Custom software engineering best practices and niches

Software applications for any company are undeniably useful. We bet that lots of businesses use Excel spreadsheets for accounting, specific CRM systems for interactions with clients, databases for keeping the information, and so on. Even mobile messengers that are commonly used as in-house chats are software pieces. From the variety of development options, custom software engineering is one of the most efficient ways for businesses.

But there are myriads of questions related to customized apps and services. When is it better to purchase this software? Which type to choose? How much will it cost? Why should a company opt for custom solutions at all? In the next sections, we will talk about the essence of bespoke programs, their differences, and their benefits. DICEUS experts, who have extensive experience in solving such problems, would like to present to your attention a small tutorial about software engineering best practices in 2022. We hope it will help you avoid the common problems of developing and customizing advanced applications.

Custom applications basics

Before proceeding to tips about strategies and market niches, we should grasp the idea of custom software. It may look simple but we suggest checking this section to be sure that you know key terms. Industry professionals can skip the introduction, though.

Differences between custom and pre-made products

Long story short, the software development sector features numerous categories and types. There are open-source and proprietary apps, cloud-based and hosted programs, and industry-specific and universal alternatives. However, the most important differences include features of tailored bespoke applications and out-of-the-box programs that are similar for all customers. Let’s look at the major features of both types and how these features differ.

Basically, premade software is created once and then distributed to numerous clients with minor to zero changes. Instead, custom solutions are unique for each customer because development teams design them from scratch according to exact requirements. Respectively, bespoke apps take more time to be delivered and this time also depends on the number of the desired features. Higher complexity means longer development and higher costs.

Talking about money, it’s the third key difference. Ready-made products often feature several different costs, including the initial software price, license fees, and monthly usage fees. As a rule, you should pay regularly and for each employee that has access to the software. Instead, custom software engineering provides for a large but one-time payment that includes all the possible services, including post-launch support.

For this moment, remember the most defining insight: out-of-the-box applications are similar for all clients while custom products are unique.

