Big data in banking: Uses and future prospects

Disruptive technologies that emerged recently are driving a major increase in the number of financial transaction devices. Even more, their number is growing in proportion to the users’ capabilities. On the other hand, more reliable information is required to correctly assess customer needs for individual products. That leads to an increase in the amount of data that requires high-quality collection, structuring, and analysis.

In this article, we examine the tasks of big data in banking, possible related issues, and ways to implement big data efficiently.

Do you have any challenges with data in your organization? We can help you.

Check out our big data consulting services.

How has data handling changed so far?

If earlier bank employees had known customers by sight, the situation would have changed radically today. These are fundamentally new service models. People can get services remotely. As a result, their number grows, whereas paper media slows down processes, and it becomes more difficult for banks to win the favor of customers.

The task is solved by the total collection of digital personal data. A user electronic portrait is formed — the information is collected from all available sources. The analysis of user behavior also generates additional amounts of data, but online monitoring is indispensable.

What is big data?

Big data is an ever-growing volume of information of varying structures and formats. Some of its major sources may include:

- World Wide Web (social media, media publishing outlets, blogs, etc.)

- Data collected by user devices (computers and mobile gadgets)

- Corporate assets (archives, databases, etc.)

- Search inputs

Conventional computer systems are not trained to work with such a variety of data sources, and they can’t cope with them appropriately.

Impact of big data analytics on the banking sector

A traditional bank has always been associated with painstaking work with financial securities. However, new technologies have changed the way bank employees work. In recent years, convenient, personalized, and secure solutions have emerged that have never been native to the industry. First of all, these are AI and ML, which are developing at a frantic pace today in various areas.

The use of big data in banking makes it possible to improve service quality and stimulate customer flow. This leads to the emergence of new products that better meet current requirements, which in turn drives demand, sales, and retention.

The analysis provides development prospects by improving decision-making and responding to requests. Customers who appreciate convenience are more likely to use mobile apps. In turn, this requires processing larger amounts of information online. Transactions are accelerated and simplified, so there will inevitably be more of them. As a result, the entire industry is modernizing, becoming more profitable, and diving deeper into the latest innovations.

Learn what we do for banks:

- Online banking

- Core banking

- Mobile banking

- Artificial intelligence

- Robotic process automation

- Data warehouse

The use of big data in the financial industry

One of the most promising areas today is the in-depth study of user data. Actually, this is a kind of correspondence dialogue with a client, which allows for identifying their requests and, based on them, providing recommendations and services.

