To stay competitive, modern insurers can’t afford to be without next-generation IT products empowered with the latest technology. Modern consumers, in turn, are accustomed to a wide range of digital channels through which they can purchase, pay, and order what they need online, without needing to visit brick-and-mortar stores. The insurance sector is not an exception. It drastically needs a new, personalized customer experience (CX) ensured throughout each customer touchpoint, including claim handling.

Claims management software is aimed at digitizing and harmonizing all claim-related workflows like submitting a claim, handling it according to the company’s rules and frameworks (for example, claim validation and settlement), and resolving (compensating or repaying for damage, etc.). This type of solution is typically integrated with larger core systems that encompass many vital functionalities, such as policy administration, underwriting, document management, and others.

Benefits of custom claims management software

Want to improve claim handling?

Let’s discuss your processes!

Core functional modules

End-to-end workflow

Custom solutions for claim management ensure an automated process to handle all phases of an insurance claim: claim initiation, claim validation and verification, claim assessment, claim processing, settlement and closure. First notice of loss (FNOL) is initiated via any convenient communication channel (mobile app, chatbot, web portal, etc.)

Automated rules engine and AI

Predefined rules and artificial intelligence that power our custom solutions help insurers handle claims automatically, spot fraud, and validate claims. AI-powered solutions enhance efficiency and speed of claim processing, reduce manual errors, and lead to a competitive edge.

Document management

Document and evidence management are crucial in reducing fraud and ensuring compliance during the claim processing process. This functionality allows adjusters and claimants to upload reports, photos, medical documents, invoices, and other documents. Our solutions can be developed with version control, tagging, categorization, workflow integration, and more.

Customer-facing self-service portals

For an excellent customer experience, modern claim processes should be organized through digital channels, providing self-service online. The latter includes customer-facing mobile applications, web portals, chatbots, and other digital means of communication that offer self-service. Policyholders should be able to file claims, track them, and attach any multimedia evidence like photos, videos, or voice notes to their claims.

Omnichannel touchpoints

Our team not only develops custom software for the insurance industry but also specializes in omnichannel experience. Our CX specialists conduct in-depth research on CX to build a robust omnichannel system for your company to ensure that all channels you use to engage customers are integrated. So, your customers can start interacting on one channel and continue it in another (e.g., filing a claim on a mobile app, providing evidence on a web portal, and speaking with an agent via a phone).

Analytics dashboards and reporting

Analytics built into our custom software for claims management allows insurers to track key metrics like volume of claims and resolution time, customer satisfaction score, premiums collected versus losses paid, agent performance metrics, and many more. Reporting functionality provides the possibility to generate reports based on historical or real-time data.

Our services

Want to talk about your project?

Some facts about DICEUS

DICEUS offering: Ready-made software products for insurance

If you want to implement software for claim management quickly and efficiently, without investing heavily in custom solutions, we offer our ready-made software products.

- Mobile apps supporting health, life and unit-linked products, car insurance (Possibility for your clients to file claims directly through a mobile app)

- Customer web portal (Possibility for your customers to submit claims through self-service functionalities)

- AI-powered chatbot (Possibility to submit claims through a chatbot)

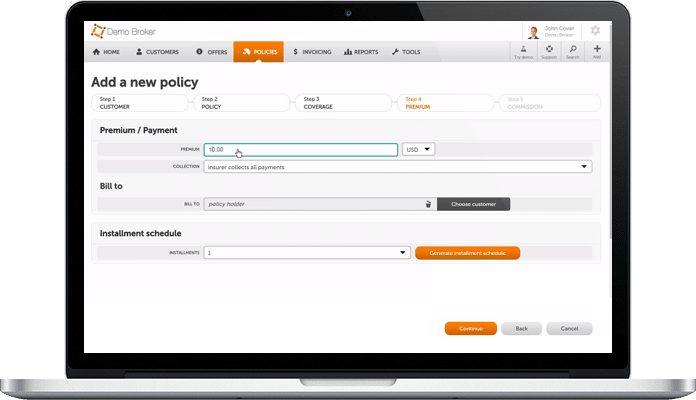

- Policy Administration System (Stand-alone module supporting back-office claim management processes of insurance companies)

Vitaminise Data Analytics

Advantages of our claims management software development services

Our insurance claims management software development process

What impacts your project duration

The final duration of a project is a matter of individual circumstance, influenced by various factors. We provide high-quality services that help you meet your objectives in the quickest time possible. However, the following are the specific aspects that influence the overall time of your project.

- Project requirements

- Time-to-market

- Team composition

- Chosen technology stack

- Integration needs

What affects your project costs

The project’s estimated financial scope can only be calculated before it is launched. A variety of factors significantly influence the estimate. Here’s what affects your project’s overall cost.

- Scope of work and project’s complexity

- The number of upgrades and customizations

- Project completion urgency

- Engagement model: Time and Material, Dedicated Team

What we need from your side

On behalf of our insurance claims system development firm, we accept full responsibility for the dependable, high-quality services we deliver. However, please prepare the following information to help us improve your project.

- Project goals, vision, and roadmap

- Project requirements

- Project-specific documentation

- Client’s availability (a couple of hours per week)

Our achievements

Our tech stack

Programming languages

Web frameworks

Other frameworks

Databases

Platforms

Client reviews

Explore our case studies

Frequently asked questions

How to improve claims management workflow?

The traditional claims management workflow can be improved, facilitated, and streamlined in various ways with the assistance of specialized software. Tailored solutions enable autonomous handling of routine tasks through digital signatures, document management tools, centralized editing opportunities, collaborative features, and more.

Do you have expertise in insurtech solutions?

We have been working with specialized claims administration software for years, ensuring professional operations in the market. We have an extensive portfolio of insurtech solutions that address various challenges, issues, and operational areas. All thanks to a well-formed pool of reliable specialists who are savvy with the top-tier technologies enabling modern insurtech.

What are the insurtech trends today?

Top trends in the industry include personalized solutions, the integration of advanced technologies (such as AI, blockchain, IoT, AR/VR), analytical predictions, autonomous digital assistants, and wearable devices. There may also be other, less popular trends. However, we can currently assist you in obtaining a claim management system that aligns with the latest trends.