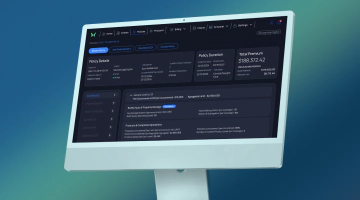

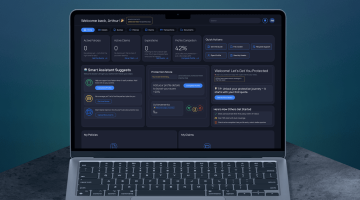

Software for health insurance companies

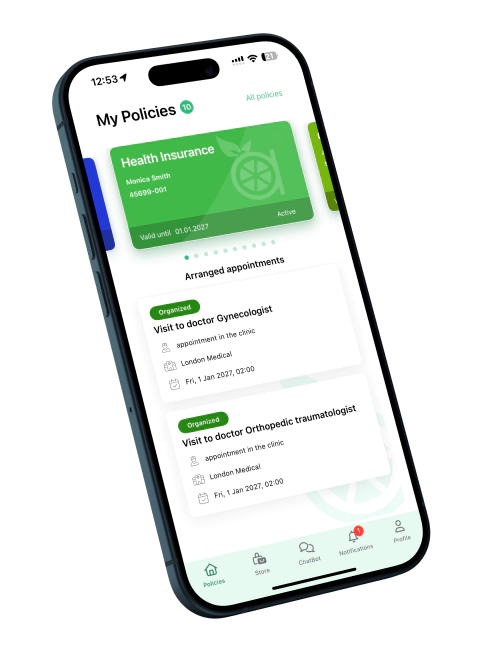

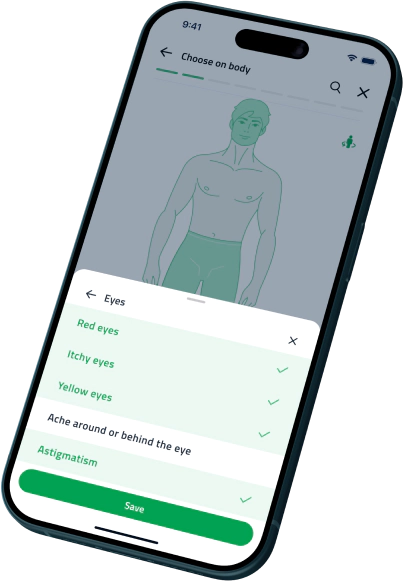

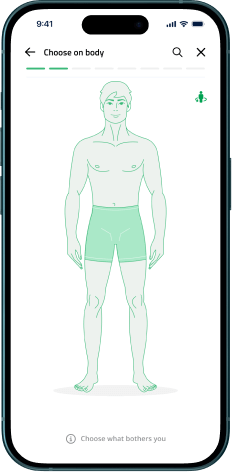

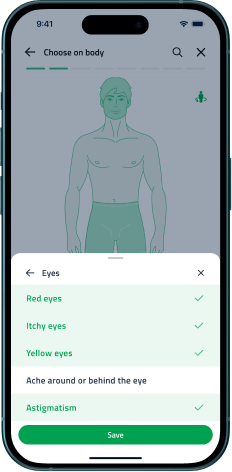

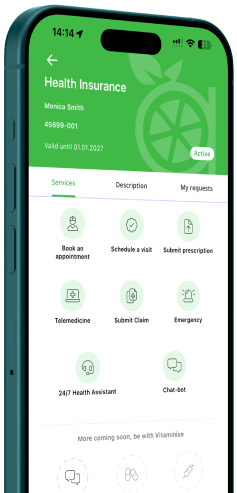

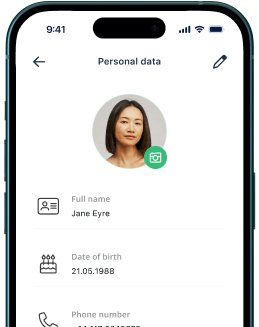

Super App

for health insurance

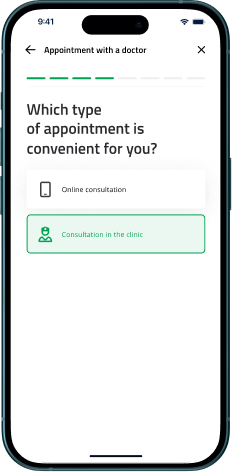

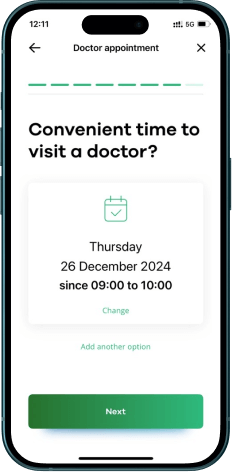

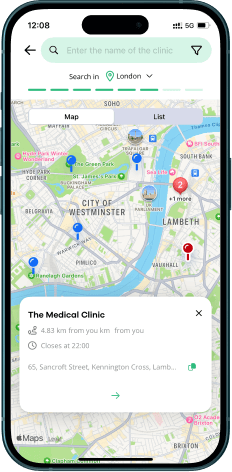

