How to build a fintech app: Types, stages, and requirements

The global fintech market is projected to grow all the way to $882.30 billion in total shares by 2030. The fintech industry possesses colossal potential, which shouldn’t really come as a surprise — everybody needs an up-to-date way to manage their money.

The Center for Generational Kinetics survey shows that 96% of millennials actively engage with their finances online. At the same time, a study titled “Millennials and Money: The Unfiltered Journey” by Viacom’s research division states that only 36% have ever used a fintech app.

So, there’s still a lot to explore and huge opportunities to seize with a brand new fintech solution. To help you enter this thriving market, we’ll guide you through all the intricacies of a fintech app development process, diving into the art and science of crafting a fintech app that stakes out a spot for you in the domain of financial technology.

Need a custom solution? Check out our fintech app development services.

Defining a fintech app

A fintech app, short for financial technology application, is software that can handle just about any financial service or functionality out of a browser or mobile device. From one-click online payment engines and websites featuring shopping carts to full-on digital banking apps, all of these can be safely considered fintech solutions.

Fintech is the digital frontier of today’s financial industry. It literally puts your bank in your smartphone, cutting out cumbersome in-person procedures (signatures, queues, ever-lacking sheets of paper, etc.) and making complex operations as user-friendly as your favorite food delivery app.

And that’s in one of its most basic forms. More niche and advanced apps put a private financial advisor, an investment counselor, or a real estate or insurance agent in your smartphone if you have the space for the whole crew.

Types of fintech apps

And there’s more than that. Modern personal finance apps, digital banks, trading platforms, etc., come in different shapes and sizes, each offering a set of finance-related benefits for a regular smartphone owner. Let’s take a look.

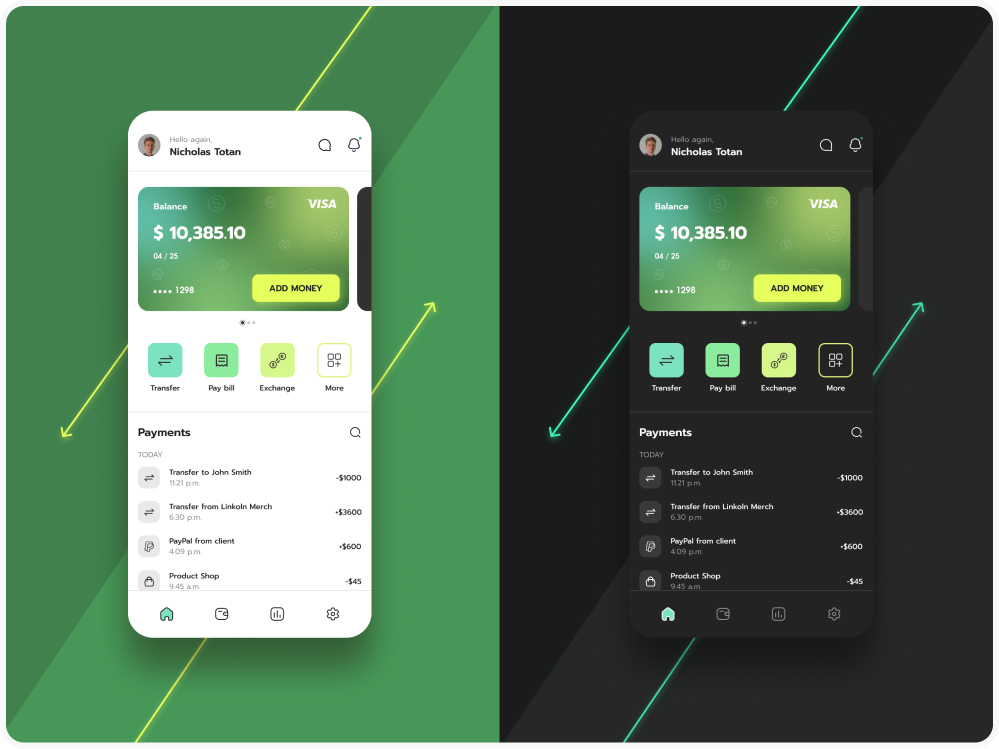

Mobile banking apps

Today’s physical and online banks require easily available interfaces for customers that enable banking services whenever and wherever needed. For this, your bank accounts are digitized and packed into a convenient one-stop app. Mobile banking is a new normal way to manage accounts, transact funds, pay bills, check deposits, and seek customer support.

