Oracle FLEXCUBE core banking: DICEUS expertise

The global economy remains fragile due to many factors, including the Russian invasion of Ukraine, disruptions in supply chains, inflation, and tight monetary policy. The Central Bank continually increases interest rates and reserve requirements for banks.

The challenges banks face globally continue to grow. Deloitte named the need to fortify the core and put a customer at the center among the major challenges. Other challenges include legacy software and data quality. Most banks have started their digital transformation and are investing in advanced technologies like big data, artificial intelligence, and blockchain. However, many of them are still far away from their goals.

Check out what services we deliver to banks.

In this article, we would like to tell you about the universal core banking system built by Oracle and called FLEXCUBE. This system can help banks overcome the above hurdles to comply with current regulations and improve most of their operations. You will also learn about our expertise in Oracle FLEXCUBE software by examining the associated case.

In this article, we would like to tell you about the universal core banking system built by Oracle and called FLEXCUBE. This system can help banks overcome the above hurdles to comply with current regulations and improve most of their operations. You will also learn about our expertise in Oracle FLEXCUBE by examining the associated case.

What is FLEXCUBE?

FLEXCUBE is an automated universal core banking software built and introduced by Oracle Financial Services. The system is used by banks and financial organizations. It provides customer-facing core banking functionalities, ensures a holistic view of all customers and enhances collaboration between bank employees and consumers.

Due to FLEXCUBE’s open-source environment and multiple APIs, its users can create their business logic, interfaces, and integrate the system with third-party applications. This international core banking system is compliant with various regulations and suitable for any bank in most countries of the world. According to 6sense, as of 2023, Oracle FLEXCUBE is used by more than 970 companies as a banking tool.

Download our free guide:

“How to upgrade your core banking system like Oracle FLEXCUBE in 12 months”

The banking challenges FLEXCUBE solves

In a competitive environment, FLEXCUBE allows banks to benefit from the following:

- Replace legacy systems with a universal solution

- Get a holistic view of customers

- Integrate with other applications

- Move to the centralized processing of big data

- Use analytical tools to evaluate customer needs in new products and services

- Provide high-level customer support

- Easily change or replace products according to the market or regulatory demands

- Support omnichannel delivery of banking products and services

- Reduce expenditures for operations and increase revenue

FLEXCUBE can propel banks toward digital transformation and innovation. It offers embedded machine learning and artificial intelligence frameworks that allow banks to get valuable data about clients’ segmentation, attrition, and lifetime value.

By the way, the FLEXCUBE system supports several deployment environments according to banks’ specific needs and offers excellent open banking capabilities.

Related article: Artificial intelligence in banking sector

Oracle FLEXCUBE features

The major features of FLEXCUBE are as follows:

