IT outsourcing banking industry: Technologies, services and trends

Traditional banking systems are closed and highly secure because they keep all processes and data inside their own ecosystems. The current market is based on ideas of trust and mutual responsibility. Outsourcing vendors sign contracts according to which they can lose up to 100% of revenue if they don’t meet the requirements.

Our company shares this vision and delivers custom products for the banking industry. We care about all stages and follow client’s needs strictly to get the best results. We offer to delegate certain tasks to our team, but the exact list of them depends on your bank’s objectives, wishes, and possibilities.

Current outsourcing services for banks

Banks can outsource nearly everything from mailing campaigns to payment processing. But IT tasks come to the fore now as they provide for digital processes. Without a robust and comprehensive in-house IT department or trusted outside partner, your company has little chance to survive and attract customers.

It’s good to check basic tools for the banking industry: administration, databases, data import, hosting, security, and support for both the front and back-office systems. Apart from traditional IT-related services, banks can outsource stuff that is moving to digital ecosystems, as well. Let’s look at three examples:

- Digital transformations. Banks actively migrate to the digital universe where they can meet new customers’ demands. IT companies serve as partners as they create and support online/digital versions of mailing campaigns, accounting tools, reports, HR management platforms, ETL processes, and so on.

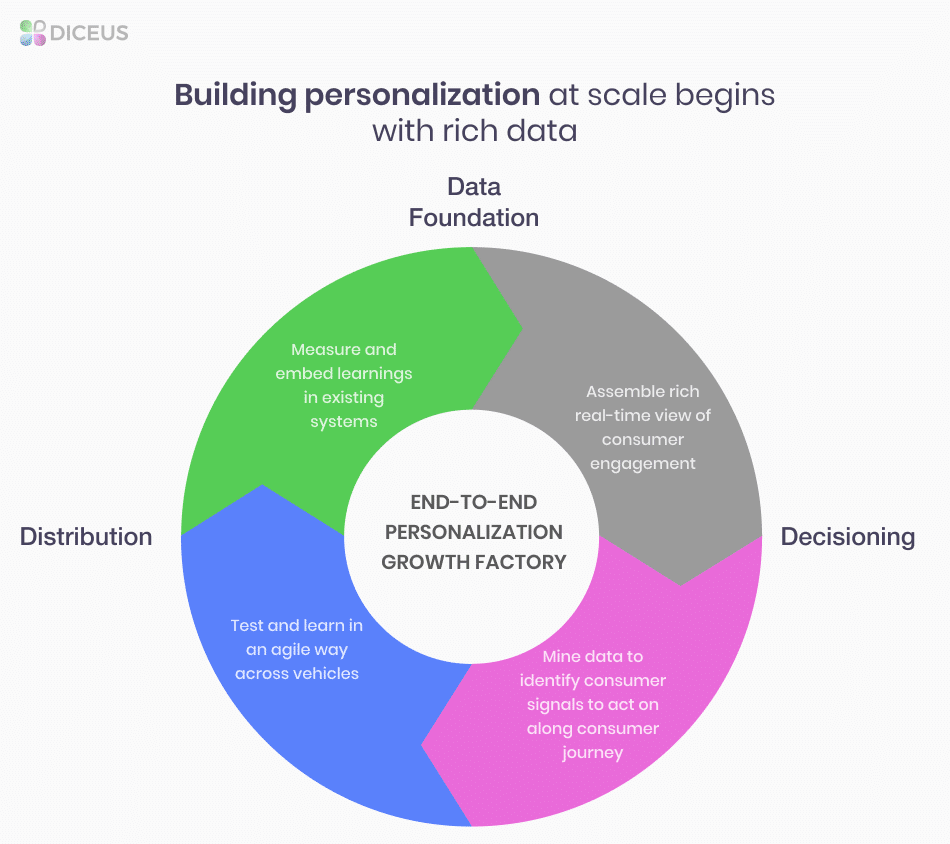

- Omnichannel solutions. Modern customers require more personalized and streamlined access to banks’ services. IT outsourcing companies can handle the migration to omnichannel platforms that provide easy access from any device. Simultaneously, such platforms facilitate real-time data collection and analysis so financial institutions can improve customers’ experience.

