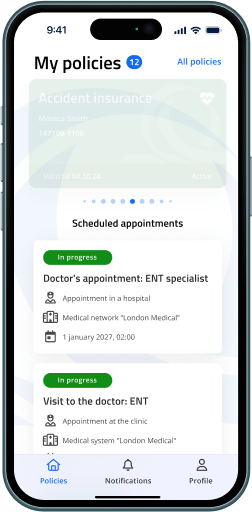

What are the key benefits of Super App for insurance companies?

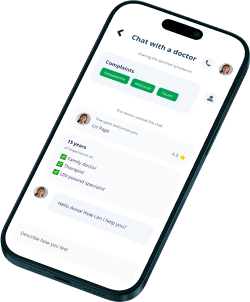

Our Super App reduces operational costs, improves customer engagement, and drives revenue growth by providing convenient self‑service functionalities to users and up/cross‑selling capabilities for insurers.

Which insurance business lines does Super App work with?

Super App works mainly with A&H and P&C insurance business lines. However, our solutions can be implemented for other lines, as well.

Will a mobile app be integrated with our core system?

Yes, it will be integrated with your particular core system through specific APIs for maximum efficiency and flexibility.

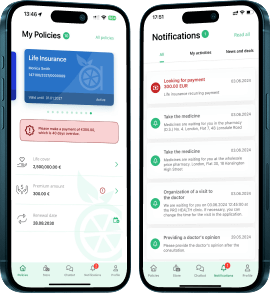

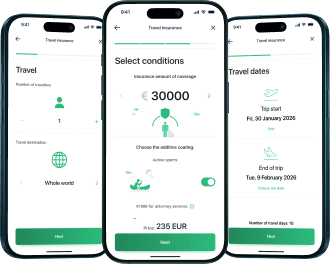

Is it possible to buy insurance policies through Super App?

Yes, it is. Users can easily choose and buy policies online by paying through an online payment system, Google Pay or Apple Pay.

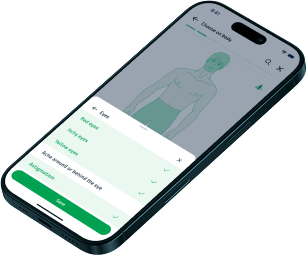

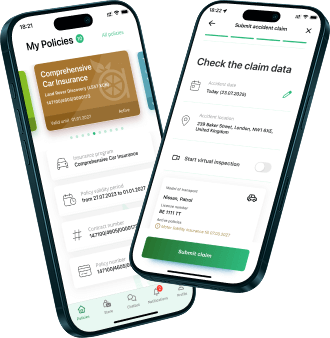

Is it possible to submit claims through Super App?

Yes, it is possible to file claims through Super App by providing incident details and uploading supporting documents, photos, and videos.

How to implement Super App for my insurance company?

First, you should consult our experts on what license will work better for your business and discuss your current challenges, business goals, and needs. Right now, you can schedule a demo session with our team to see all the features and their values for your company.

What are Super App's advantages against custom software development?

There are no comparable ready‑made licensed solutions like our Super App in the insurance market. While some insurers develop custom apps, they lack the functionality and flexibility of our products. In‑house development by insurers is significantly more expensive and time‑consuming, while custom software development firms tend to offer solutions that are similarly costly and take longer to implement.

Core insurance platform vendors also offer mobile solutions. Still, since mobile applications aren't their primary focus, these tend to be underdeveloped and lack the necessary flexibility to meet changing customer needs.

Super App uses advanced technologies, including AI, and incorporates deep insurance expertise. It's a modular, native iOS and Android solution for life and non‑life insurance. It allows insurers to quickly tailor it to their needs without the delays typical of in‑house development.

Can I customize Super App according to our branding / needs / requirements?

Surely, Super App will be customized according to your company's branding, Tone of Voice, design system, etc. More robust customization (development of additional features, integration with APIs, etc.) is also available and includes a discovery phase.

Do you provide technical support?

Yes, technical support is provided on a yearly basis. It includes not only regular updates and bug fixes but also guaranteed access to professional team support responding to the incidents according to the severity level in a chosen communication channel and providing consultations on functionality when needed.

What licenses does Super App have?

Super App is a B2B SaaS solution providing unique digital functionalities for insurers through subscription‑based licensing, implementation fees, and ongoing support services. Currently, base fee licenses, module‑specific fee licenses, support, and customization are available for insurance companies worldwide.