Our ready-made software solutions for insurance

AI-Based Underwriting Workbench

A digital platform for underwriters that supports decision‑making with AI, provides account insights, and ensures effective collaboration with brokers, MGAs, and other partners.

Learn more

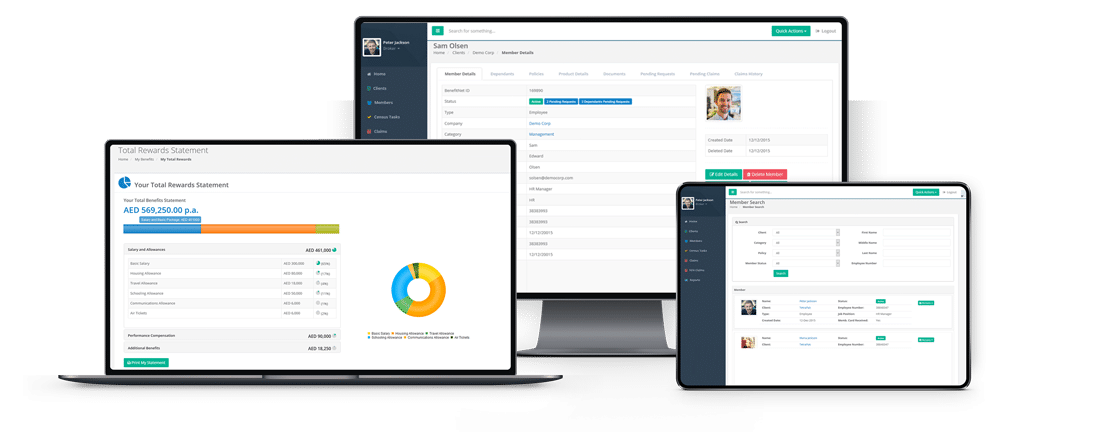

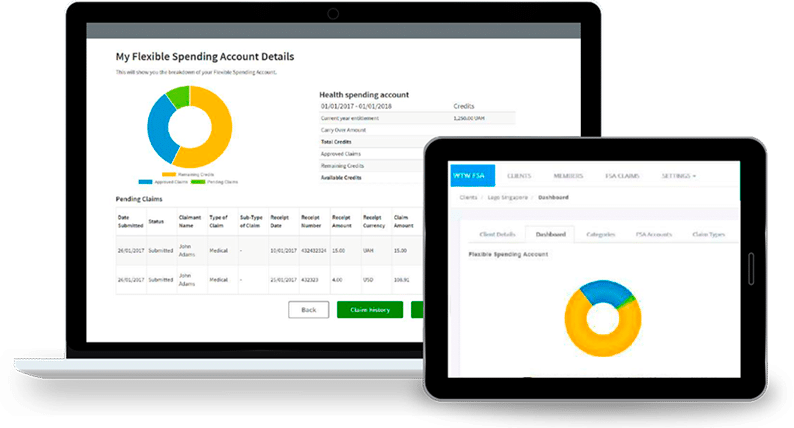

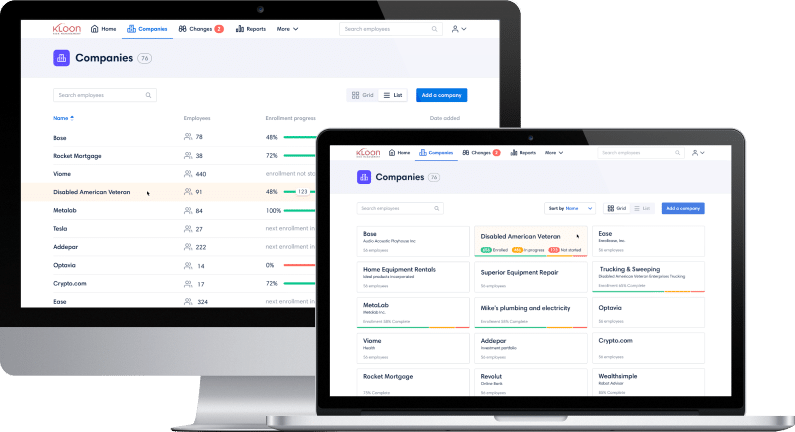

Individual and Group Insurance Management Platform

Comprehensive insurance management platform for businesses and employees to manage health, life, pension, auto, and other insurance plans and benefits.

