Reflections on the 4th annual retail banking technologies summit in Vienna

The 4th Annual Retail Banking Technologies Summit organized by Allan Lloyds Group took place on February 4-6 in Vienna. Being a significant event in the banking/FinTech industry, it attracted dozens of experts from Europe and other regions. Among the representatives, there were C-grade employees from Barclays, BBVA, BNP Paribas Group, Danske Bank, HSBC, Raiffeisen, Sabadell, and Santander. This year, it was focused on emerging technologies and their influence on modern banking services.

As an official sponsoring partner, DICEUS prepared well for the summit. We studied the market and made a dream team of two professionals:

- Yevhen Zhurer, Strategic Sales Manager. Yevhen presented our company and our services to potential partners.

- Vladimir Korotich, Account Director. Vladimir focused on the tech side of our products and offers.

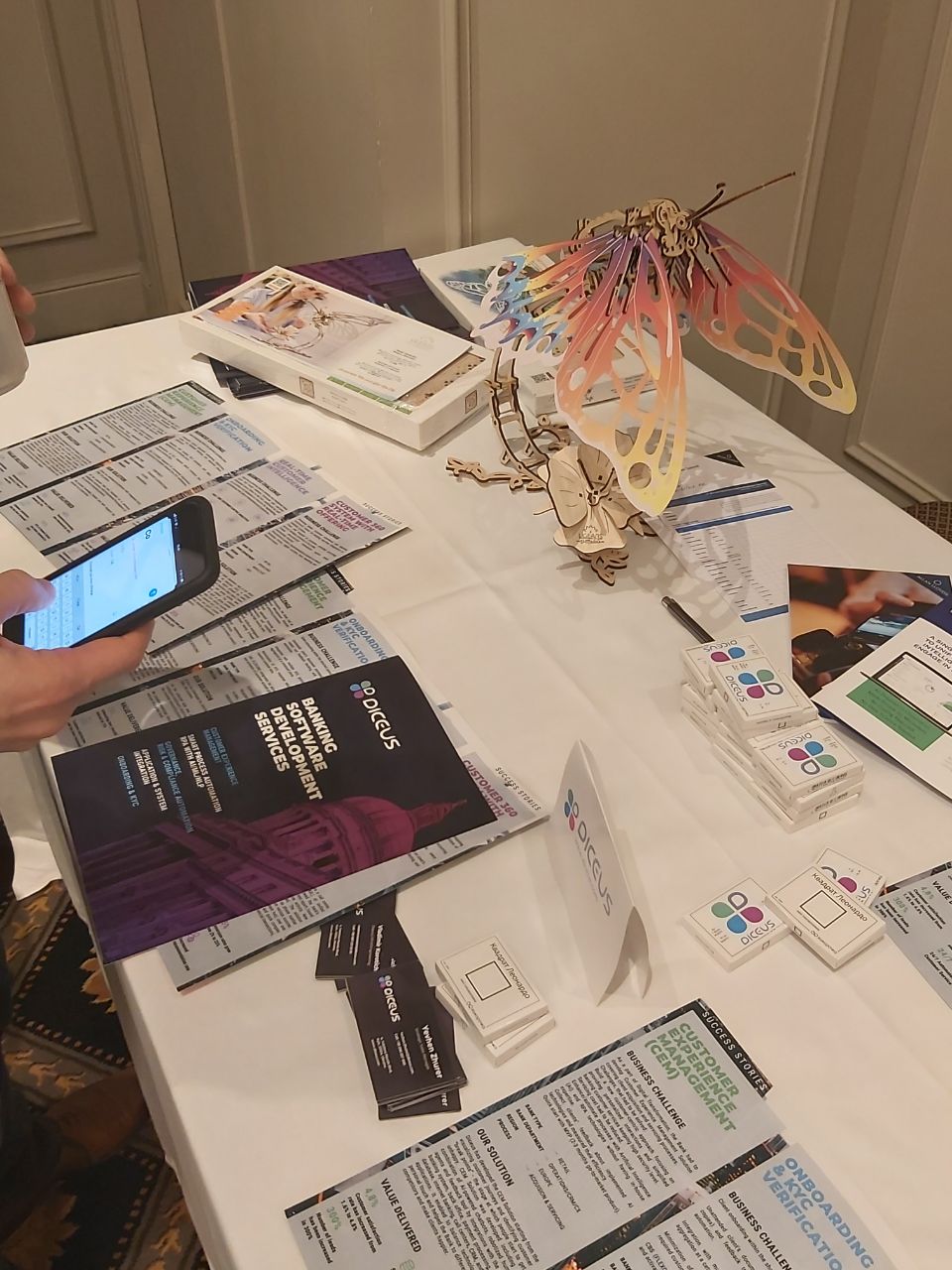

At the event, DICEUS delegation had own stand with branded brochures, cards, and incredible Ukrainian mechanical models from Ugears. All the interested visitors could leave their contact info to get these models from our marketing department later.

Yevhen Zhurer shares: “Mainly, we wanted to study the landscape of retail banking and understand if our focus on it is correct. Eventually, we found that the market demands our core expertise in the fields of professional KYC, onboarding, and customer experience”.

Further, you can learn more about the event, its results, and our impressions.

Overview of the summit

The event took place over three days. On February 4, the early participants could join a workshop where banks shared their pains and bottlenecks. During the first day of the conference on February 5, visitors attended networking sessions, case studies from banks, and presentations from partners. A final panel discussion featured topics like data, chatbots, and digital models. The second day also was focused on banking case studies and two roundtable discussions: about customers and regulation/security.

Surely, DICEUS representatives visited all the key events during the conference. The first one was a workshop organized a day before the summit. Surely, our employees attended speeches and lectures from the industry experts, including:

- Blockchain solutions in retail banking

- Cybersecurity and traditional security

- Digitalization and UX

- FinTech partnerships

- Innovative business approaches

- Open banking APIs, benefits, and challenges

- Payments innovations

- Regulatory compliance

- Retail banking trends for 2020

Based on our experience and impressions, we can define the most prominent or relevant topics for the banking industry. Feel free to check them below.