Both huge financial institutions, like Bank of America and Chase Bank, and smaller independent startups, like Cash App, have long adopted mobile banking solutions that make credit and debit card owners’ lives easier.

Where are these used?

Across banking and financial services, but also extensively used by consumers and third-party providers across all sectors relating to personal finance management.

Crowdfunding platforms

Crowdfunding is a decentralized fundraising method that allows people with great ideas to seek funding from a global audience. Specialized crowdfunding platforms open this funding to everybody, making it possible for ideas and projects to find support online beyond traditional financing routes (e.g., investor pitching, showcase organizations, etc.).

Kickstarter and Indiegogo are the brightest examples of facilitating crowdfunding for just about anybody interested and with a worthy concept in hand.

Where are these used?

Widely used across creative industries (film, music, publishing), tech startups, and by individuals for personal causes or entrepreneurial projects.

Blockchain and cryptocurrency apps

Bitcoin, Ethereum, and tons of altcoins are actively shaping today’s crypto market. Crypto holders and traders need an efficient way to manage their digital assets. Wallets for storing cryptos, exchange platforms for trading, blockchain directories, and online portals dedicated to news and market insights can all be considered blockchain/cryptocurrency apps.

For instance, Coinbase and Binance are the most popular crypto platforms out there, equipped with many essential features, like e-wallets and blockchain-protected trading.

Where are these used?

These apps are primarily used in the financial sector but are also increasingly adopted by industries like supply chain, healthcare, and real estate for secure and transparent transactions.

Peer-to-peer (P2P) lending apps

P2P lending solutions connect borrowers and individual lenders, thus cutting out the intermediation of cumbersome financial institutions. Platforms like Lending Club and Prosper give borrowers access to loans with potentially lower interest rates than traditional lenders have to offer.

In turn, lenders get to earn a return on their investment. Both parties’ experiences are enriched with tools for setting loan terms and rates, credit risk assessments, and more.

Where are these used?

Mainly in the financial sector, especially in personal lending and small business financing.

