Earth observation software for insurance niche

Project overview

Earth observation solutions and technologies are emerging in insurance as a means to boost the efficiency of business processes and save costs. In particular, observation of extensive land areas from satellites results in in-depth forecasts and predictions, especially in the conditions of increasing climate change. With satellite observation assets and the ability to process them in hand, an insurance provider is one step ahead of competitors in the market.

Business challenge

An underlying challenge was to provide the client with an ability to get a better, more detailed analysis of the environment and premises from satellites to efficiently assess the risks of insurance case occurrences. This allows the agency to come up with more individualized risk calculations and see more clearly the insurance coverage potential for prioritizing cases at hand.

Technical challenges

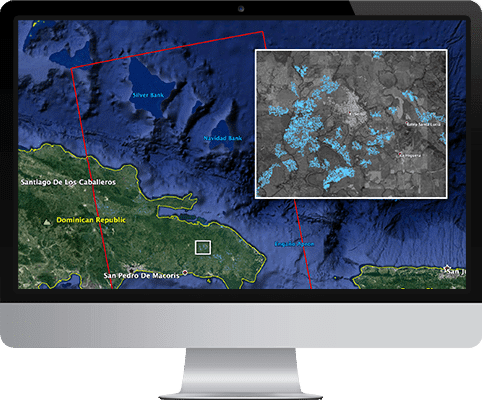

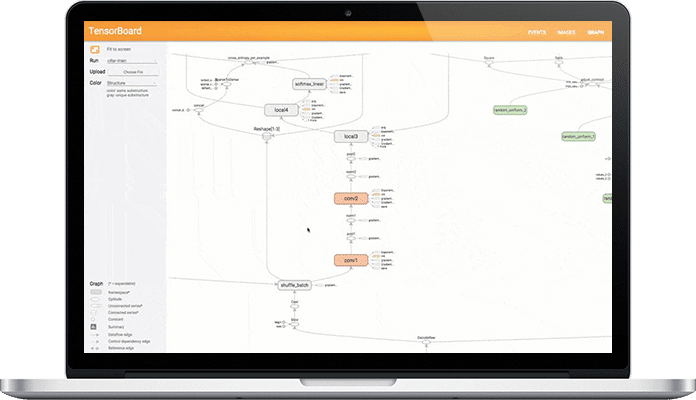

To reinforce the client’s insurance practice, DICEUS set a goal to develop a software solution that helps predict the risks by gathering and analyzing archived and real-time satellite data. We had to establish user-friendly, smooth transferring and viewing of large visual data assets to enable more precise and fruitful decision making based on detailed analysis of areas’ susceptibility to different hazards.

Solution delivered

DICEUS team has worked on the project for 11 months to develop an efficient niche product that quickly collects real-time data for highly-efficient modeling and management of insurance risks, forecasting related events, assessing damage, and monitoring affected areas after devastating happenings.

Let’s discuss how we can help with your project

Key features

Digital image processing

Quick access to data processing capabilities provided by Sentinel-1 and Sentinel-2 ensures relevant data around the clock.

Analytical data models

These help to analyze all available information and prevent any possible risks.

Historical and real-time data

Comparing archived and real-time data, you can get valuable statistics and predict many insurance business-undermining matters.