Insurance risk management software helps carriers accurately assess and classify the probability and influence of profit loss that may happen on the customer’s side and require some arrangement from the insurer’s side. DICEUS offers the creation of tailored software in compliance with carriers’ risk-specific frameworks and strategies.

Benefits of bespoke risk management software for carriers

Tailor-made IT products for carriers can significantly improve risk performance by implementing predictive analytics, customization, automation, and integration capabilities. As a result, the risk management framework works more efficiently and is better adapted to the organization’s needs.

Possibility to analyze large volumes of data in real time and use predictive modeling to assess the likelihood of various events.

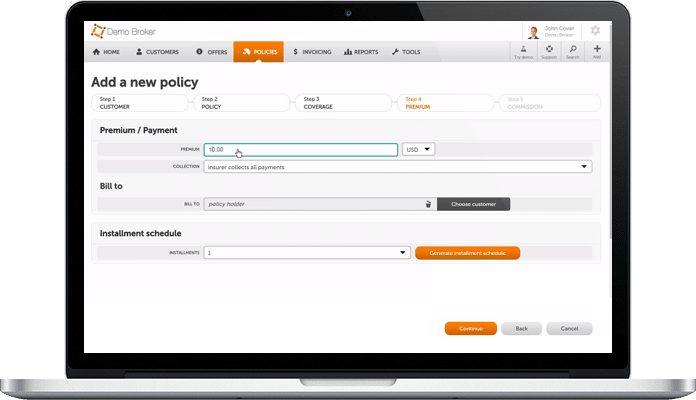

Opportunity to reduce manual errors by automating tasks in underwriting, claims processing, and policy management.

Integration with external data sources (economic indicators, weather data, industry reports, etc.) to help carriers be always up to date on factors influencing their risk landscape.

Improved cybersecurity measures ensure that customer data is protected, which also reduces various breaches and other related risks.