Personal budgeting apps

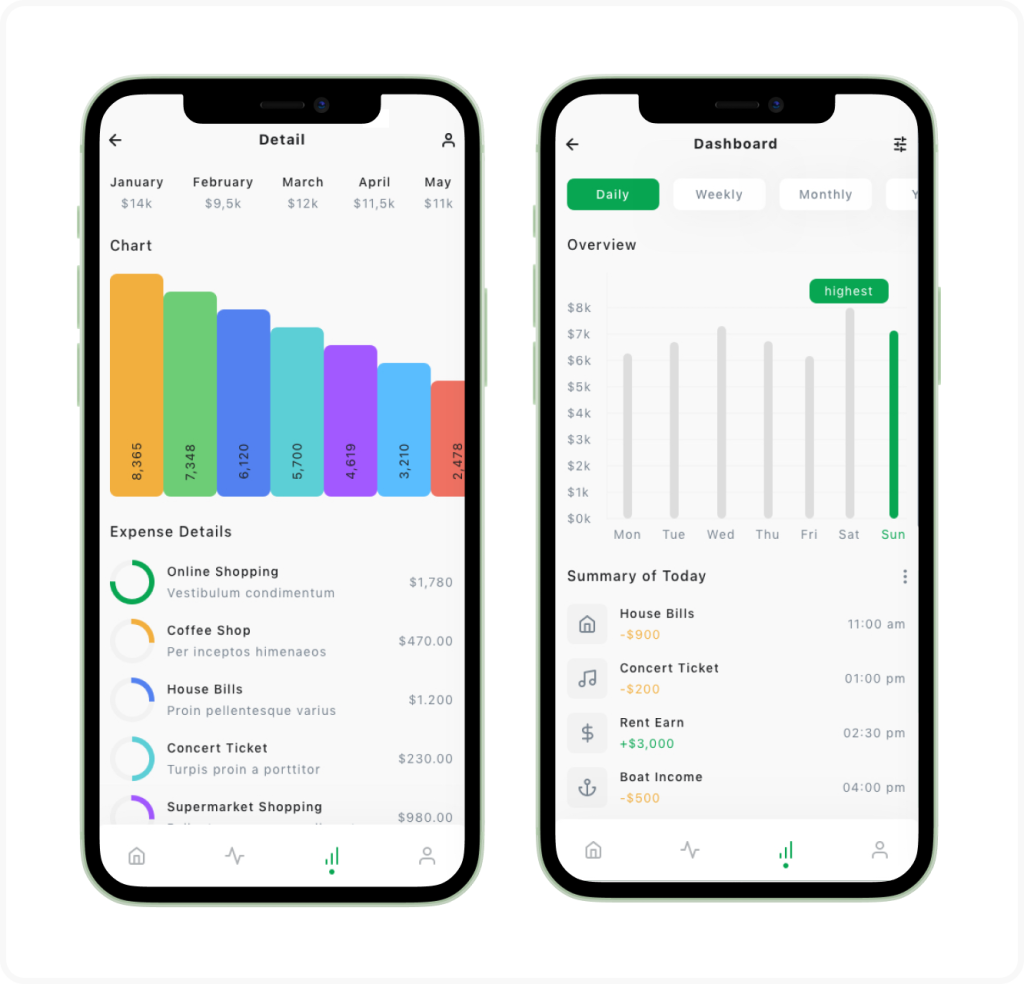

A personal finance app assists your everyday financial management with tools for tracking expenses, categorizing purchases, setting savings goals, and getting analytics reports. These apps are often integrated with bank accounts, offering insights into spending habits and providing suggestions for improving financial health.

Apps like Mint and YNAB (You Need A Budget) have demonstrated the popularity of such solutions in the mobile market.

Where are these used?

Targeted at individual users across all sectors looking to manage personal finances more effectively.

Payment processing apps

These apps allow sellers to instantly accept payments from buyers through online/mobile channels (buyers, in turn, get a way to transfer funds easily). No need for a bank visit, cash, or complicated invoicing.

PayPal and Square, to name a few, have given businesses a secure and efficient way to delegate and automate payment processing.

Where are these used?

E-commerce, retail, and any business handling online transactions can benefit from these apps.

Insurtech apps

Insurtech apps bring insurance services closer to the crowd. Such apps have introduced new insurance models, such as on-demand insurance and peer-to-peer insurance, changing the way insurance can be provided for customers.

Platforms like Oscar and Lemonade offer features for policy management, claims filing and tracking, personalized insurance recommendations, and even telematics for case-based policies.

Where are these used?

Insurance industry, including health, auto, home, and life insurance sectors.

Learn more about Vitaminise Mobile App for insurance.

Investment apps

How does an up-and-coming startup attract funds without having a network of suitable investor contacts? On the flip side, how does an ambitious entrepreneur find a way to invest in a truly promising project without the previous history of investments? This is exactly where a specialized investment app does the trick.

A convenient mobile solution gives regular users the platform for investing in stocks, bonds, business securities, mutual funds — you name it, without going far. Such an app usually lowers the investor’s entry barrier by offering reasonable minimal investment amounts (take Robinhood and E*TRADE as examples).

Where are these used?

The financial sector, particularly investment and wealth management, but accessible to consumers from all backgrounds.

Robo-advisors

Talking about introducing complex financial operations and niche opportunities to the masses, you can easily get a personal financial advisor without any background in finance, too. In a digital form, of course — convenient robo-advisors run on smart algorithms to generate investment tips, business portfolio management directions, and descriptive answers to pressing questions. And all based on users’ financial goals, banking history, and other optional analytics.

Hugely demanded financial advice platforms like Betterment and Wealthfront should serve as an inspiration.

Where are these used?

Wealth management and financial planning, appealing to both new investors and those with established portfolios looking for cost-effective management solutions.

Regtech apps

Regulatory compliance can be yet another challenging “grey zone” for established businesses and aspiring entrepreneurs alike that can be facilitated with fintech software. Primarily, regtech solutions are tuned to assisting financial institutions with regulatory operations, allowing them to automate repetitive processes, manage data, and monitor compliance with regulatory requirements.

However, platforms like Chainalysis and ComplyAdvantage are great examples of making regulatory assistance accessible to any entrepreneur in need.

Where are these used?

The financial services industry, as well as any sector dealing with strict regulatory compliance requirements, such as healthcare and telecommunications.