- Blockchain technology. Innovations rapidly change industries, and blockchain technology highly relates to the financial sector. While banks may face difficulties with decentralized platforms, experienced IT teams are ready to implement them. Thanks to blockchain-based storage and networks, your company can deliver and protect data much more efficiently.

- CRM. Banks rely on their customers’ loyalty a lot. This means that specific systems for attracting, retaining, and pleasing clients are vital for any bank that wants to grow. CRM platforms are considered as totally in-house tools because they keep sensitive information.

- BI and analytics. To deliver perfect services, financial companies have to study clients and learn their wishes. Business intelligence and analytical departments gather big data, create comprehensive reports, and suggest changes.

Interested in banking software development? Our team provides free consultations for clients!

What do banks outsource these days?

The world’s leading consulting agencies have published their insights on the progress in various industries. Particularly, Deloitte and Elixirr issue new versions of their reports dedicated to banks and finance. Here are the five most important bank outsourcing services for 2019.

- Improvement and modernization. 29% of surveyed companies plan to use IT to improve accessibility for workers and customers. 23% of them plan to modernize legacy systems.

- Cloud-based outsourcing. Online storages are highly convenient and more efficient in a matter of data loading and extracting speed. Cloud services allow outsourcers to cut costs even better and provide better performance.

- Strong focus on security. With the migration to clouds, companies focus on cybersecurity. This sector is prevailing in various bank outsourcing projects and investments.

- Several partners. The growing sophistication of industries disrupts traditional all-in-one companies. More players appear to handle unique needs, so we can expect banks to partner with several teams.

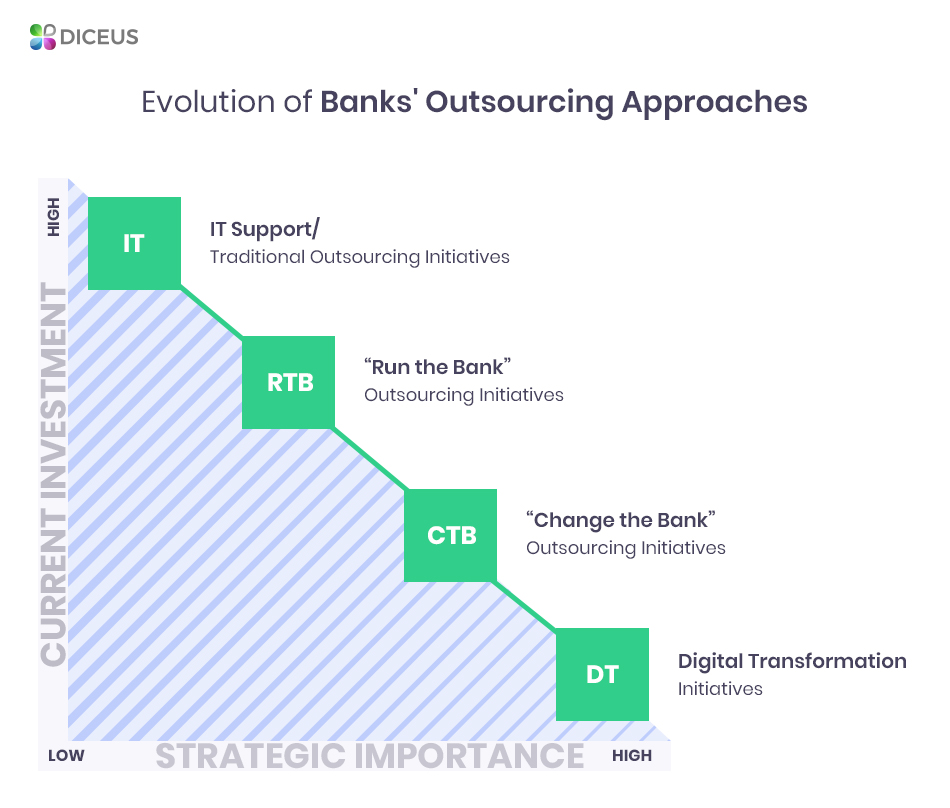

However, the most global trend relates to the nature of outsourcing. Since the 1990s, banks have delegated only tech stuff to remote companies to cut costs and free resources, but modern markets introduce new approaches.

