Chatbot for insurance: Key features and use cases

In the IT-powered world of the early third millennium, the insurance industry is undergoing digital transformation, quickly becoming a deeply high-tech-driven sector. Insurance companies use various digital solutions to automate policy purchase and claim reporting, improve customer engagement, and decrease paperwork. New channels of communication, such as a mobile app and chatbot, are offered to customers for more convenient user experiences.

Forward-thinking players in the domain prioritize leveraging machine learning and artificial intelligence in insurance software products to maximize the efficiency of their IT infrastructure and guarantee a higher level of customer satisfaction. AI technology helps revolutionize shop floor processes such as claims management, fraud detection, data analytics, and more.

One of the insurtech innovations gaining traction among insurers nowadays is a chatbot. Let’s discover chatbot use cases in insurance and determine the capabilities a chatbot should have.

Insurance chatbot use cases scrutinized

As the best insurance chabot examples prove, this technology excels at performing the following assignments.

- Onboarding clients. Getting a new customer to learn the insurance workflow takes considerable time and effort. Pre-programmed chatbots can take people through this complex journey in a no-sweat way by providing instructions on how to file a claim, purchase a policy, etc.

- Claim processing. Here, chatbots are a second-to-none AI automation tool. Thanks to them, clients can file a claim 24/7 with virtual assistants accompanying them all along the way – from determining the type of claim they plan to make and uploading all photos and documents to submitting the claim. Moreover, the software will help them track the claim’s progress and inform the client of every milestone it has reached.

- Policy renewal management. People can renew an expired policy within several minutes during one conversation. And if a chatbot is integrated with a payment system, the client can pay for the renewal immediately and be done with it.

- Cross-selling and upselling. Policy renewal is a perfect opportunity to offer clients-related products. Thus, a chatbot for health insurance can persuade the customer to purchase a home or car insurance in addition to the core policy.

- Customer support automation. In this role, a chatbot for insurance performs the same self-service functions as for other industries. Many of the clientele’s FAQs, queries, and problems are standard, so addressing them can be entrusted to AI. However, if handling some issues is beyond the chatbot’s competence, it will connect the customer with a human assistant who can solve uncommon or complex problems.

- Reducing personnel workload. By automating communication with the clientele, chatbots free the workforce to pursue more creative activities that require human intelligence and specialized skills.

- Fraud detection. Insurance is a scam-susceptible business realm where unscrupulous people often try to capitalize on the inadequacy of the companies’ protective mechanisms. An AI chatbot for insurance can be trained to detect symptoms of fraudulent behavior, perform risk assessments, and notify insurance personnel about suspicious events.

- Collecting customer feedback. People can share their impressions of cooperating with the insurance company by participating in chatbot-driven surveys and questionnaires.

- Individualized marketing. Using the results of monitoring customer behavior and buying habits, chatbots can issue tailored recommendations and extend personalized offers, discounts, bonuses, and more.

- Lead generation and conversion. Chatbots can become an important instrument for assembling contact information that will be used to attract new customers, accompany them down the conversion funnel, and help people make a purchase.

- Internal workflow management. A chatbot for insurance agents is a good crutch for streamlining and facilitating repetitive chores, allowing them to focus on more complicated back-office processes.

- Sending proactive reminders. One of the pivotal functions of chatbots is their messaging capability. The personalized notifications they send increase transparency of the claims processing pipeline and augment customer experience in general since people feel valued and unique clients the company cares about.

To let an insurance chatbot become a vital element of your digital ecosystem, you should equip it with relevant functionalities.

The checklist of insurance chatbot features

As a vetted IT company specializing in insurance chatbot development, DICEUS realizes that custom products of this kind can have different capabilities according to the project requirements. However, any insurance chatbot can’t do without some must-have features.

Quote generation

Being integrated with quoting software, the AI powering the chatbot can analyze the input information concerning the client (age, gender, occupation, location, etc.) plus the level and type of coverage they look for. After that, the chatbot gives recommendations on the policy to be chosen and provides an estimation of the future premium cost with all taxes, discounts, and additional fees.

Policy purchase

This capability allows users to perform the full cycle of acquiring a policy – from applying for it to clinching the deal. Also, customers can view it whenever they need, change its type, order an insurance card, update account details, and more.