Learn more

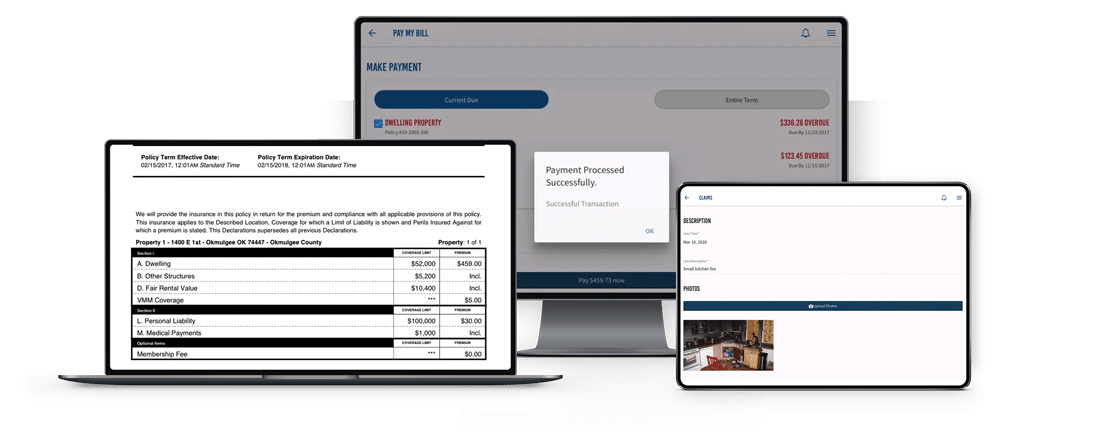

Policy Administration System

A ready‑made policy administration system with modules to manage policies, products, claims, and billing. Built for insurers, captives, and captive managers.

Learn more

DWH for insurance

Our DWH solution grows with your business and is built to adapt as your data needs evolve. We offer DWH implementation and maintenance to support the emergence of new data sources.

Learn more

Customer Web Portal

A self‑service customer portal that encourages clients to purchase insurance products and services online. It offers functionalities such as policy comparison, quoting, purchasing, claim reporting, and status tracking.

Learn more

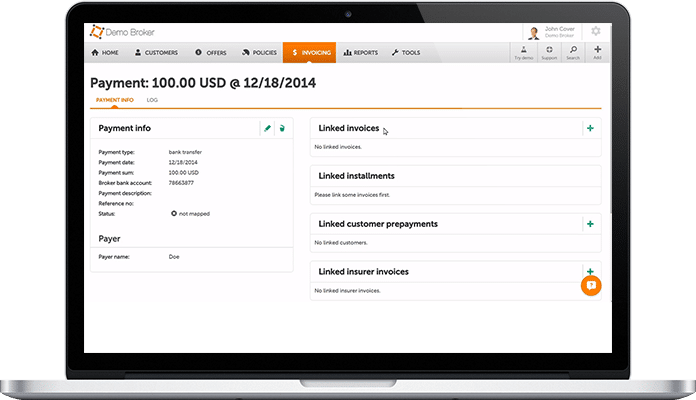

Broker Portal

A pre‑built digital portal allowing brokers to prepare policies, create invoices, monitor claims, manage customer relationships, and track analytics in one place.

Learn more

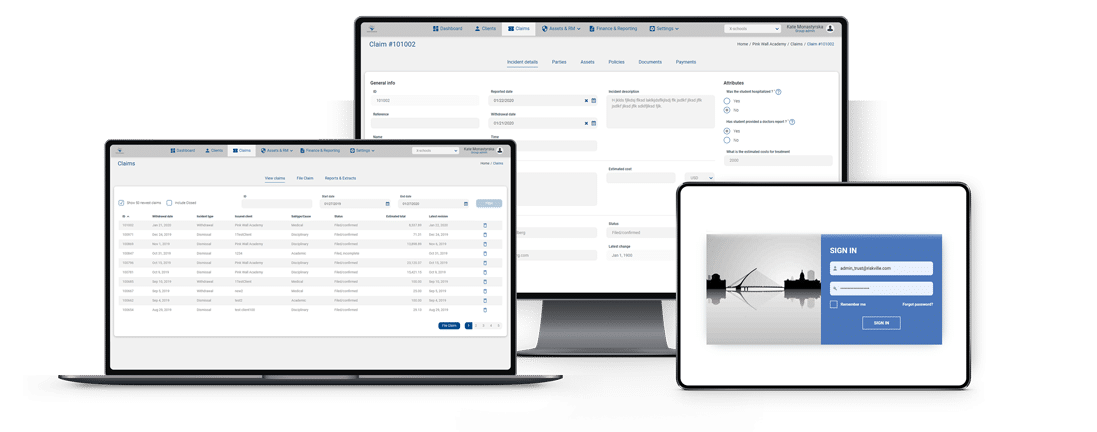

Captive insurance

A modular, ready‑made policy administration system for captives and captive managers to manage products, policies, and claims in a centralized place.

Learn more

AI-Powered Chatbot

A conversational solution powered by LLMs that understands context, recognizes both voice and written messages, and ensures a personalized customer experience.

Learn more

Insurance carriers

Insurance carriers

Insurance brokers

Insurance brokers

Reinsurance companies

Reinsurance companies

Managing General Agents

Managing General Agents

Third-Party Administrators

Third-Party Administrators