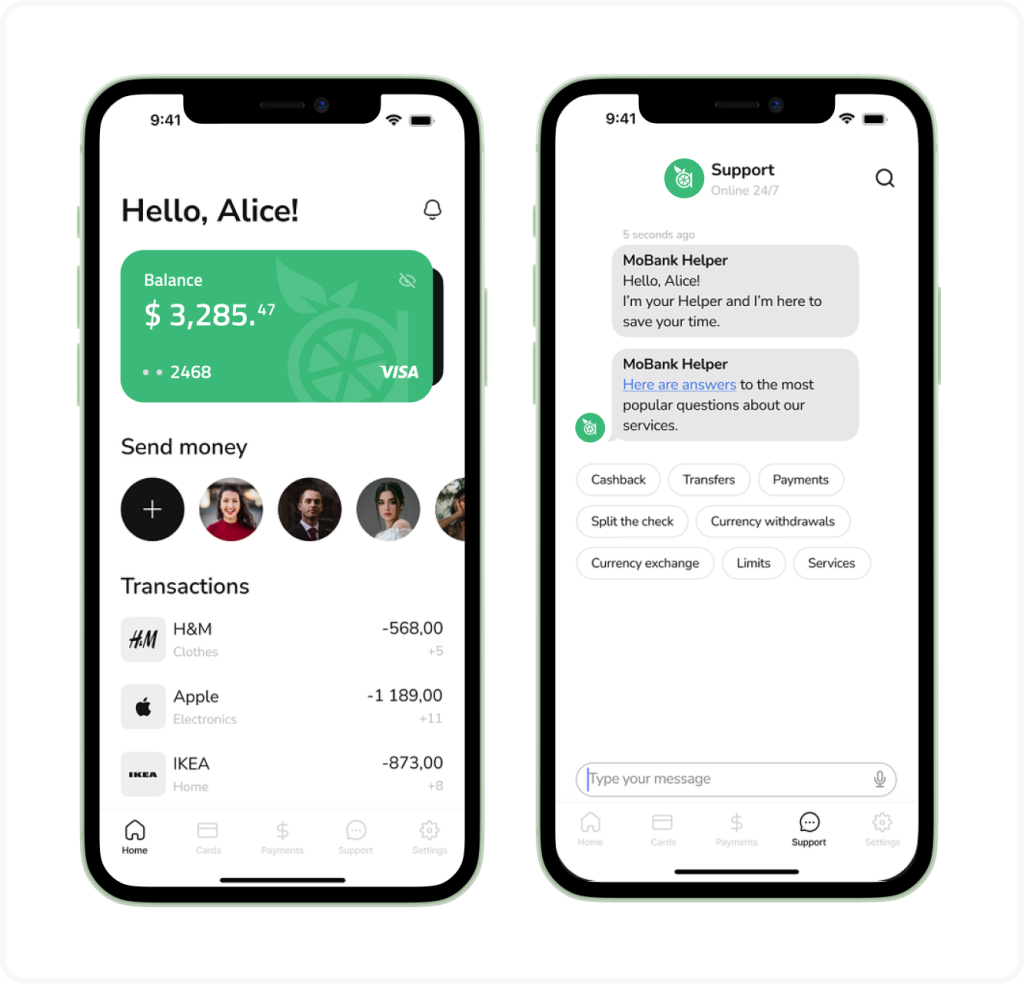

For this, AI-based applications are used; they provide recommendations for reducing costs, preserving savings, and investing. For example, a well-structured notification system works selectively, making it easier for users to pay for services on time, avoiding erroneous payments, etc.

Tracking transactions in real-time helps you identify habits, optimize performance, predict profit growth patterns in consumer behavior, and offer services at the right time. This increases conversion rates.

A modern user should receive an answer to any of their questions around the clock. Robots help in this matter — they process requests as quickly as if the client were directly in the department. Moreover, full-on virtual banks are already working perfectly, having abandoned the usual branches with cash desks and other inherent attributes.

DICEUS has big data expertise. Here’s what we offer.

What are the perks of leveraging big data in the banking industry?

Zooming in on the assets of big data in banking

Financial organizations that implement big data solutions in their pipeline routine declare the following workflow improvements.

- A comprehensive view of business. A bank receives a complete picture of its shop floor processes – from internal productivity to client behavior patterns and current market trends. With such information at the managers’ fingertips, banking institutions can make data-driven decisions and improve their business indices.

- Business process optimization. When combined with AI mechanisms and ML algorithms, big data technologies enable monitoring performance metrics, ushering in greater operational efficiency and significant cost savings.

- Augmented customer satisfaction. Since banks and other financial institutions assemble and hoard tons of customer data, they can analyze personal and transaction information of their clientele and customer spending patterns to offer personalized customer service, administer targeted marketing campaigns, and take other steps to improve customer experience.

- Granular customer segmentation. Banks gain valuable insights from digging into their clients’ spending habits and user behavior that serve as a key to classifying the customer base into smaller groups and launching relevant marketing campaigns specifically targeted at a narrow audience.

- Implementation of algorithmic trading. Such systems applied to data collected by banks excel at making faster and more efficient trading decisions than human personnel are capable of.

- Rock-solid cyber security. Big data analytics tools are highly instrumental in all data security initiatives, helping financial institutions detect fraud, forestall malicious practices, and comply with data security regulations.

Among all those boons, first-rate customer experience is the chief priority.