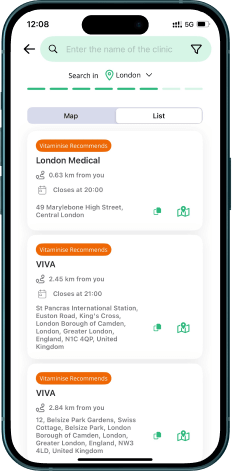

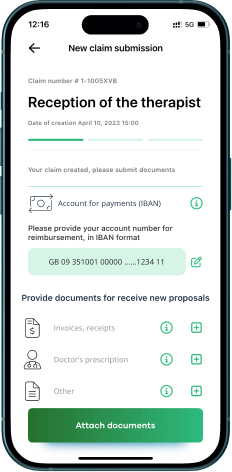

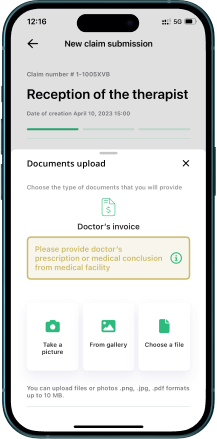

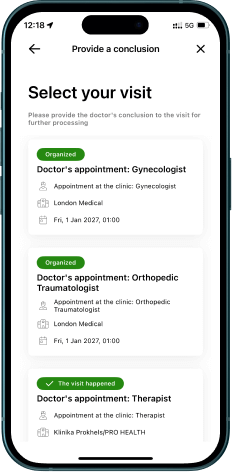

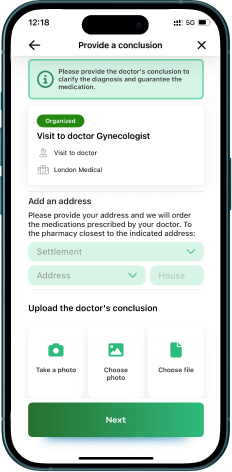

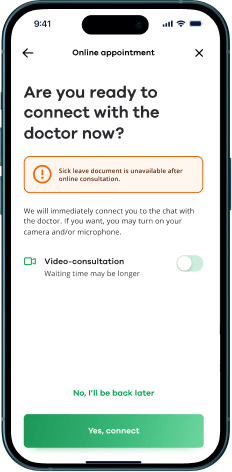

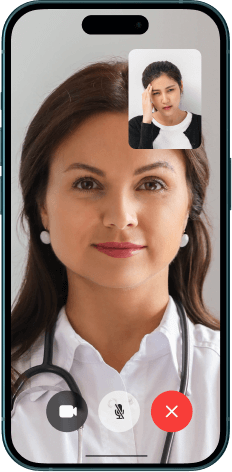

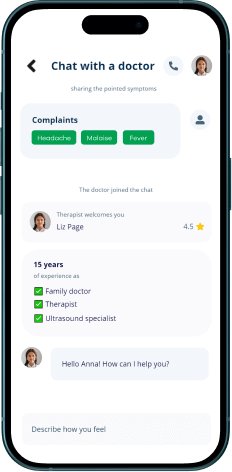

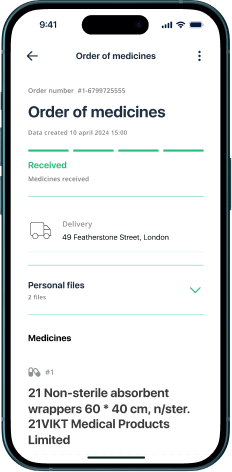

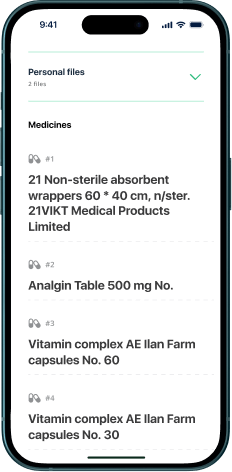

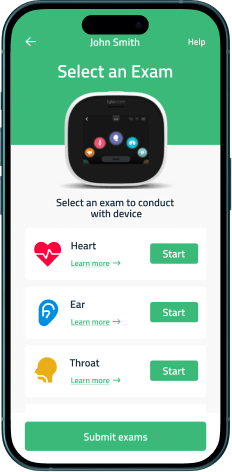

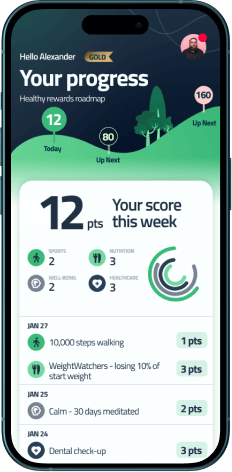