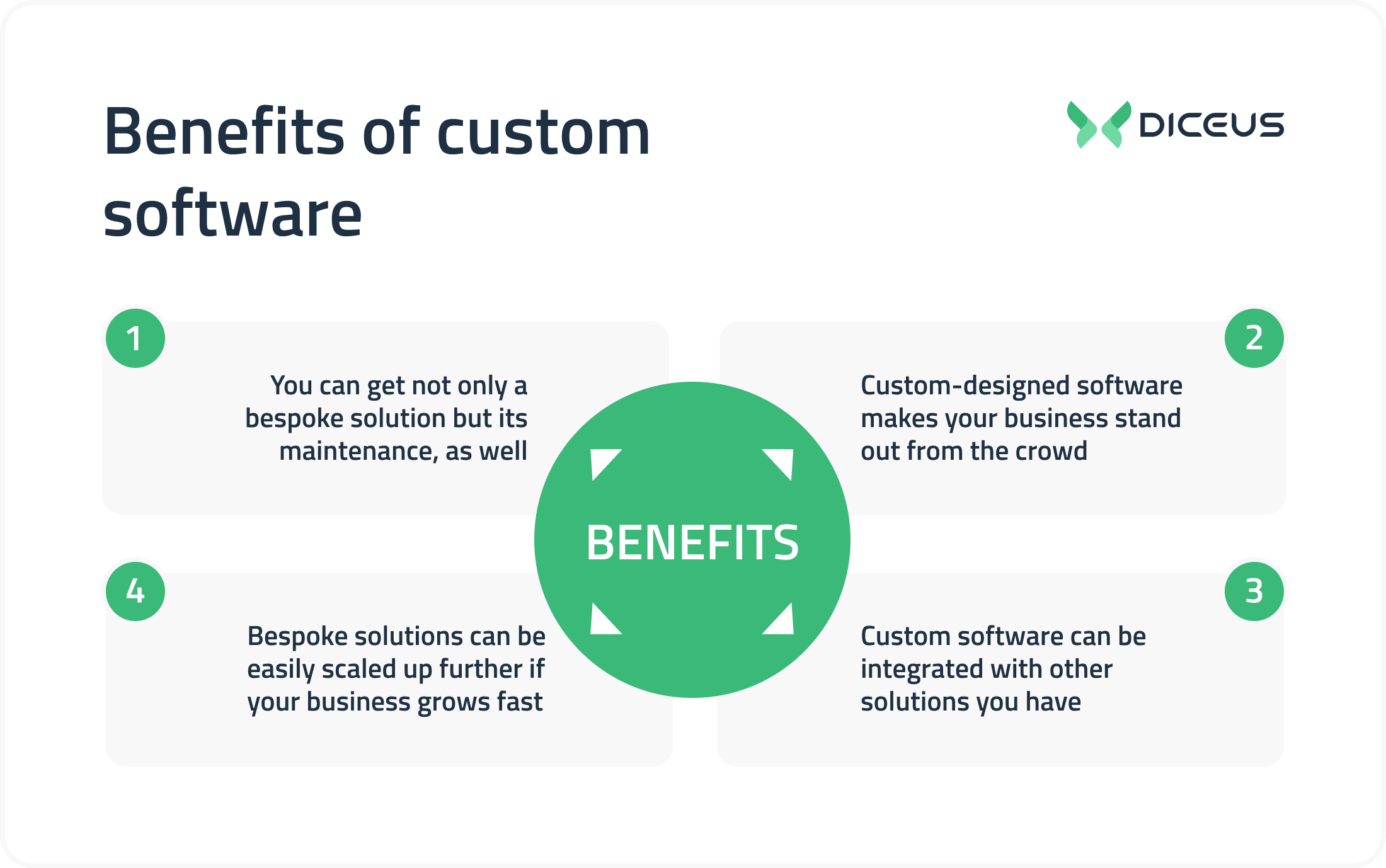

Benefits of custom software development

Let’s move to the exact advantages of the described software apps. The first one related to customization options and perfectly-tailored functions should be clear now. According to it, each customer of a dedicated development company can conclude the list of the required features or separate applications, discuss it with dev partners, and finally receive the working software with all these features implemented. Additionally, tech teams can suggest other useful tools that boost the company’s performance.

Hence, there are other noteworthy benefits of bespoke modules for commercial companies:

- All-in-one services. It’s not a big deal to talk to devs and ask them about extra tech services. As a result, you can order not only the software but its lifelong maintenance, customer support, regular upgrading, and testing.

- Integration. Often, businesses use specific software apps, including outdated tools. Dedicated developers can connect these legacy systems to new programs and migrate core data quickly so you will not experience destructive performance dips.

- Market advantage. As far as bespoke solutions exist in a single copy designed for a single business or individual, they provide an advantage over market competitors. Rival companies simply don’t have access to your game-changing features.

- Scalability. Custom developers also can easily leave enough space for future business growth. Unlike off-the-shelf apps that have limited scalability options, tailor-made products can be planned with the aim at long-term development.

Finally, all the mentioned strengths lead to the higher efficiency of this software type. A regular customized product in software engineering optimizes business processes better than traditional apps, usually. Of course, you should be aware of the team’s needs and business goals to get the most out of custom applications. If the company really requires these tools and knows how to use them, they will lead to high ROI and amazing optimization.

Best practices relevant for software engineering

Specialists do not consider writing programs as the ultimate goal. They think more in terms of meeting the needs and solving end-user issues. The occurrence of some can sometimes be predicted, and with the help of competent design, difficulties in the future can be avoided.

A wide variety of tasks causes certain difficulties. Some require parallel running applications, while others require sequential execution of several. That’s why before starting work, the engineer usually goes through the following checklist:

- Which tasks are to be handled?

- What can be done to avoid or prevent certain issues?

- What needs to be done to make issue-solving simpler with the help of a developed app?

Standardized conventions help keep code relevant and useful to both clients and programmers. But let’s talk about the techniques that help create production-level solutions.

Writing quality program code

Good program code is clear, readable, easily extensible, and runs well with other applications. All in all, the quality should be high, and the design should be such that the program can be easily modified in the future.

Readability

Any programmer spends most of their time reading, not writing code. If it is not understood by other professionals when needed, it will be difficult to update it. Clean and modular code is easy to read and is logically structured by function, making it more organized and efficient.

It is worth noting that it is almost impossible to accurately identify indicators or parameters for code clarity. Partially, such tasks are solved by observing generally accepted language norms, and using successful software models and development methods. Only this is not always enough. But over time, thanks to experience, a professional sort of intuition appears in professionals, which helps them.