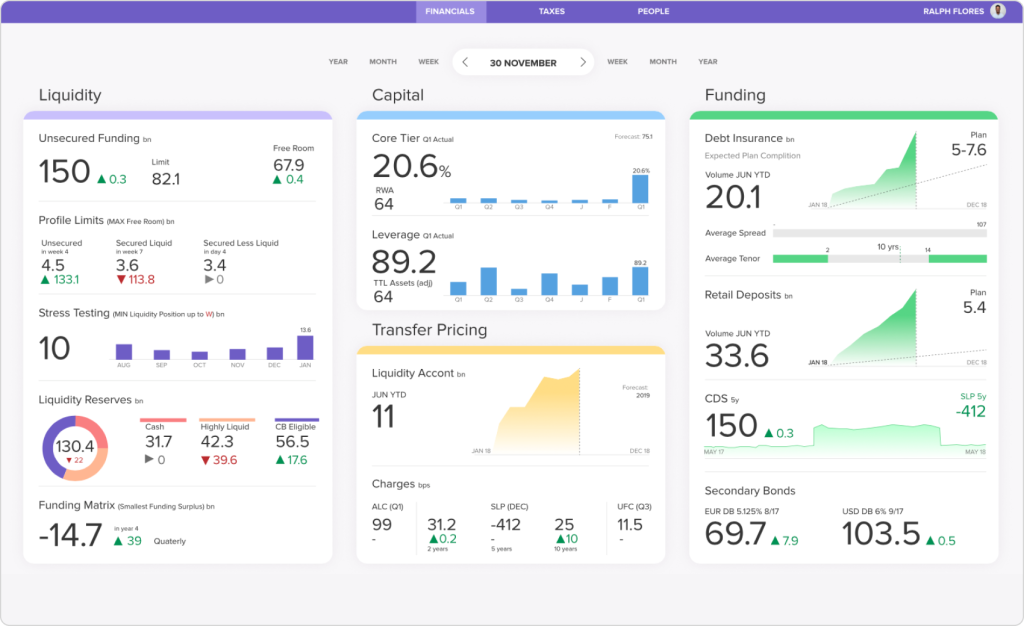

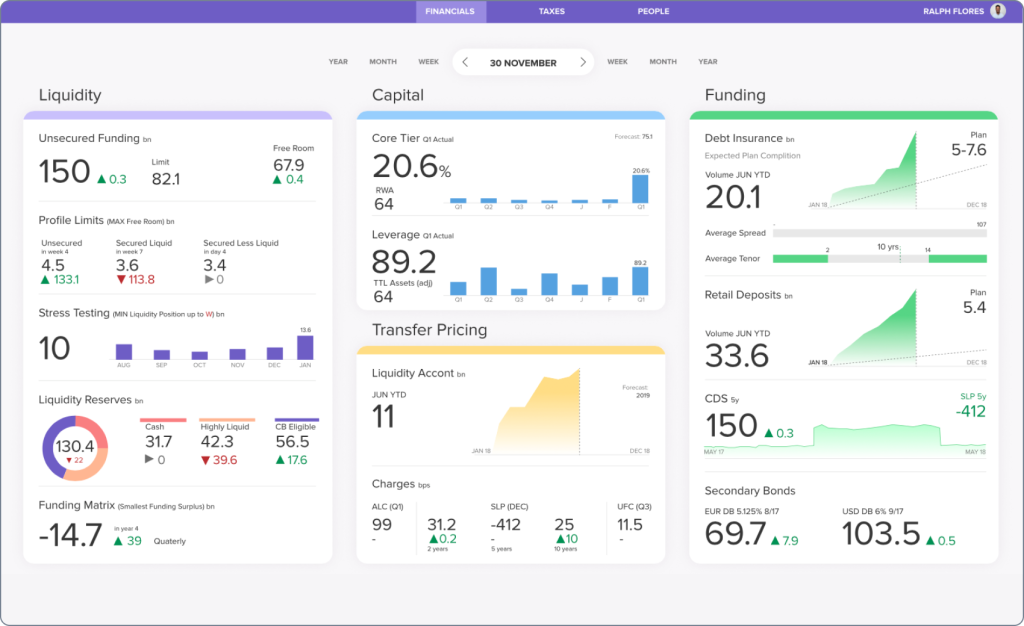

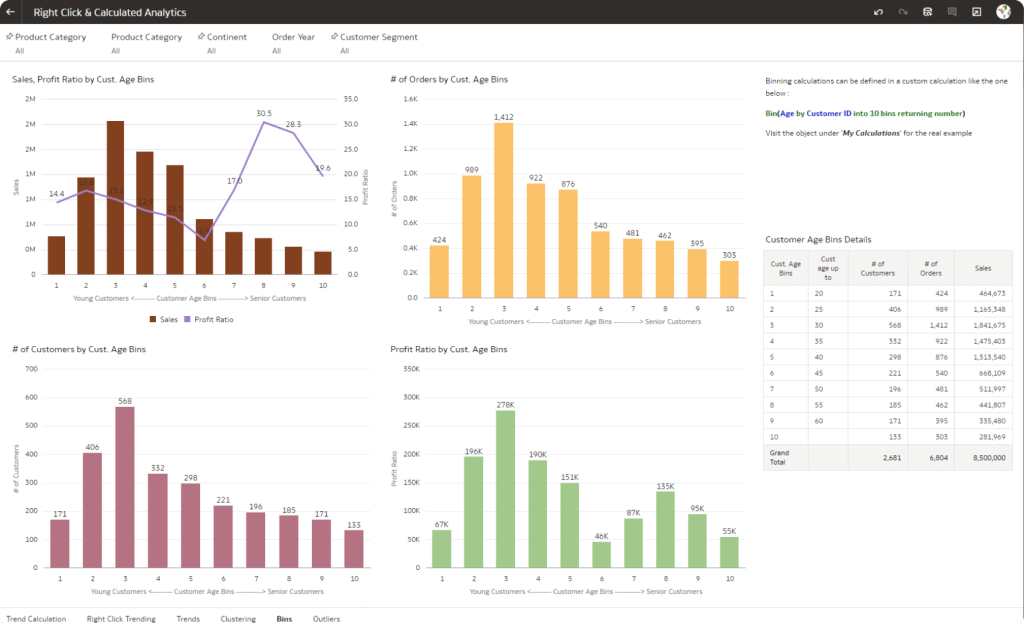

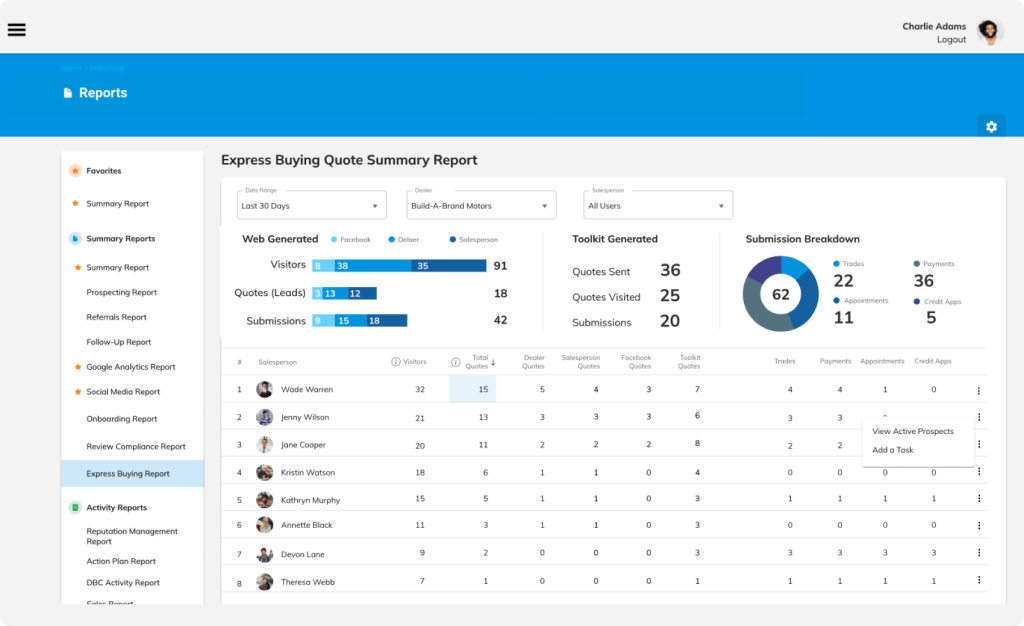

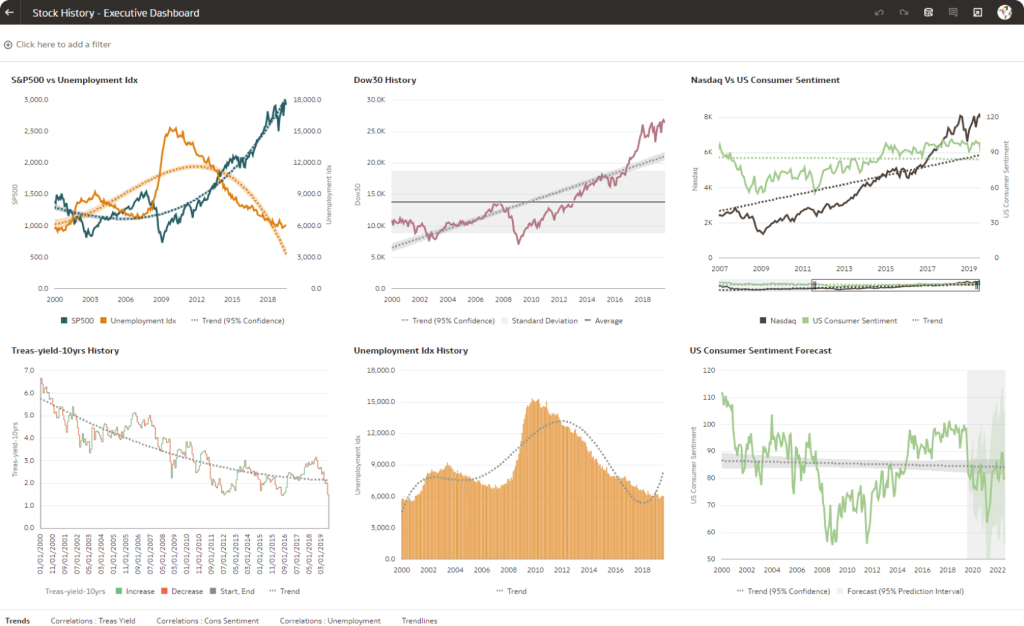

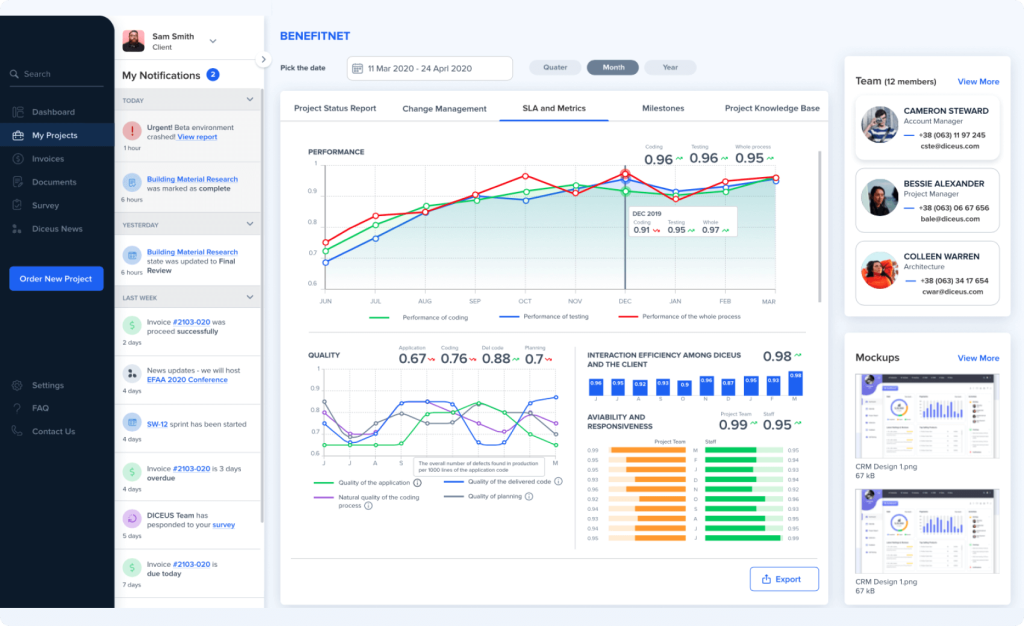

