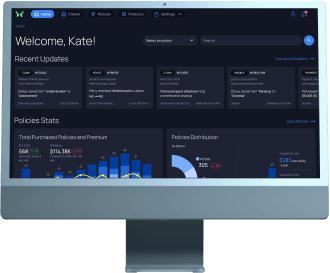

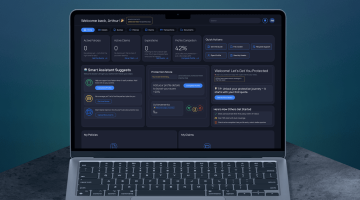

Main dashboard

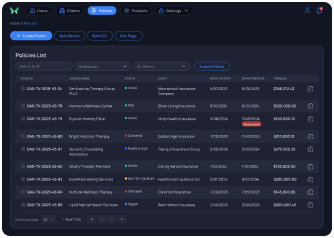

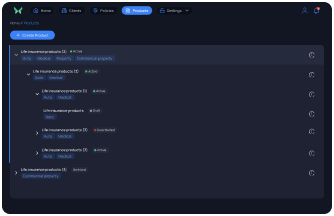

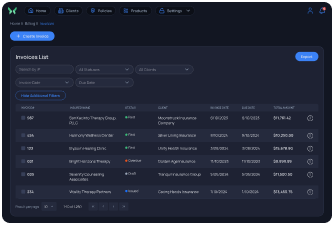

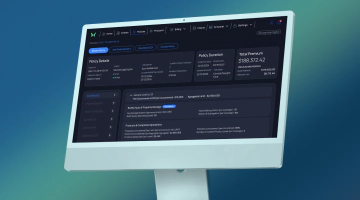

Begin your journey with a powerful, user‑friendly dashboard that displays portfolio performance, including data on policies and claims, billing, and customer interactions.

Real‑time updates, visual analytics, and intuitive navigation allow users to track policy performance, claim progress, and premiums.

Our policy administration system in insurance offers clear insights into policy status distribution, monthly premium trends, and recent activity, enabling more intelligent decisions and effective operations.