Data governance for banks: Top 5 benefits of implementing

Modern banks collect, store, and process huge amounts of data that relate to the financial organization’s customers and pipeline operations. All this information containing personal, sensitive, business, and finance data (some of which belong to master data) should be protected from unauthorized access and compromising, kept in an easy-to-handle format, and adequately analyzed to enable banks to enhance their workflow and maximize ROI. Achieving these goals is possible only when banks develop and implement an effective data governance strategy.

What is banking data governance?

Data governance in banking encompasses a variety of operations related to controlling, accessing, and managing banking data. It boils down to establishing and improving policies and setting up processes to ensure the usability, accuracy, availability, integrity, quality, and security of data banks employ. The deliverables of an adequate data governance program include algorithms, tools, and technologies that optimize a financial institution’s efficiency, step up its data analytics routine, promote innovation in the industry, support risk management, and streamline regulatory reporting.

Related article: “Master data management in banking: Challenges, benefits, and best practice”

How does data governance for financial institutions work?

Relying on the data governance best practices, banking sector organizations create a comprehensive data governance model that has the following objectives in view:

- Appointing data stewards assigned to specific data sets who will monitor data quality, resolve issues, and enforce adopted policies

- Restricting data access to authorized staff only

- Ensuring data privacy and regulatory compliance

- Establishing firm data format standards

- Pinpointing data sets (both structured and unstructured) that require protection

- Tagging data types with the subsequent assignment of roles and responsibilities

- Onboarding data solutions and technologies that streamline data management and processing

- Introducing automation on a large scale

- Determining and implementing metrics that provide efficiency assessment.

- Monitoring and evaluating data governance pipeline to identify improvement areas.

- Training employees and stakeholders to foster data governance awareness and promote its best practices.

When handled properly, financial data governance can bring many advantages.

Five benefits of implementing data governance in banking

As long-time data solutions experts, we at DICEUS perceive five significant assets professional data governance can bring to banks and other financial institutions.

Benefit 1 — Compliance with regulations

Given the exorbitant sums banks deal with, the financial sector has always been a magnet for fraudsters and swindlers. Law enforcement bodies have turned this domain into one of the most heavily legislated ones. Basel III, Anti-Money Laundering (AML) requirements, Know Your Customer (KYC) measures, and other statutory mandates pressure banks to stay compliant and prevent fraud. In case they fail, hefty fines and other penalties are imminent. The number and diversity of such regulations are so great that complying with them is a hard row to hoe.

The only way to ensure compliance is to have an adequate data governance strategy and tools. Using them, banks can maintain a transparent audit trail and conduct lineage mapping to trace the origin, movement, and transformations of data they operate. Also, it ensures maximum data protection, control, and security across all data storage facilities and mitigates possible risks of leakages or penetrations. Besides, data governance mechanisms let organizations monitor the state of the current legislation in the field and be aware of changes occurring to guarantee their functioning always meets legal requirements.

Benefit 2 — Data-driven decision-making

Ensuring the high quality of data is the cornerstone of data governance policies. However, this is only the first step in data processing. When all the critical information is complete, accurate, consistent, up-to-date, understandable, and relevant, it becomes the raw material for business intelligence operations.

High-end BI tools will analyze the available data pooled from different sources and turn it into actionable insights. Having them at their fingertips, business analysts, marketing experts, and other specialists will identify current trends and forecast future ones, build predictive models, and plan the organization’s campaigns accordingly. Such knowledgeable decision-making is critical to obtaining a competitive edge and driving business growth.