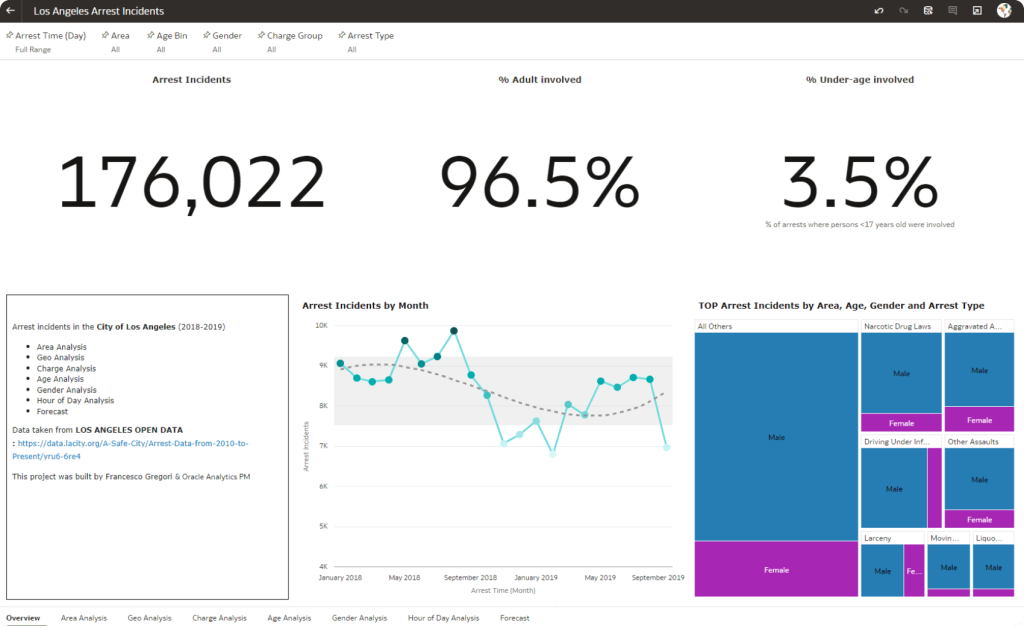

Examples of big data visualization on various dashboards

The importance of customer experience

It just so happened, but it is an indisputable fact. Due to the specifics of social networks, today’s customers are more willing to share confidential information. Perhaps their attitude towards this issue will not change in the near future. This means that its value will increase. Just one good analysis of mobile apps or social media activity can replace costly and lengthy surveys.

