Mobile banking trends 2024-2025

There is no field in the contemporary digitalized age where mobile devices haven’t established a firm foothold. We increasingly rely on our gizmos to learn, work, travel, obtain treatment, shop, and have fun. To keep abreast of this across-the-board advent of mobile technologies, enterprises throughout various domains launch ground-breaking digitalization transformation initiatives where mobile services become a centerpiece.

The banking industry is moving in the wake of this revolutionary process. Financial institutions of all sizes and areas of specialization offer a wide range of online banking services to consumers and develop mobile banking apps to provide an ultimate mobile banking experience for a multi-billion-strong audience of smartphone owners. And they are doing a great job! While four years ago, 1.9 billion people worldwide were active users of digital banking products, in 2024, this astounding number is expected to almost double and reach a mind-blowing 3.6 billion (according to Statista). Why are banking apps conquering the realm of banking services?

Need custom mobile banking development? Here’s what we offer.

Making the case for mobile banking apps

DICUES has been developing apps in the mobile banking niche for over a dozen years. Knowing this sector’s target audience inside out, we can pinpoint the pivotal reasons that have made a mobile banking app a subsistence product.

- Control over customers’ banking activities. People know that they can manage their finances 24/7, wherever they are. A banking app enables them to transfer money, check on their savings account, pay bills, monitor expenditures in their digital wallets, view transaction history, and perform other operations when they please.

- The sense of security. There is no longer a need to carry a large sum of money in your pocket, and there is no longer a fear that it can be lost or stolen. Instead of producing their wallets to pay for any product or service, account holders press a couple of buttons on their gadget’s screen and let mobile apps take care of payments.

- Time efficiency. In the past, financial affairs took a lot of time. People had to visit a brick-and-mortar branch, stand in a queue, fill out countless forms, etc., to get a loan, transfer money, or deposit a sum in their bank accounts. Now, they can do everything in a matter of minutes, if not seconds, and turn to other errands that require their close attention.

- Cost efficiency. Switching over their services online allows banks to reduce OPEX, which translates into the ability to offer clientele more competitive prices, higher interest rates, special discounts, and other financial incentives that come as a pleasant bonus to banking service consumers.

- Wide auxiliary opportunities. Accessing bank accounts or paying for groceries with your smartphone at a supermarket are bread-and-butter opportunities a finance app provides. Besides those, modern people use their gizmos to buy tickets to sports events, book a room at a hotel, pay for a taxi ride, and enjoy other services and commodities offered by third-party organizations.

Such a roster of perks explains the steady growth of the global mobile banking industry market, which crossed the $1.3 billion threshold last year and is predicted to triple by 2030, manifesting a remarkable CAGR of 15+%.

Such impressive mobile banking statistics is the best proof of the vital necessity of mobile banking app development for financial institutions with big-time aspirations. To guarantee the success of their mobile app, a far-sighted bank should pay close attention to trends in mobile banking that will carry the day in the industry in the near future.

Banking software development is one of the expertise domains DICEUS excels at. We constantly monitor the sector’s state, detecting and exploring banking trends that will shape the realm for years to come. What are the latest trends 2024 ushered in that will also stay relevant next year?

You might be interested in reading our latest article: “How to start a neobank”