Efficiency

Optimizing code requires making sure that it executes a function quickly. If the final product is slow and unstable, seemingly good code for large and complex projects may not be useful. It is also necessary to minimize the amount of memory it occupies so that it does not affect the performance of the application and its energy efficiency.

Refactoring

Reworking the code basically improves its structure without sacrificing functionality. If several blocks do similar things, they should be refactored into a single function and thus simplify the code. If necessary, changing the operation of one function is easier than digging into several.

Coding style

Skills develop over time. To do this, you will have to improve your knowledge in the field of development. Using the following points will help you develop an effective working style:

- Descriptive names for functions and variables

- Modularity in code

- Avoiding excessive indentation

The code must always comply with the rules, regardless of whether it is common to all languages and markup or specific.

Version control

Efficient evaluation is a key factor in writing good code. This refers to the development environment that synchronizes changes with the master file. In a professional project, this provides significant advantages:

- There is an option to save a backup

- All development contributors can synchronize changes at any time

- Specialists do not interfere with other participants in the process when they change the functions of a common project

- If errors occur, reverting to the stable version will resolve the issue

The ability to simply fix bugs is a key attribute of good software. Errors in the program should be easily identified and recorded centrally, and the developer should be able to logically eliminate them and debug the application. He/she should be able to easily connect, access execution information at any time, and check the health of any part of the system.

To do this, follow three major principles:

- KISS – “Keep It Simple, Silly“. Create simple and concise code designed for the “fool”. It must be meaningful and accurate. This will ensure its high maintainability without significant loss of time and effort.

- YAGNI – “You Aren’t Gonna Need It”. Discard any currently unnecessary coding. You can add anything you need later on.

- DRY – “Don’t Repeat Yourself”. Reduce repetition by implementing abstractions or grouping code into functions.

Environment and testing

Software engineers develop applications that can run on computers of different architectures and operating systems. They should work equally well at different resolutions and screen orientations, as well as not eat a lot of memory and processor power.

If we are talking about web applications, then they should work across all major browsers. When creating a desktop application, you need to make sure that it starts and works correctly on Mac, Windows, and Linux.

Engineers think through scenarios and plan testing. It all starts with choosing the ideal option, in which everything works without errors. Then they document likely problems and put them into the plan. Some people start by writing code, which they call test examples, which simulate scenarios of all possible problems and errors. And then a program is written that can work with any of the options considered.

Compliance with coding standards guides and shapes the development process, and testing ensures that the result meets the finalized requirements.

Unit tests are used to evaluate small standalone pieces of logic. Short and frequent testing sprints get things done better than one big iteration after product completion. This helps maintain a modular structure and ensures a higher quality of the end product.

User focus

A good programmer prioritizes User Experience (UX). The human-machine interaction has an infinite number of variations. The more decisions are applied, the better the program will turn out. And this is being developed with the user’s behavior scenarios in mind. You don’t just add new features to fill up space – put yourself in the user’s shoes. Functions should be simple, intuitive, and easy to use.

Reliability, security, and protection

A professional familiar with best practices in software engineering is responsible for the safety and security of their solution. Parts of the program must be resistant to incorrect input and interaction. Users will always make mistakes, involuntarily or knowingly, in order to break the application and get to some resources. This is why the development should answer the following questions:

- If the user has forgotten the password, how many times can he/she try to re-enter it?

- What if someone else is trying to block the account?

- What will you do if the login attempt looks like an automated attempt?

- Can a user send their credentials over an unencrypted data link?

- What if the login request came from an unusual location?

- What have you done to protect your users from cross-site scripting and cross-site request forgery and commonplace phishing?

- Do you have a backup strategy in case your servers are DDoS-attacked?

Well-protected program code does not save important information in text form. It protects it with a complex one-way cipher (which is easy to encrypt, but nearly impossible to decrypt without a key). And errors in programs are not always obvious. This is why software engineers understand the importance of good tools to enable them to write correct and secure software.

Related article:

What is the primary purpose of penetration testing?

