KloonRisk – an insurance broker solution for Kloud-Soft

Project overview

The underlying responsibility and major task in insurance is providing, claiming, and negotiating insurance compensations. For this area of work, profiled specialists are assigned. In the era of huge data accumulation and all-consuming digitizing, such specialists need sufficient software powers to better cope with their responsibilities. The insurance broker solution we built for the insurance-focused client provides great automation capabilities to facilitate and accelerate insurance compensation management in the company.

Client information

Kloon Risk Management is a Singapore-based provider of a wide range of insurance management capabilities. Covering an extensive list of industries and niches, the company’s philosophy is to help businesses optimize and improve the performance in the market by excluding major risks and errors.

Business challenge

Compensation management in insurance can become an increasingly time and effort consuming task highly difficult for a human specialist or even a whole team of specialists to handle. The related data in an insurance company accumulates endlessly and every process must be as precise as possible. A dedicated broker software solution is intended to help a company handle such routines without any downtime, excluding a lot of manual work and boosting an insurance provider’s performance all-around.

Technical challenges

For Kloud-Soft, we had to implement a convenient cloud-based interface for managing a number of insurance-related elements, such as leads, quotations, debit notes, claims, policies, clients, etc. All that is centered around intuitive insurance broker functionality. Every element has respective descriptions (details), listings, and editing capabilities. On top of all basic interface functionality features, we had to also implement authentication, set up and configure hosting via Azure Cloud, and assure the high quality of the whole solution.

Solution delivered

KloonRisk is a versatile insurance broker software solution to help the client keep lots of important insurance data in one place and better manage compensation claims. Th ability to list leads, clients and related data on them makes KloonRisk quite a universal tool that company specialists can use on a regular basis to keep everything in check. Without going too far, all the info on claims and where they are directed can be accessed right away.

Let’s discuss how we can help with your project

Key features

Quotation, leads, & debit notes

The client can create, edit, and delete detailed description forms for leads, quotations, and debits, send manual reminders, email notes to an insurer, submit and update commission fees, and more.

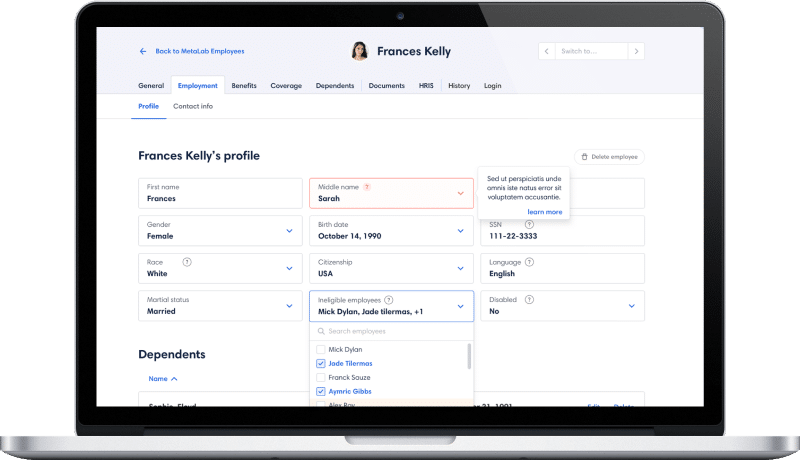

Policy & client descriptions

Clients can be conveniently listed and described in the dedicated fields subdivided into the clients and policy details.

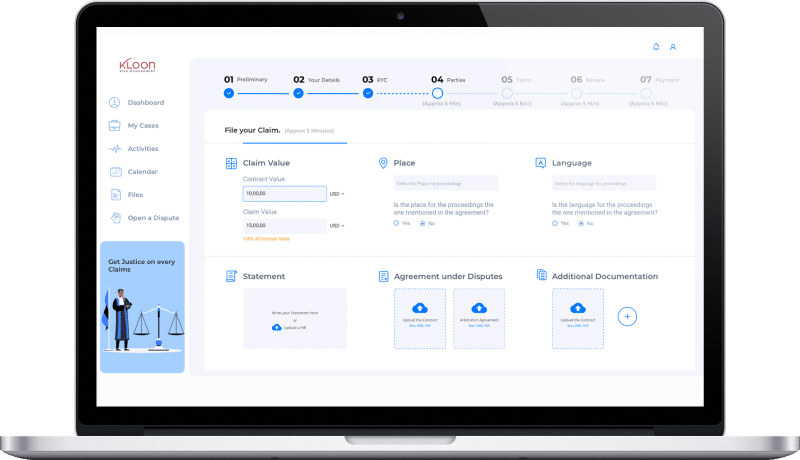

Separate claims interface

On the special screen, claims can be created and edited, history of resubmission can be viewed, partial and full payment forms can be filled, and cover letter can be generated and notified about.

Microsoft Azure Cloud

Microsoft Azure Cloud HTML

HTML Bootstrap

Bootstrap Visual Studio

Visual Studio Jira

Jira Selenium

Selenium Telerik Kendo UI

Telerik Kendo UI NUnit

NUnit Microsoft Project

Microsoft Project