Customer experience reigns supreme

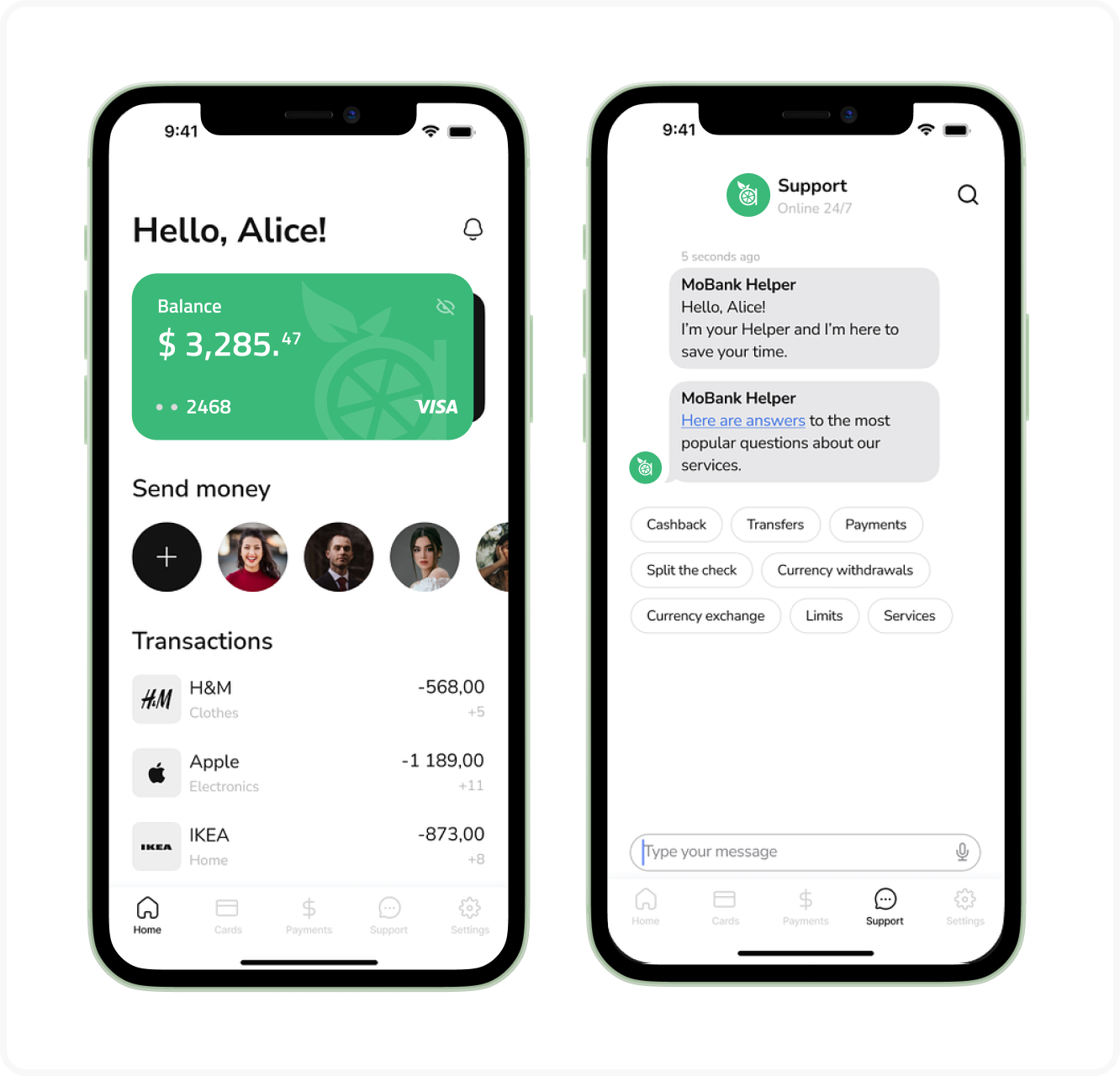

Since the overarching goal of a mobile banking app is to provide the best-in-class customer experience, obliging the client to come to the forefront. A tech-savvy app leveraging cutting-edge know-how won’t take you far if it is too complicated to use or fails to address a client’s pain points. That is why a user-centered approach is mission-critical in the mobile banking category of apps.

However, to please a customer, you should understand their needs, preferences, challenges, and concerns. Innovative big data tools and financial business intelligence mechanisms allow banks to analyze customer profiles, obtain a 360-degree view of their target audience, and develop personalized customer engagement strategies for catering to the needs of individual clients.

Artificial intelligence as the core of a mobile banking app

Any vision of the mobile banking industry’s future is incomplete without AI-powered tools. These tools are triumphantly entering the niche and finding ever-new use cases to enhance the power of IT products employed there.

The first thing that comes to mind concerning this technology is AI-driven chatbots that can replace human staff and handle 80% of customer support and personal consulting tasks. Yet, in fact, the application of artificial intelligence in mobile banking isn’t limited to this area. It has a huge potential to boost fraud detection, where its voice and image recognition capabilities will help identify and prevent scam attempts. Besides, when bolstered with machine learning algorithms, AI can fuel predictive analytics tools, enabling entrepreneurs to assess risks, anticipate trends, and optimize shop floor routines.