Top-priority topics

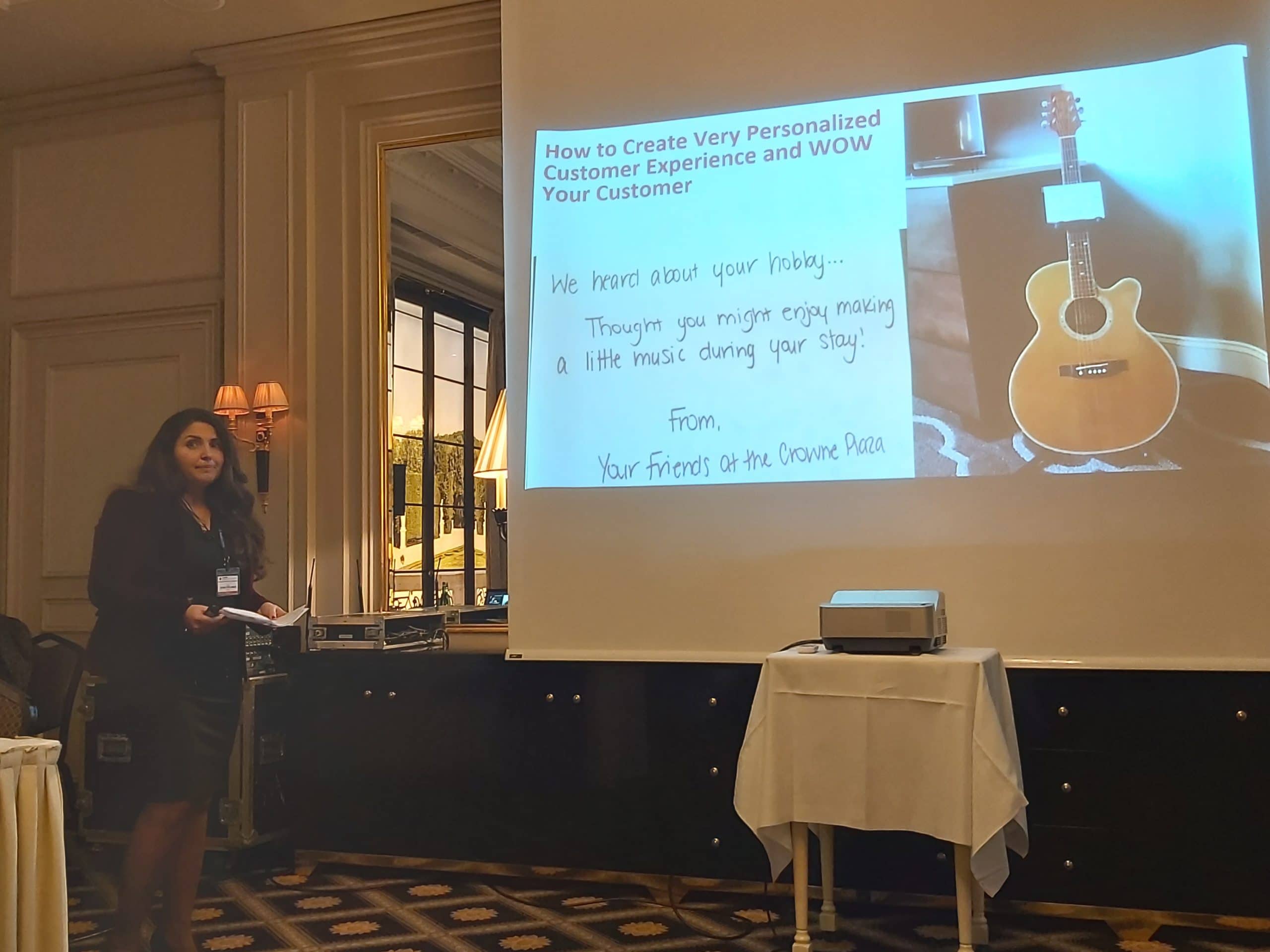

Generally, the event was dedicated to different innovative approaches: in payments, business strategies, customer experience, and regulations.

Blockchain and stablecoins

Particularly, Alfonso Ayuso, CIO of Sabadell, shared some insights into Libra – a blockchain/cryptocurrency project developed by Facebook. The speaker talked about how the International Monetary Fund and other regulative authorities affect the financial structure of Libra. He also shared his thoughts on the perspectives of the project. It’s now clear that the European Central Bank and local banks build infrastructure for blockchain digital currencies.

Regulatory compliance and cybersecurity

Apart from close attention to the regulation of modern financial assets like cryptocurrencies and blockchain products, conference participants discussed general compliance, too. Several reports were focused on security and cybersecurity issues. Notably, Craig Hughes, CEA of Danske Bank, provided insights into open banking ecosystems. Moreover, a workshop held on February 4, also helped bank representatives to share their cybersecurity issues.

Social media for Gen Z

Representatives of two banks from Turkey educated attendees about their innovative approach to social media customer experience. For instance, they rely a lot on Instagram. Via stories packed with deep links and bound to the premiers of popular TV series or movies, banks set integrations with internal products. This strategy boosts conversion rates significantly, e.g. +36% in revenue of retail banking products after the launch.

