Claim submission

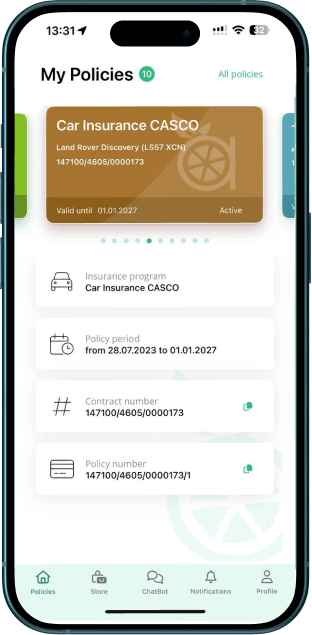

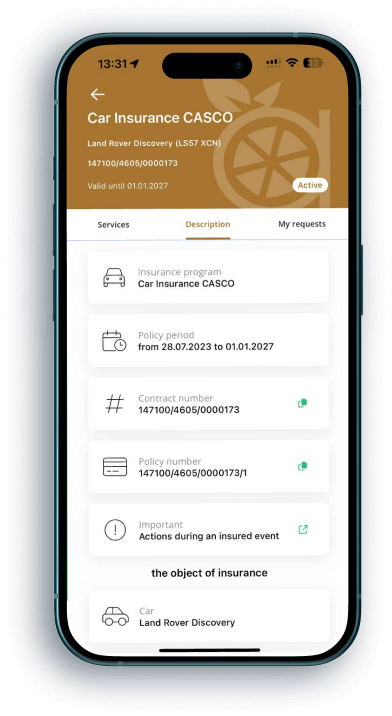

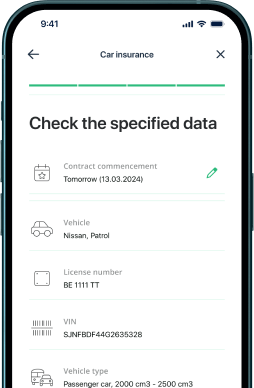

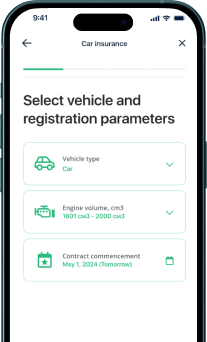

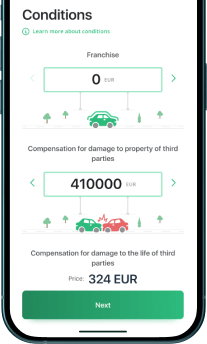

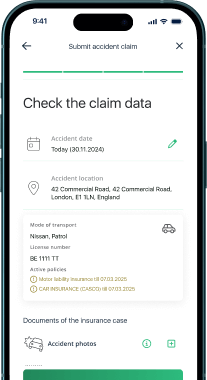

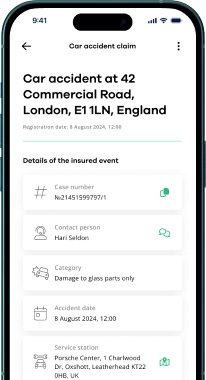

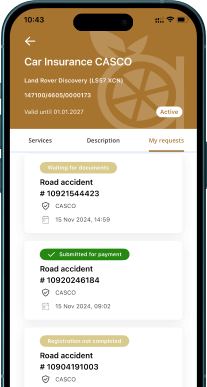

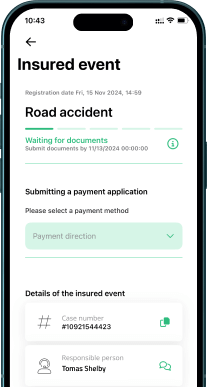

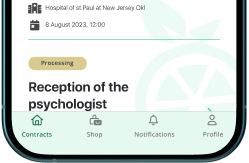

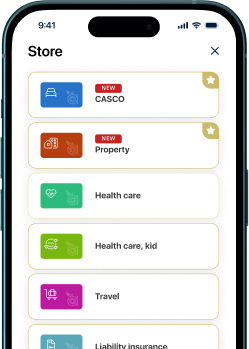

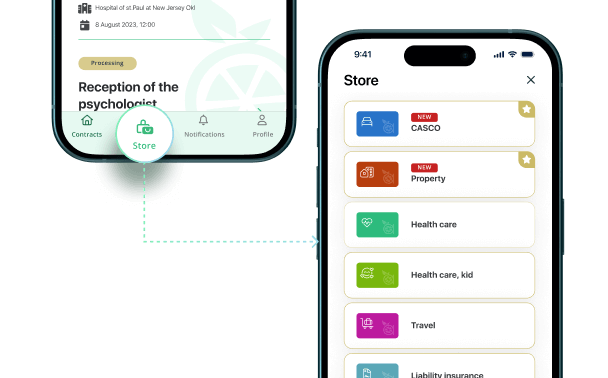

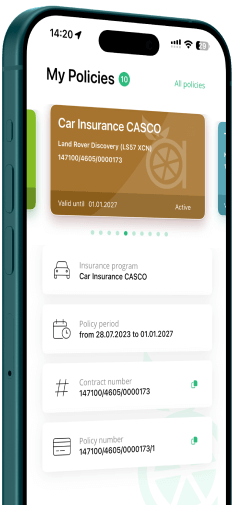

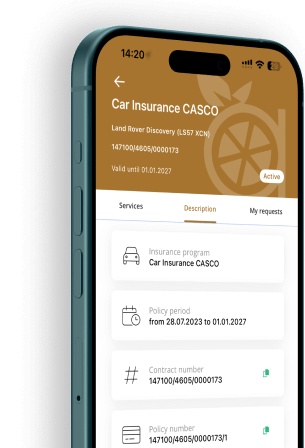

Our Super App is an auto insurance claims software that allows policyholders to submit a claim once an insured event occurs (accidents, collisions, theft, roadside assistance, etc.) by providing all the required information. The app captures all essential data (insurance program name, policy term, contract number, car data, and more) so that the insurance company can proceed with the claim without delays.

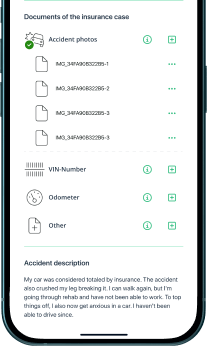

Policyholders also choose the location of the accident on the map, which is very convenient, as there's no need to enter it manually. The generated claim report contains the accident date, location, and all vehicle information. Additionally, users can attach accident photos and any supporting documents. Once checked, the claim can be submitted.