For example, increased regulations, technological progress, and higher customer demands can lead to run-the-bank and change-the-bank strategies according to which financial facilities outsource even core and back-office processes like due diligence systems, mortgages, risk management, HR tasks, and marketing.

Modern banks have to be agile by focusing on clients and predicting their needs. Currently, the age of digital transformation has started while outsourcing partners use BI and analytics to evaluate banks’ performances, new technologies, and consumers’ engagement levels. Remote vendors implement innovative technology to create and support modern mobile and cloud solutions for banks.

Benefits of IT outsourcing for banks

We can distinguish the exact advantages of IT outsourcing for banks. Here they are:

- Save money. With an outsourced IT department, you can cut expenses related to the work of in-house employees and hardware/software maintenance.

- Improve security. Outer teams are usually skilled enough to provide for great cybersecurity.

- Focus on core tasks. A lot of banks hire IT outsourcers to hand over daily tasks. In this case, your own experts will be able to concentrate on strategic points.

- Attract customers. You get access to a rich talent pool with developers and designers that can cooperate to build a user-friendly interface that will provide users with a great experience.

Keep in mind also that financial institutions can pass on more activities besides the ones that are IT-related. Thus, banks can get even more benefits because they free more time to focus on strategic tasks.

5 technology trends in the banking industry

Here are the top trends in the fintech industry.

- AI for personalization. Customers of bank services know what they want, and they have precise requirements about the way banks treat them. The implementation of AI will help to learn the customer experience and predict their expectations.

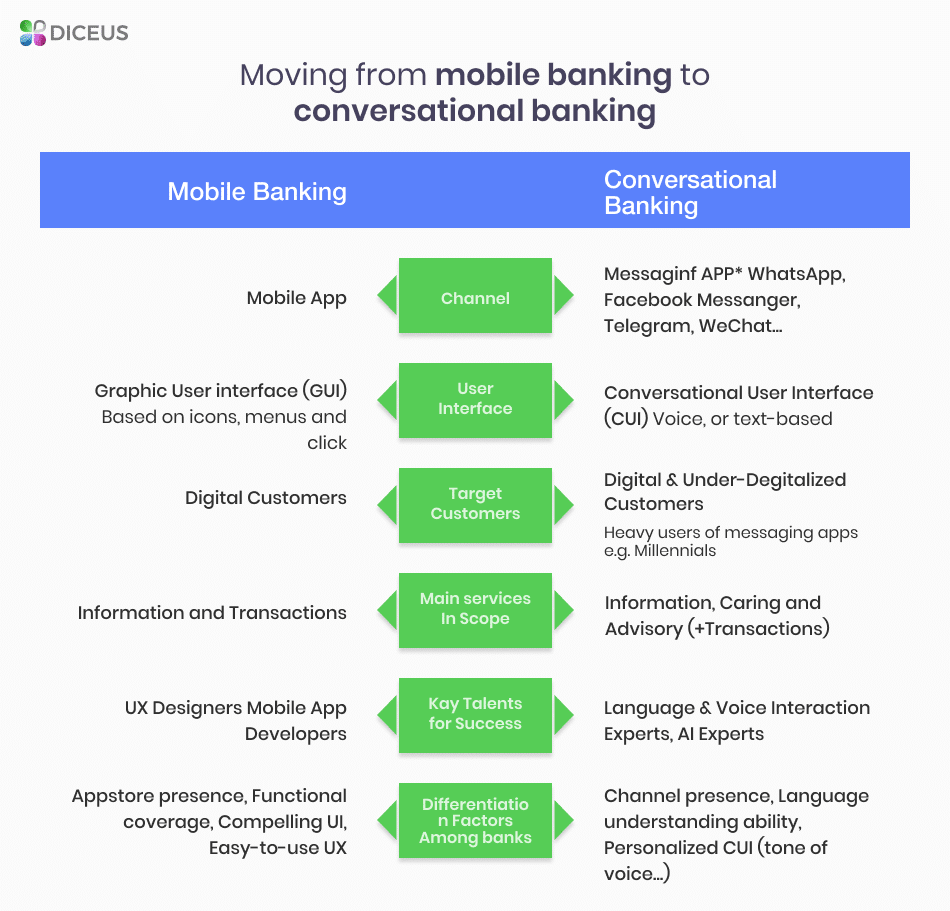

- Voice-first approach. You could have heard of “intelligent agents”. Customers can make payments with the voice commands, or they can set up regular alerts with their voice. Some experts believe that people will use voice to communicate with the banking software in the future.