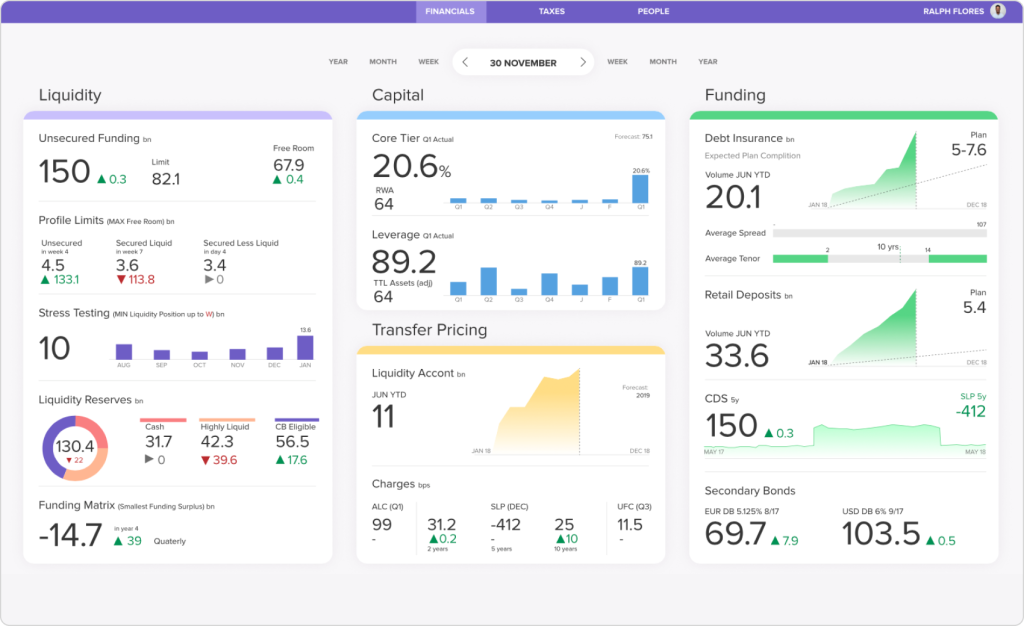

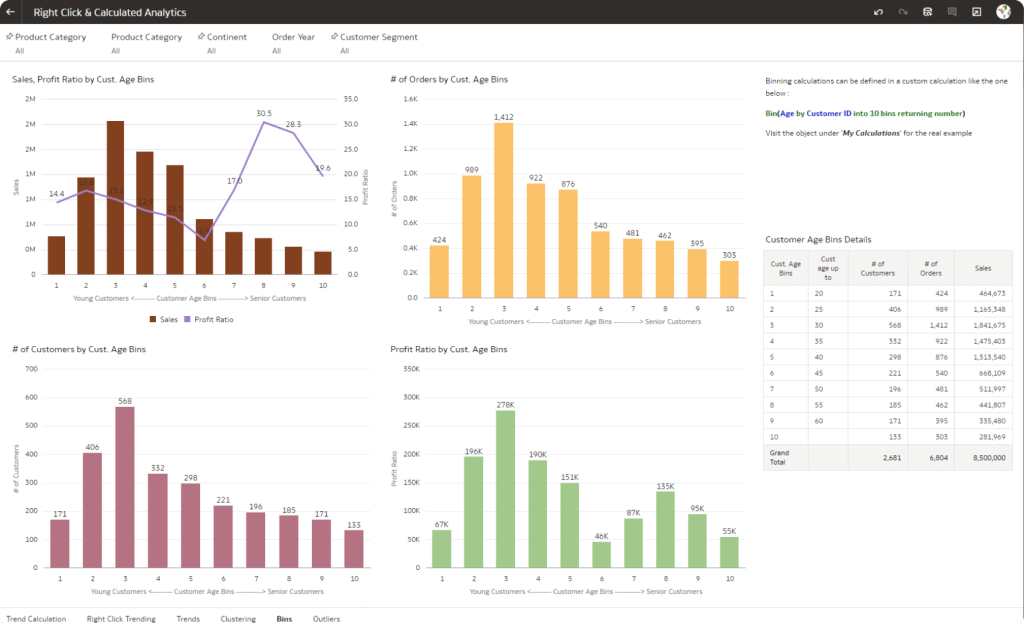

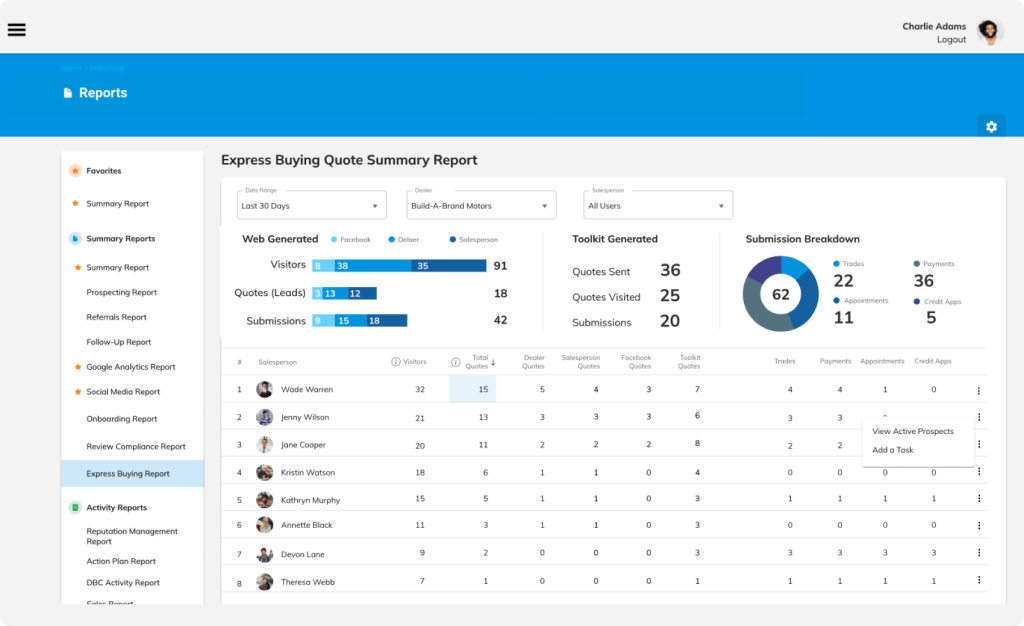

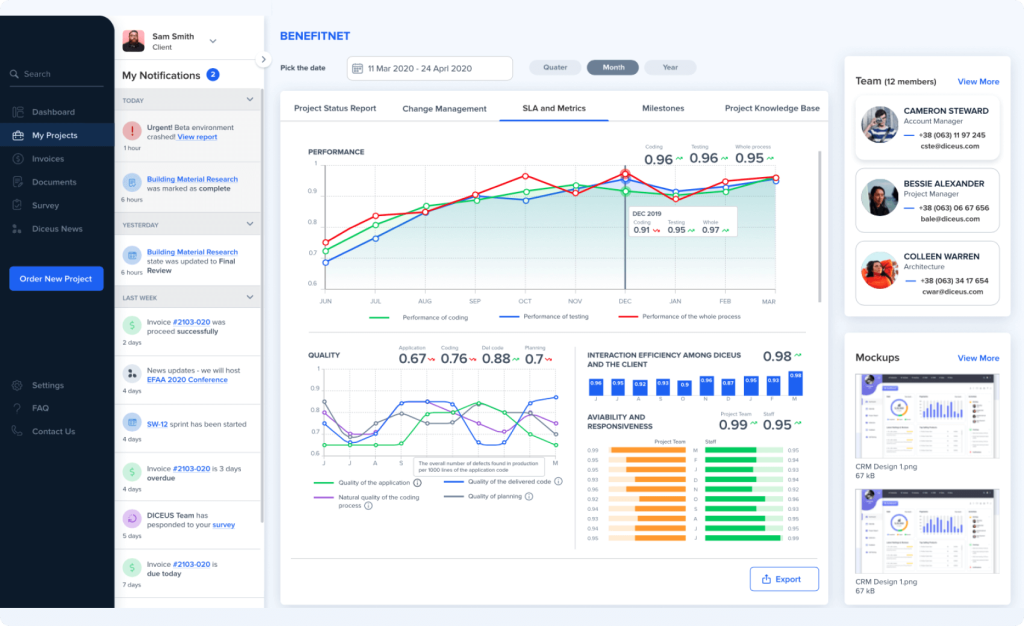

Examples of data analytics for effective decision-making

Benefit 3 — Improved customer experience

The data subjected to in-depth analytics initiatives concerns not only the internal pipeline of financial institutions. Equally important is the processing of client-related information. When a bank understands its customers’ behavior, preferences, and pain points, it can implement customer segmentation, improve client profiling, and provide them with tailored recommendations, relevant offers, and targeted services. Such personalization efforts will augment customer satisfaction, build trust and confidence among the clientele, and foster brand loyalty.

Moreover, when the data governance policy is efficient, it will ensure a seamless customer experience across multiple touchpoints. Thanks to robust data sharing between the bank’s branches and departments, clients will obtain consistent service of first-class quality no matter what interaction channel with the financial institution they opt for.

Also, data governance initiatives implemented in compliance with GDPR and other regulations guarantee the complete protection and safety of customer data via harnessing secure mechanisms for capturing, updating, and storing customer data.

