What are the key benefits of the DICEUS’s chatbot for insurance companies?

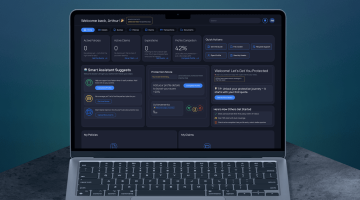

Our chatbot offers several benefits for insurance companies: improved customer service, cost efficiency, enhanced user engagement, faster claim processing, personalized user experience, scalability, and security. It supports a hybrid pricing model and can scale according to the company’s size and number of policyholders, making it flexible for small, medium, and large insurance providers.

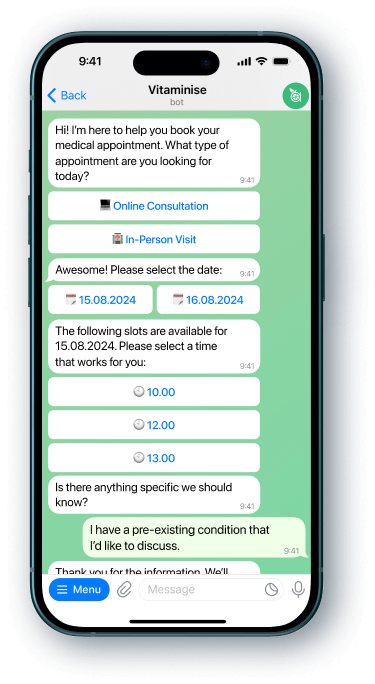

The chatbot is based on a Large Language Model that makes it possible to understand the context, recognize voice and multiple languages so that customers can easily buy insurance hands‑free wherever they are.

Which insurance business lines does the chatbot work with?

Today, our chatbot works mainly with car insurance. However, it can be set up for other insurance business lines.

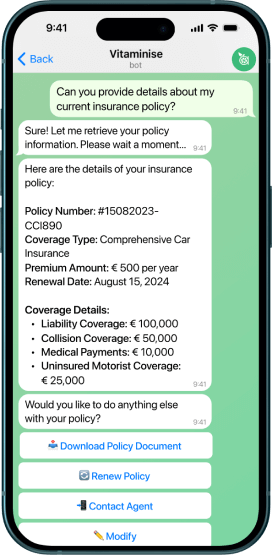

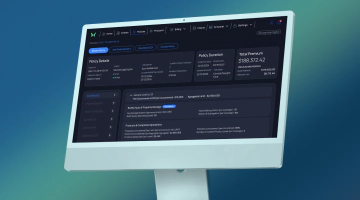

Will the chatbot be integrated with our core system?

Yes, it will be integrated with your particular core system through specific APIs for maximum efficiency and flexibility.

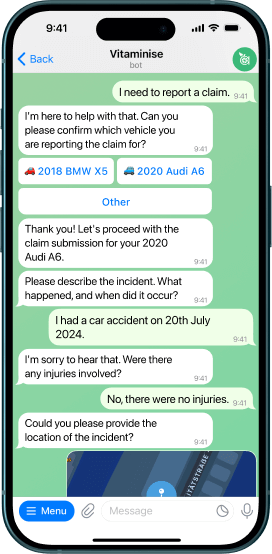

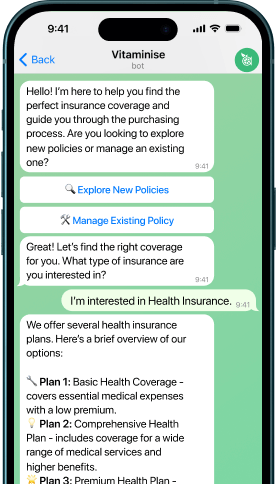

Is it possible to buy insurance policies through the chatbot?

Yes, it is possible to buy policies. Just provide the required details and the bot will offer you a few options to choose from. Once the desired plan is selected, the bot will offer to buy insurance online.