Comprehensive and in-depth analysis allows you to evaluate receipts to accounts and draw conclusions about the standard level of income/expenses, which sources of income are more stable, and through which channels the client prefers to conduct transactions.

Understanding the nuances of the user environment allows you to draw conclusions about possible risks and prevent fraud. This makes it easier to make informed decisions, including on the possibility of extending loans and assessing the associated risks. In addition, it helps to cope with compliance checks, audits, and reporting and reduces overhead costs.

To summarize, banks are using new technologies for the following tasks:

- Receiving reports faster

- Preventing suspicious transactions, fraud, and money laundering

- Analyzing clients’ income and expenses

- Reducing credit risks

- Creating personalized banking products

Big data implementation is highly beneficial for both neobanks and traditional financial institutions, however, it often faces pitfalls and bottlenecks banks must learn to avoid.

Challenges of embracing big data in the financial industry

As is the case with everything new and complex, the use of big data in the banking sector can have certain problems defined below.

Legacy infrastructure

The banking sector innovates too quickly. As a result, most of the existing systems are unable to cope with the growing workload. In collecting, storing, and analyzing data, outdated infrastructure becomes an obstacle that jeopardizes system stability and the implementation of advanced analytics tools.

Security issues

The use of systems that are not designed for big data creates risks. The security system must guarantee the sturdy protection of incoming user information.

Huge data volumes

When processing a large number of different types of data, there is a possibility of encountering certain technical difficulties. Implementation of big data is in the interests of any financial institution, but some things require the high professionalism of the staff. Therefore, banks should first consider upgrading their existing infrastructure before embarking on a big data strategy.

Moreover, the amount of data generated during operations grows exponentially over time. Financial organizations should envisage the scalability of their IT ecosystem and its ability to accommodate the increasing amounts of personal and financial data they work with.

Regulation requirements

The industry is governed by strict regulatory requirements such as the Fundamental Trading Book Review (FRTB), for instance. Those tend to be scrupulous about privacy, access to user data, and speed of reporting. This can significantly slow down the transition to new technologies; however, there is no other way.

To use big data, a financial institution must be mature enough, both from a business and IT perspective. Artificially, without the direct need and the existing infrastructure, this is impossible.

Data quality and integrity

If the data collection a financial institution possesses contains inaccurate or incomplete data, it can tell negatively on the outcomes of the big data analysis and the organization’s overall functioning. That is why banks should provide first-rate data quality management and ensure their EDW stores only well-structured data that is accurate, complete, consistent, relevant, understandable, and kept in easy-to-read data formats.

Data silos

It can happen when a financial institution has numerous departments and branches, each relying on its own (often on-premises) infrastructure and isolated software environment. In this case, data can’t move freely across the organization and serve as the single source of truth. Banks should eliminate all barriers to the free exchange of existing data and promote the formation of a holistic data view accessible to all stakeholders.

Considerable implementation costs

High-end big data solutions capable of processing huge quantities of current and historical data are big-ticket items. For smaller banks, launching and maintaining big data ecosystems can be prohibitive, yet this is the only way for contemporary financial organizations to keep abreast of novel trends, retain customers, and hone their competitive edge.

Skill dearth

As the application of big data analytics in banking soars, the demand for qualified professionals who can develop such solutions also increases. That is why far-sighted actors in the financial services industry are constantly on a hunt for skilled big data experts who can consult on the peculiarities of its implementation and create a custom big data product to suit an organization’s needs and requirements.

Customer trust

Aiming to provide more personalized services, financial organizations track customer behavior and collect heaps of valuable data on their clientele. The latter increasingly voice concerns regarding the way their personal and sensible data is used and clamor for complete transparency of data handling procedures. Without fostering clients’ confidence and reacting adequately to customer feedback, banks can’t hope to build trustful relationships with consumers of their services.

If financial organizations pay close attention to the above-mentioned aspects of big data implementation, they will pave the way to the successful harnessing of this technology in their future endeavors.

Big data in banking: A glimpse into the future

As a vetted IT company with rich experience delivering top-notch banking solutions, DICEUS believes that big data will find wide application in the following domain niches.

- Risk management. By analyzing transaction history and customer behavior in real-time, banks will be able to detect potential threats, generate risk assessment reports, and step up their risk management processes in general.

- Fraud prevention. When the power of big data is bolstered with the employment of machine learning algorithms, financial organizations will be able to detect patterns and anomalies in transactions and nip fraudulent activities in the bud.

