IT staff augmentation vs managed services – What to choose?

The fierce market competition requires the IT business to meet the challenges at the highest velocity, which calls for a special approach to organizing a project team. A sudden lack of expertise or proper skills at a certain project stage may undermine your reputation as a provider. There are two well-tried solutions here — expand the existing in-house team or delegate a certain portion of tasks to a third-party specialist. Both options are very well working, but which one suits you best? In this article, we’ll compare staff augmentation vs managed services.

Statistics show that over 57% of companies trust external specialists, and analysts predict that by 2027 the outsourcing market will have exceeded $405 billion in global share. It is also believed that outstaffing reduces corporate expenses by about 15%.

DICEUS is a dedicated development company with vast experience in the field of bridging the gap and tackling staff shortages. Based on our field experience, we will try to help you understand the ins and outs of the managed services model vs staff augmentation so that you make the right choice in the long run.

Staff augmentation vs managed services

| IT staff augmentation | Managed IT services | |

|---|---|---|

| Advantages | Seamless staff integration Flexibility of staffing Reduced cost of hiring Faster hiring Faster time to market | Easy employee monitoring Flexible cooperation Outcome guaranteed Access to expertise and skills |

| Disadvantages | Required onboarding Required project manager Time for integration of new employees into your team | Higher costs Security vulnerabilities Difficulties related to change request management |

| Processes | Outsourced functions | Outsourced solutions |

| Billing | Rate-based (biweekly/monthly) | Based on retainer (annually) |

| Project types | Scalable, fast-growing | Stable, long-term |

| Recruiting | Hired by vendor | Ready to start |

| Office facilities | Vendor | Vendor |

| Payroll | Vendor | Vendor |

| Management | Client/Vendor | Vendor |

| Engagement | Full-time | Full-time/part-time |

| Overhead costs | Vendor | Vendor |

| Employee perks | Client/Vendor | Vendor |

| Salary review | Client/Vendor | Vendor |

| Communication | Direct | Vendor’s PM |

| Best use cases | Scalable and fast-growing project Required external resources Well-funded projects | Stable businesses Required outsourced IT staff for long-term clear tasks |

IT staff augmentation — Meaning

This is a labor resources expansion model where your team is augmented with professionals from a third-party provider. The difference from regular hiring is that you receive specialists from the staff of another company on the basis of a temporary contract.

Why do you need intermediaries, you ask? If your task is to quickly get quality work resources at a profitable rate, and there just happen to be specialized vendors that have people with the experience and knowledge that you need. You simply make up for the temporary shortage of specialists, but without integrating them with your own staff for good.

Staff augmentation process

There are three major stages to the whole process:

- Definition of requirements. First, you have to pinpoint what knowledge and skills you lack, how many and what kind of specialists you need.

- Search and evaluation of new employees. It is necessary to choose a company that will find suitable candidates or offer its own outsourced people. You can check their suitability with the help of interviews and tests.

- Adaptation and support. It is important to familiarize hired personnel with the internal policies, values and core technical concepts of the company in order to integrate them into the work environment. They should be involved in the continuous team training and have their feedback considered for building strong relationships in a renewed team.

Types of staff augmentation

First off, staff augmentation may differ in terms of collaboration form:

Short-term augmentation

This option is usually employed when full-time specialists cannot physically cope with the tasks. For example, they are on vacation, on sick leave, or they simply do not have enough time due to their heavy workload, and there is only a temporary lack of expertise.

Long-term augmentation

Long-term augmentation services are optimal for complex, large projects that need extensive input. This approach is often used to reduce the time to start project implementation, as well as to cut the costs of finding and training your employees

The process can also be subdivided into categories of augmentation by the specialist qualification level:

Commodity

A fitting option is when reliable workers are required to perform simple tasks that do not require high qualifications. This, for example, can be auxiliary work in a warehouse, construction, retail, etc.

Skill-based

Sometimes, workers with particular skills are needed, the level of which does not matter. This may be the collection and processing of data, work with clients, basic copywriting, and similar types of work.

Highly skilled

An option when you need talents with advanced skills. For example, software developers, programmers or designers with a unique set of capabilities, experience and knowledge.

Pros and cons of the IT staff augmentation model

The staff augmentation approach flexibly integrates business processes and a team of specialists to achieve the required goals. The service provider can fill client positions from the pool of available talent around the world, but all risks are borne by him/her only.

Pros

- Reduced costs. You can hire a specialist for a certain period of time without special obligations. You do not have to pay for his/her training because you selected them specifically for particular tasks.

- Staff flexibility ─ quick access to critical human resources. Project requirements change as technology advances. This makes it difficult to retain talent, but you can easily change the headcount to suit your needs.

- Full integration. The added specialists are treated as members of your team. Permanent employees will get along faster with them than with an outsourced team and won’t worry about their jobs being threatened.

We can safely mention right now that in the stand of managed services model vs staff augmentation, the latter certainly wins when time pressure is especially heavy.

