Insurance web portal development and ready-made portals

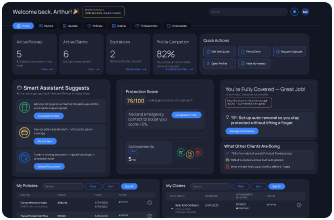

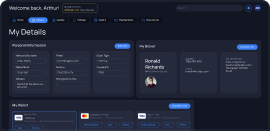

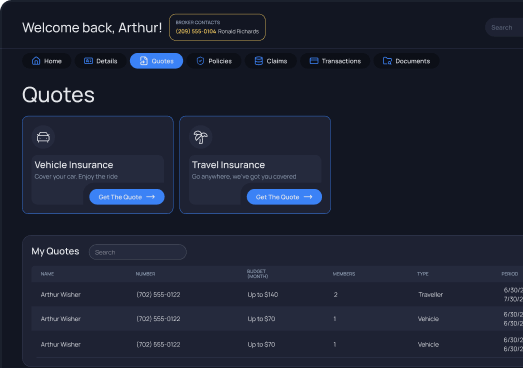

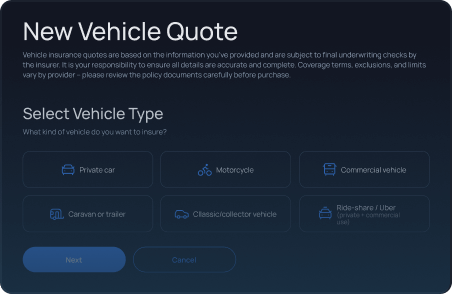

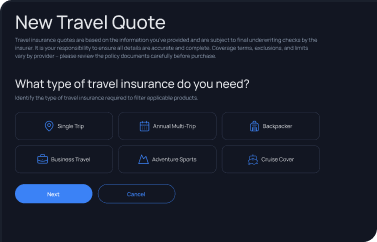

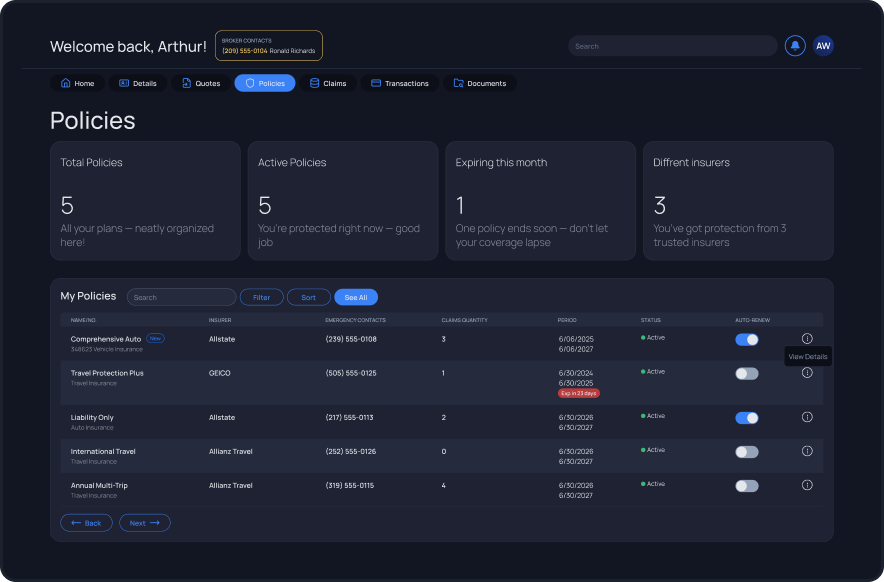

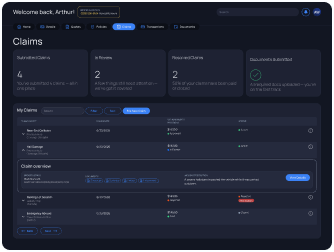

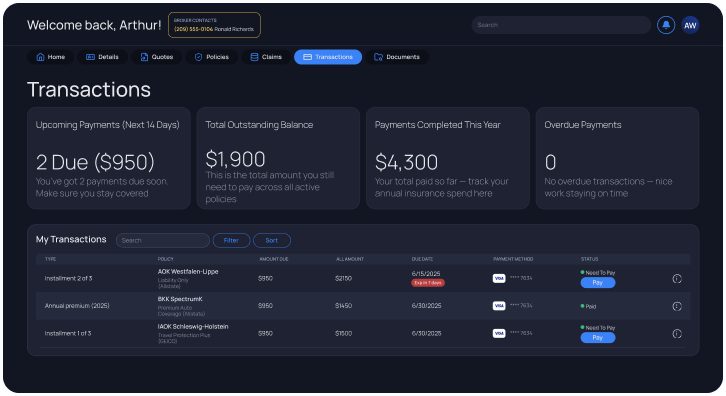

DICEUS is an insurance portal development company that offers a ready-made customer-facing web portal for insurance businesses. Our portal empowers policyholders with full control over their insurance journey. It provides personalized, user-friendly dashboards, real-time policy and claim management, instant quotes, and secure payments.

Book a demo

Along with our portal, we also provide custom development services according to top-quality software standards and principles. Our solutions are built based on in‑depth UX/CX research, according to customer business needs, and with a focus on omnichannel customer experience.

Below is a detailed overview of our insurance portal, explicitly developed for insurance companies and their customers. It has a set of pre-built functionalities designed based on insurance-specific workflows and is easy to integrate with other software like core systems, DWH, CRM, and other companies' and third-party data sources.