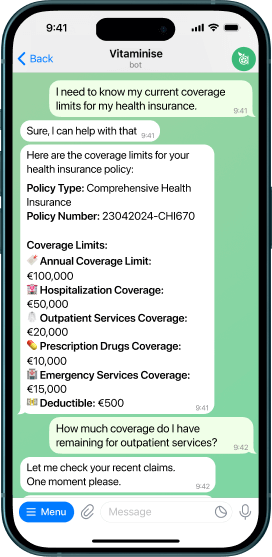

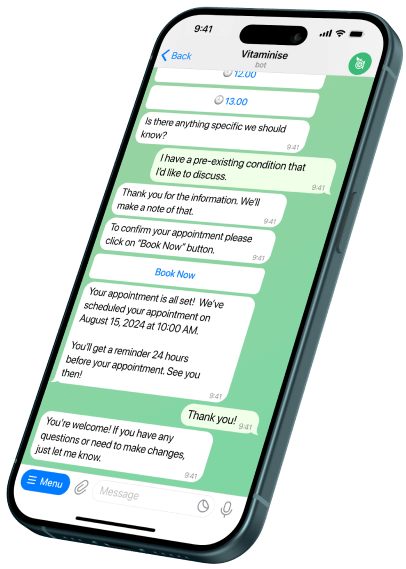

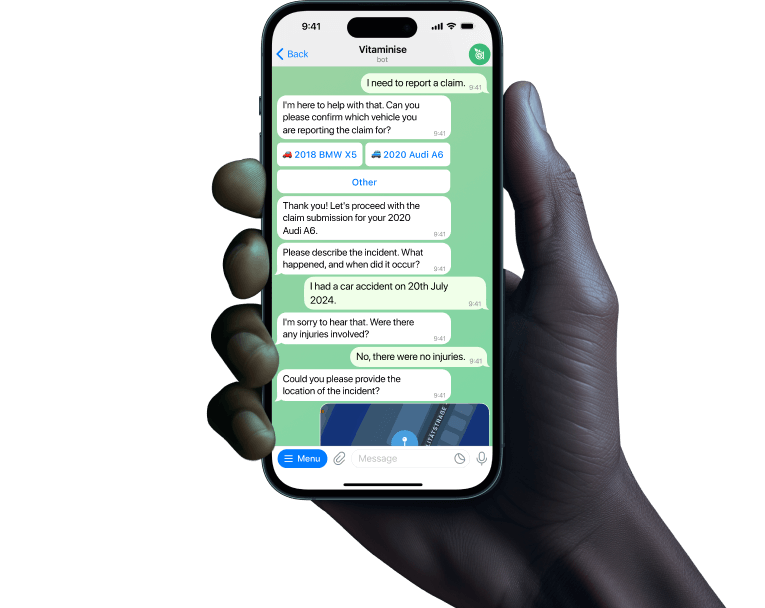

Is it possible to submit claims through the chatbot?

Yes, submitting claims via the bot is a simple procedure. Just provide the accident details and upload the supporting documents, photos or videos, and get further instructions.

How to implement your chatbot for my insurance company?

Just contact our team for a demo session to learn more about the advantages and functionalities of our solution. Once we know your business needs and goals, we will consult you on the most suitable subscription plan for you.

How does your software solution ensure security?

Our solution ensures security through end‑to‑end data encryption, multi‑factor authentication, secure API integrations, and compliance with industry standards like GDPR. It also uses role‑based access control, session management, and real‑time monitoring to safeguard sensitive information in insurance operations.

Do you provide technical support?

We offer two options for technical support: free and business. Both ensure basic support during working hours, response to various issues, consultations on functionalities, updates, and more. More information is available in the support information section above.

Licenses

We offer a Hybrid license (subscription and usage based) with 4 packages depending on the number of users (policyholders) your company has.

ChatGPT

ChatGPT Telegram

Telegram WhatsApp

WhatsApp Instagram

Instagram Facebook

Facebook Payment systems

Payment systems Open data portals

Open data portals