How to build insurance agency management software: Benefits of custom systems

In our high-tech-driven age, ignoring IT advancements spells lagging hopelessly behind your competitors and losing customers by the dozen. Realizing this, companies across all industries invest heavily in professional and client-facing software innovations.

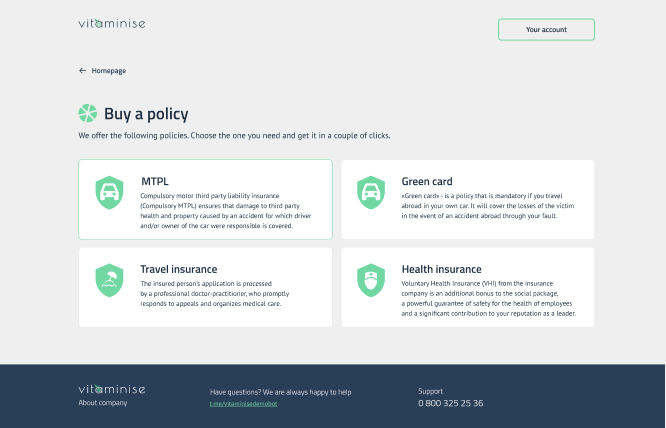

The insurance field moves in the wake of this trend, with insurance organizations embracing digitalization on an ever-growing scale. They launch brokerage solutions and healthcare insurance apps, leverage the power of artificial intelligence for fraud detection and claims management, harness AI-fueled analytics products, etc.

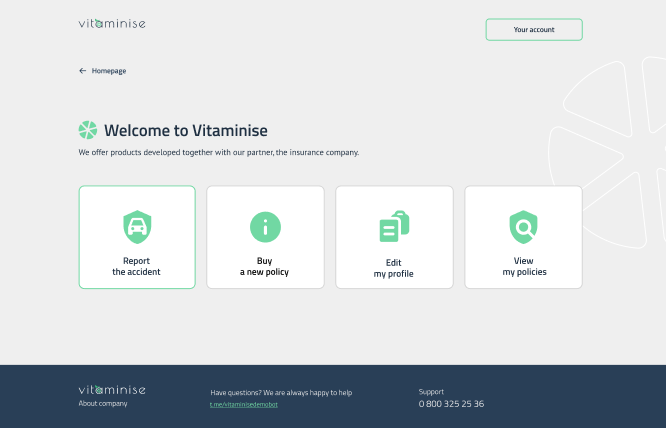

One more digital instrument that can become a game-changer for insurance firms poised for business success is a custom insurance agency management system (AMS). Let’s find out what a custom agency management system is and why it is important for organizations in the domain to have robust AMS insurance software in place.

What is an agency management system?

An AMS is a comprehensive multi-functional enterprise solution that acts as an organization’s major information hub. It is a virtual venue for collecting, storing, and organizing customer-related data. Dossiers kept in an AMS typically contain contact and contract information, enabling personnel to track current clientele and augment customer service.

AMS software dates back to the early 1980s when it was an on-premises product requiring regular upgrades. Since then, it has undergone revolutionary changes and turned into a cloud-based software-as-a-service solution. Such transformation ushered in security, scalability, flexibility, and minimal hardware acquisition and upkeep costs.

What is the role of AMS in the insurance pipeline?

Need a custom solution for your agency? We offer custom insurance agency management systems.

Functions of the insurance agency management system

Companies in the realm that make IAMS an integral part of their IT ecosystem rely on it in the following aspects of their shop floor routine.

- Maintaining organized and accurate records. Staff working with clients can always refer to the AMS to get in touch with customers or learn the details of their contracts. Such a clear view of the clientele is crucial when an organization grows, which entails the exponential increase of customers and data concerning them.

- Contract option generation. This capability of AMS allows potential consumers to review service options and learn the price tag for the item they are interested in.

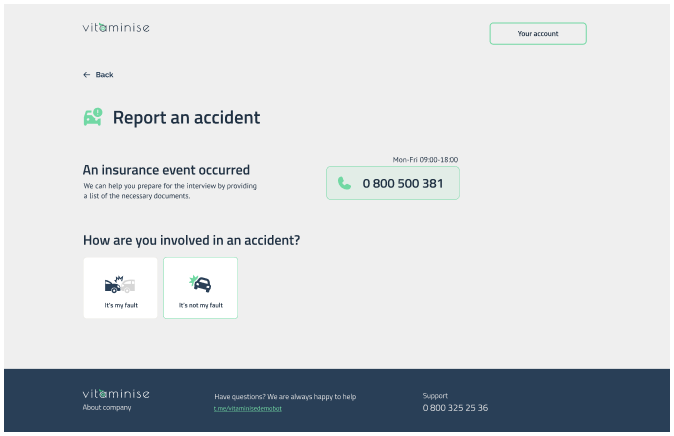

- Policy tracking. Since all relevant information is kept in a centralized databank, employees can create each policy’s history, which contains its type, date of sale, number, carriers, and commissions. Once they have done this, they monitor multiple policies and get notifications if any of them need renewal.

