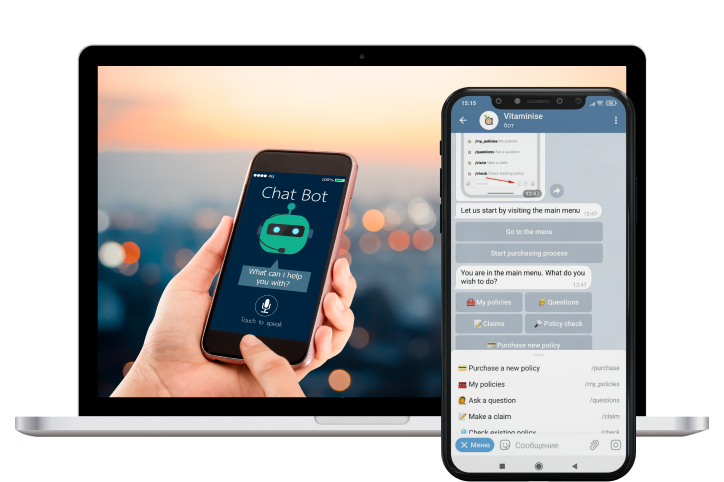

Chatbot “Vitaminise” used by the insurance company

Project overview

The goal of the project was to provide customers with easy access to various insurance products via digital channels (messengers, mobile apps, web portals). It is related to the purchase and claim handling for products like car insurance, travel insurance, property, pet, health, and others. For the carriers, this project stands as enablement to interact instantly with the end customers. While planning the project, the client and DICEUS decided to create an MVP (minimum viable product) based on the bot. The idea of mobile app development remains actual, but for now, the work with chatbot development has been done.

Client information

Vitaminise is a young Ukrainian company that develops chatbots for insurance companies to sell industry-specific products through mobile apps and messengers. The company’s goal is to help insurers improve customer engagement with the help of advanced technology solutions and make insurance processes as transparent as possible. Vitaminise is focused on introducing to people new user-friendly digital ways of purchasing insurance, submitting claims, and getting paid.

Business challenge

Many people don’t understand how insurance works. Vitaminise’s goal was to make it transparent for consumers and help them understand the main processes like price formation. Vitaminise wanted to release the key functionality of insurance product sales through the chatbot with “Autofill your data from DIIA.” The second feature – users can submit a claim and get paid directly through the chatbot. This process is complicated as people call an insurance inspector to take photos and videos of car damage. Vitaminise will allow users to submit claims via chat, take videos online, and answer inspector’s questions. Once a claim is approved, you get paid directly to your account.

Technical challenges

During the first milestones when we developed the insurance sale feature, our team met the issues of integrating the bot with the state online services provider. The problem is that insurance companies have no ready-made API solutions for such integrations, and we should make some changes in code to comply with requirements.

Solution delivered

Vitaminise is a chatbot developed for the insurance company. The specific product the bot works for is car insurance. The chatbot allows for entering the car data (state number). All data relating to the car number plates are automatically pulled up to the chat, so there’s no need to fill in the information manually. As of now, users are offered one major product – compulsory motor third-party liability insurance, complemented by two extensions like limit raise and direct settlement. A user can choose a major product with or without the extensions mentioned. Once the product is chosen, the user can see its price. Afterward, the user is offered two options to enter the data. The first one is to enter the information manually. The second one is to get authorized with DIIA, the Ukrainian unified portal of state services. Once the person chooses DIIA, he/she gets the link to DIIA’s app, where all needed data (passport, individual taxpayer number, address, etc.) is taken. After all data is gathered, the person gets a link for payment and, once paid, receives the policy.

Let’s discuss how we can help with your project

Key features

Buy insurance through a chatbot

There’s no need to visit brick-and-mortar offices to buy insurance. Instead, customers can purchase insurance products directly on their mobile phones.

Get your policy in a few clicks

Once the policy is paid, users get their digital policy document by email. It helps insurance companies become paper-free and reduces the paperwork that clients have to do to buy insurance.

Pay for insurance online

When a user chooses the product, he/she sees its price. Since the chatbot is integrated with the payment gateway, it allows users to pay for their insurance online.

Autofill in all required data

While purchasing the policy, users can autofill their information by entering car details. Customers don’t need to manually enter their information.