulations and standards when building a mobile banking app?

The major standards and regulations a banking app must comply with concern the security of user data. App creators must ensure their product is protected against data leakages, hacking attempts, and malware infection. Such protection is provided by compliance with GDPR, PSD2, PCI DSS, CCPA, and other legal norms.