Vladimir Korotich notes: “This approach is an example of highly innovative and disruptive strategy. I haven’t seen similar customer-oriented interaction ideas in Europe as this region is far more conservative in its methods.”

Impressions and results

On the morrow of the event, our delegation was happy and full of new insights. The event attracted many professionals from different corners of Europe and even from Egypt! Banking experts from Austria, Belgium, Czech Republic, Denmark, Estonia, Greece, France, Spain, Switzerland, and Turkey share their experience.

Particularly, we set new business links with two banks:

- Banque Cantonale Vaudoise – Mrs. Maxime Charbonel, Head of Digital.

- Danske Bank – Mr. Craig Hughes, Chief Enterprise Architect.

At the end of the day, the 4th Annual Retail Banking Technologies Summit turned into a highly constructive event for DICEUS. We discovered essential banking trends, got acquainted with prominent industry experts, and learned the critical user pains. Eventually, we realized that our services in the field of customer experience and onboarding are pretty demanded.

The only organizational drawback made it more difficult to connect to participants. All sponsors of the conference were located in a separate room, without any pointers. Hence, some visitors even didn’t know about sponsor stands! It took some time to find people in the main halls and come back to show them branded production…

Nonetheless, this issue didn’t prevent our team from enjoying the conference and educating the world about DICEUS.