- Building templates. Many insurance workflows rely on standardized documents. An insurance agent management system can be geared toward creating some typical document templates (contracts, invoices, insurance applications, etc.) for the personnel to swiftly fill them out.

- Data analysis and reporting. To be of any use, data collected during an insurance agency’s operation should be properly processed and analyzed. Special analytics tools AMS systems are equipped with allow for customer segmentation and an in-depth understanding of the clientele’s behavior, pain points, preferences, and needs. Such reports are highly instrumental in identifying and forecasting trends, pinpointing business opportunities, and boosting strategic planning.

- Providing operational insights. The live reporting ability of AMS to monitor tasks and performance metrics lets companies obtain a real-time view of their functioning as a whole and the efficiency of every employee. The analysis of such indices empowers executives to manage their shop floor processes better and make data-driven personnel decisions, including rewarding the best staff members and reprimanding those who underperform.

A Customer Relationship Management system can also perform many of these functions. What are the differences between AMS and CRM?

AMS vs CRM: Comparing two systems

As a vendor specializing in custom CRM development, DICEUS can reveal four characteristics that distinguish AMS from CRM.

- AMS has a greater scope. As a rule, CRM is geared toward some major business aspects. AMS has no limitations as to the sphere of application. It can handle the automation of any pipeline procedures – from implementing policy updates to sending birthday emails.

- AMS is an all-in-one solution. CRM can rely on several platforms or software applications to do its job well. AMS functions as a single product that covers all data and workflow management aspects in one service.

- AMS is a niche product. It is fundamentally an insurtech solution. Due to the fine points of its design and development, AMS insurance software is honed to operate in this domain. CRM has a broader application range and can be onboarded by organizations from all business areas.

- AMS can be tailored to various industry fields, while CRM is industry-neutral. Despite being originally an insurance agency management system, AMS software has significant customization potential. During its set-up stage, developers can configure the system to cater to the individual needs of a specific company.

Given the diversity and volume of data it is called to organize, AMS suits insurers better. What should you look for while implementing AMS software for insurance?

Benefits of agency management system software

Here, you will learn what perks all stakeholders obtain from using custom insurance agency management solutions.

- Maintaining organized and accurate records. Staff working with clients can always refer to the AMS to contact customers or learn the details of their contracts. Such a clear view of the clientele is crucial when an organization grows, which entails the exponential increase of customers and data concerning them.

- Manual task automation. No matter what business field you work in, numerous routine tasks always take up a great part of the personnel’s time. For instance, in the insurance sector, they have to manage renewals, handle invoices, process payments, track commissions, generate quotes, etc. AMS insurance software can tackle these errands by automating such back-office workflows.

- Client touch automation. The system can generate reminders for the workforce to contact customers on special occasions related to business issues (such as contract renewals or claim follow-ups) or life events (birthdays, anniversaries, and the like). Moreover, such communication can be automated as well.

- Reducing operator errors. Human factors often cause mistakes and failures when dealing with huge amounts of data. When this task is entrusted to technology, the quality of data processing soars while the number of issues plummets.

- Enhancing workforce productivity. Automation is always about enabling employees to do more within a working day. When provided with a centralized data hub, they have a single point of reference and source of truth, which rules out the necessity of wasting time and effort switching from one app to another in search of relevant information.

- Providing operational insights. AMS’s live reporting ability to monitor tasks and performance metrics lets companies obtain a real-time view of their functioning as a whole and the efficiency of every employee. Analyzing such indices empowers executives to better manage their shop floor processes and make data-driven personnel decisions, including rewarding the best staff members and reprimanding those who underperform.

- Expanding collaboration opportunities. AMS software can improve employee interaction by setting up various communication channels. Its live chat or direct messaging features streamline joint efforts and allow several workers to team up on a single client.

- Enabling remote work. The vicious attack of the global pandemic called for switching to a remote mode of work across many industries. The plague has subsided, but people still need an opportunity to perform their duties even when absent from the workplace. Thanks to AMS, employees can access the information it contains via a mobile device, no matter where they are.