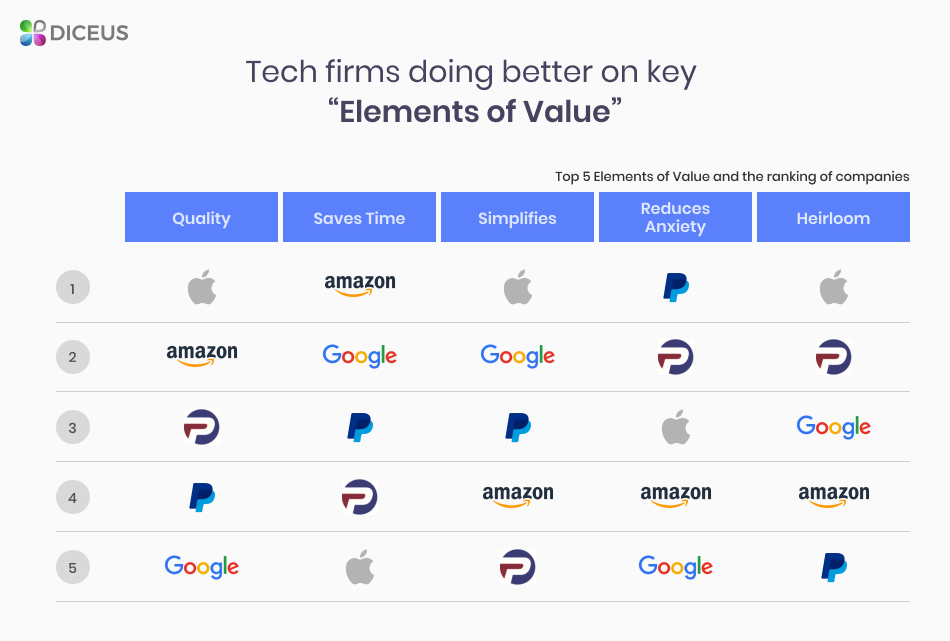

- Open API. This is a major focus of Amazon, Facebook, Apple, and other global enterprises. The major reason that banks cannot implement it in their everyday operations is a lack of IT expertise. Here’s the outsourcing that comes to the rescue. There are a few fully digital products in the banking sphere like Koto or Citibank.

- Digital banks. These are completely new solutions that have a new approach to communicating with bank clients. The reason that there’s a small number of digital-only banks is a lack of technical expertise. The implementation of digital-only approach requires finding such expertise somewhere outside and outsourcing software development services may truly help.

- Technology for privacy and security. People tend to trust companies that are open for big tech companies like Google or similar ones. If you plan to introduce a new software product on the market, it’s good to have such enterprises as your partners.

