Our client is a major bank under NDA from Germany.

Project overview

Client information

-

Team composition

2 members

-

Client name

Bank under NDA

-

Expertise used

-

Duration

2 months

-

Services provided

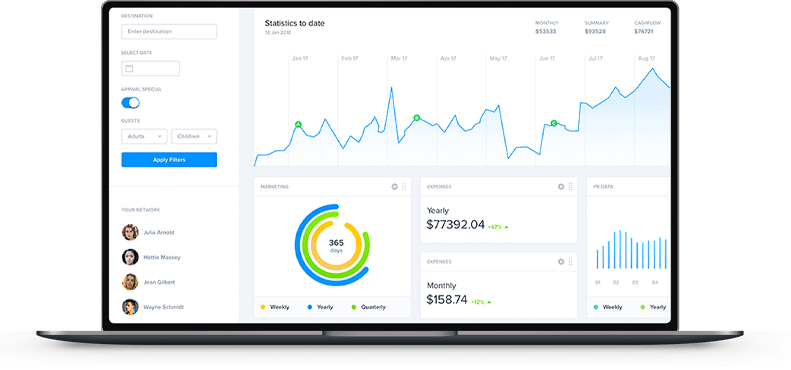

Software architecture, UI/UX design, System integration services

-

Country

Germany

-

Industry