Claim submission

It comes into play when an insurance event occurs. Chatbots can tackle the entire procedure end to end and guide the client through all its stages: incident reporting, filling out a First Notice of Loss form, updating claim and incident details, and tracking the claim’s progress. It helps facilitate claim validation, evaluation, and settlement drastically.

Customer support

This is considered the core function of a chatbot in any field, and insurance chatbots are no exception. An AI-fueled chatbot’s NLP capabilities and ML algorithms enable it to handle customers’ FAQs swiftly and efficiently and modify their responses based on the content and speaker’s intent. When connected to the company’s AMS, CRM, or other databases, a chatbot can personalize answers and offer tailored troubleshooting scenarios.

Appointment scheduling

If a policyholder needs a consultation with a specialist concerning a certain aspect of the insurance pipeline, the chatbot can arrange that. The AI behind the solution will direct the user to the mobile app or a web portal to book an appointment with a doctor (if it is a health insurance issue) or an auto mechanic (if they need to repair their car in the event of vehicle insurance).

Telemedicine

This feature is indispensable for health insurance chatbots. They can enable a customer to get in touch with a clinician via a telemedicine tool that is an integral element of the insurance company’s app or web portal. Then, if a personal visit to the doctor is impossible at the moment, they can address the problem promptly in the remote mode.

Push notifications

Chatbots can be programmed to send different messages triggered by certain events. Thus, customers receive reminders about policy renewals or due premium payments and learn about special offers, discounts, or promotions the company extends. The effect of such messages can be maximized by their customization and individualization when they become informal and congratulate people on important occasions or invite them personally to participate in some activity.

With the roster of features finalized, you can embark on insurance chatbot development. Let’s see how DICEUS handles such projects.