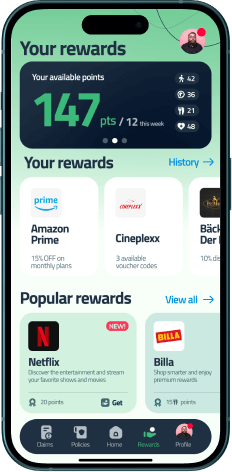

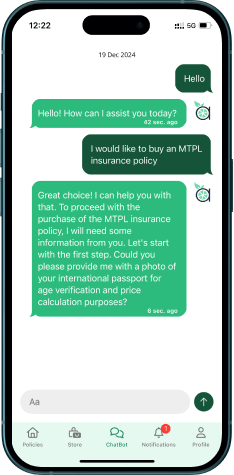

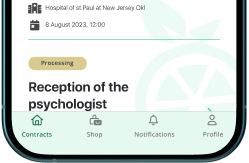

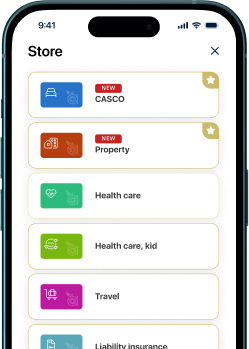

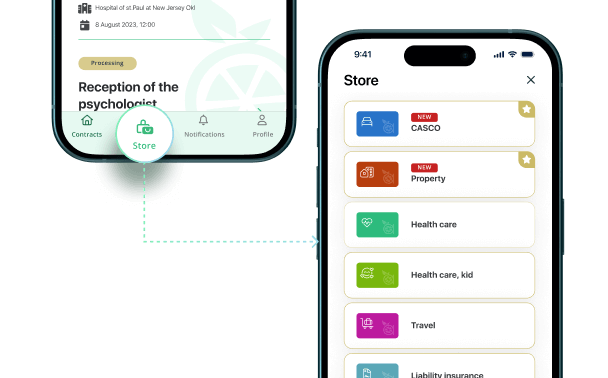

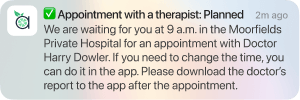

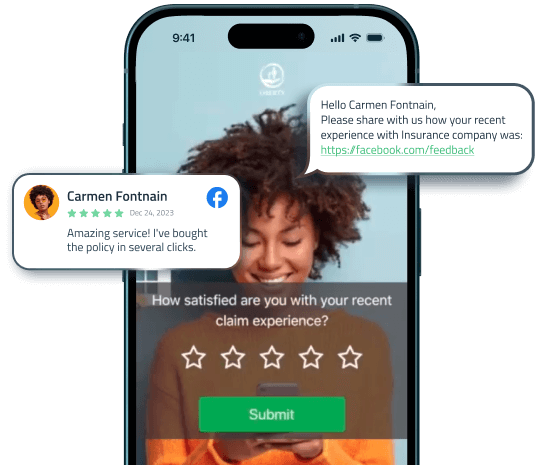

Super App is one of the health insurance software solutions developed by DICEUS, which automates customer interaction and engagement with innovative self‑service functionalities for policy purchase, claim submission, symptom checking, and more.

Book a demo