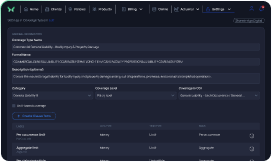

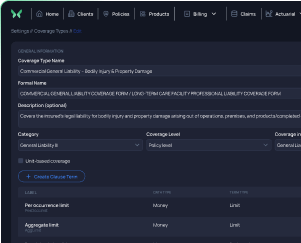

Coverage configuration builder (low code)

Coverage configuration builder (low code)

This low-code builder supports configurable policy-level and facility-level coverage. You can bind as many clause terms to each coverage as needed by specifying the term name, type (limit or deductible), basis (per occurrence, per claim, etc.), data type (monetary, percentage, etc.), and the exact value for each term. You can also mark a clause term as required. If a term is needed, the user must enter it when creating a policy. The system will not allow the policy to be saved until this value is provided.

Limit types

Limit types

Different programs may require various limit types in policy coverage. Depending on the selected Limit Type in the coverage configuration, the system automatically displays the relevant input fields during policy creation.

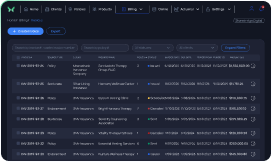

Document Templates Center

Document Templates Center

A centralized Document Templates Center stores and manages all template documents. It allows captives to upload templates, define their types (policy, invoice, endorsement), specify whether the template should be used as the default, link the template to a specific product and version, and to a particular client or multiple clients, if needed.

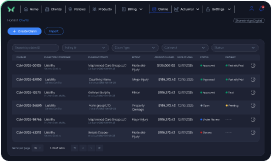

Custom fields

Custom fields

Every captive insurance program is unique, and standard system fields often do not meet the specific needs of captives and captive managers. Our Policy Administration System addresses this by allowing users to create custom fields instantly, eliminating the need to request changes and wait for system upgrades. With a low-code builder, users can easily name a new field, select its type, and create a custom field tailored to their requirements.

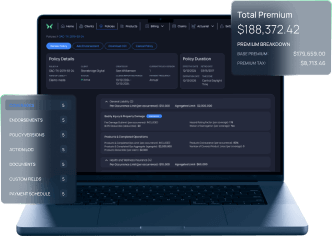

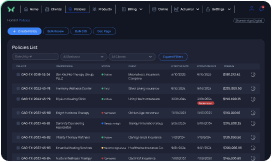

Endorsements

Endorsements

Create and configure endorsements using full low-code functionality. Users can link endorsements to products and policies in just a few clicks, and all defined custom fields automatically populate the PDF/Word documents during policy creation.

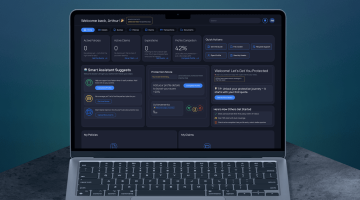

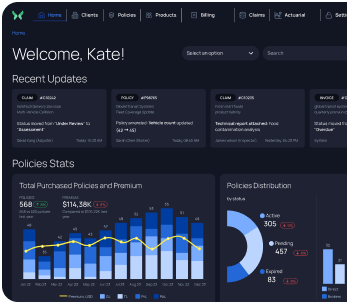

Dashboards

Dashboards

Dashboards and charts can be configured to display the required analytics and reporting, which are usually tracked by captives and captive managers. These may include loss and claims performance dashboards, underwriting and premium dashboards, risk management and exposure dashboards, and many more.

Management fee invoicing

Management fee invoicing

The management fee invoicing feature in captive insurance software is designed to handle the unique billing and invoicing requirements for management fees, which differ from the traditional premium invoicing model. This feature ensures accurate, flexible, and automated management fee calculations and invoicing, catering to the specific needs of each captive.

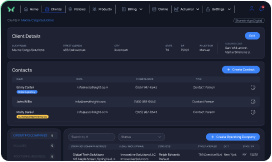

Users and access

Users and access

Create, add, and invite users to the system to efficiently work with your colleagues. You can view user details, deactivate users, and archive data when needed. User roles and access settings are configurable, allowing admins to give permissions and define who can view, edit, or manage specific parts of the system.

Email logs

Email logs

Track emails, their status, type, time, recipients, and attached documents. Email logs help verify correspondence, including claims, policy notifications, and renewal reminders. Users monitor communication logs and ensure critical messages and documents are delivered successfully.

Limit types

Limit types Document Templates Center

Document Templates Center  Custom fields

Custom fields  Endorsements

Endorsements Dashboards

Dashboards Management fee invoicing

Management fee invoicing  Users and access

Users and access Email logs

Email logs