DICEUS has extensive fintech expertise. Learn more.

How to build a fintech app: A step-by-step guide

Building a fintech application may require some serious tech know-how. To get a handle on creating your fintech app, check out the main steps we’ve laid out for you.

Choosing a proper fintech niche

Do you already have a good idea as to which area of global fintech your new app will cover? If not, selecting a niche is a critical decision shaping the way you build a fintech app.

You should keep your target market in sight. Decide whether you want to develop your own fintech solution, such as creating a DeFi lending/borrowing platform, or enhance an existing one by reducing the number of clicks needed for operations or integrating with social networks.

To stay competitive, consider developing an in-depth useful solution. With numerous basic fintech apps already available, it’s essential to offer something fresh.

Selecting a tech stack

A tech stack is the primary foundation for building your fintech application. Different technologies, their combinations, and the depth of expertise employed can all unravel different development scopes and end-product results.

Building a team

The required tech stack shapes the size and depth of expertise of your development team. And vice versa — the specialists you need for your project may outline the tech stack scope by pointing out exactly the tools they need for work.

It depends on how you start — whether you already have product definitions and requirements as well as your own team or not (in any case, a dedicated team will help you plan out a tech stack, and a pre-defined tech stack will guide the choice of necessary specialists for a recruiter or project manager).

Here’s the list of specialists usually involved in fintech app development:

- Project Manager

- Front-End Developer

- Back-End Developer

- Business Analyst

- Designer

- QA Specialist

You can either engage a third-party partner or assemble an in-house development team. Selecting the right type of collaboration is another key consideration:

- Outstaffing. This option is perfect if you’ve already got a team in place but need to fill some skill gaps with a couple of specialists. For instance, you may need an iOS and an Android developer. Reach out to an outstaffing-ready provider to quickly find the right, pre-screened, and pre-interviewed specialists to join your team.

- Outsourcing. If you’re pressed for time and budget but need a complete fintech app development team, this option is for you. By partnering with an outsourcing software developer, you’ll have a full team of professionals ready to dive into your project. This approach saves money and time that you would otherwise spend on hiring and managing an in-house team without really sacrificing quality. Outsourcing allows you to quickly recruit talent from around the globe, find a budget-fitting specialist, and avoid geographical restrictions.

Need a development team? We offer IT staff augmentation services.

Doing even more research

Fintech developers need to conduct extensive multi-faceted research before kicking off a development workflow. In addition to the preliminary planning (niche choice) and tech stack definition, the three pillars of this research include the market study, the choice of a monetization model, and the roadmapping of key features.

- First, you have to analyze the arena to get a view of what the existing market for fintech solutions can offer and identify potential target audiences and the best market opportunities (a Project Manager along with a Business Analyst will help you with this).

- Then, you’ll need to settle on a monetization model. Paid subscriptions, advertising, and transaction fees are among the most common variants to choose from (a Business Analyst or, optionally, a separate Marketing Specialist handles this).

- Lastly, sketch out how the user interface will look and what interactions it will offer. The rough outline will help handpick features for a Minimum Viable Product (MVP)*.

[*MVP is a safe, cost-efficient approach to introducing new solutions to booming markets. A minimum viable product is the most basic version of your app meant to demonstrate the concept in action, captivate target users, and collect feedback for further improvement and completion. That’s why we’d strongly recommend starting with an MVP.]

Essential features you need

Even though you can add required functionalities as you go or after the MVP launch, it’s best to have your facts straight and your project foundation sturdy. So here are some essentials your fintech app will need.

Account management

Suppose a user has multiple bank accounts, credit cards, or loans. They need a consolidated view of everything. You can centralize the management of financial accounts in one platform, enabling:

- Balance monitoring across accounts (checking, savings, credit cards)

- Private storage and management of private information

- Transaction history to track spending and deposits

- Easy setup and management of recurring payments and transfers

Payment processing

For a competitive market offering, prioritize user convenience. In particular, you should enable instant payments and transfers without the need for cash or bank visits. Integrating a payment processing engine (like Stripe, Google Pay, etc.), you can offer users:

- Peer-to-peer (P2P) transfers for splitting bills or sending money

- Bill payments with scheduling options for regular expenses like utilities

- Integration with mobile wallets for contactless payments

- Real-time transaction processing and notifications

Need to improve payment processing or develop it from scratch? Learn more about our payment processing development services.