- Customer profiling. Banks can analyze a wide scope of client data (including transaction history, spending patterns, online behavior, social media activity, and more) to assess people’s credit scores and make data-driven lending decisions.

- Operational efficiency. The internal data banks collect will enable them to identify underperforming departments and employees, pinpoint areas for optimization, reduce OPEX, and improve performance across the organization.

- Predictive analytics. Reacting to events that happen is a poor business approach, leading to failures. Predictive big data solutions sift through a plethora of market data and help decision-makers forecast industry trends, assess economic conditions, calculate interest rates, and perform other operations related to asset allocation, investment management, and strategic planning.

- Open banking. Big data will be at the core of a comprehensive ecosystem where multiple third-party actors develop software products around a financial institution. Thanks to data sharing and seamless integration of the ecosystem’s elements, such financial behemoths will be able to collaborate with fintech startups and launch innovative services and products.

- RegTech. Big data will play a pivotal role in regulatory technology advancement, allowing banks to monitor the ever-changing field of legal standards, meet compliance norms, and avoid violation penalties and fines.

- AI and ML integration. These two disruptive technologies can boost the power of big data manifold and lift decision-making to a new level. They improve the accuracy of predictive models, step up risk management, automate complex workflows, and reduce errors caused by human factors.

- Real-time analytics. The sophistication of big data mechanisms will create better opportunities for instant decisions, especially in those areas (like fraud detection and prevention) where prompt reaction is mission-critical.

- Individualized customer experience. The future of banking will see a tailored and interactive approach to providing financial services. Due to big data implementation, each client will be offered personalized products, which enhances customer satisfaction and promotes brand loyalty.

- Financial inclusion. A meticulous analysis of markets and target audiences will help banks pinpoint underserved population strata, get to grips with their needs, and cater to their requirements, thus fostering economic equality.

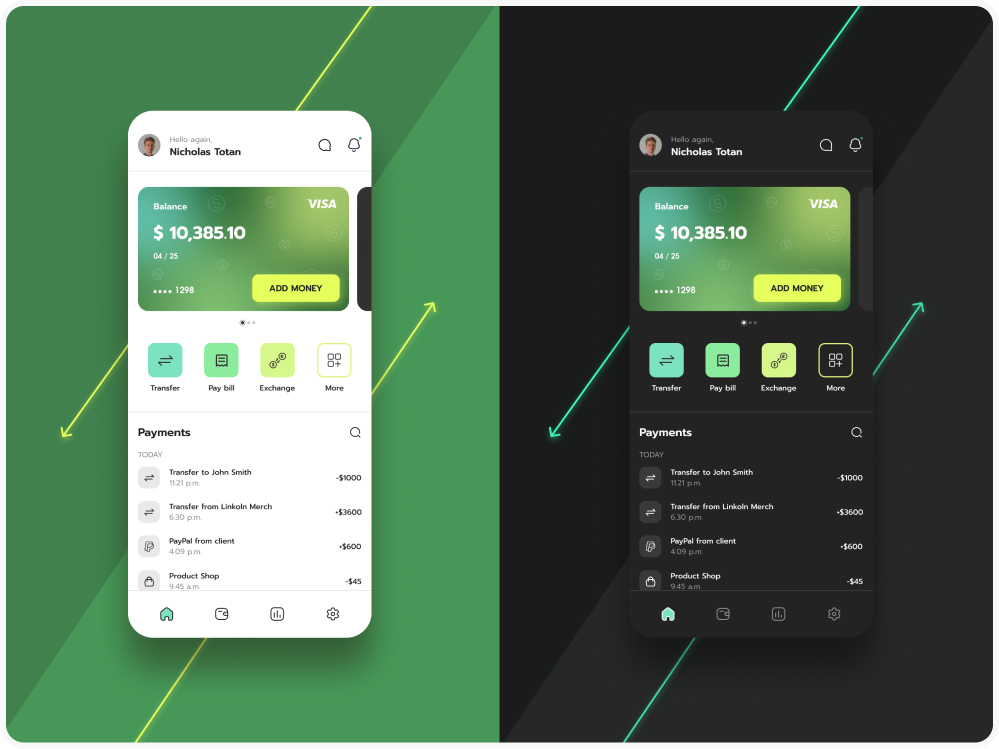

- Human-centric design. Big data is a huge repository of knowledge about customer behavior, service preferences, client pain points, and compelling needs. With such information at their fingertips, financial organizations will be able to create more user-friendly and intuitive online experiences for their clientele.

- Global expansion. With big data up their sleeve, financial institutions will find reaching out to new audiences a breeze. They can access a vast pool of information on local economies and trends dominating there, dynamics of their development, customer behavior conditioned by cultural peculiarities, and other vital data that will let them understand national markets and minimize risks associated with entering the unknown ground.