In-house IT vs. IT outsourcing

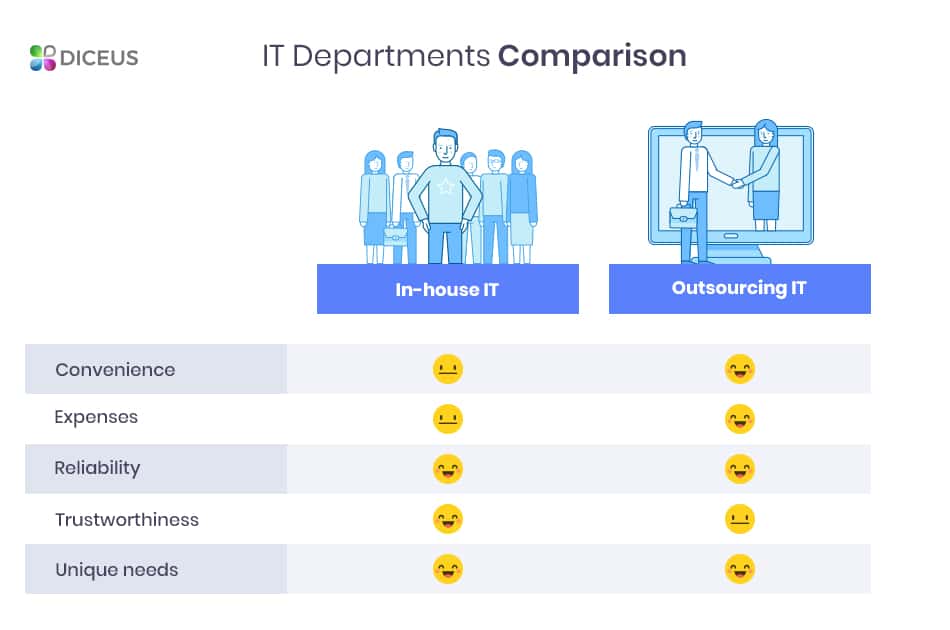

As we know both the current situation and the top tendencies in the IT outsourcing industry for banks, it’s time to ask if we need third-party partners to entrust them some services. Can own IT teams be better?

The main advantage of in-house solutions is their reliability and uniqueness. The in-house IT department consists of trained employees who know the features of your bank and focus on its needs exclusively. You don’t have to share key information with other parties because all processes are inside the bank’s ecosystem. However, remember that the higher cost of labor, security, and maintenance costs, as well as need in the proper HR department to hire and train your IT-related experts.

On the other hand, outsourcing services for banks are convenient as you can pass on daily tasks to the already formed team of professionals. Usually, these IT geeks are skilled and certified, so they can provide efficient expertise, save your time and money, and even deliver unique business analysis. By cooperating with companies that focus on clients’ needs, you get the same team but located outside. As for security issues, outsourcers also care about their reputation and don’t want to fail.

As a result, we can compare internal IT departments and outsourcing teams:

- Convenience: outside partners free your employees from routine.

- Expenses: hiring outsourcers is more profitable.

- Reliability: both ways are reliable if you work with professionals.

- Trustworthiness: in-house workers are easier to control.

- Unique needs: you get a personalized approach in both cases.

Your first IT bank outsourcing project

It should be clear now that diversifying is essential for all modern businesses. It’s good to start with the analysis of the market and the IT outsourcing industry, consider the difference between internal solutions and delegating tasks. To facilitate it, we’ve prepared a few tips to help you get started:

- Define the company’s needs. Choose what processes you want to pass on and what processes will remain unchanged. Generally, managers keep core strategic initiatives in-house while they delegate daily IT operations.

- Secure an SLA. This paper specifies how and when the chosen outsourcer will maintain processes, how it will react to emergency cases, and so on.

- Foresee potential expenses. Outsourcing lets you move from CAPEX to OPEX. The latter costs are more flexible and can be easily represented in SLA. And don’t forget about force majeure.

- Know your laws. To avoid miscommunications and customers’ complaints, we recommend studying local regulations properly.

- Check the partner’s reputation. Security is vital in the IT outsourcing industry. Be sure to cooperate with reputable companies only.

Risk share with software development vendors

And here’s the most important step of our guide. We realize how banks risk when deciding to share their in-house data with other companies. That’s why we think that proper research of the market and available outsourcing teams is crucial. In our company, we provide the necessary guarantees and sign key contracts.

We have successfully developed several solutions for leading banking facilities:

- Data warehouses: we have created the architecture and design of databases with end-to-end workflows, ERL data acquisition, general ledgers, COTS-MIS systems, data adapters, and business rules. These apps are successfully implemented and currently supported.

- Online banking solutions: we have delivered mobile applications with wallets, live updates, and social network integrations, and web services with modules for clients’ info, documents, loans, deposits, currency exchange, etc.

- Fintech software: we have designed and integrated managerial systems with automated reporting tools and stand-alone and SaaS applications for accounting, analytics, and visualization of financial data for employees and users.

At DICEUS, we have great expertise in big data, and we have gained a solid portfolio during the last few decades. We know how digital solutions can transform the whole way of operations in the front and back-office systems. We focus on building and delivering robust and reliable data warehouses, CRM systems, and other products. You can have a look at the cases made by DICEUS and make sure that we craft cutting-edge solutions only.