- Sustaining social media presence. Social media is an indispensable part of the modern business landscape, and it is a felony to ignore its tremendous customer engagement power. AMS facilitates client retention and lead generation efforts and allows organizations to keep a firm foothold in the realm of social networks.

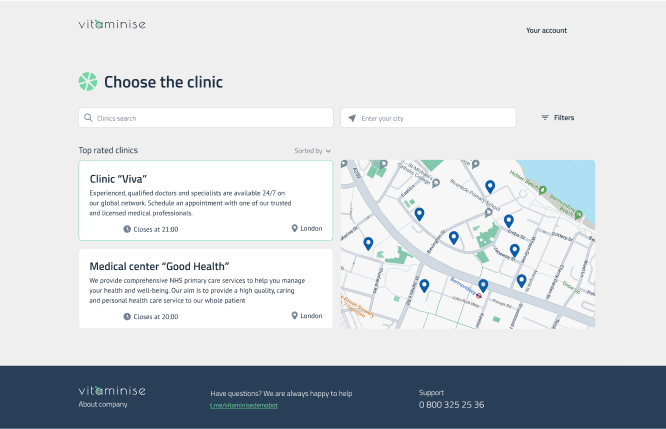

- Providing access to third-party services. When equipped with relevant APIs, agency management systems allow seamless access to multiple external software products, enhancing the efficiency of the personnel who handle them.

- Boosting lead generation and increasing sales. IAMS is just what the doctor ordered for nurturing your lead base, maximizing customer retention rates, and driving sales. By automating lead creation and follow-up, insurance agents can make a list of customers in a split second, qualify prospects before converting, create a customizable lead form, and give a shot at offering customers various upselling and cross-selling options.

- Individualized approach. In-depth client segmentation opportunities provided by a first-rate IAMS allow agents to classify clients according to their demographics, location, purchasing patterns, etc. Then, they can tailor their marketing efforts to cater to the requirements and interests of each group and even each person within it.

- Augmented client experience. All the previous assets add up to guarantee quick and efficient services for consumers, which translates into excellent customer experience and brand loyalty of your clientele.

Despite the weighty upsides of insurance agency management systems, you should be aware of possible obstacles to their implementation.

Embracing IAMS: Bottlenecks and pitfalls to avoid

What are the major red flags in AMS onboarding and employment?

- Difficulty in usage. If the solution you want to harness contains unclear instructions, cluttered interfaces, complex workflows, and unintuitive navigation, you will lose more than you gain by harnessing it. Your employees will waste their precious time trying to make head or tail of it instead of attending to their responsibilities. A good AMS is user-friendly, easy to navigate, and quick to master.

- Downtime issues. If the system is out of service for a long time, its usefulness for your business decays to zero. To avoid such disruptions to your workflow, look for software vendors with robust infrastructure, proactive system monitoring, reliable recovery and backup measures, and redundancy mechanisms.

- Numerous bugs. Downtime can also be caused by low-quality software that crashes often, behaves in an unexpected way, produces inconsistent calculations, distorts data, sends error messages, etc. Make sure your AMS has undergone all QA checks and has a stable and reliable performance.

- Security gaps and non-compliance. Since customers entrust their personal and financial information to insurance companies, AMS the latter use should be developed with security as a core underlying principle. Data encryption, multi-factor authentication, regular security updates, and compliance adherence mechanisms should be non-negotiable elements of any IAMS.

- Integration problems. Being a part of an insurance company’s IT environment, agency management software never functions as a siloed product. It must play well with numerous internal and external systems, providing seamless interaction with them and complete compatibility in data formats.

- Inadequate support. Even if any of the above-mentioned issues crop up occasionally, all problems can be solved by a competent support team or IT vendor personnel. An ideal outsourcer is the one who reacts promptly to all your questions and requests, addresses issues on short notice, and provides proactive advice on handling the system in the future.

All these challenges can be mitigated by the proper choice of an AMS. And the first thing you have to decide is whether you would buy a boxed solution or opt for building a bespoke one.

Custom vs out-of-the-box AMS: Which is better?

At first sight, off-the-shelf insurance software has a definite edge. Why? Because it is easy to install, user-friendly, cheap to acquire (some solutions may even be free, whereas others will cost you a moderate sum as a monthly or annual license fee) and can be onboarded hand over fist. They have numerous built-in features and enjoy the support of a wide user community that can lend you a helping hand in learning nuances of handling or troubleshooting. However, first appearances may be deceptive.

