RiskVille cloud solution for risk and insurance management

Project overview

Riskville is a single database that helps manage customers and business records as well as track all the insured and self-insured assets. It is aimed to organize and streamline all the processes related to risks, claims, and insurance in one system.

Client information

RiskVille offers a cloud-based solution for insurance companies to manage and automate their everyday business activities. It serves the needs of agencies to manage benefits, commercial, and personal lines. The solution has already proved its high performance and efficiency in claims management, risk management, policy management, and customer self-service support.

Business challenge

RiskVille came to DICEUS to develop a secure and easy-to-use platform to manage core operations with insurance policies, risks, and claims in one place. Our customer wanted to create a platform that will provide all the critical features for insurance-related activities like rating, quoting, billing, claims and risks management, storing and analyzing customer information.

Technical challenges

The technical challenge was to create a light cloud-based all-in-one flexible insurance platform, which could automate and manage risks, incidents, claims, and insurance policies. It was required to create a multi-modular solution that would be implemented within 3 days and customized to any agency without developers’ involvement and at no additional costs.

Solution delivered

Our team developed the most comprehensive solution available for all aspects of captive management, insurance and risk management. Riskville is a single secure database allowing consolidation, control, risk management.

As a result, our customer got a solution with useful digital options that allow users to easily handle their customer records, business units, and manage workflows, import and export data, and develop group structures by applying an innovative hierarchy tool.

Let’s discuss how we can help with your project

Key features

360-degree customer view

Agencies can create complete customer profiles that store such data as contacts, demographics, policies, and other documents. This functionality allows using historical and real-time data to conduct substantive analysis and forecasting. As the main benefit, you can create more personalized insurance product offerings.

Policy management

Riskville provides standard policy templates to simplify your routine activities. You can also customize the templates according to various risk coverage and compliance regulations. When the policy is expired, rest assured it will be renewed automatically.

Risk management

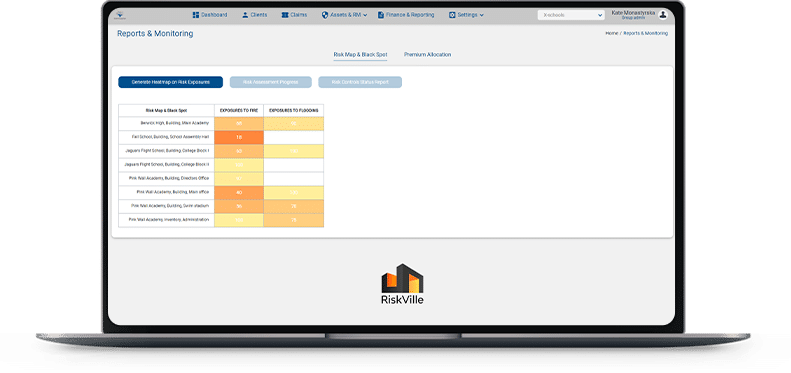

RiskVille solution has a comprehensive toolset for risk management, including risk identification, monitoring, assessment, and reporting. Using the latest analytics tools, you can forecast risks for all types of assets and develop the respective premiums programs.

Claims management

Self-service capabilities allow for reporting customer claims online. Reporting will be customized if you have any specific requirements. Your employees will be notified of incoming claims. On-time claims management improves customer satisfaction rate.

Microsoft Azure Cloud

Microsoft Azure Cloud HTML

HTML Bootstrap

Bootstrap Visual Studio

Visual Studio Jetbrains

Jetbrains Navicat

Navicat Jira

Jira WebStorm

WebStorm SSL (CloudFlare)

SSL (CloudFlare)