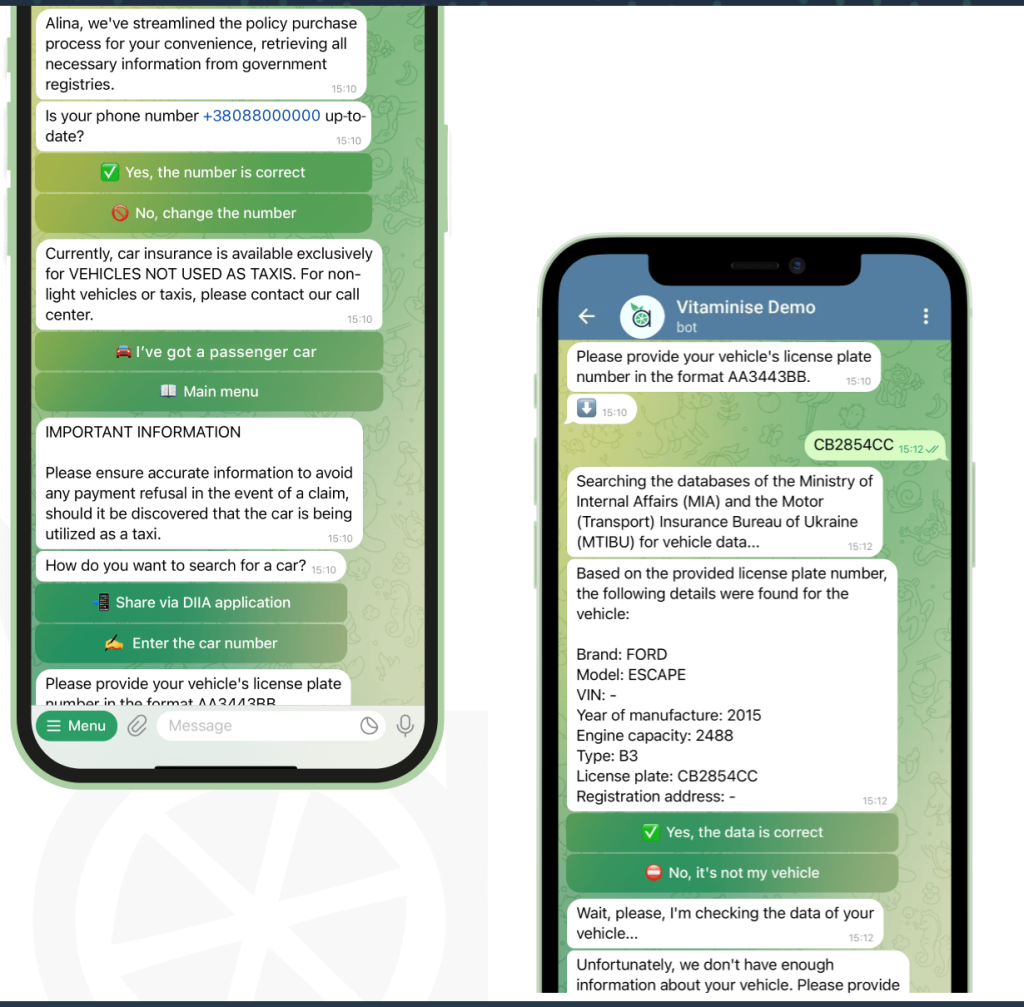

The Vitaminise case study

During our decade-plus presence in the chatbot market, we have delivered numerous solutions of this kind. The Vitaminise insurance chatbot is an essential element of the enterprise digital ecosystem, also comprising a mobile app, web portal, data analytics, and customer feedback tool. What are the advantages of this product?

- It has a wide integration potential being compatible with various messengers (WhatsApp and Telegram), social media (Facebook and Instagram), multiple payment systems, and open data portals.

- It supports numerous business lines, including life, health, disability, travel, P&C, car, pet insurances, and more.

- It performs such functions as customer onboarding, policy selling, policy management, claims management, and FAQ automation.

The chatbot can be enriched with other features according to your company’s needs and requirements.

In a word, we have created a flexible and scalable AI-fueled insurance chatbot that provides 24/7 customer support, collects client data for analytics, accelerates customer-facing and internal pipeline processes, reduces the workload on support personnel, boosts cross-selling and upselling opportunities, and paves the way for turning your insurance company into a paperless business.

If you think Vitaminise dovetails into your company’s business goals, contact DICEUS to acquire it. In case you need a solution of different scope or capabilities, you can commission a full-cycle development of another bespoke insurance chatbot.

As it happens in many digitally-driven contemporary industries, AI in insurance finds numerous applications. One of the most popular use cases of artificial intelligence in this sector is the creation of insurance chatbots. When equipped with relevant functionalities and developed by a competent IT vendor, chatbots can revolutionize multiple elements of the insurance pipeline (such as client onboarding, claim processing, policy renewal, and customer support), improve fraud detection, boost lead generation, reduce employee workload, and promote a personalized approach in customer-insurer relationships.

FAQ

What are the key features that make a chatbot ideal for the insurance industry?

Chatbots are efficient AI-fueled tools whose 24/7 customer support capabilities make them indispensable for any industry. Insurance chatbots’ power can be enhanced by niche functionalities such as policy renewal and purchase, claim submission, quote generation, appointment scheduling, etc.

How does natural language processing contribute to the effectiveness of insurance chatbots?

Unlike rule-based chatbots, AI-driven solutions harnessing NLP can discover the intent of the question depending on its context and adjust their responses in accordance with the collected information. Their machine learning algorithms allow them to enrich their expertise after each customer interaction and improve the quality of recommendations clients receive concerning major insurance pipeline processes.

What role do quick response times play in enhancing user satisfaction with insurance chatbots?

When addressing a chatbot, customers have an urgent or important problem to solve, so they expect to obtain prompt and accurate answers. If the response is too long or delayed, it leaves people frustrated, diminishes trust, and increases the chances of switching to a competitor. By keeping the response time of your insurance chatbot to a minimum, you will avoid such consequences and augment user satisfaction considerably.

What are the benefits of incorporating machine learning in insurance chatbots?

The major asset of machine learning solutions is their ability to become more sophisticated after processing new data sets. When equipped with ML algorithms, insurance chatbots can comprehend and interpret written and spoken human speech, pick relevant details from it, analyze the context of each statement, and discern the speaker’s intentions. Such capabilities make chatbot-customer interaction very close to human-to-human communication.

Can insurance chatbots integrate with existing CRM systems?

Not can, but they must, in fact. Utilizing a chatbot as a standalone solution undermines its value for the organization. By making it an integral element of the insurance company’s software environment and integrating it with CRM, owners ensure the chatbot’s access to detailed customer insights, thus enabling it to provide tailored assistance and personalized recommendations.