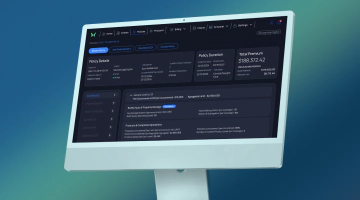

To ensure efficient support and complete control over the Insurance Data Warehouse, we built DWH SUPPORT — a custom web app based on the Oracle APEX platform. It improves day‑to‑day operations, making it easier for teams to monitor, diagnose, and manage complex data flowing across the DWH environment.

With real‑time visibility into ETL processes, interactive dashboards for load status, and built‑in error diagnostics, DWH SUPPORT helps quickly identify and solve issues. It also enables the secure performance of operational tasks directly through the interface — decreasing downtime, enhancing data reliability, and improving operational efficiency.

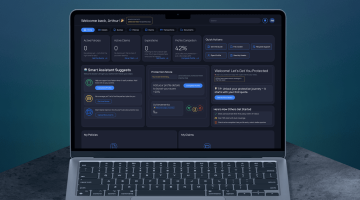

To enable rapid incident response and real‑time platform monitoring, a specialized bot —

DWH ALERTS — was built and integrated with Jira. It provides instant tech alerts, automatically creates support tickets, and gives real‑time updates on data load statuses. So issues are detected and resolved more quickly.

.svg)

.svg)

.svg)

.svg)