Enhanced security

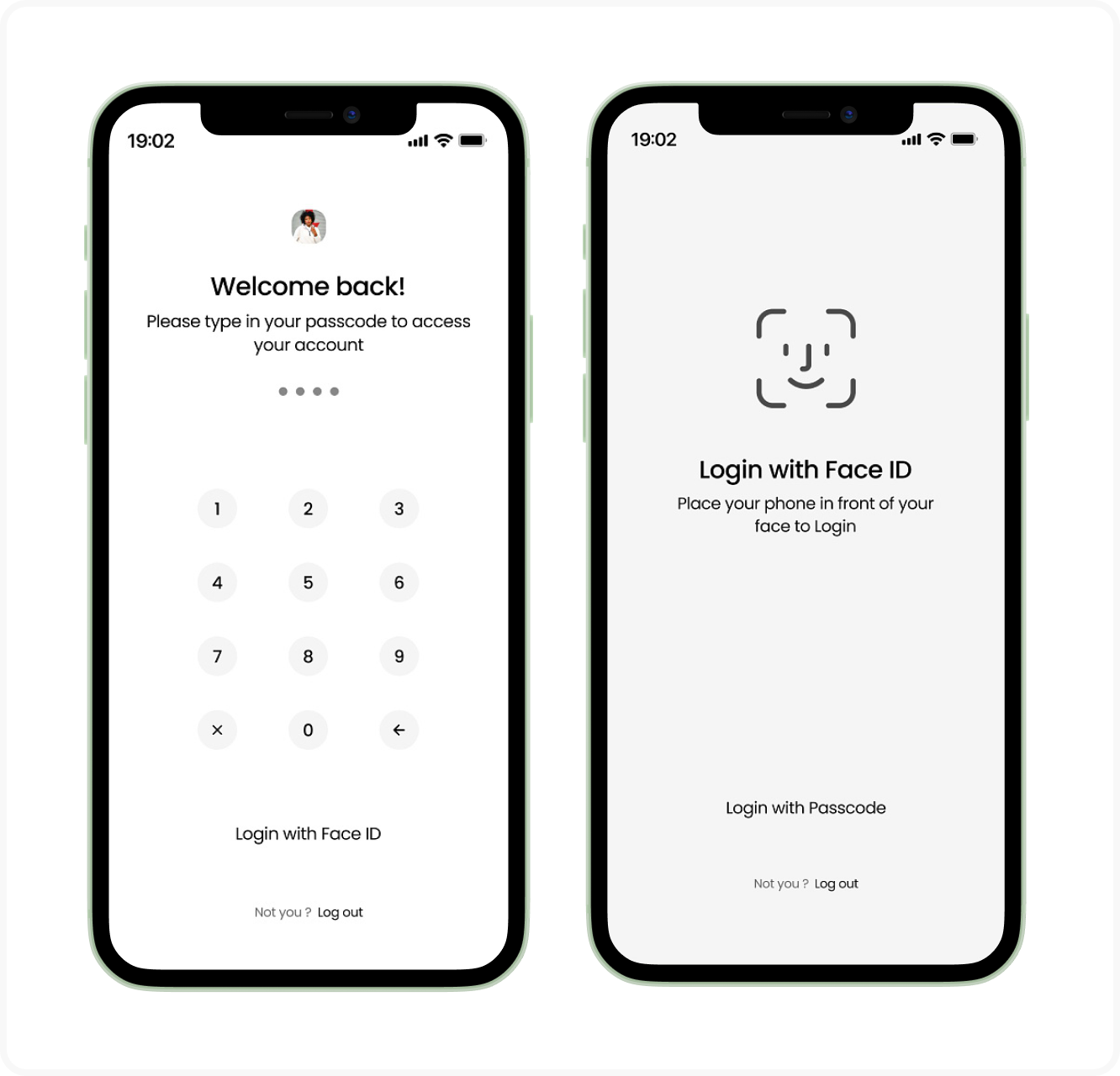

Any finance-related sphere attracts many fraudsters and cyber criminals who want to capitalize on the vulnerabilities of software solutions in this sector. The same applies to the banking industry, where hacking attacks and data leakages are considered top mobile banking security concerns. The cyber criminals’ malevolent activities are becoming ever more sophisticated, so simple passwords and PIN authentication aren’t enough to protect a customer’s personal data and bank account from being compromised.

AI also comes to the rescue in this situation. To comply with industry data security regulations, a mobile banking app should have multiple identification procedures in place (such as cellular, Wi-Fi, and device identification) and harness biometric authentication methods. These measures include eye scanning, facial recognition, voice recognition, and fingerprint scanning.

Apps equipped with biometric authentication mechanisms are harder to hack or replicate, which makes them super secure IT products.

Integration with IoT devices

Nowadays, wearables of various kinds (smartwatches, web-enabled glasses, fitness trackers, headsets, smart jewelry, and even smart suitcases) have gained considerable traction and become important elements of the everyday IT landscape for tech-savvy people. It makes perfect sense to join such devices into a single network powered by robust IoT solutions.

If a person’s wearables are synchronized with their mobile phone, their owner can use any of them for banking purposes, like making NFC payments, receiving notifications about changes to their bank account, checking other banking information, and more.

Financial institutions will also benefit from integrating IoT technologies in their banking and payment apps since they will enable banks to obtain a vast amount of customer data. Such dossiers can be used as actionable insights into consumer behavior and spending patterns, allowing banks to launch data-driven campaigns and personalize services offered to clients.