Learn more: How to improve customer experience in insurance

Benefit 4 — Reduced manual and redundant operations

Modern banks can’t hope to survive under the deluge of tons of data, to say nothing of outstripping their competitors and satisfying clients. They can make head or tail of it only by employing specialized high-tech tools selected by the stipulations of a well-thought-out data governance strategy. Robotic Process Automation (RPA) and state-of-the-art AI-driven solutions are second-to-none mechanisms for augmenting operational efficiency.

They will allow banks to eliminate redundancies, ensure data consistency, reduce errors, minimize the negative impact of the human factor, automate repetitive tasks, and orchestrate efficient data processing. As a result, access to, retrieval, and sharing of information are streamlined and facilitated, which takes the delivery of financial services and the company’s productivity to a new level.

Read our latest article “Data migration strategy: Best practices and key pitfalls”

Benefit 5 — Reduced operational costs

Manual data management is not only an ineffective, slow, and tedious routine. It is also an expensive one. Employing personnel to process multiple records and dossiers wastes your financial and human resources but brings you nowhere regarding labor productivity.

By entrusting data governance processes to machines and technologies, you get the same or even better results within a shorter time and free your workforce to solve more creative or complex tasks. Another money-saving opportunity is harnessing the self-service capabilities of first-rate data governance solutions that enable the drastic depreciation of operational expenditures. Banks can enjoy all these benefits if they implement a data governance program correctly.

Learn more about our banking data warehouse services

The essentials of a data governance framework

Having accomplished multiple data projects in the banking industry, we know that creating an adequate data governance framework is mission-critical for success. Indeed, it should dovetail with the unique needs of an organization. Yet, some universal aspects must be considered while developing it.

- Standardized regulations and rules. They include both external and internal guidelines that serve as the source of benchmark principles for data processing, management, and maintenance.

- Quality standards. These should ensure data’s reliability, accuracy, and consistency across the financial institution.

- Transparency. All data governance procedures should be straightforward and clear-cut so that any employee, auditor, or stakeholder should understand how data handling is performed.

- Accountability. The framework should define data ownership and lay out the responsibilities of the persons in charge.

- Data administration. A dedicated data administrator (data steward) should be appointed to oversee and manage data governance. We recommend choosing such an official from the non-tech departments of the bank. Implementing data governance initiatives will be perceived as an organization-wide endeavor, not a siloed IT issue.

As you see, data governance implementation requires professional skills and in-depth experience both in the field of data processing and in the banking industry in particular. DICEUS can map out a data governance program for your organization and provide fintech tools to implement it. Contact us to give your bank’s data-handling pipeline a powerful boost.

Conclusion

Contemporary banks struggle with managing enormous amounts of workflow, business, client, and other data. By onboarding an efficient data governance strategy, they will not only step up their data processing routine but also reduce manual operations, cut costs, ensure regulatory compliance, improve customer experience, and pave the way for more data-driven decision-making. To succeed, it is necessary to enlist the help of an experienced vendor who will assist banks with creating a custom data governance model and develop a set of bespoke data tools.

FAQ

What is data governance in banking?

It covers various measures to enhance banking data access, control, and management. Its best practices include appointing a data steward, ensuring data security and regulatory compliance, establishing data format standards, assessing data handling efficiency, harnessing automation, and more.

How to incorporate data governance in banking?

It all starts with developing a comprehensive data governance strategy and framework. They contain the employees responsible for implementing transparent and standardized data management rules and tools to be leveraged. You can implement the program across the organization when all these are laid out fairly and squarely.

Why is data governance important?

Contemporary banks collect, store, and process tons of information related to the internal pipeline, customers, legal regulations, etc. If these data are kept in disarray or mishandled, financial institutions will suffer from inefficiency, low productivity, customer dissatisfaction, regulatory non-compliance, and excessive expenditures. Implementing adequate data governance will address these problems.

Where should data governance reside?

Organizations differ as to who should be held responsible for data governance. They may position it under the Chief Financial Officer (CFO), Chief Risk Officer (CRO), Chief Operational Officer (COO), or even Chief Privacy Officer (CPO). Yet, the wisest course is to appoint a dedicated employee – the Chief Data Officer (CDO) – who will focus solely on creating and implementing a data governance program.