Budgeting tools

Make your app truly useful by helping users stay budget-conscious and not only check and manage but also save finances efficiently. For instance, users can view spending histories and patterns and set spending limits with features like:

- Expense categorization with a view of spending habits

- Budget outline with custom spending limits for different categories

- Alerts and notifications when approaching or exceeding budgets

- Financial reports and insights for review and adjustment of spending behavior

Credit monitoring

If your app is related to crediting or meant to integrate with digital bank accounts, offering the following features will make tons of users’ lives easier:

- Real-time credit score updates and monitoring

- Alerts on credit report changes to detect fraud or errors

- Tips and recommendations for improving credit health

- Detailed credit report access and explanations of factors affecting scores

Investment management

Join the cause of making worthwhile investing opportunities readily available for your users. Both novice investors and active entrepreneurs will benefit from:

- Portfolio management tools to track and adjust investments

- Access to market research, analysis, and investment news

- Real-time trading of stocks, mutual funds, and other securities

- Automated investing options for setting investment strategies

Personalized recommendations

Personalization is another competitive tool — people always seek higher-yielding saving opportunities and better rewarding credits. Help them with:

- Financial product recommendations (e.g., loans, credit cards) based on user profile

- Investment suggestions tailored to the user’s risk tolerance and goals

- Savings tips and strategies to maximize financial health

- Alerts on new financial opportunities or changes in the financial landscape

Financial education

Depending on how far you wish (and can afford) to take it, capture your users’ minds with different extents of personalized financial advice and insights through:

- Educational content on various financial topics (investing, saving, budgeting)

- Interactive tools and calculators for financial planning

- Webinars, courses, and articles from financial experts

- FAQs and glossaries to demystify financial jargon

Security features

No need to explain how finance and security must go hand in hand. There are loads of sensitive information your app must efficiently govern, e.g., with the help of:

- Biometric authentication (fingerprint, facial recognition) for secure access

- Two-factor authentication for reinforced protection

- End-to-end encryption of data to protect personal and financial information

- Regular security audits and regulatory compliance check-ups

Third-party integrations

In order to be up to the market standard, a good fintech solution must be smoothly integrated with all relevant external channels, like:

- API integrations with banking, funding, and other financial services

- Connectivity with accounting and business management software

- Social media integration for sharing financial goals or achievements

- Partnership features for rewards, discounts, and promotional offers

Customer support

Customers are the heart of any business, and you should support them accordingly by offering:

- Multi-channel support (chat, email, phone) for convenience

- Knowledge base and FAQs for self-service support

- Live chat and chatbots for instant assistance

- Ticketing system for tracking and resolving user inquiries

Building an MVP

Is your development crew all set with requirements and scopes? Time to set off development. As we mentioned, It is better to begin by creating the MVP. It’s only wise to evaluate your idea and test the waters before building a full-fledged fintech product.

This way, you can release a product at a minimal cost without any extra expenses and use that money for further completion of the product. The minimum viable product should demonstrate how exactly you can solve relevant user pains, as well as quickly get investors on board, receive feedback, and lower the risk of your idea not paying off.

Working on app design

Your future app’s user interface, user experience, accessibility, and visual aesthetics are all defined, planned out, and implemented at the design stage. On top of avoiding cluttering the UI with unnecessary features, here are some pro tips for achieving efficient UI/UX design (design area + main goals):

- UX design: intuitive navigation, fast access to elements and information, user-friendly UI guidance, and personalization.

- UI design: consistent screen looks and feels, reflection of brand attributes, clear and concise info presentation, and responsive view across platforms and devices.

- Accessibility: inclusivity for users with disabilities (via screen readers, sharp text contrasts, voice recognition, etc.), and multilingual localization.

- Visuals: brand logos and colors, charts, progress bars and graphs for data visualization, micro interaction elements (animated buttons, additional navigational options, etc.).