- Responsive UI

- Personalized UX

- Core functionalities for traditional and non-traditional banking

- Machine Learning

- Blockchain

- Data privacy and regulatory compliance

- Biometric face recognition

- Multi-language, multi-currency, multi-entity operations

- Support for multiple deployment environments and banking ecosystems

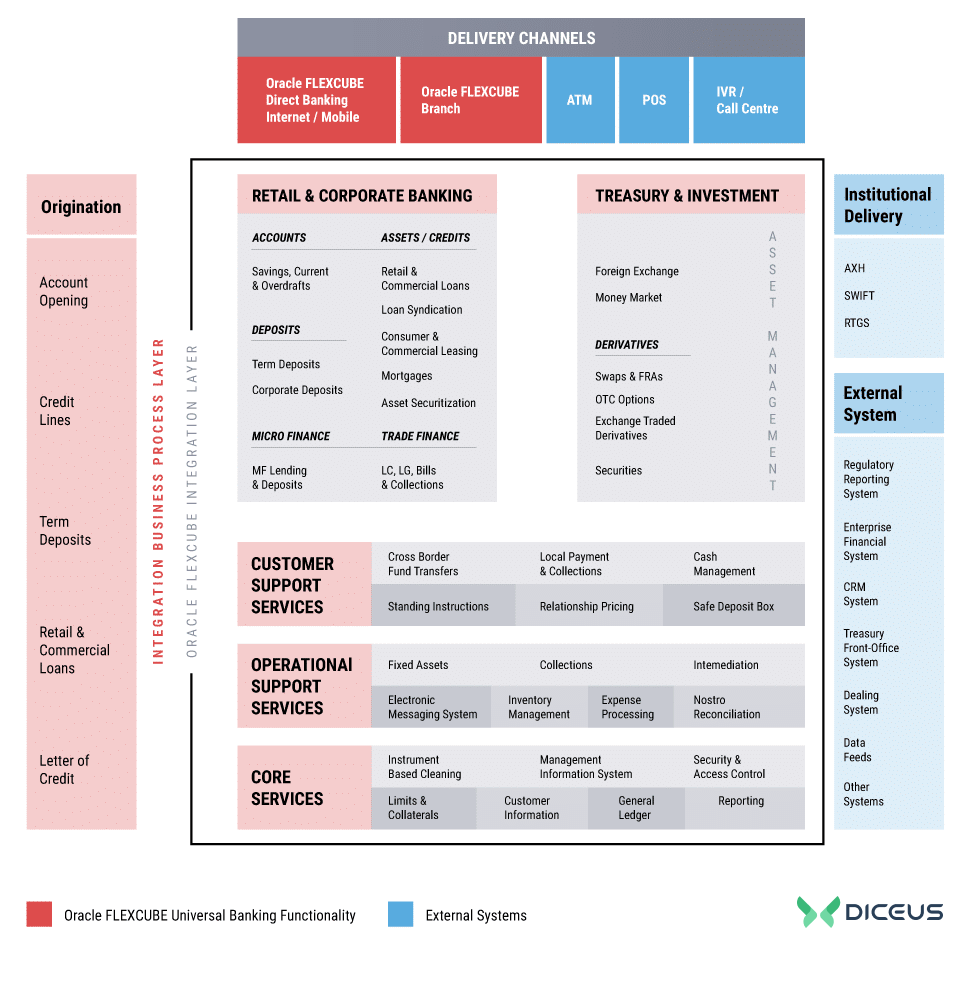

FLEXCUBE functional modules

Oracle FLEXCUBE core banking software benefits

Today, any financial services business is searching for new ways to grow and prosper. Modern core systems meet this need and provide the following benefits:

Omnichannel banking. The system supports omni-channel banking. Customers can interact with the bank via multiple digital channels such as mobile apps, online banking, ATMs, AI-powered chatbots, and branches. Thus, banks can ensure a consistent and unified customer experience regardless of the channel they choose. Moreover, an omnichannel approach to customer experience simplifies customer journeys and reduces paperwork, manual jobs, and operational costs.

Innovation. To retain customers and attract new prospects and leads, banks can use modern core banking software. By optimizing their capabilities to create customer-centric products and services, banks can significantly improve time-to-market and revenue. FLEXCUBE differentiates from similar products by its flexibility and multiple customization options.

Agility. Modular solutions allow banks to be more agile in the future. It means they will be able to implement various change requests faster or adapt to emerging conditions. FLEXCUBE is a microservices-based platform – developers can work with a single functionality without a significant impact on other modules.

Integration. FLEXCUBE provides fast integration with third-party applications to meet the needs of large banking ecosystems. It has all the needed APIs and libraries to be smoothly integrated with third-party fintech solutions, digital payment providers, and other banking platforms. Therefore, banks can easily and quickly expand their service offerings, innovate faster, and create new revenue streams through partnerships and collaborations.

Cost-effectiveness. FLEXCUBE is an excellent way to migrate from legacy systems. It is fully compliant with current regulatory requirements, customer needs, and expectations. The system supports various deployment environments and reduces costs for innovation.

Data analytics. The system captures valuable insights from customer data, transactions, and market trends, enabling banks to make data-driven decisions, identify opportunities, and mitigate possible risks. Thanks to advanced data analytics, banks can optimize pricing strategies, improve product offerings, and enhance risk management practices.

Learn more about best banking software

DICEUS expertise in FLEXCUBE

Our former Account Director Volodymyr Korotich has kindly shared his knowledge about DICEUS expertise in FLEXCUBE. Below, he talks about one of the recent business challenges our client met during the coronavirus outbreak.

“As for today, we continue working on the development and maintenance of a database warehouse needed to support decision-making processes within the bank. There are particular data about sales, customers, and financial balances generated by DWH from multiple systems. Bank management, risk management department, sales department, and general office make decisions, i.e., some changes are made in product categories, and deposit and credit rates are being increased or decreased. Management is done via monitoring the indicators in the warehouse. The source of this knowledge is a specific range of systems, one of which is the core banking system.