Financial inclusion

In the condition of the cutthroat competition symptomatic of the current banking sector, enlarging the customer base is of paramount importance for financial organizations that want to join the major league of business in this field. One of the methods to augment client outreach is to increase the accessibility of the banking solution, where voice control is the primary instrument.

Integrating an AI-powered virtual assistant into your banking app and equipping it with a voice command feature will enable people with various disabilities (such as eyesight impairment or locomotive dysfunctions) to pay bills, transfer money, and enjoy other services a banking app provides.

Another measure aimed at involving a greater number of app users is the development of specialized low-bandwidth solutions that will offset the substandard quality of internet connection in rural areas.

Collaboration with fintech startups

Even when embracing digitalization, traditional banks tend to be rather conservative in their policies and workflows. Establishing partnerships with disruptive fintech startups and setting up a network of APIs to enable access to their services dramatically augment their banking app’s capabilities.

First of all, it ushers in cutting-edge innovations fintech startups are so good at. Second of all, it increases the range of service options (for instance, peer-to-peer lending, remote deposits, or buy-now-pay-later feature) without heavy investments in upgrading the app. Third of all, the novel approaches discovered and introduced by startups can essentially streamline and facilitate the bank’s existing pipelines.

Related article: “How to build a fintech app”

Crypto wallets

Crypto currencies’ reputation is far from absolutely positive, yet this market is on a spike, with over 8.800 active digital currencies circulating in the crypto world. Naturally, the number of crypto operations increases quickly, too, along with the number of people involved in them. That is why future-oriented banks can’t ignore the potential of this ever-growing market and should adapt to the changes in the global financial landscape.

If you are a novice in this niche, we recommend starting small. Add a crypto wallet feature to your app and enable operations with the major coins (such as Bitcoin or Ethereum).

But keep track of the situation in the field and be ready to expand your crypto functionality roster.

The above-mentioned trends are the most crucial ones that dominate the industry today and will continue to do so in the foreseeable future. If you harness them during banking app creation, your product is likely to become a leader in the niche. However, equipping your app with state-of-the-art technologies that align with the latest developments in the domain is impossible without a competent IT vendor.

The qualified team of DICEUS has relevant experience and in-depth knowledge of the mobile banking realm to deliver a top-notch solution within time and budget. Contact us to obtain a smoothly functioning banking app with a sleek design that will address all pain points and live up to the expectations of your target audience.

To sum it up

The ubiquity of mobile devices has caused a rise in the usage of niche apps that allow consumers to get access to a whole range of services. Mobile banking apps enjoy global popularity as time- and cost-efficient digital instruments that provide people with quick and secure financial services of various kinds.

To let their app keep abreast of the current trends in the sector, its creators should leverage AI-powered capabilities, implement secure data protection mechanisms, integrate the app with a network of wearable devices, equip it with a crypto wallet, prioritize customer experience, and ensure its broad accessibility.

Frequently asked questions

What are the most significant trends shaping mobile banking?

To create a robust banking app that will hit it big, you should prioritize the customer experience of its users, ensure security and regulatory compliance, boost its functionalities with AI, integrate it with wearable devices, equip your product with a crypto wallet feature, take thought for financial inclusion and accessibility, and partner with disruptive fintech startups.

How are mobile banking apps enhancing security?

Reinforcing cyber security can be achieved in two ways. First, such products can introduce robust identification measures, including device, Wi-Fi, and cellular identification. Second, they can be equipped with various AI-fueled biometric authentication mechanisms (Face ID, Voice ID, retina scanning, and fingerprint scanning). When implemented to create a balanced system, these measures will minimize chances for financial and personal data leakage through a banking app.

What are the main challenges in developing a banking app?

The top concerns for banking app creators are providing strong user data protection and meeting regulatory standards in this field (such as GDPR, CCPA, PCI DSS, and PSD2 compliance). Besides, developers should take care to select the right platform for their app (or opt for cross-platform app building), correctly determine the roster of features, and provide a seamless user experience.

What role does gamification play in modern banking apps?

The banking domain relies on customer engagement techniques similar to those used in other industries today. Gamification is one such scheme that increases the app’s interactivity to attract clients, retain them, and foster brand loyalty. Among the most popular gamification mechanisms are tutorials, achievement badges, rewards, coupons, special offers, discounts, and other kinds of loyalty programs.

What’s the impact of wearable devices on banking app development?

Today, people utilize a wide range of wearables in their everyday lives. A cutting-edge banking app can unite smartwatches, fitness trackers, headsets, web-enabled glasses, and other IoT-powered devices into a single ecosystem with the mobile phone. Consumers can use any of the components to access banking services (money transfers, NFC payments, etc.) at their convenience.