Cons

- Management costs get higher as your team gets bigger

- It is difficult to keep track of the work of remote workers

- There is a need for training in the internal processes of the company

- Adapting to new people always requires some effort and extra time

- Security and access protection measures will have to be controlled

All in all, this model is best employed for fast-growing projects.

Managed services — Meaning

Managed services are a task delegation model where you outsource certain IT functions, roles, and responsibilities to a third-party vendor. MSPs can solve any problem: from helping develop advanced products, websites, and applications, to tending to cybersecurity and backup with the latest tools and techniques.

This is a complete outsourcing of support for your project to meet specific requirements without the need to hire in-house specialists. Typically used when there are not enough funds to hire and manage your own IT teams. You will benefit from predictable pricing, freedom from IT management, and the ability to focus on core business tasks. However, you cannot control the work of the provider to the fullest.

Types of IT managed services

The variety of services offered by MSP always allows you to choose a well-suited option. You can find a provider that offers a range of services from the list below, or one that specializes in just one specific service.

Networks and infrastructure

In these aspects, MSP solves any of your network tasks: from creating a local network, WAP, and to various connections. Its tasks also include managing backup and storage options.

Security

This is where a provider ensures the security of the remote infrastructure. The tasks include everything from BDR options to virus protection, as well as support for updating critical services and utilities.

Communication

A service provider monitors and manages messaging, data, telephony and video applications. In some cases, the integrated team performs the functions of a call center on your company’s behalf.

MSaaS

If SaaS (Software as a Service) offers an 80% complete solution, MSaaS (Managed Software as a Service) model will provide 100% of everything you need for your business. The provider will customize the software or create unique features at your request.

Cloud infrastructure

This category of services covers computing, storage, networking, and IT. Some vendors may also offer virtualization services for applications, software, operating systems, and more.

Data analytics

Such services include business intelligence analysis to identify specific market trends and create business-boosting roadmaps. It is indispensable for well-qualified data management in order to improve business efficiency, in case you lack a dedicated specialist.

Support services

This service usually covers the full range of specialized maintenance and support efforts — from performing routine tasks to solving complex problems at the personnel level.

Pros and cons of IT managed services

The managed services solution allows businesses to focus on their core work agenda while reducing costs and staying in line with technological innovations.

By entrusting your technology operations to the professional hands, you gain access to world-class technology capabilities and skills without the need to hire, train, and manage IT staff.

Pros

- The contract (SLA), on the basis of which the service is provided, reduces risks.

- A scalable pricing model where costs depend on results. You can avoid the costs associated with purchasing new equipment, training staff and paying wages to full-time employees.

- A large pool of talent, which helps provide a wider selection of talent to meet changing demands.

- More flexibility. MSPs are always available, which increases productivity in the long run.

- Better monitoring. The provider monitors all processes during the project and takes over the search for the necessary tools and resources.

- Less problems with staff. This is the responsibility of the provider, you can focus on other issues

- Tailored results. Typically, the MSP will assess the risks and provide the most appropriate project implementation plan.

Cons

- Remote work constraints. Since MSP staff are not situated in your office, they are less available to deal with urgent issues. To remedy this shortcoming, make sure your MSP is able to provide immediate 24/7 available support.

- The reduced synergy between business and IT. The provider may not always have a deep understanding of your internal infrastructure and needs. Find one that specializes in serving businesses in your industry.

- Higher price. It is not always possible to get a complete package of tools and resources at the desired cost. Some MSPs require higher fees. It is difficult to reconcile the price with the work performed when pricing is based on hourly pay.

- Certain security risks. When you hire a supplier, you provide access to sensitive data. This may potentially be a big risk. It can be minimized if the provider can ensure compliance with security standards and/or supports NDA.

Outsourced managed services allow you to hire a team of professionals armed to the teeth with skills, knowledge, and technical tools tailored to your needs. You will not be able to manage the project that sensitively, but you will be able to track it. Regular reports and analytical statistics will help build trust between you and the provider. When choosing an MSP provider, look at experience, reviews, and rates, and see if there are any hidden costs.

When are managed IT services effective?

If your employees are short on time, unprepared to embrace new technologies, and fundamentally redesign your company’s digital assets, consider an MSP. With their help, you will gain new potential and free your staff from duties that are too difficult for them to handle at the moment. In general, the service is worth considering if:

- You don’t have your own development team

- The entire project is outsourced

- A long-term versatile project is being implemented

- You are working on a start-up from scratch

Difference: Staff augmentation vs managed services

The models are similar in nature but different in essence. Staff augmentation allows you to solve specific one-time tasks as they arise. At the same time, the client retains the overall management of the project. The provider will not try to improve your systems comprehensively, but will simply fix your specific problem.

MPS is more like a traditional partnership. It is used when long-term relationships outside the scope of a specific project are planned. In this case, the provider controls the process and bears full responsibility for its results.