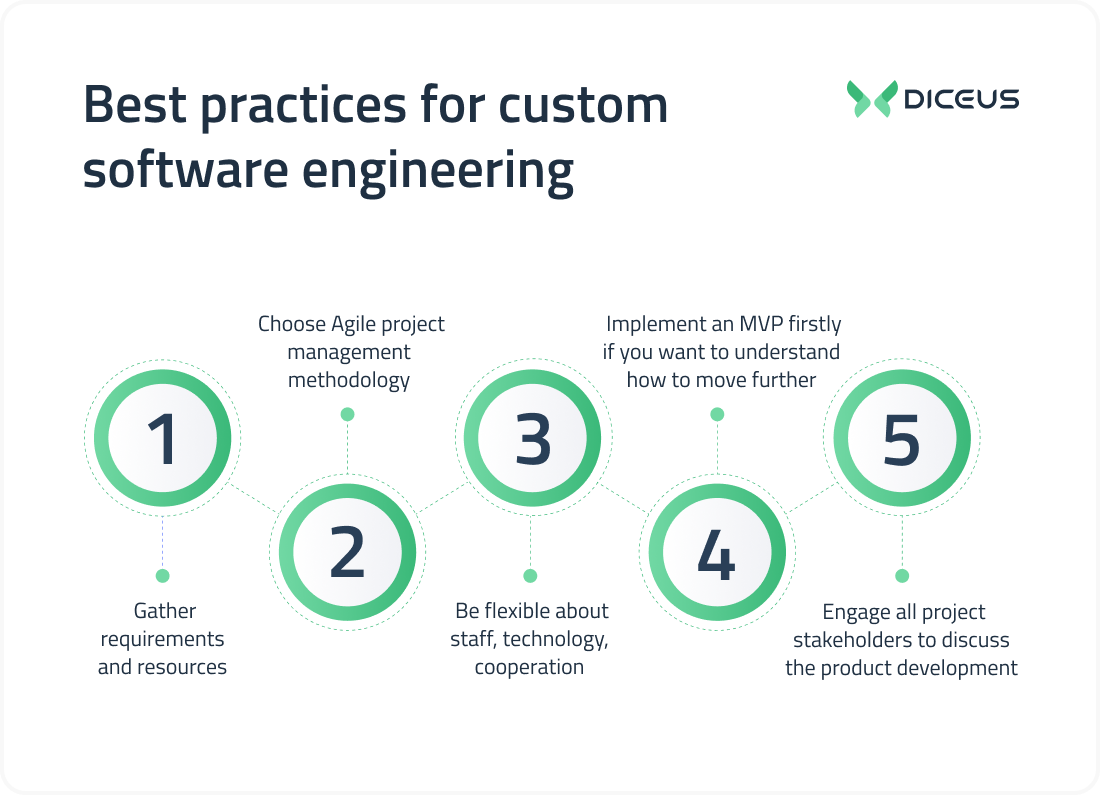

Best practices for customization software engineering

Generally, best practices are referred to as ready-made applications. Developers analyze the market and a given industry, check other software apps, and then list several of the most efficient and satisfying approaches. Using these methods, devs then create their own programs to deliver them to clients. Best practices in development help to reach the desired goals because they have more guarantees of appropriate results.

However, sometimes, best practices are insufficient to yield the expected results. When you need something unusual and unique, something that can provide a great advantage over opponents, then you look for custom apps. The catch is that custom teams also use certain best practices but they are more focused on the creation process. Further, we unveil five popular approaches to developing a customized product in software engineering.

1. Evaluate requirements and resources

First things first, you want to plan everything properly. Don’t look for developers and don’t try to start coding before accepting all terms and conditions. This point splits into two parts:

- Requirements. Everything you want to be realized in the final product. Additionally, we suggest considering functional and non-functional requirements.

- Resources. Everything you can dedicate to development. Usually, teams don’t have enough resources for the internal project but they can handle one or two tasks.

After approving both points, you will have a much more detailed and transparent plan for the upcoming development. It’s better not to change major decisions such as core functions and the number of resources you can dedicate.

2. Opt for Agile methodology

Modern strategies often are based on iterative approaches instead of all-in-one processes. Agile isn’t an extremely innovative idea but it suits various dev requirements perfectly.

Put simply, this strategy provides for breaking the entire project into several subsequent sprints that last for 1-2 weeks. Each sprint has its own goals and rules so developers focus on one feature and don’t waste time on secondary tasks. Additionally, you as a client can leave feedback at the end of each sprint to adjust the development process.

Overall, the iterative approach is convenient because it optimizes everything. Devs focus on core stuff, managers track performance, employees learn about new features one by one, etc. Plus, Agile also allows the creation of more flexible schedules.