Ready-made software is a garden-variety product created to suit an average user. Its scope of functionalities is limited to universal features and basic third-party integrations that may turn out deficient for companies with specific requirements and business areas. But you can add something you lack, right? Not really. Modification, upscaling, and fine-tuning off-the-shelf software are hardly possible, if at all, very often triggering vendor lock-in. On the flip side, in the package, you get some features that you will never use but have to pay for as a makeweight.

The same is true of boxed solutions’ security, whose mediocre level can leave a customer with high demands in this aspect dissatisfied.

The seeming cost-efficiency of off-the-shelf insurance products is also tricky. Their support, maintenance, and customization will cost you a pretty penny, even if they are free to download. Plus, the necessity for regular payments will turn boxed software into a big-ticket item down the line.

Bespoke solutions are everything boxed software is not. You have to fork out a considerable sum as an initial investment and then wait until they are developed and put into operation. However, such inconveniences are amply offset by the ability to choose the features and integrations you will need for your shop floor routine. Moreover, you can tailor the roster list whenever you need, upscaling or downscaling the system in accordance with the company’s current state or growth perspectives. Also, since you own the end product completely, you can implement any data protection mechanisms that you find necessary.

In a word, commissioning a custom AMS, you pay a lump sum once and get a flexible solution that dovetails into your agency’s business needs and can evolve on demand, providing a strategic advantage in the niche. If such an idea seems appealing, you should understand what functionalities your future software will contain.

Learn more about off-the-shelf and bespoke solutions.

Key features of insurance agency management system software

Having delivered multiple insurance agency management software projects, DICEUS experts know what such systems’ mission-critical functionalities are.

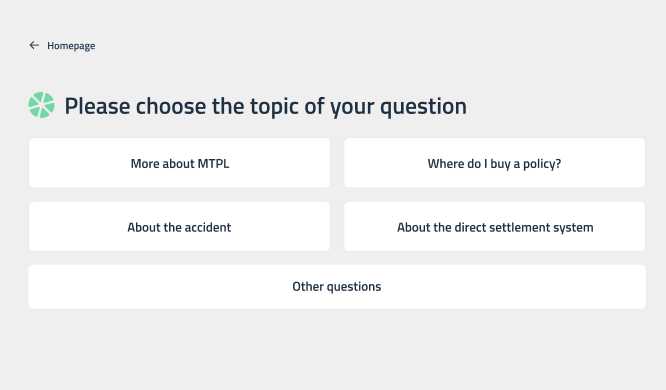

- Dynamic forms. Well-thought-out and structured intake forms contain mandatory questions and incorporate various question types to personalize the user experience for insurance company clients. The forms should be tailored to suit various kinds of projects and offered according to the prompts the customer selects during the intake procedure.

- Customizable workflows. Every insurance agency is unique in the workflows it relies on. That is why a top-notch AMS should allow you to fine-tune workflows and let them dovetail into your organization’s pipeline.

- Collaborative editing. In insurance, several team members can work on the same document. If they do it independently, they may work with outdated copies of it, overlook editing requests, or try to modify the final version of the document, spoiling the result achieved by others. The collaborative editing feature allows personnel to introduce changes in the document in real-time and make the document available to all stakeholders, thus avoiding conflicting edits.

- Real-time reporting. This is another concurrency capability that extends beyond document editing and covers all shop floor processes within the organization. Knowing what projects are underway now, how many projects are completed each month, or how long every project takes, you can introduce the necessary changes into the pipeline to increase productivity and improve the efficiency of your workforce.

- Integrated accounting. A comprehensive agency picture is impossible without adequate accounting. By integrating this feature into your AMS, you will be able to centralize all income and expenditure data (such as payments, billing, product information, and more) and radically cut down on reporting time.

- Seamless communication. For a large team whose members often work remotely, efficient communication is mission-critical. AMS has become a universal interaction platform allowing personnel to stay in touch with colleagues and clients and receive timely updates on all developments in claim status and progress.

- Email integration. Your employees must be able to send or receive emails without leaving the system, which accelerates pipeline processes and takes the organization’s efficiency to a new level.

- Mobile access. It enables personnel to stay tuned and continue working out of the office or on the road. They can retrieve information they need and collaborate with colleagues, thus contributing to the common project.

A step-by-step guide to creating an IAMS

If you don’t know how to build insurance agency management software, here is a brief outline of the development process DICEUS leverages in its software building pipeline.