In general, there are over 100 core banking systems in the world. FLEXCUBE is just one of those. Previously, its name was iFlex until 2005, when Oracle acquired it for $900 mln from an Indian software provider. FLEXCUBE core banking consists of multiple modules. It continually evolves with the market and regulatory demands that are met and implemented by local system integrators. Central banks inside each country regulate the financial policy. Thus, banks should comply with these policies on different levels, including liquidity.

Core banking is the fundamental general ledger that allows banks to manage their core operations. It serves for opening accounts, payment of credit, and deposit interests. It is also the primary source of information about customers and the most important bank information, consequently.

Our team was involved in an urgent change request associated with FLEXCUBE’s credit module. Due to the coronavirus outbreak, many world’s central banks issued directives in terms of which commercial banks had to restructure credits and payment schedules. That’s because many people lost their jobs and couldn’t pay interest on mortgage loans.

However, the core banking system is not intended for these functions, as any product changes can be considered fraud. Our client was able to solve this issue with data deviation between analytics and reporting caused by the changes made in the system.

The change request from the client’s side was transferred to our team for analysis. Together with an Oracle engineer and FLEXCUBE database consultant, our developers managed to implement the change within a few weeks. We performed a series of tests: smoke testing, regression testing, and integration testing.

Due to the coronavirus pandemic, central banks have obliged banks to restructure loans. That decision has affected most banks’ operations and changed significantly their plans for 2020. To implement this request, calculate a new model and connect it with future payments, and find the gap, every bank had to perform substantial analytical work. All this should be confirmed with corresponding legal documentation and be technically implemented. Our team has managed to deliver the change under a tight schedule successfully.”

Read a case study: Oracle FLEXCUBE credit module modification

Explore our Oracle expertise.

How DICEUS can help you by using its experience with FLEXCUBE

DICEUS develops cloud-based solutions, custom software, web and mobile applications for a wide range of industries, including banking and financial services. We have extensive experience in Oracle FLEXCUBE, Oracle Java, Oracle Siebel CRM, and other Oracle solutions. Our teams can handle any change requests for various core banking modules. Feel free to get professional IT consulting, business analysis, software development, and testing services.

FAQ

What is Oracle FLEXCUBE core banking system?

Oracle FLEXCUBE is a comprehensive solution that allows banks to create and manage various types of products, from loans to Islamic banking. FLEXCUBE application supports retail, commercial, and investment banking. According to Gartner, it is ranked as one of the most decent and trusted core banking systems in 2024.

What are the key benefits of Oracle FLEXCUBE core banking system?

The system has a simple and clear user experience and a slew of important functionalities needed to manage financial operations. The solution allows financial institutions to create, launch, and manage various products: microfinance, loans, deposits, and more. Large product portfolios are easily managed and can be scaled if needed. Offerings can be tailored according to customer preferences and locations. ML-powered recommendations for product management can help improve up-selling and cross-selling efforts. The system provides advanced analytics on branches, products, customers, and business. It can be integrated with other banking systems.

How does Oracle FLEXCUBE core banking system support regulatory compliance?

The fast-evolving financial services industry requires continuous banking transformation and improvements. Banks often face complex challenges when a new regulation appears, as they should quickly develop the right strategy to comply. FLEXCUBE easily adapts to new regulations as it is highly configurable. Workflows, processes, and reporting capabilities can be adjusted to comply with regulatory requirements. Besides, the system has great reporting functionality covering capital adequacy, liquidity, anti-money laundering (AML), know your customer (KYC), and many more.

Is Oracle FLEXCUBE core banking system scalable?

The system is scalable, allowing banks to expand their operations and support growing volumes of transactions, data, and customers. It is achieved thanks to the modular architecture, horizontal and vertical scalability (by adding either more hardware or upgrading the current hardware), load balancing mechanisms to distribute processing workload across multiple nodes or servers, and more.

How does Oracle FLEXCUBE core banking system contribute to digital transformation in banking?

Implementing Oracle FLEXCUBE in banking drives digital transformation as this product supports omni-channel banking. Customers can communicate with banks through various digital channels: mobile applications, ATMs, branches, chatbots, and online banking. Excellent CX is ensured by the possibility to open accounts online or apply for a loan. Also, the system supports real-time transactions, integration with third-party fintech solutions, and RPA (robotic process automation) capabilities.