For insurers

Insurers get an all-encompassing individual and group insurance management platform with modules to handle key insurance operations:

Workflows and business rules

Workflows and business rules

Implement automated workflows for individual and group insurance policy administration, claims processing, invoicing, and client onboarding without the need for custom development.

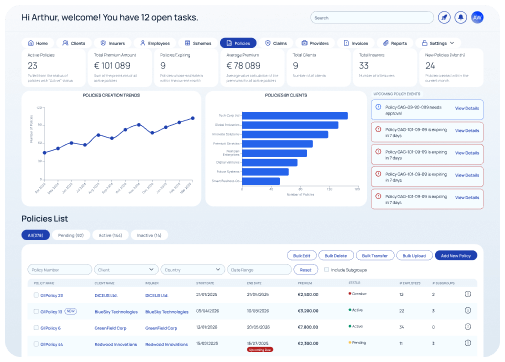

Product and policy administration

Product and policy administration

Create and administer new individual and group insurance products, and set coverage levels, exclusions, and benefits. Key functionalities include policy issuance and enrollment, policy renewals, terminations, and modifications, group premium calculation.

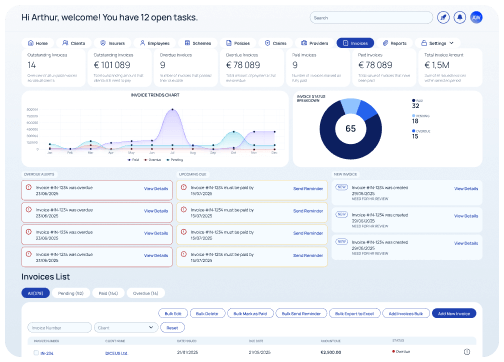

Quote generation, invoicing, and billing

Quote generation, invoicing, and billing

Respond to customer inquiries and create tailored individual and group insurance quotes and proposals. Generating invoices, importing, validating, and processing multiple invoices simultaneously.

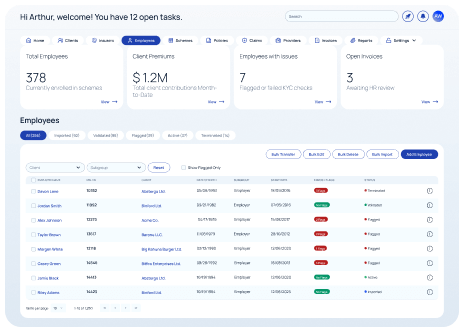

Client (Individual/Group) management

Client (Individual/Group) management

Create client profiles, manage client data and documentation, manage and configure various insurance plans, and provide support.

Claims and reimbursement processing

Claims and reimbursement processing

Claim management functionality enables bulk claims upload, automated claim validation, and reimbursement. Functionalities like multi-step claim approvals and integration with healthcare providers or car repair stations for direct claim handling automate workflows and prevent fraud.

Reporting and dashboards

Reporting and dashboards

Generate reports and real-time insights, use interactive dashboards and KPI tracking, task and workflow monitoring. Reporting and dashboards can be customized according to insurance business requirements to track various data, including claims, policy renewals, enrollment trends, benefit usage, etc.