Step 1. Research

We kick off by collecting relevant information and identifying project requirements. Our experts meet the customer’s representatives to learn all they can about the company’s current state (size, range of services, target audience, business goals, growth aspirations, etc.) and its vision of the solution they want to obtain.

Step 2. Planning

With all necessary data at our fingertips, we determine the composition of the project team, the tech stack they will need, the scope of the project, its timeline, and major deliverables.

Step 3. Building a prototype

Although this phase is considered to belong to mobile app creation, we practice it in AMS development as well. It allows the project team to receive a clear idea of the future system’s logic, structure, and appearance. Besides, trial usage feedback gives us valuable insights into the product’s deficiencies before the actual development begins.

Step 4. UX/UI design

Now, we tackle the client side of the product, amending and amplifying user flows, customer journey maps, and visuals outlined at the prototyping stage.

Step 5. Development

This is the longest phase of the SDLC, during which developers create the solution’s architecture and build features, modules, databases, and functional algorithms according to the approved plan and product specifications.

Step 6. Quality assurance

Here, QA engineers submit the solution to various kinds of tests (including usability, performance, load, stress, penetration, compatibility, and more) to make sure the product has no bugs or security gaps and operates according to expectations. Once the software is found fully functional, it is deployed and goes live.

Step 7. Support and maintenance

As a responsible vendor, we never leave our customers as soon as the product is delivered. We stay with them for a while to monitor the solution’s operation, fix issues (in case they are spotted), and provide advice concerning the system’s functioning while the personnel learn to work with it.

To build the best-in-class AMS containing all these and any other features you need for the efficient functioning of your insurance agency, you should hire a competent IT vendor. The qualified and certified specialists of DICEUS have long-time experience and the necessary technical expertise to deliver a custom insurance agency management software product of any scope and complexity within time and budget. Drop us a line to obtain a high-end insurance AMS that will boost the efficiency and productivity of your firm.

Summing it up

As part of the comprehensive IT ecosystem, an agency management system is an all-in-one data hub where insurance companies store information about their clientele. When implemented as a cloud-powered SaaS solution, AMS is a second-to-none instrument for maintaining accurate dossiers, automating manual tasks, mitigating operator errors, increasing collaboration opportunities, providing business insights, and more.

To make the most of insurance AMS, you should fill it with relevant features (dynamic forms, customizable workflows, collaborative editing, real-time reporting, integrated accounting and email capabilities, mobile access, and the like) and hire a high-profile IT vendor to create a bespoke solution that will address your insurance agency’s unique needs.

FAQ

What is custom AMS insurance software?

This is a bespoke cloud-based enterprise solution that serves as a single digital venue for collecting, storing, and organizing information an insurance agency operates in its shop floor processes. As a rule, such dossiers contain contact data of the clients and details of their policies, but the organization may commission additional capabilities and integrations for their AMS.

How does custom AMS insurance software differ from standard AMS solutions?

Boxed solutions of this type contain only garden-variety features that suit an average insurance agency. By commissioning a made-to-order AMS, you can tailor the capability roster according to your company’s needs, fill it with unique functionalities, and integrate it with the platforms and third-party systems you want. As a result, you pay only for the features you will use in your pipeline operations.

What are the key features of insurance agency management software?

The choice of features is conditioned by the specifics of the agency that orders the implementation of AMS. Insurance organizations can’t do without dynamic forms, customizable workflows, real-time reporting, collaborative editing, integrated accounting, email, and social media tools, and reliable communication instruments. Other features can be added at the customer’s discretion.

How does custom AMS insurance software benefit insurance agencies?

With a smoothly functioning AMS in place, insurance companies can maintain organized business records, automate the lion’s share of manual tasks, reduce human-driven errors, generate policy options, increase collaboration opportunities, facilitate remote work, obtain operational insights, sustain constant social media presence, and more.

What are the benefits of using custom insurance agency management software?

Boxed solutions of this type contain only garden-variety features that suit an average insurance agency. By commissioning a made-to-order AMS, you can tailor the capability roster according to your company’s needs, fill it with unique functionalities, and integrate it with the platforms and third-party systems you want. As a result, you pay only for the features you will use in your pipeline operations.

How can insurance management software help manage leads and boost sales?

The automation of many insurance workflows allows agents to build customizable lead forms, which are second-to-none instruments for accelerating lead nurturing, streamlining and facilitating contacts with customers, and boosting their lifetime value. Also, employees can utilize the information AMS contains to segment the clientele according to various factors and offer each category products and services as a part of upselling and cross-selling initiatives.