What is an Underwriting Workbench?

An Underwriting Workbench is a digital platform built to improve and modernize the insurance underwriting process. It acts as a centralized workspace that supports underwriters with AI‑powered decision‑making tools, automated workflows, and real‑time collaboration features.

What challenges does the Underwriting Workbench solve?

Firstly, the system harmonizes all messy data scattered across your documents, emails, and other assets to receive and process submissions appropriately. Secondly, it uses artificial intelligence to correctly evaluate risks and various factors affecting insurance coverage and price. Thirdly, this platform is a single place to keep all customer history in order to understand your clients better and offer them relevant quotes.

How to implement the Underwriting Workbench?

Our platform is easy to implement. We start with figuring out your underwriting journeys, internal and external data flows, and third‑party sources of data you use. Then, we proceed with building the proper workflows and configuring the platform to your specific requirements.

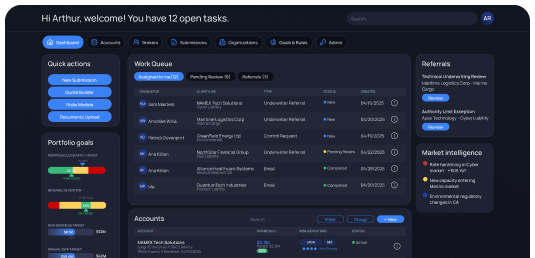

What key functionalities does the Underwriting Workbench provide?

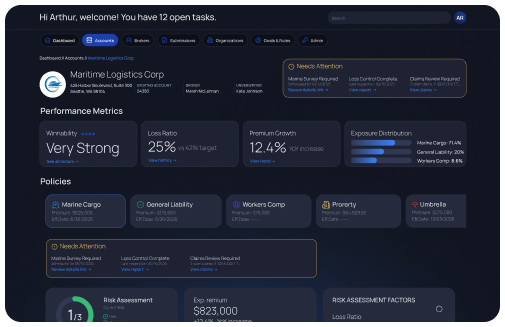

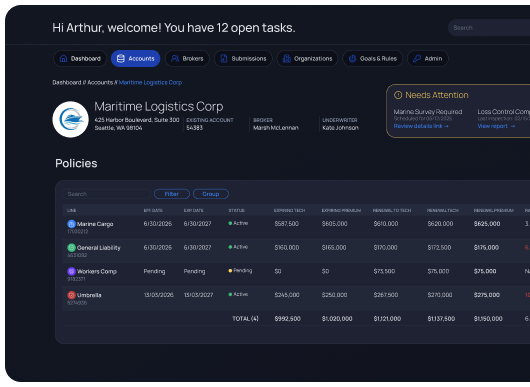

The platform includes dashboards, submissions, accounts and policies, broker portal, goals and business rules, reports, and admin functionalities to do risk selection effectively. DICEUS' Underwriting Workbench Software enhances underwriting efficiency by offering:

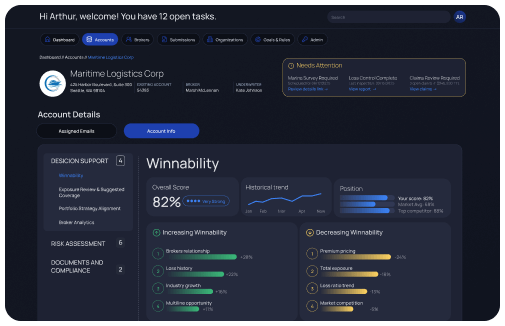

- AI‑driven risk analysis and intelligent decision support

- A 360° view of each account, including full policy and claims history

- Automated submission intake from unstructured sources like emails and PDFs

- Integrated rate, price, and quote automation (RPQ)

- Broker and MGA collaboration portals for seamless communication

- Clash check and risk overlap detection to manage portfolio risk

- Customizable rules and workflows to align with underwriting guidelines

Can the platform be integrated with external systems?

Yes, our software product can be integrated with other systems you use for underwriting purposes: external data sources, bordereaux processing solutions, asset valuation and risk data sources, and many more.

Is there any portal for brokers and coverholders?

Yes, our solution for underwriting provides a user‑friendly broker portal for collaboration, ensuring seamless quote creation and policy management.

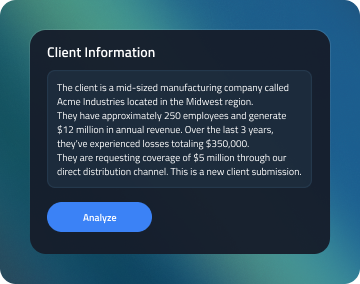

How does artificial intelligence enhance decisions?

AI enhances underwriting by analyzing unstructured applications, finding anomalies, and creating respective recommendations. It calculates triage scores, assesses risk appetite, and indicates winnability, helping underwriters make more informed decisions faster.

What types of submissions can Underwriting Workbench process?

The workbench supports both structured and unstructured applications from various sources, including emails, PDFs, spreadsheets, and digital forms. It automatically extracts required data and structures it for review.

Does Underwriting Workbench work for all lines of business?

Yes, it is adjustable to support several lines of business across various types of insurance. Custom workflows, rules, and scoring models ensure flexibility across underwriting needs.

Can underwriters adjust their rules and workflows?

Absolutely, underwriters and admins can create and manage business rules, risk thresholds, referral triggers, and decision criteria to comply with business strategy and underwriting guidelines.

What kind of analytics and reporting does Underwriting Workbench provide?

The platform provides user‑friendly dashboards and reporting tools to track application trends, quote turnaround, underwriters' performance, brokers' activity, and portfolio health. Insurers can track:

- Application and submission trends to monitor volume and channel efficiency

- Underwriter performance, including task completion, risk scoring accuracy, and goal achievement

- Broker and MGA activity to assess relationship value, submission quality, and engagement levels

- Quote turnaround times to identify delays and improve response rates

- Portfolio health, including exposure concentration, risk overlap, loss ratios, and overall book performance

- These insights support continuous improvement in underwriting strategy, pricing models, workflow efficiency, and operational oversight.