Insurance risk management software development services

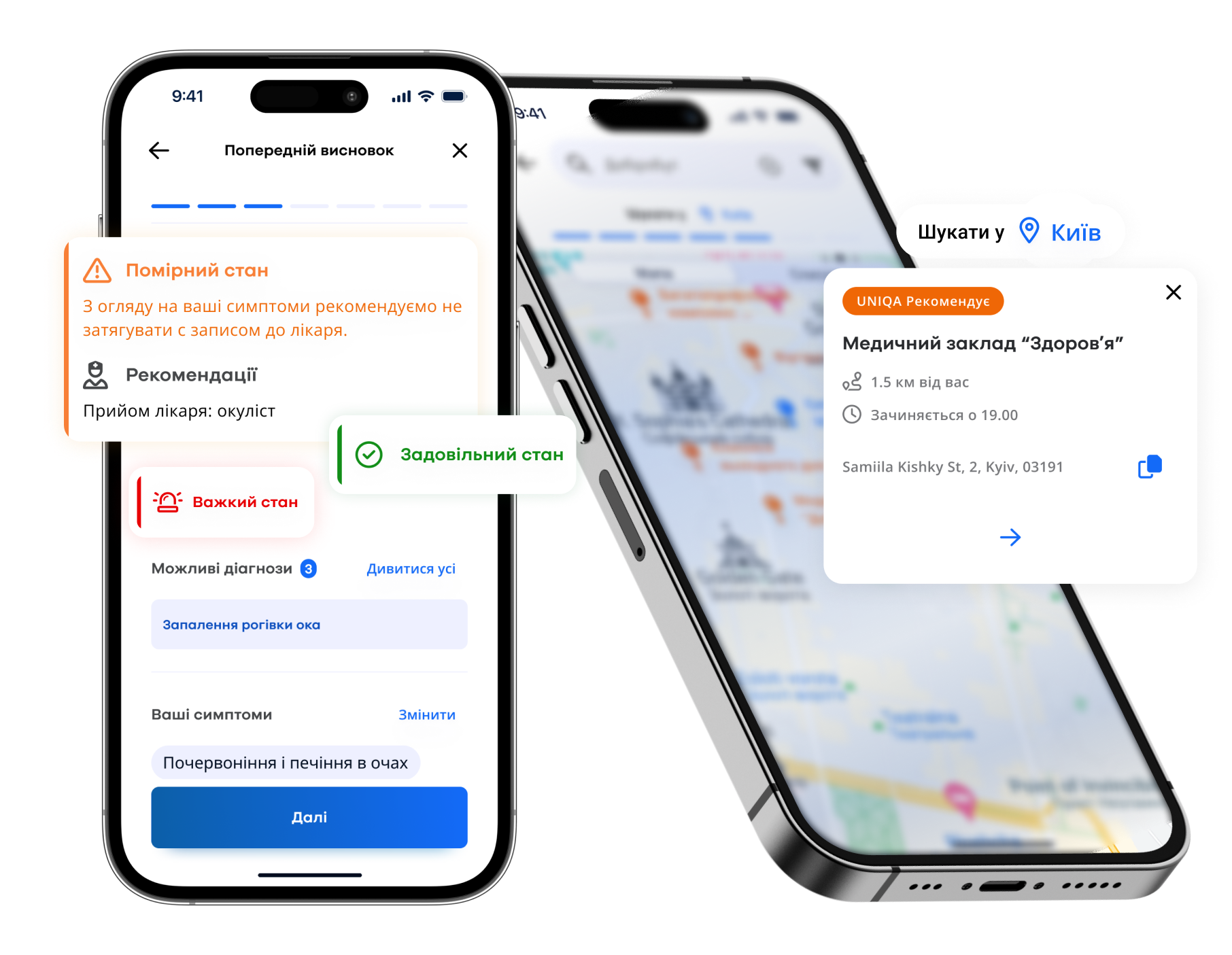

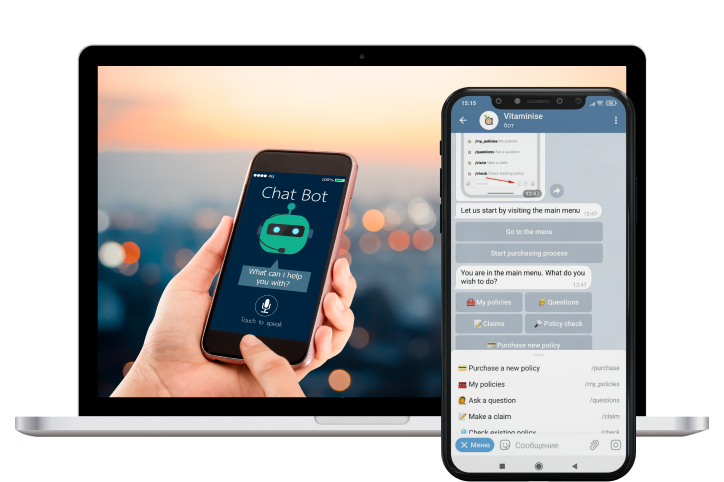

DICEUS has more than 10 years of experience building bespoke systems for leading carriers like Willis Towers Watson, BenefitNet, BriteCore, and UNIQA. We will be happy to help you realize your project ideas and reach business objectives.

Want to discuss your project?

Book a free 1-hour consultation with our experts.

Benefits of DICEUS risk management software development services

Some facts about DICEUS

Our insurance risk management software development process

DICEUS is a custom insurance risk management software company that follows an Agile approach to engineering and project management. It allows us to deliver IT solutions effectively and cost-efficiently. Below is our standard SDLC. We recommend starting a project with a discovery phase, as it allows all project stakeholders to get a clear understanding of the project’s goals and scope, compose a roadmap, identify possible risks, and optimize costs.

What impacts your project duration

Before you start a project, you can never define the precise time it will take. However, a ballpark estimation is possible if we have the following information.

- Project requirements

- Time-to-market

- Team composition

- Chosen technology stack

- Integration needs

What affects your project costs

The project budget usually depends on the factors enlisted below. We highly recommend to start any project with a discovery phase to accurately define the project scope.

- Scope of work and project’s complexity

- The number of upgrades and customizations

- Project completion urgency

- Engagement model: Time and Material, Dedicated Team

What we need from your side

Please provide the information indicated below to help us define your project scope accurately.

- Project goals, vision, and roadmap

- Project requirements

- Project-specific documentation

- Your availability for project discussion sessions

Our tech stack

Client reviews

Explore our case studies

You might be interested in the following options

Frequently asked questions

How does technology help manage risks in insurance?

The insurance business faces a number of operational, reputational, and compliance risks that threaten the functioning of any insurance company. In addition to the conventional risks caused by inadequate professional service or adverse environmental conditions, the digital age brings IT-related threats like data breaches and other kinds of cybercrime. Given the gamut and complexity of such dangers (especially the high-tech-driven ones), it is impossible to address all the challenges without relying on the state-of-the-art means that the contemporary IT industry has in stock.

What software solutions are popular for risk management?

To effectively forestall risks and eliminate them, risk management software must have prediction capabilities, reporting and analytics functionality, a user-friendly interface, incident navigation, and wide integration options. Many existing off-the-shelf solutions, such as TimeCamp, Qualys, MasterControl Risk Analysis, Resolver, nTask, Audits.io, Reciprocity, and many others, tick these boxes. However, only bespoke software built with regard to your unique needs and specific requirements can give you full value.

What is a risk management system in insurance?

In the insurance industry, risk management presupposes assessing the likelihood and financial consequences of events that may happen to the customer. The system responsible for this task must identify the premium cover and the value of insurance risk through leveraging statistical and mathematical modeling. Its other priority lies in helping clients detect risk events to prevent them in a timely manner as well as reinforcing feedback techniques to enhance the performance and profitability of the underwriting process.