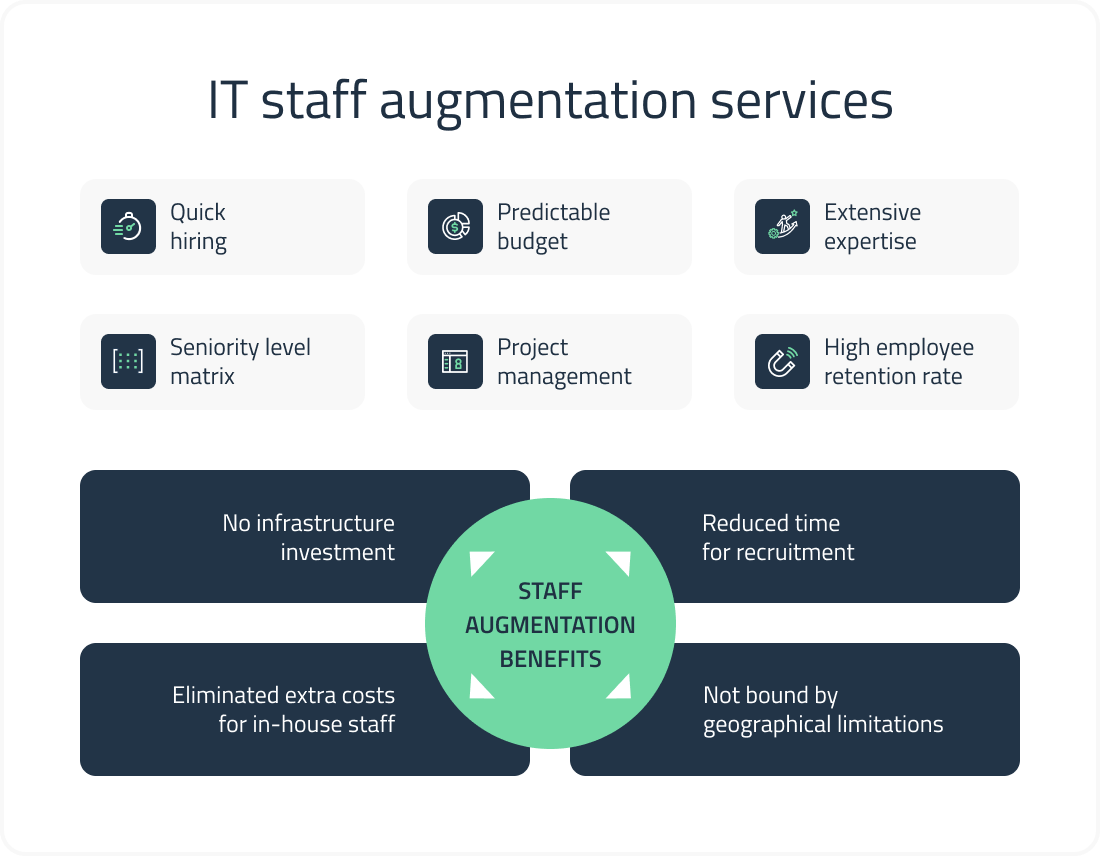

IT staff augmentation services: DICEUS proposal

At DICEUS, we guarantee an ideal option for large projects. You can get talents and technologies that your company lacks without going broke. This is an effective way to fill in the gaps and polish your project in no time at a reasonable cost.

Quick hiring

We will find the right IT professionals for you within three weeks. The recruitment process is streamlined based on many years of practice in the field.

Predictable budget

We offer transparent rates, and you only pay for what you get. You hire a specialist with the necessary skills, experience, and knowledge to work on a specific project patch within a set time frame.

Vast experience

Our recruitment pipeline includes many professionals with a wealth of cutting-edge solutions for a wide range of industries.

High qualifications

Thanks to a specially designed matrix of seniority levels, you will be able to select the necessary specialists with the necessary qualifications. You can hire professionals by choosing from several seniority levels, taking into account tasks, responsibilities, and budgets.

Expert project management

The project manager on our part ensures that the team clearly understands the requirements and goals of your exact project. We provide detailed reports and invoices on a regular basis, keeping a close eye on progress.

Staff retainment

Our pool of talents consists only of highly qualified specialists who are confident in their abilities and experience. You don’t have to worry about someone quitting at the most inopportune moment and putting your company’s future at risk.

Summary

The staff augmentation model allows you to quickly scale certain team functions. The managed services model, on the other hand, is better suited for long-term infrastructure and security initiatives.

If you need additional professional skills for an important project and do not want to tackle extra risks, feel free to contact us. We will find the ideal specialists for you and offer a solution that ensures the full integration of an effective IT team into your structure.

FAQ

What is IT staff augmentation?

Staff augmentation is a service for hiring short-term third-party IT specialists on-demand for a specific project. Assumes hourly or weekly payment.

What are managed services?

Managed services are the form of delegating responsibility for the management and maintenance of processes and functions in order to improve operations and reduce budgetary costs by reducing the burden on the in-house personnel. Includes monitoring and maintenance, as well as support and management of IT systems at a fixed monthly or annual fee.

What’s the difference between managed services and staff augmentation?

In the MPS model, the supplier is committed to delivering a “result” at a price, rather than simply performing an action without any obligation, as opposed to expanding staff. Its value is determined on a planning basis, as the organization needs to define requirements based on service and performance criteria.