- Sustainability and social responsibility. Banks are not only about making money. These institutions (as well as all other establishments in the modern world) have environmental and social responsibilities that are increasingly becoming a tipping factor in a person’s decision to join this organization. Big data analytics will become a key to gauging the social and ecological impact of a bank’s activities and allow for the introduction of more sustainable business approaches down the line.

What we offer

DICEUS provides high-quality outsourcing services for handling big data in the banking industry, considering your existing infrastructure, functional and non-functional requirements, project risks, and other risks that may impact the outcomes.

Our experts will consult you on seamlessly transforming your data, considering all opportunities as price, operating costs, efficiency, loyalty, and many more. We can help you do the following.

- Create a strategy. The definition of a business goal is at the heart of a comprehensive strategy that spans all departments as well as the partner network. You will know where your data is going and growing rather than focusing on short-term, temporary fixes.

- Pick a suitable platform. A flexible, scalable, and secure cloud platform will allow you to collect as much data as you need in real time.

- Get started quickly. We recommend starting with the discovery phase to obtain a fundamental set of documents required for successful project execution. These usually consist of requirements, software specifications, a project roadmap, recommended team composition, and a technology stack.

Benefits

We are dedicated to delivering high-quality results. Our experience will help you improve security, make reliable predictions, facilitate secure data sharing, and increase customer satisfaction. Our experts will advise you on the best practices and approaches to implementing big data technology. They will also provide you with a step-by-step strategy for your project.

Big data in the banking industry solutions will enhance security through natural language processing, voice recognition, and machine learning. Our support team responds quickly to requests and generates valuable data to identify your strengths and weaknesses. You will be able to anticipate desires, improve personalization, and achieve increased customer loyalty, as well as your own competitiveness.

Big data development

Experts in big data software will advise you to design, develop, and test custom software based on your business goals.

We take a holistic approach to developing big data products in the banking sector according to specifications. We specialize in advanced analytics solutions. Our focus is on data warehouses, 360-degree customer view systems, data mining, and business intelligence reporting.

The support includes regular checks and reviews to ensure the solution is working correctly and delivering the expected business value to your company. Based on the results of maintenance, you receive reports with predefined indicators and recommendations for improvements.

The timing and cost of the project depend on the following factors:

- Project scope and complexity

- Selected technology stack and platform

- The urgency of the project

- Engagement: Time and Material, Dedicated team, IT staffing

Discover banking projects accomplished by DICEUS

Data warehouse for bank

Siebel to Appian data migration in banking

Secure payment gateway

Robotics process automation for payroll processing

Robotics process automation for payment processing

We will be happy to learn about your project goals, so feel free to contact us for a free 30-minute strategy session.

FAQ

What is big data, and how is it impacting the banking industry?

The term “big data” is used to describe an ever-growing amount of information in various formats and structures received from multiple sources. When leveraged in the banking sector, it can help financial organizations handle huge datasets concerning their clients and personnel, enabling them to improve their operational efficiency and personalize the services they provide for consumers.

How has big data evolved in the banking industry?

Big data as a notion was coined in the 1990s, but it got significant traction two decades later with the appearance of MapReduce and Hadoop. Since then, big data technologies experienced a boom thanks to the development and sophistication of cloud computing, in-memory know-how, and NoSQL databases. Today, big data in banking is described with the 4 Vs: volume (huge amounts of generated data), velocity (the speed of data generation and processing), variety (multitude of data types and formats), and veracity (trustworthiness of collected information).

What are some real-world examples of big data analytics in banking?

JP Morgan and Chase leverage big data to analyze customer behavior, dissect the US economy, and read into future trends. Goldman Sachs employs the technology to identify lucrative investment opportunities. American Express relies on big data in fraud detection. BlackRock utilizes the technology to develop effective asset management strategies. For Morgan Stanley, big data is the key to portfolio analysis optimization, understanding marketing dynamics, and assessing risk factors.

In what ways does big data benefit modern banking?

By making big data solutions part of their IT infrastructure, financial organizations optimize their pipeline operations, obtain a comprehensive view of business, boost their cyber security, fraud detection, and risk management, implement algorithmic trading systems, achieve granular client segmentation, and dramatically increase customer satisfaction by personalizing their services.

What are the key challenges and concerns regarding big data in banking?

When embracing big data, financial organizations should modernize their legacy infrastructure, envisage upscaling opportunities of respective software, ensure data quality and integrity, avoid data silos, take care of security issues, comply with legal regulations in the sector, foster customer trust, allocate considerable budget, and find qualified IT specialists to implement big data solutions.