3. Be flexible

Just accept the fact that the development process will take longer than you estimated. Often, new obstacles and desires appear so the planned product changes, and developers have to adapt to new conditions. In this case, hard deadlines can be destructive. Instead, schedules with flexible frames are more convenient as they leave enough room for changes. Of course, they also require better management and control.

4. Implement an MVP firstly

Here’s another hint for Agile devs and their clients. An MVP is an application that comes with basic features only. Compared to final powerful products, MVPs cost less, can be installed in a simpler way, and can be upgraded in different directions. By deploying an MVP, you can test how the planned functions work or how customers react to this new stuff. Additionally, employees also can check how things work before installing more complex versions.

5. Involve employees

Finally, any company is about the team. You create software for workers so it’s a good idea to consult with them. Still, you want to avoid that noise related to multiple decisions. The best way to engage people who will work with the planned app is to ask them directly. For instance, you can create an online platform to gather opinions and process suggestions. In this case, managers still will decide but they will consider the ideas of colleagues.

Perfect industries to implement bespoke apps

Apart from best practices, it may be useful to know what market niches are the best ones for implementing custom programs. Firstly, all companies that feature a high level of tech innovations are likely to benefit from bespoke tools just because there are no out-of-the-box analogs. Here, we talk about startups and science groups focused on high-tech engineering, aerospace, military, energy, and biotech.

Apart from them, there are more traditional sectors:

- Commerce – to get a market advantage in the run for clients’ attention.

- Education – to automate interactions between students and schools.

- Finances – to reduce human errors, speed up transactions, and boost UX.

- Law – to get rid of enormous paperwork and focus on personal discussions.

- Logistics – to easily track fleet and manage warehouses.

Planning your customized product in software engineering

Okay, now check the final insight: all industries can get benefits from custom solutions. It’s not about your size or your market niche, it’s about your real goals and requirements. Remember to plan everything to understand whether a bespoke app will be profitable for the team or no. Ask yourself about target users and customers, core functions, main goals of current processes, etc. By analyzing, you will be able to grasp the importance of custom products.

GoodFirms reports that the most demanded custom applications are enterprise solutions or ERPs (84.7%). The next ones are tools for business automation (53.9%). E-commerce platforms and software for Big Data processing are also popular while CRM and educational applications close the top six. So, you can start from this point. After getting info about the company’s goals, try to correlate them with software type to see how they can be useful.

At the end of the day, custom software engineering is almost always profitable. You only should choose a professional development team. Our company handles various dev approaches and works with different industry experts. We can help with planning, optimizing resources, coding, testing, training, upgrading, and further maintenance. We are tech partners instead of outsourcers so all the delivery and quality guarantees are provided.

FAQ

This section is already traditional for our guides. Below, you can quickly move through all the key points unveiled in the article to get the most valuable ideas.

What is a customized product in software engineering?

Long story short, a custom app is a software product that was designed for a given client exclusively. Other customers can’t get the same copy.

When should you opt for bespoke solutions?

Generally, there are three reasons for choosing custom software development. Firstly, you have unique requirements that can’t be covered with pre-made apps. Secondly, you don’t want to get redundant features of premade apps for a high price.

How to develop the best custom product?

Best practices for custom development include comprehensive planning, usage of Agile methodology, flexible schedules, MVP implementation, and engagement of all project stakeholders.

What is the cost of customization?

The frames are wide as the final cost depends on multiple factors. Normally, the smallest apps start from $2,000 while more complex software can exceed $250,000. Sometimes, the largest enterprise solutions feature a $1+ million cost.

What is a software engineering practice?

Existing software engineering practices outline a set of concepts, methods, and tools that must be taken into account when planning and developing top-of-the-line software.

How are best practices relevant for software engineering?

Software engineering best practices are indispensable for working through main application tasks and achieving high-quality results when strictly followed.

What does best practice mean in software development?

Every other relevant software engineering best practice outlines a set of approaches, recommendations, or standards that, when combined, address the root causes of development problems.

Conclusion

Despite vendors of out-of-the-box applications relying on best practices more than custom devs, the latter ones also have various tricks and hints to deliver the best app. You can get strong market advantages by selecting custom development because eventually, the company will get a totally unique product.

We can’t predict how the development sector will progress over the years. Nonetheless, we know that good and up-to-date software is required for all successful companies. Feel free to ask our experts about the perfect customized product in software engineering as we handle various dev approaches, including the most innovative ones. Don’t hesitate!