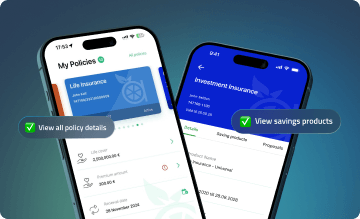

What is the Insurance Core Suite by DICEUS?

The Insurance Core Suite is a set of modular, ready‑made back-office solutions that support key insurance processes such as policy administration, claims management, billing, and more. These modules are designed to integrate seamlessly and scale with your business. You can implement only the module(s) you need, that’s why this solution is cost-effective as compared to expensive enterprise-grade systems.

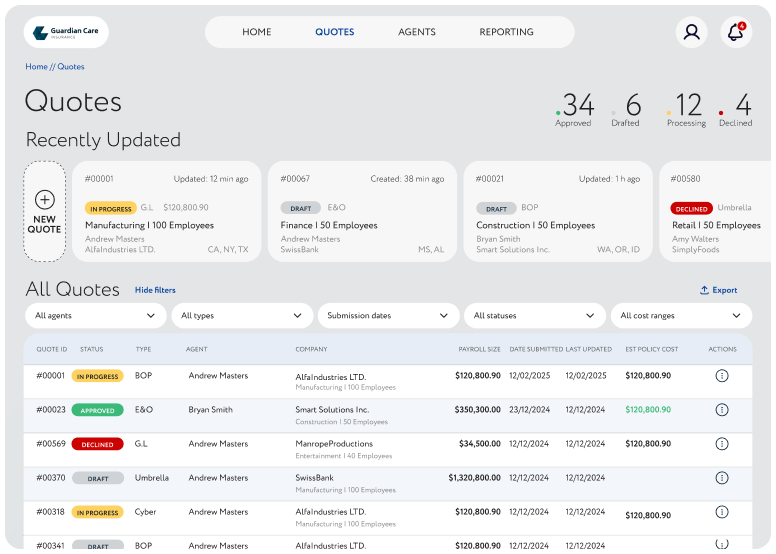

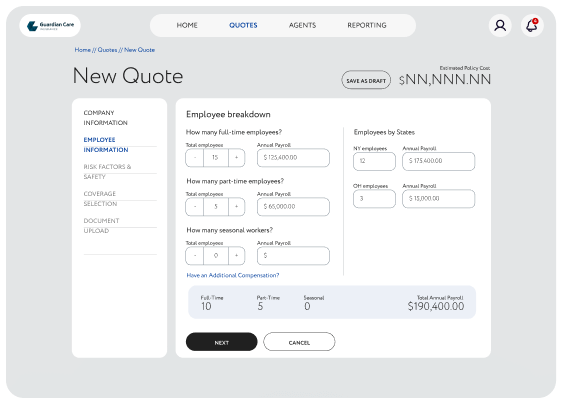

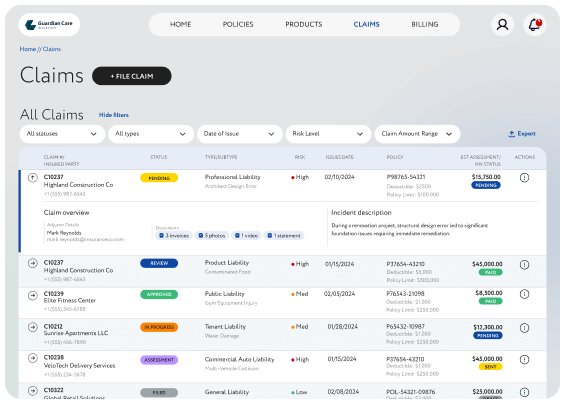

Which modules are offered?