Building APIs

You’ll need to either turn to existing business functionalities or create them from scratch to integrate services like budgeting and bill tracking into your fintech app. Whichever path you choose, it’s essential to create REST APIs for smooth integration with the website. Consider these tips:

- Build Representational State Transfer (REST) APIs

- Use Swagger to record your API

- Use tools like Postman for testing and app development

- Maintain your API with secure databases such as MongoDB and PostgreSQL

- Adhere to regulations for API requests and responses

- Implement authentication and data encryption to secure your API

Developing and testing

With the design framework in hand, software engineers and developers can jump in and set things in motion. This involves connecting all the dots into a comprehensive structure and making them respond to user interactions. The specialists hardcode and integrate elements and algorithms, set up operations, and adjust configurations.

The whole process must be sealed with thorough testing and QA. Reliable specialists usually combine manual and automated testing techniques and iterate until perfection. Post-testing quality assurance helps gather valuable feedback to iron out any unexpected issues. Once the app is glitch-free, it’s ready for the official launch.

Collecting feedback and upgrading your app

After launching your app (MVP or otherwise), gather feedback from your target audience and keep the application up-to-date through regular updates to consistently meet ever-increasing user expectations.

These updates may include bug fixes or expanding the app’s functionality. It’s important to maintain communication with your users and gain actionable insights to keep them satisfied and find new ways to disrupt market competition.

Related article: “How to start a neobank”

Advantages you get

To summarize and recapitulate all the goodies of a successful fintech app launch, we can’t but double down on the forward-minded benefits of becoming a fintech provider.

Becoming a part of innovation

Automation boosts efficiency and reduces physical strain. Developing a fintech application allows you to tap into the potential of advanced tech like Machine Learning (ML) and Artificial Intelligence (AI). By incorporating these tools, you can introduce fresh financial products and services while simplifying and automating operations, making data analysis more accurate, and delivering an excellent custom experience to each customer.

Facilitating operations and lowering entry barriers

New businesses often face challenges when obtaining loans to launch or grow their operations, mainly due to strict requirements and risk assessments that traditional financial institutions impose. At the same time, individuals with limited credit history may find it challenging to secure bank loans. You come in to reshape the lending environment and cover this huge demand.

Providing investment options

Investing has also been complex and limited to a select few throughout the years. The complicated financial markets and the high fees of professional advisors often stop people from joining in. However, by introducing a new fintech app, you may open new opportunities for anyone seeking project funding or chances to grow personal wealth.

Diversifying payment solutions

The growth of fintech has not only expanded the range of payment options available to businesses and consumers but has also made integrating these options into apps or websites more cost-effective and, overall, convenient. As a business adopting new tech like blockchain and mobile wallets, you can now offer a variety of payment methods beyond traditional credit cards and cash (cryptos, P2P, invoicing, etc.).

Advancing data protection

Software security and data protection have been advancing along with all other technologies for fintech app development. Today’s apps employ encryption, two-factor authentication, and cloud-powered security measures to safeguard financial transactions and user information. Going for a fintech product development is a great chance to dive into the trendiest, most advanced cybersecurity tools and methods.

Wrapping things up

Building a thriving fintech app is an exciting journey as well as a multifaceted process that requires careful planning, innovative thinking, and attention to detail. Understanding the various types of fintech apps, the stages of development, and the essential requirements sets the stage for creating a powerful and impactful app that will resonate with your audience.

Be sure to constantly keep up with the latest trends and techniques in the fintech industry and to continuously improve your app based on customer feedback. With dedication and creativity, your fintech app can truly transform how people manage their finances and interact with financial services.

FAQ

How to create a fintech application?

Creating a fintech application takes several key steps. First, you need to outline your target audience and the exact type of services you are to provide. Next, you’ll need to create designs for the user interface and user experience, keeping it intuitive and simple to navigate. Then, you’ll need to build the backend infrastructure and connect the required APIs. Finally, you’ll need to test the application thoroughly to make sure it functions correctly and meets the needs of your users.

How long does it take to develop a fintech app?

The time it takes to develop a fintech app varies depending on factors, such as the app’s complexity, the features you wish to include, as well as the expertise of your development team. On average, developing a fintech app from start to finish can take anywhere from a few months to a year or more.

How to create a financial services app?

Creating a financial services app calls for a few essential steps. You’ll need to define your target audience and the specific financial services you want to offer, design the user interface and user experience, develop the backend infrastructure, and test the application thoroughly. Additionally, you’ll need to ensure your app complies with any relevant regulations and security standards to protect user data.