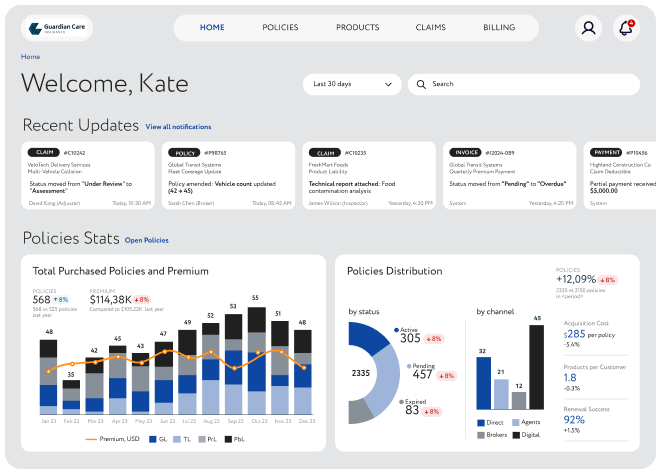

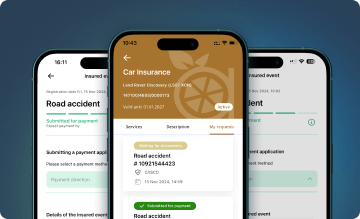

We offer the following modules that can be implemented separately or as a whole set: policy creation, policy administration, quoting, issuing, and management, claim management, billing, and invoicing. Additional support systems such as customer portals, reporting tools, and integrations are available.

Can I implement only specific modules?

Yes. Our core suite is modular, and you can pick and activate only the modules you need, whether that’s just policy administration, claims, billing, or a combination of several modules.

How compatible is it with my existing systems?

DICEUS delivers the modules to be flexible: they integrate with your current CRM, ERP, and other platforms. Integration of modules with your existing platforms will help your organization use data efficiently and reduce manual work.

Is the solution suitable for both individual and group insurance?

Absolutely. DICEUS provides support for both individual and group insurance policies, with modules tailored to manage individual and bulk enrollment, policy templates, claims, billing, and more.

What are the benefits of using ready‑made modules?

Key advantages of leveraging insurance core suite modules include speed to market, cost savings, and proven reliability. It means that you get software deployed faster and cheaper than if you developed custom solutions because these modules are already built and have configurable components.

Does DICEUS offer customization?

Yes. While the solution is ready-to-use, DICEUS also offers full customization services to tailor modules precisely to your workflows, customer experience, and business rules.

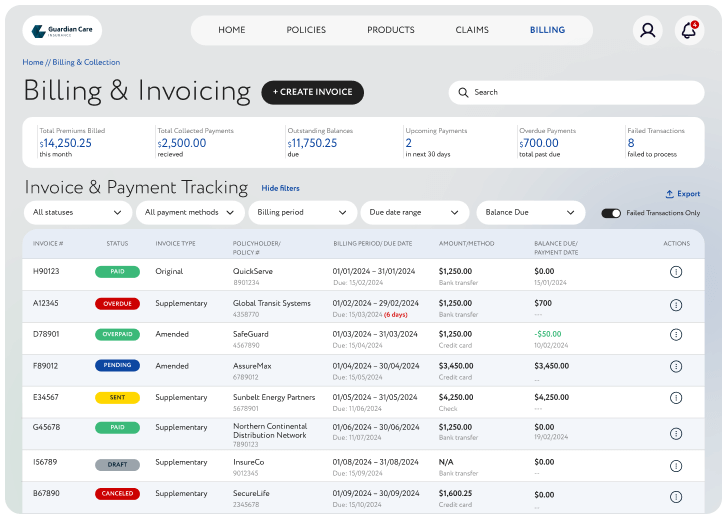

How does billing and invoicing work?

The Suite includes a billing and invoicing module to automate premium invoicing, payment tracking, reminders, and financial reconciliation, all integrated with core policy and claims data.

Can I add new modules over time?

You can begin with one or two modules and scale up as your business grows. The architecture is designed for incremental implementation. The development of any additional modules different from the ones offered or features is available upon your request.

Which types of insurers typically adopt this solution?

Insurers providing health, life, investment, travel, car, and other types of insurance use our modules to create a modern, modular, and scalable back-office system without investing much in complex enterprise software solutions.